Among the leading cryptocurrency brokers in the U.S., Coinbase and GDAX , both managed by the same team, stand out due to their high reputation and effective fiat-to-crypto conversion options.

In 2017 alone, Coinbase exceeded $1 billion USD in revenue, underscoring that both it and GDAX are staples in the crypto world, likely here for many years.

To clarify what each platform uniquely offers, we'll detail differences and notable features between GDAX and Coinbase.

Comparing Two Crypto Giants: How Coinbase and GDAX Differ

Consider Coinbase as a gateway to cryptocurrency—it’s straightforward and user-friendly, allowing first-time buyers to easily purchase bitcoin and ether directly with bank accounts without needing extensive knowledge. For a deeper dive, see our caters to newcomers GDAX caters to more experienced users, providing advanced trading features that are particularly appealing to seasoned crypto enthusiasts. complete Coinbase review .

Transfers between Coinbase and GDAX are seamless due to shared ownership, making moving fiat funds simple. advanced traders Having a Coinbase account automatically grants access to GDAX, making it our primary focus.

The user experience on Coinbase is designed to be straightforward—getting started is akin to setting up a new email account.

Sign Up

To register, simply provide 1) your full name, 2) email address, 3) a chosen password, 4) your state, and 5) a reCAPTCHA solution. Afterwards, you're all set with both a Coinbase and GDAX account.

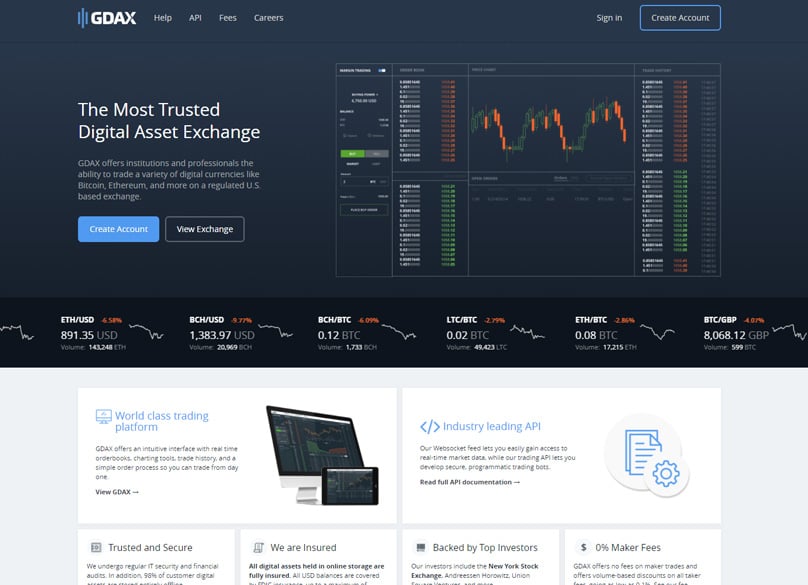

The interfaces reflect each platform's goals.

Coinbase's UI is exceptionally user-friendly, attracting numerous newcomers with its simplicity. This ease-of-use is a significant advantage.

Interfaces

GDAX’s UI, however, presents a suite of advanced options, which can be overwhelming to those not familiar with economic concepts relating to cryptocurrency.

You can add funds to Coinbase or GDAX via bank transfers.

Buying cryptocurrencies directly requires linking and verifying your bank account on Coinbase through two small transactions initiated by the exchange.

Deposit and Withdrawals

Withdrawals on both platforms are flexible. Move cryptocurrencies to a digital wallet or convert them to fiat for transfer to your bank account. Coinbase also supports PayPal withdrawals.

Credit card purchases? Coinbase can handle those, too.

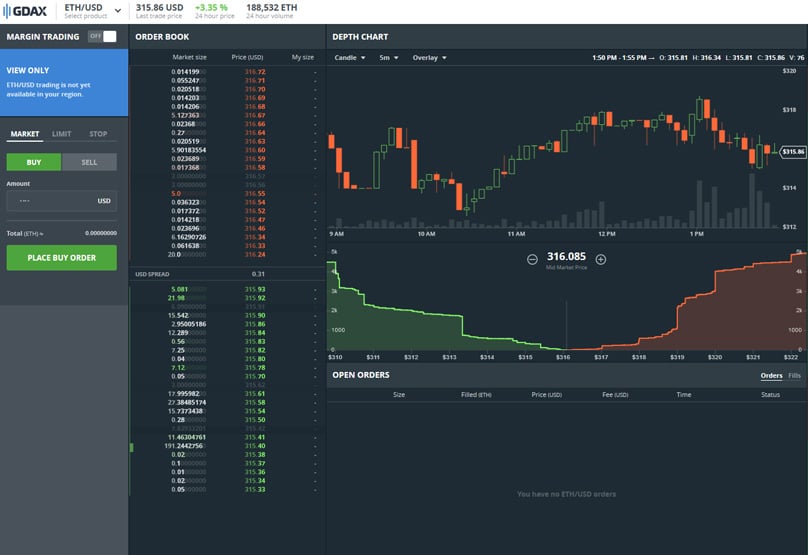

Unlike GDAX, Coinbase doesn't allow for different order types—purchases are straightforward without customization.

GDAX, however, offers advanced options like margin, limit, stop, and market orders, enhancing trading possibilities. GDAX’s flexibility will suit active traders.

Order Types

GDAX is known for its low trading fees, which never exceed 0.25%—a rate that rivals many other exchanges.

Coinbase, in contrast, includes significant fees as part of its convenience. Using a credit card costs 4%, and bank transfers 1.5%.

Coinbase vs GDAX Fees

Utilizing both exchanges can be economical—by funding your Coinbase account through bank deposits, you automatically set up GDAX. Then, transfer funds to GDAX and trade there with only a 0.25% fee.

Security on both Coinbase and GDAX is robust. Coinbase leads in cryptocurrency custodial services, offering 'Coinbase Custody' for asset protection.

Simple Trick to Save on Fees

Coinbase provides secure 'vaults' for users, while businesses can benefit from custodial services. Although GDAX lacks vaults, transferring crypto to Coinbase offerings is straightforward.

While support often falls short in crypto exchanges, Coinbase and GDAX improve by adding numerous support staff.

Security

Both platforms offer 24/7 support—reachable at +1 (888) 908-7930 for general concerns or if account security is compromised.

For straightforward inquiries, explore the help sections of both exchanges.

Customer Support

Coinbase and GDAX list identical cryptocurrencies. Available trade options include:

And their listings are expanding—as both aim to feature new, decentralized, and reputable projects through a modernized framework.

In summary, expect new additions to Coinbase and GDAX in the near future. here and here .

Accepted Cryptos

Users have noted that during market surges in 2017, both Coinbase and GDAX frequently went down.

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

The issue is from the system overload caused by a surge in new crypto users.

Can we expect better performance in 2018? Likely. Many users, however, have sought alternatives in frustration.

Similar Growing Pains

Newcomers in the U.S. or Europe looking to delve into cryptocurrencies should definitely consider

Experienced traders will find GDAX appealing. Despite needing improvements, these platforms have shown immense potential, hinting at promising futures.

While small exchanges abound, larger platforms like Coinbase and GDAX offer reliability and a seasoned reputation.

Conclusion

William M. Peaster, a seasoned writer/editor, specializes in the crypto sphere covering Ethereum and Bitcoin, featured in prominent publications. Contact him on Telegram at @wmpeaster. recommend Coinbase .

FTX to Commence Repaying $11.4 Billion to Creditors on May 30

Binance Halts Wallet Team Member Amid Insider Trading Investigation