Dubai, UAE, March 28th, 2025, Chainwire

Crypto exchange Coincall Within just a year and a half of its inception, Coincall has managed to take its place within the top five global crypto options exchanges based on trading volume , underscoring its rapid ascent in a burgeoning industry drawing attention from both big institutions and individual traders.

The impressive uptick in Coincall's performance, backed by both in-house insights and third-party evaluations, ties back to an effective Q1 strategy comprising impactful marketing initiatives and product developments. These moves were made in tandem with major partners in crypto such as SignalPlus , DWF , and Big Candle Capital .

Crypto Options: Transitioning from Specialized Tactic to Fundamental Market Element

Traditionally the realm of quantitative analysts and hedge funds, options are now becoming increasingly popular among crypto-savvy traders. These contracts allow investors to buy or sell a financial asset at a predetermined price — facilitating complex hedging, volatility trading, and strategic speculation.

As the digital currency market matures, crypto options are more frequently considered essential components of financial architecture. This notion gained traction this month as talks emerged about Coinbase the potential acquisition of Deribit , a leading BTC and ETH options exchange, for a speculated $4–5 billion . While the negotiations have cooled, the market sent a clear message: crypto derivatives now take the main stage.

The Fresh Face in the Top 5 — and Surging Ahead

Coincall's notable emergence is remarkable not only for its pace but also due to the company's infancy. Having been founded at the end of 2023 , Coincall positions itself among top players, accounting for 9-10% of Deribit's market size .

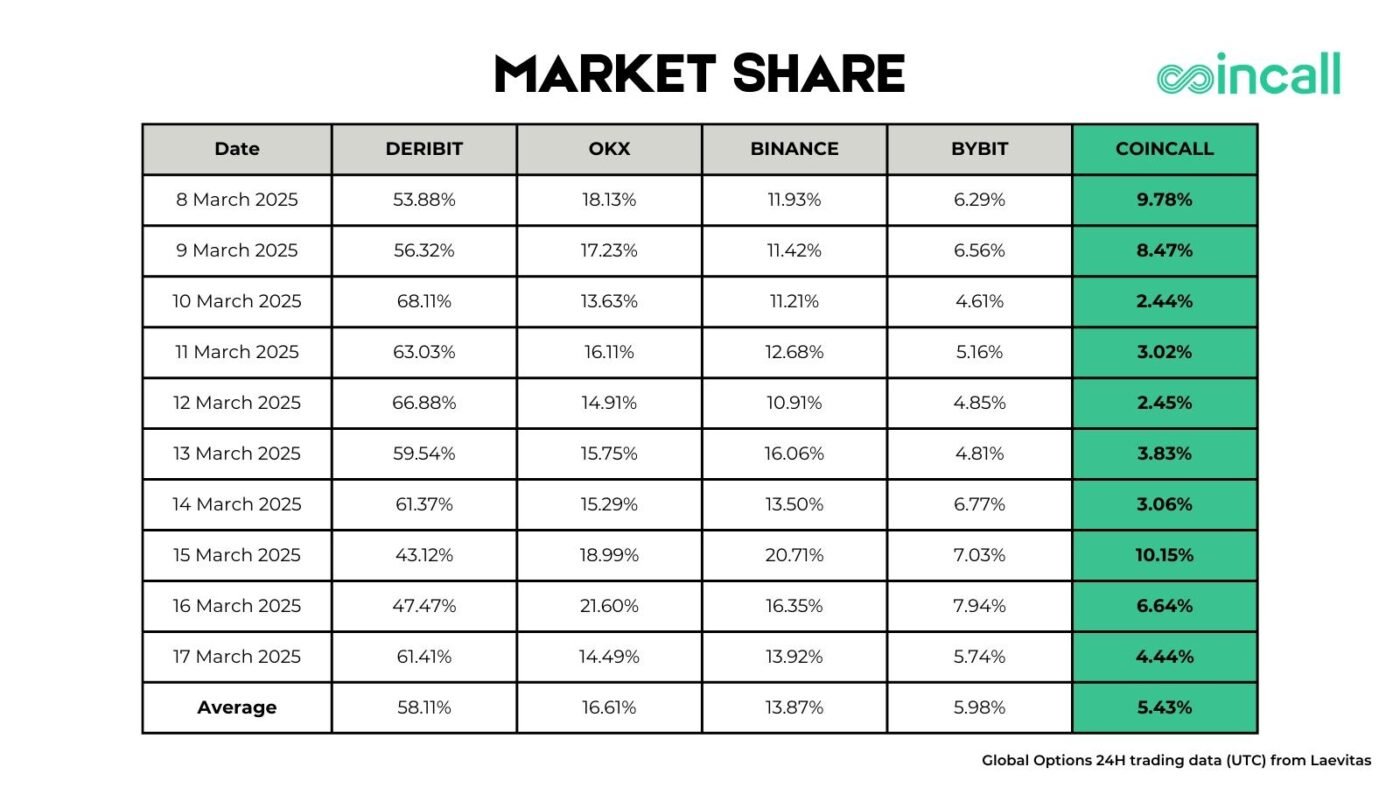

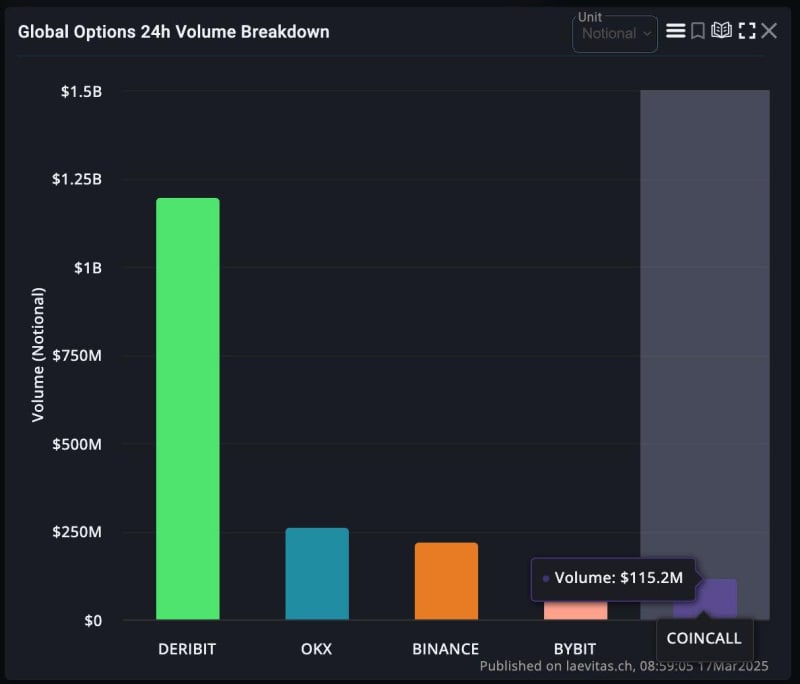

Data from Laevitas shows Coincall grabbing an average of 5.43% market share between March 8 and 17, 2025, peaking significantly at 10.15% on March 15. Additionally, the exchange experienced substantial volume, holding 9.78% on March 8 and 6.64% on March 16 — signifying upward momentum and increasing competitiveness in the global crypto options landscape.

Coincall's relative market share and growth vector set it apart as the youngest ever to crack the Top 5 , standing out as one of the most promising entities for acquisition or institutional collaborations among emerging competitors. As the spotlight moves from established titans to nimble contenders, Coincall finds itself at the heart of discussions, nearing the market share of industry heavyweight ByBit.

Leadership Backed by Vision

In January, Coincall appointed Daryl Teo — an ex-strategist from Alibaba Group (NASDAQ: BABA) and a seasoned crypto investor — has taken on the role of Chief Operating Officer and a minority shareholder. He joins CEO Jimmy, alongside key leaders hailing from OKX, Paradigm, and Bytedance.

\"We are observing crypto gain broad acceptance as a value store,\" Teo remarked. \"Options represent the new frontier — offering leverage, flexibility, and strategy. Our aim at Coincall is straightforward: make investing swift, intuitive, and secure for all.\"

‘Earn While You Trade’: Offering Yield and Capital Efficiency

Coincall's recent development, Earn While You Trade (EWYT) , aims to do away with the common trade-off between yield generation and active trading.

With EWYT, users can:

- Earn up to 6.4% APR on USDT holdings

- Utilize 90% of staked funds as trading margin

- Withdraw anytime with no lock-up periods

- Enhanced capital efficiency for active traders

This feature allows users to gain yields on stagnant capital, all the while maintaining their trading activities, providing an alternative way to utilize capital efficiently.

Users can explore the product here .

Wider Market Trends: Crypto Infrastructure is on the Rise

Coincall's ascent mirrors the broader momentum in crypto infrastructure developments. Statistics reveal that PitchBook $11.5 billion in venture capital was directed at crypto and blockchain ventures in 2024 through 2,153 deals — marking a significant rebound from the previous downtrend.

“The forthcoming era of crypto will revolve around tangible infrastructure,” noted Teo. “Platforms engineered with a deliberate focus on capital efficiency and user-accessibility are poised to define the coming decade.”

About Coincall

Coincall Coincall, an up-and-coming crypto options exchange launched in 2023, prioritizes easy access, capital efficiency, and a seamless trading encounter. The platform, offering ample liquidity, swift transactions, and unique features like Earn While You Trade, is crafting the future of digital-asset-derived trading.

Contacts

Daryl Teo

Coincall

daryl@coincall.com

Marketing Lead

Vera K.

Coincall

vera.k@coincall.com

Disclaimer: This is a press release issued by a third party responsible for its content. Please ensure you conduct your independent research prior to making any decisions based on this information.