TLDR

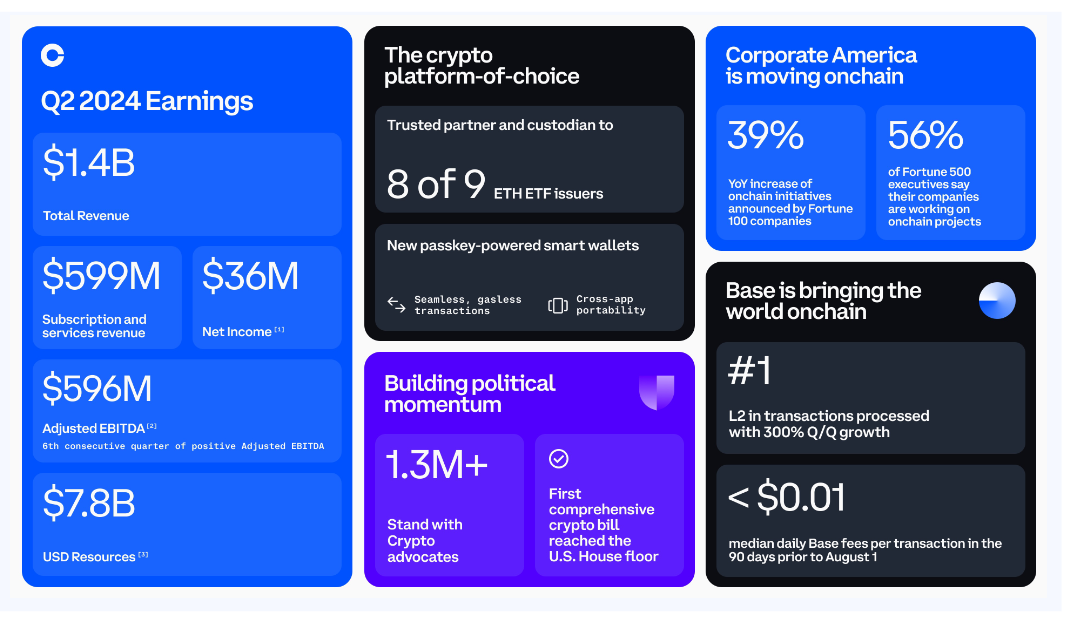

- Coinbase's Q2 financial performance saw it earn $1.45 billion, topping the anticipated $1.4 billion by analysts.

- Total trading activity soared by 146% year-over-year, amassing $226 billion.

- Revenue from transactions climbed 138% to $780.9 million, accompanied by a rise in subscription and service income to $599 million.

- Achieving its third successive profitable period, Coinbase declared a $36 million net income for the quarter.

- Following the positive financial release, Coinbase's stock saw a 3-5% increase in aftermarket trading.

As a powerhouse in the US crypto exchange landscape, Coinbase... reported stellar second-quarter results on August 1, 2024, further solidifying the crypto market's recovery. Post-announcement, shares gained 3-5% in after-hours trading. In Q2 of 2024, Coinbase posted a total revenue figure of $1.45 billion, exceeding the Wall Street projection of $1.4 billion. This marks a remarkable 104% uptick from the prior year's period, underscoring the notable rise in crypto trades.

Notably, total trading volume expanded by 146% year-over-year, reaching a substantial $226 billion. This uptick was chiefly fueled by institutional traders, with their trading volume jumping 142% to $189 billion. Retail trade also climbed substantially, rising 164% to $37 billion.

Revenues from transactions, a primary income source for Coinbase, surged 138% to $780.9 million. This growth can be majorly credited to a 130% rise in consumer transaction income, though it slightly missed expert forecasts of 141% transaction growth.

Revenues from subscriptions and services, which cover stablecoin revenue and blockchain rewards, grew to $599 million. This marks a 17% hike from Q1 and nearly twice the amount from Q2 of 2023. This upswing was partly due to Coinbase acting as a custodian for several asset managers launching spot Bitcoin ETFs.

By finishing the quarter with a $36 million net income, Coinbase's latest results mark a continuous streak of profits, totaling its sixth quarter on an adjusted earnings before interest, taxes, depreciation, and amortization basis.

However, this profit encompassed $319 million in pre-tax crypto investment losses, mostly unrealized due to diminished market prices from Q1 to Q2.

Even though overall results were favorable, the adjusted EBITDA of $596 million fell short of consensus expectations, which were pegged at $607.7 million. Earnings per share hit 14 cents, an improvement from the previous year's 42-cent loss, although it didn’t meet FactSet's 95 cents per share forecast.

Looking forward, Coinbase outlined a Q3 forecast projecting subscription and services revenue between $530 million and $600 million, a significant jump from last year's $334 million in the same timeframe.

The company's CEO, Brian Armstrong, spotlighted notable advances in securing greater regulatory transparency for the crypto field in the United States and around the globe throughout Q2.

“Crypto policy now mainstream in the US, gaining bipartisan traction, with notable momentum in both the House and Senate to move forward on significant legislation,” Armstrong mentioned in the shareholder update.

Coinbase's expanding involvement in the crypto ETF space was also highlighted. As the caretaker for most US spot Bitcoin ETFs launched in January, and many Ethereum ETFs trading since July 23rd, the exchange stands at the forefront.

Blockonomi's Editor-in-Chief and Kooc Media's creator, a UK-Based Digital Media Organization, an advocate for Open-Source Software, Blockchain Innovations, & a Fair and Free Internet for everyone.