Currently, the cryptocurrency trading arena is teeming with diverse exchanges, each promising unique benefits and potential drawbacks. With such a wide array of options available, making a well-informed, data-driven choice can be quite a challenge.

Coinbase This platform is widely recognized as one of the largest and most favored cryptocurrency exchange services on a global scale, boasting over 30 million users who have collectively exchanged more than $150 billion in digital assets.

Coinbase is known for offering high-quality standards in its services, yet certain advanced trading tools or support for an expanded range of cryptocurrencies are still missing.

Top Choices in the Crypto Sphere: Alternatives to Coinbase

Here’s our exhaustive list of leading choices to help you buy cryptocurrency swiftly and securely. Coinbase These exchanges stand as formidable competitors to Coinbase, noted for their features, fee structures, supported cryptocurrencies, payment options, user safety measures, and security protocols.

Originally established in 2013 to offer cloud mining for crypto holders, this platform has developed into a UK-based cryptocurrency exchange, providing diverse services like cross-platform trading, liquidity order-books, instant transactions, and more.

CEX

CEX.io CEX.io is tailored to cater to a spectrum of users, from novices to day traders and even institutional investors, now serving over 3 million clients across nearly all global nations and a substantial portion of the United States.

CEX offers three main products: the 'instant buy' feature, the 'CEX.io exchange,' and the 'CEX.IO broker.'

Features

The instant buy option lets users acquire Bitcoin swiftly via Visa or MasterCard, designed for hassle-free transactions within just a few clicks. Buyers have choices pre-set at $200, $500, and $1,000 worth of Bitcoin or can opt for a custom amount.

The CEX exchange operates akin to the most popular digital currency platforms in the market today. After setting up an account and completing the KYC checks, users can trade an array of cryptocurrency pairs like BTC/USD, ETH/USD, BCH/USD, and more, bolstered by margin trading and convenient price analysis tools.

The CEX broker enables margin trading of digital assets through Contracts for Difference (CFDs), with perks like comprehensive access to markets and a demo account for trial runs.

Staking options allow users to earn by holding coins or tokens within their CEX accounts.

CEX calculates fees based on a user's trading volume over 30 days. For beginners trading less than 5 BTC, a taker's fee of 0.25% and a maker's fee of 0.16% apply, while for volumes over 6,000 BTC, the taker's fee drops to 0.10% with a 0% maker's fee.

Fee policy

CEX also imposes certain deposit and withdrawal fees, with Visa/MasterCard USD deposits at 2.99% and free bank transfer deposits. Card withdrawals incur a service fee of 1.8%-3% plus $3.80, while bank transfer withdrawals involve a 0.3% fee plus $25.

Navigating the CEX platform should be straightforward: create an account, complete the know-your-customer process, and fund the account using available payment methods.

Ease of use

With an intuitive and largely bug-free interface, CEX also offers a mobile app for trading on-the-go.

The platform supports a wide range of cryptocurrencies, including BTC, ETH, BCH, among others, and even supports fiat currencies like USD, EUR, GBP, and RUB, as well as stablecoins like USDT and USDC.

Supported coins & payment methods

CEX offers various payment methods for deposits and withdrawals, including Visa, MasterCard, SWIFT bank transfers, and ACH.

Highly regarded for its security, CEX has maintained its record of not losing user funds due to its robust anti-fraud measures and compliance with necessary legal standards.

User safety & security

Here's another viable Coinbase alternative aiming for rapid, secure, and global accessibility in cryptocurrency exchanges. Since its inception in 2013, it has facilitated the trade of millions worth of digital currencies to over 1.9 million users across 188 countries.

Read our full CEX review here .

CoinMama

CoinMama Values that the company holds dear include simplicity, integrity, collaboration, customer focus, growth, open communication, enjoyment, coin ownership, and innovativeness.

This platform ensures swift, secure, and easy operations, allowing users to buy Bitcoin instantly after account verification. Featured options and custom amounts are available for purchase, while Bitcoin sales are limited to SEPA bank transfers for European customers.

Features

With a competitive fee structure, the platform charges a 2% market rate tax and a 3.90% commission, decreasing with higher volumes. Card transactions add a 5% processing fee unless done via SEPA bank transfers, which are free.

Fee policy

CoinMama focuses on user satisfaction, featuring an easy-to-navigate layout even for beginners, comprehensive help sections, and personalized support.

Ease of use

Users must set up accounts and complete KYC for identity verification before engaging in cryptocurrency trades through various payment methods.

CoinMama supports buying of Bitcoin, Bitcoin Cash, Ethereum, and others, with credit/debit cards and bank wire transfers as payment methods, accepting all fiat currencies.

Supported coins & payment methods

Bitcoin cash-outs are processed through SEPA bank transfers within Europe alone.

Having experienced a past cyberattack exposing user emails and passwords, the platform's swift response ensured no crypto loss, earning it a safe reputation.

User safety & security

Emerging from Austria in 2014, this innovative platform has attracted 1 million users and boasts a robust security protocol alongside winning user experiences.

Read our Coinmama review here .

Bitpanda

BitPanda Its growing reputation is driven by abundant features, user-centric design, and support for numerous coins.

The platform showcases a range of cutting-edge tools like the Bitpanda platform, its global exchange, and more, all designed to enhance user engagement and experience.

Features

The Bitpanda Global Exchange offers an advanced trading environment with low fees, multiple high-liquidity EUR pairs, an integrated API, and comprehensive support for traders, ensuring secure fund management.

Its ecosystem token has emerged as a successful European IEO, giving users access to discounts and other benefits across Bitpanda's services.

Bitpanda Pay bridges the traditional and fintech financial sectors, enabling crypto-based fiat payments to IBANs.

Bitpanda Savings serves consumer needs with flexible, automated tools that help build and diversify financial portfolios without hassle.

With Bitpanda Metals, users can invest in precious metals like gold and silver through digital assets at competitive fees.

The Swap feature allows users to instantly exchange digital assets efficiently.

Other highlights include Bitpanda to Go, Plus service for major investors, and an affiliate program offering 20% commissions for referrals.

Best Picks for Coinbase Alternatives in 2023: Instant Crypto Trading at Your Fingertips

Fee policy

Let's dive into eight standout choices as alternatives to Coinbase. We'll explore their trustworthiness, variety of cryptocurrency options, deposit methods, fee structures, and overall user experience.

Ease of use

Discover Top Coinbase Alternatives: Trade Cryptocurrency with Speed and Ease

Nowadays, the crypto scene is bustling with numerous exchanges, each offering its own unique perks and drawbacks. With so many choices available to the crypto enthusiast, navigating this digital marketplace to make well-informed decisions can be challenging.

Supported coins & payment methods

Coinbase is hailed globally as one of the most prominent and widely-used platforms for cryptocurrency exchanges. Over the years, it has attracted more than 30 million users, handling a staggering $150 billion in trades.

User safety & security

Though Coinbase is known for its high-quality services, it doesn't cover everything. Users may find certain advanced trading tools and additional cryptocurrency support to be lacking.

Read our Bitpanda review here .

Binance

Binance Leading Alternatives to Coinbase in the Cryptocurrency Market

Here's our take on the best substitutes for Coinbase that empower you to buy cryptocurrency both quickly and securely.

Features

These exchanges compete head-to-head with Coinbase, offering unique features, attractive fee schedules, a variety of supported digital currencies, flexible payment options, robust security features, and a strong focus on user protection.

Originally established in 2013 to facilitate cloud mining for cryptocurrency holders, this company has transformed into a UK-based crypto exchange. It now boasts an extensive suite of services ranging from cross-platform trading to instantaneous buy-and-sell capabilities.

CEX.io caters to a diverse range of users, from newbies to day-traders, right up to large institutional investors. Today, it serves over 3 million clients across nearly every country in the world, including 38 states in the US.

CEX stands out with three core services: 'instant buy', the 'CEX.io exchange', and the 'CEX.IO broker' function.

The instant buy option is particularly user-friendly, allowing users to purchase Bitcoin swiftly using their MasterCard or Visa. The process is streamlined to just a few clicks, with pre-set purchase options for $200, $500, and $1,000 of BTC—plus the option to enter a custom amount.

Fee policy

Secondly, the CEX exchange functions like other leading digital currency platforms. Once an account is set up and KYC details are confirmed, users can dive into trading various crypto pairs like BTC/USD, ETH/USD, BCH/USD, XRP/USD, BTC/EUR, plus other altcoins and stablecoins. Margin trading is available as well, and the market data tool simplifies price analysis by tracking fluctuations for all pairs.

Lastly, the CEX broker option offers margin trading for digital assets through Contracts for Difference (CFDs). Users benefit from comprehensive access to spot markets and CFD opportunities, plus there's also a demo account available for practice.

Ease of use

CEX also offers staking options, rewarding users for holding tokens or coins within their CEX accounts.

Supported coins & payment methods

The platform's fee structure is designed with trading volume in mind. For example, newcomers with under 5BTC in trades in the past month face a 0.25% taker fee and a 0.16% maker fee, while high-volume traders exceeding 6,000BTC enjoy lower fees of 0.10% for takers and 0% for makers.

Depositing or withdrawing funds on CEX may involve fees. A deposit using Visa or MasterCard in USD costs 2.99%, whereas bank transfers are free. Card withdrawals have a fee between 1.8%-3% plus a $3.80 commission, while bank transfers cost 0.3% of the transfer value plus a $25 tax.

User safety & security

Using CEX is designed to be a straightforward process. Setting up an account and passing the know-your-customer checks are the first steps, after which funding your account with one of the many payment methods is possible.

Read our Binance review here .

CEX sports an intuitive, mostly bug-free user interface. It also offers a mobile app for trading on the go. Binance.US

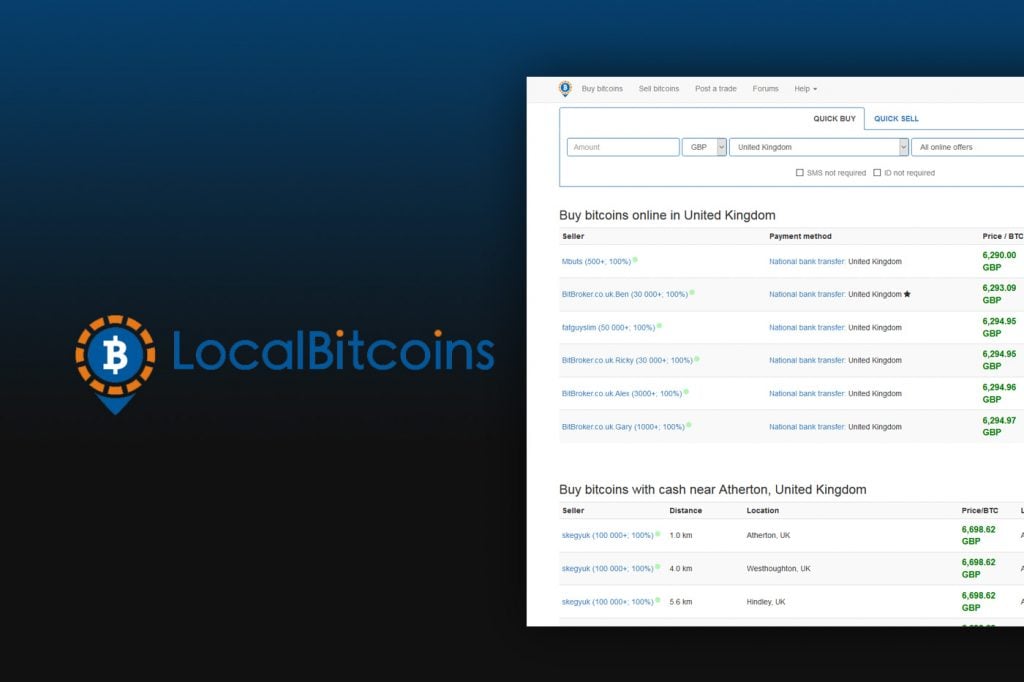

LocalBitcoins

LocalBitcoins You can trade a wide range of cryptocurrencies on CEX, including BTC, ETH, BCH, BTG, DASH, LTC, XRP, XLM, OMG, MHC, TRX, BTT, ADA, NEO, GAS, BAT, ATOM, XTZ, GUSD, ONT, ONG, and USDC. Supported fiat currencies are USD, EUR, GBP, and RUB, and available stablecoins include USDT and USDC.

Features

Supported payment options on CEX include Visa, MasterCard, SWIFT bank transfers, and ACH bank transfers for depositing and withdrawing your funds.

CEX is reputed as a secure platform, having not lost any user funds to date. The exchange adheres to strict anti-fraud measures and refund policies, is legally registered, compliant with PCI/DSS standards, and has a certificate of incorporation.

Fee policy

Another reliable option over Coinbase is a platform that prides itself on offering energy-efficient, fast, globally accessible crypto exchange services established in 2013. Serving over 1.9 million users in 188 countries, it's a favorite for trading vast amounts of digital currency.

The company stands by core principles of simplicity, integrity, synergy, customer focus, adaptability, open communication, enjoyable engagement, crypto ownership, and cutting-edge innovation.

Ease of use

This platform is geared towards excellence, allowing immediate Bitcoin purchases post-account creation and verification. On the landing page, fixed BTC purchase options are laid out—100EUR, 500EUR, and 1,000EUR—or opt for a custom amount. Other popular cryptos are also available to buy, albeit selling is currently limited to BTC via SEPA transfers for European banks. It doesn't offer a wallet service yet.

Known for its cost-effective approach, CoinMama applies a straightforward market rate tax of 2%, with an extra 3.90% commission generally that tapers off with higher transaction amounts. Transactions through debit or credit cards come with an added 5% processing fee. SEPA bank transfers carry no charge, while those done through SWIFT bear a flat tax of GBP 20 for orders under USD 1,000. Exceed this, and transactions are free from commission fees.

CoinMama prioritizes a seamless experience. Its user-friendly interface makes navigation effortless, even for novices, and it includes a comprehensive FAQ section and help options for any inquiries. Customised support is available to all.

Supported coins & payment methods

Before diving into trades, users open an account and undergo KYC verification to confirm their identity. Once verified, cryptocurrencies can be bought or sold using available payment methods.

Currently, CoinMama facilitates buying Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Cardano, Litecoin, Qtum, and Ripple. Payment in fiat currencies can be made using credit/debit cards (Visa & MasterCard) or bank wire transfers, accepting any fiat currency.

User safety & security

Bitcoin withdrawals can only be completed using SEPA transfers in Europe.

In the past, this platform faced a cyberattack, which resulted in a data breach of 450,000 users' emails and passwords. Despite this, no cryptocurrency was compromised thanks to the vigorous efforts of the security team. Hence, this Slovakian exchange retains its reputation for security.

Read our LocalBitcoins review here .

BitIt

Bitit Introducing another burgeoning crypto platform, established in 2014 in Austria. With a million users and a dedicated team of over 160 members, it processes multimillion-dollar transactions and boasts a PSD2 license, solid security procedures, and an excellent user experience.

Its rising popularity is due to a wealth of features, user-centric approach, and comprehensive support for multiple coins.

Features

Among its flagship features are the Bitpanda platform, its sophisticated global exchange, the ecosystem token, Bitpanda Pay, Bitpanda Savings, Bitpanda Metals, Bitpanda Swap, Bitpanda to Go, Bitpanda Plus, the Bitpanda Affiliate program, and the Bitpanda App.

Fee policy

The Bitpanda Global Exchange acts as an advanced trading hub designed for skilled traders, complete with an integrated API, globally accessible services, secure fund management, and a host of high-liquidity EUR trading pairs with minimal industry fees.

Ease of use

Its ecosystem token, Europe's most triumphant IEO, provides access to sizeable perks and discounts when using Bitpanda's leading services.

Bitpanda Pay serves as a bridge connecting conventional finance with fintech, allowing users to handle crypto-based payments in fiat directly to any IBAN from their user account.

Supported coins & payment methods

Bitpanda Savings lets customers create and broaden their investment portfolios seamlessly, offering a suite of auto-saving tools for flexibility and stress-free savings.

With its Bitpanda Metals service, the platform offers purchases of gold, silver, platinum, and palladium using digital assets at some of the market's most competitive fees.

User safety & security

Utilizing the Swap feature allows for quick exchanges between digital assets without hassle.

Read our BitIt review here .

EO.Finance

EO.Finance Additional offerings include Bitpanda to Go, a convenient service for buying prepaid cryptocurrency through a network of 400 branches and 1,350 partner branches in Austria. The Plus service caters to major investors with enhanced limits and specialized services, while the affiliate program rewards users with up to 20% commission for every new lead they bring onboard.

Features

Leading Options for Crypto Trading: Discover Alternatives to Coinbase in 2023

Let’s delve into eight exceptional alternatives to Coinbase, evaluating them based on trustworthiness, variety of cryptocurrency offerings, deposit methods, cost structures, and overall user satisfaction.

Fee policy

Coinbase Alternatives: Efficient Cryptocurrency Trading Solutions

Ease of use

Currently, the digital currency ecosystem is brimming with a multitude of crypto exchanges, each with its distinctive perks and challenges. Choosing the right platform involves navigating this myriad of choices to make an informed and well-judged decision.

Supported coins & payment methods

This platform is widely recognized as a prominent player among global crypto exchanges, boasting a user base of over 30 million who have collectively transacted over $150 billion in digital currency.

Coinbase is celebrated for its outstanding services, though it lacks certain features such as advanced trading tools and support for a broader assortment of cryptocurrencies.

Read our EO.finance review here .

User safety & security

Exploring Premier Alternatives to Coinbase in the Crypto Sector

CoinCorner

Founded in 2015, CoinCorner Here is a comprehensive list of the top contenders to Coinbase, enabling swift and secure cryptocurrency transactions.

Features

The following platforms stand out as formidable competitors to Coinbase, offering attractive features, competitive fee structures, supported digital currencies, varied payment methods, user protection, and asset safety.

Launched in 2013 initially offering cloud mining services, this company has transformed into a UK-based crypto trading platform providing diverse services such as cross-platform trading, order-book liquidity, and instant buy/sell options.

Fee policy

CEX.io caters to all traders, from novices to seasoned investors and institutional clients, boasting a clientele of over 3 million spread across the globe in more than 99% of countries and 38 US states.

Ease of use

CEX provides three core services: 'instant buy', the 'CEX.io exchange', and the 'CEX.IO broker'.

Supported coins & payment methods

The instant buy feature enables immediate Bitcoin acquisitions via MasterCard and Visa, streamlined with just a few clicks. Customers can choose from pre-set options ($200, $500, $1,000 in BTC) or a custom amount for instant purchase.

The CEX platform functions similarly to popular digital currency exchanges, providing account setup and KYC compliance, enabling trading of various crypto pairs like BTC/USD, ETH/USD, and others, including margin trading.

User safety & security

CEX's broker service facilitates margin trading of digital assets through Contracts for Difference (CFDs), offering benefits like exposure management and comprehensive market access. A demo account is available for practice purposes.

Bottom line

Staking is available, rewarding users for storing cryptocurrencies in their CEX wallets.

1Comment

The platform supports currencies including BTC, ETH, BCH, and several others, in addition to USD, EUR, GBP, and RUB in fiat. Supported stablecoins include USDT and USDC.