As digital currencies continue their ascent in the investment world, both among individual traders and major financial players, cryptocurrency platforms are striving to offer the most comprehensive and user-friendly trading environments. Standing tall among these, Coinbase has rolled out its upgraded Advanced Trade feature, superseding its former Coinbase Pro platform.

Coinbase Advanced Trade This new feature is a haven specifically tailored for seasoned crypto traders. Coinbase's ambition is to unify its myriad services into a single intuitive platform designed to cater to trader demands. By doing so, it does away with the hassle traders previously experienced when shifting between different Coinbase products.

A major focus in crafting Advanced Trade was responding to traders' insights to ensure rapid access to the tools and market data essential for executing trading strategies effectively. Thus, Coinbase has unveiled thorough chart options via a collaboration with TradingView, added over 500 trading pair options, and introduced features like reward schemes.

With the sunsetting of Coinbase Pro in November 2023, existing users can seamlessly transition their funds and trading histories to Advanced Trade. This switch is designed to be smooth, allowing traders to continue without missing a beat. Both existing and new users will benefit from Coinbase’s top-notch security measures.

Explore the enhancements in Advanced Trade over Coinbase Pro, highlighting improved charting tools, broader asset choices, enticing rewards, mobile functionality, and much more.

We’ll guide you on how to embark on this new platform, both as an existing Coinbase Pro aficionado and as a newcomer to Coinbase. By the time we’re through, you’ll be poised to tap into all that Coinbase Advanced Trade has in store for an unparalleled, seamless trading journey.

Key Points

- It effectively replaces Coinbase Pro, providing a more enriched trading environment loaded with more tools and functionalities, all within a single platform.

- Dive into advanced TradingView charting with 104 indicators, sophisticated order types, and the opportunity to earn up to 6% rewards on currencies such as USDC.

- Retains the same competitive trading fee structure based on 30-day trading volume as on Coinbase Pro.

- Open your window to over 550 trading pairs with liquidity levels on par with Coinbase Pro.

- Experience smooth fund transitions from Coinbase Pro; balances are automatically reflected in users’ accounts.

Key Features

With the introduction of Coinbase Advanced Trade, users can dive into a superior yet intuitive advanced trading experience, enriched with several upgrades over the previous Coinbase Pro platform. Key features include:

Advanced TradingView Charts

One of the standout additions is the customizable TradingView charts. These give traders access to a plethora of over 100 different indicators, such as moving averages, RSI, MACD, Bollinger bands, and more. These tools are essential for spotting trends, identifying reversals, determining entry and exit points, and refining trading strategies. Moreover, the platform supports sophisticated chart types and detailed candlestick views.

More Order Flexibility

Beyond the traditional market and limit orders, Coinbase Advanced Trade also supports stop-limit transactions, allowing traders to manage risk effectively by setting automatic buy or sell triggers at predetermined prices. The order management dashboard further simplifies overseeing open positions.

Rewards Up to 6% APY

Unlike Coinbase Pro, the new Advanced Trade platform grants users benefits from rewards on assets stored with them. For instance, traders can garner up to 6% returns on USD Coin (USDC) holdings, providing an opportunity for free crypto earnings that can be periodically cashed out or reinvested.

Smooth Mobile App Integration

With Advanced Trade's full range of tools and features now accessible on Coinbase’s mobile application, users won’t need to toggle between different apps, accessing TradingView charts, order modes, perks programs, asset ranges, trading pairs, and more.

Getting Started

Entering Coinbase Advanced Trade is straightforward, especially for those transitioning from Coinbase Pro.

For Existing Coinbase Pro Users

The migration of assets and historical trading data from your Coinbase Pro account is performed automatically. Initiated in November 2022, the process ensures that your funds are credited to your standard Coinbase portfolio.

To tap into Advanced Trade, update your Coinbase app or head to their web portal. Once there, go to the 'Trade' tab and select 'Advance Trade' to access the dedicated advanced trading section. advanced.coinbase.com Within this platform, you can check all relocated balances under 'Portfolios' and resume your trading activities from where you left off, enjoying tools crafted for earnest traders.

For those new to Coinbase, setting up an account is a breeze, taking just a few minutes. Simply follow these steps:

For New Coinbase Users

On Coinbase.com or via the Coinbase mobile app, hit Sign Up.

- Input your name, email, password, and location to set up your account.

- Add your phone number to receive an SMS code for verification.

- Verify your email address.

- Provide your personal info for identity checks.

- Submit a valid ID issued by the government.

- Activate two-factor authentication for added safety.

- Connect a bank account or card for payments.

- Once your account is all set, switch to Advanced Trade from your profile section on web or mobile to explore its extensive offerings designed for dynamic crypto traders as outlined in this guide.

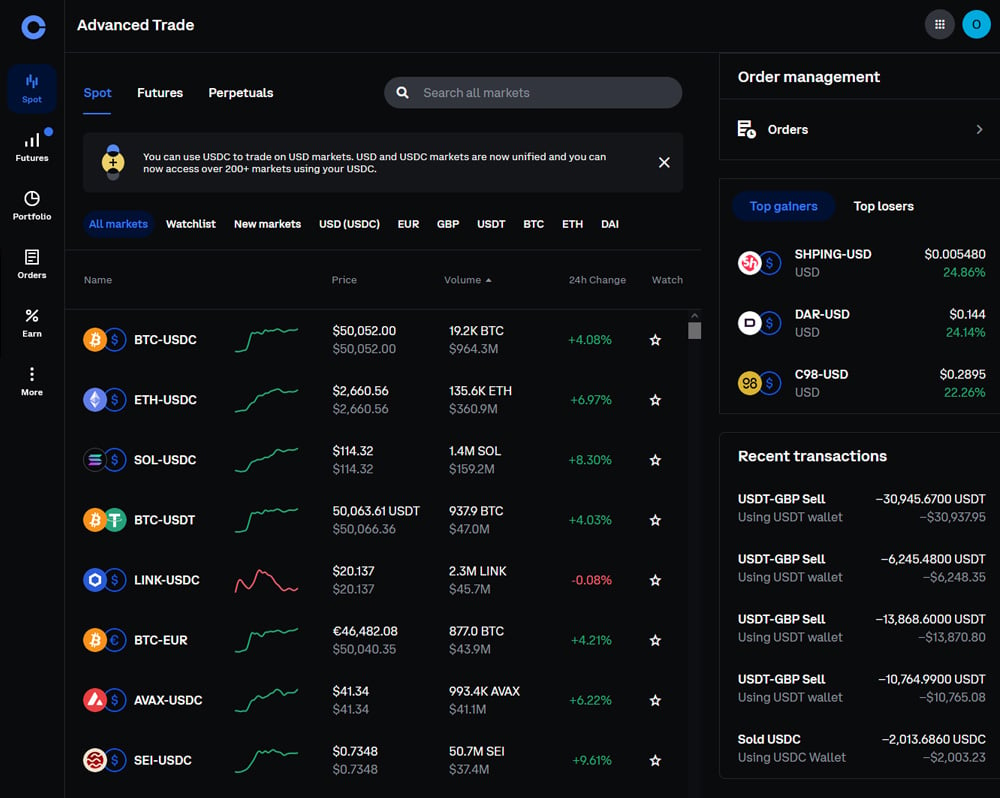

Navigating the Advanced Trade Dashboard unveils an array of tools and features that give you greater command over your digital assets, including:

The Advanced Trading Interface

The price chart here offers a quick method to review historical pricing trends. Customize it by choosing specific time frames and chart forms, alongside a variety of indicators for a deeper understanding of pricing movements.

- Price chart

It's useful for assessing past pricing and trading volumes of an asset over selected durations. - Time Range

An order book details buy orders (bids) and sell orders (asks) for assets. Examining order books reveals the price offerings from buyers and sellers, as well as the distinct units they wish to trade at those prices. Within Coinbase, order books are vertically split, with asks at the top in red and bids at the bottom in green. - Order Book

The depth chart visualizes the order book. Here, the x-axis indicates price points from left to right, and the y-axis shows available asset quantities for buying or selling from bottom to top. Much like order books, the depth chart divides into a buy and sell side. The green line depicts total bid values, while the red line shows ask values. At the center rests the current mid-market price and the gap between highest bid and lowest ask. - Depth Chart

The candlestick chart shows high, low, open, and closing prices for assets during specific times. These metrics include O (opening price at the start), H (highest trade price), L (lowest trade price), and C (closing price at the end). Meanwhile, a line chart reflects an asset's past prices by linking several points with a continuous line. - Chart Types

Coinbase's Advanced charts are powered by TradingView, featuring indicators like EMA, MA, MACD, RSI, Bollinger Bands, and numerous drawing utilities.

Charting Tools

TradingView's library offers 104 market indicators tracking trends and patterns, aiding your trading decisions. You can choose multiple indicators for a well-rounded view of an asset’s buy and sell dynamics. Notable ones include:

Technical indicators

RSI (Relative Strength Index) highlights a trend’s persistence and potential reversal points.

- EMA (Exponential Moving Average) provides average price point insights for assets.

- SMA (Simple Moving Average) offers a long-term average perspective for asset pricing.

- MACD (Moving Average Convergence/Divergence) depicts average price extremes.

- A customizable watchlist further assists users in rapidly identifying market trends and opportunities.

Watchlists

Coinbase Advanced empowers traders to anticipate market volatility with maker orders, limit orders, and stop-limit orders.

Order Types

Maker orders are instantaneous transactions executed at the most favorable current market price, allowing swift buying or selling at optimal rates, ideal in fast-paced scenarios.

Limit orders let users set maximum buy prices or minimum sell prices, triggering transactions only when these conditions are met, essential for handling large trades at desired rates.

Stop-limit orders work by setting a predefined price, called the stop price, to automatically initiate limit orders for buying or selling, serving as a tool to both safeguard profits and manage losses.

Unique to Advanced Trade, compared to Coinbase Pro, is the addition of an Auction mode.

Coinbase Advanced supports 552 market pairs and maintains liquidity levels aligned with Pro, enhancing trade efficiency.

Liquidity and Market Availability

Real-time market insights are supported, featuring APIs for both REST and WebSocket protocols.

Trading via API

With your Coinbase Advanced Trade account ready, let’s embark on a walk-through of a sample trade, showcasing key features in action from initiation to conclusion.

How to Trade

Initially, confirm your login on the Coinbase website or app, and toggle settings to access Advanced Trade's dedicated trading dashboard.

Accessing Your Trading Dashboard

Highlighted on the left sidebar, you'll find the pivotal segments:

Portfolios section: Review holdings, balances, and transfer actions.

- Coinbase Advanced Trading Platform Overview: A Comprehensive Guide - Blockonomi

- This article provides a deep dive into what makes Advanced Trade stand out from Coinbase Pro, highlighting features like enhanced charting, a wider array of accessible assets, incentives for rewards, capabilities of the mobile app, and beyond.

- Coinbase Advanced Trading Platform Overview: Essential Insights

- With cryptocurrencies capturing the interest of both individual and large-scale investors, exchanges are in a race to offer the best trading environments. Coinbase, renowned as a leading global cryptocurrency exchange, has unveiled Coinbase Advanced Trade, rolling out improvements over its former platform, Coinbase Pro.

- Crafted for seasoned crypto traders, this platform intends to unify all of Coinbase’s offerings into a singular, user-friendly ecosystem that caters precisely to trading demands. It resolves the prior challenges of navigating through various Coinbase products.

Placing Your Order

- Critical to the development of Advanced Trade was heeding trader feedback to enhance speed and access to vital features and data necessary for executing trading tactics. Therefore, Coinbase integrated detailed charting via TradingView, expanded access to over 500 trading pairings, and included perks like incentives programs.

- Following the discontinuation of Coinbase Pro in November 2023, users will find their balances and trade records smoothly transferred to Advanced Trade. This transition is designed for convenience, enabling traders to seamlessly continue their activities. Both newcomers and veteran traders will benefit from Coinbase’s top-notch security measures.

- We’ll also walk you through setting up on the new platform, whether you’re transitioning from Coinbase Pro or starting fresh with Coinbase. By the end, you’ll be equipped with the knowledge to make the most of everything Coinbase Advanced Trade has to offer for an unmatched, smooth advanced trading journey.

- It succeeds Coinbase Pro by delivering an upgraded trading experience packed with additional tools and functionalities under a unified platform.

- Order type (limit, market, stop limit)

- Side (buy/sell)

- Size (quantity of BTC)

- Price

Features sophisticated TradingView charts with 104 indicators, offering intricate order types, and options to earn up to 6% rewards on assets like USDC.

- Maintains the same competitive trading fees based on 30-day volume as with Coinbase Pro.

Monitoring and Closing Out Trades

Grants access to over 550 trading pairs while maintaining Pro’s liquidity levels.

Facilitates the easy transition of funds from Coinbase Pro; user funds are automatically transferred by Coinbase.

By surpassing its predecessor, Coinbase Pro, the Advanced Trade platform introduces pivotal enhancements to unlock a more robust yet convenient trading experience. Key features now available include:

A significant upgrade is the introduction of highly customizable TradingView charts that offer traders the use of over 100 indicators like moving averages, RSI, MACD, Bollinger bands, and more. These tools are designed to help discern trends, foresee market reversals, determine optimal entry and exit points, and refine trading decisions. Advanced Trade also supports diverse and in-depth candlestick charts.

Costs and Rewards

Fee Structure

Alongside the usual market and limit orders, Coinbase Advanced Trade offers stop limit orders. These help traders manage risk exposure by triggering automatic buying or selling when the asset reaches a set price. The platform's order management interface streamlines monitoring of open positions.

| Category | Coinbase Advanced | Coinbase Pro |

|---|---|---|

| Fees | <=0.4% maker, <=0.6% taker | <=0.4% maker, <=0.6% taker |

| Rewards | Unlike its predecessor, Advanced Trade grants the capability to earn rewards on stored assets. For example, USD Coin (USDC) held balances can yield up to 6% in rewards. This paves way for earning free crypto which traders could periodically withdraw or reinvest. | Not supported |

| Asset Availability | 550+ market pairs, with the same liquidity | 350+ market pairs |

| Order Types | Market, Limit, Stop Limit | Market, Limit, Stop Limit |

| Charts | The full range of Advanced Trade features and tools is easily accessible through Coinbase’s mobile apps, inclusive of TradingView charts, order types, perks programs, asset options, trading pairs, and more. There’s no more need for toggling between the Pro and regular Coinbase apps. | Starting with Coinbase Advanced Trade is straightforward, especially for users transitioning from Coinbase Pro. |

| Security | The automatic process for transferring assets and trading histories from Coinbase Pro commenced in November 2022, with funds being credited to your standard Coinbase account. | To navigate Advanced Trade, simply upgrade your Coinbase mobile app or access it on the web, then go to the “Trade” tab and choose “Advanced Trade” to start using the specialized trading dashboard. |

| Mobile App | Yes | Yes |

| Trading API | Yes | Yes |

Earning Rewards on Assets

Here, you can view your transferred balances under “Portfolios” and continue your activities from where you left off in Coinbase Pro, leveraging tools crafted for intensive traders.

Security

If you are new to Coinbase, setting up an account is fast and can be done in a few steps.

Some of the key protections include:

- On coinbase.com or the Coinbase app, tap Sign Up.

- Provide your name, email, password, and location to establish an account.

- Enter your phone number to get an SMS code and verify the code to complete the process.

- Submit personal details for confirmation of identity.

Upload a valid official government ID.

Activate two-factor authentication for added security.

Conclusion

Link a bank account or card as your payment option.

Once your account is established, switch to Advanced Trade from your user profile on web or mobile to access its full suite of features designed specifically for proactive crypto traders, as explained in this guide.

- Once you’re on the Advanced Trade Dashboard, you’ll discover various tools and features to assist you in managing your digital assets more effectively, such as:

- The price chart offers a quick and intuitive way to explore past pricing dynamics. You have options to tailor your view by selecting time ranges and chart types, alongside leveraging several indicators unveiling insights into trends.

- Up to 6% APY rewards on assets like USDC

- It facilitates reviewing the historical pricing and trading volume of assets over specified durations.

- The order book lists buying and selling orders for assets. By exploring order books, you gain insights into the prices at which traders are willing to buy or sell, as well as the quantities involved at each price. On Coinbase, order books are structured vertically with selling orders in red at the top and buying orders in green at the bottom.

The depth chart illustrates the order book. The x-axis represents price points, increasing from left to right, while the y-axis displays the total amount of assets available for buying or selling, rising from the bottom upwards. Mirroring the order book, this chart has a buying and a selling side; the green bid line shows the value of buying orders, and the red ask line presents the value of selling orders. Centrally, you’ll see the current mid-market price, highlighting the gap between the top bid and bottom ask.

The candlestick chart delineates the high, low, open, and closing prices of assets within select time frames. Here, O signifies the asset’s starting price, H indicates the peak trading price, L shows the lowest price, and C highlights the ending price for that period. Additionally, the line chart provides a historical pricing overview by connecting data points using a continuous line.

As noted, Coinbase Advanced charts draw power from TradingView presenting indicators such as EMA, MA, MACD, RSI, and Bollinger Bands, plus drawing tools.

TradingView offers access to 104 market indicators. These track market tendencies and patterns, guiding trading decisions. Users can select multiple indicators for a clearer view of any asset's price dynamics, with some popular ones being:

RSI (relative strength index) indicates the length of trends and signals potential reversals.