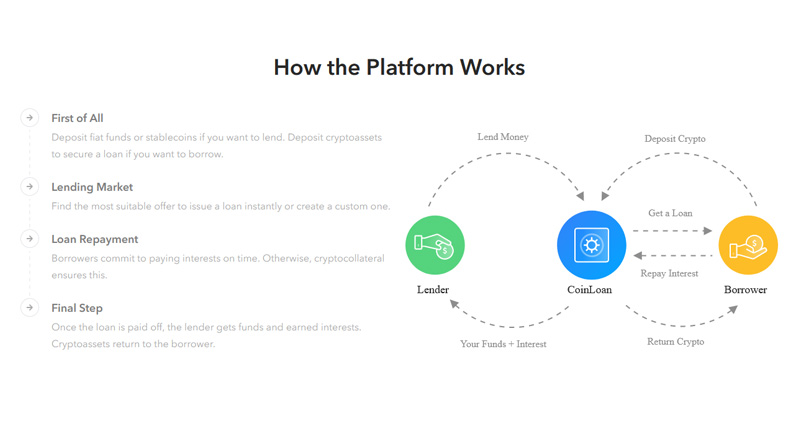

The realm of peer-to-peer lending has experienced remarkable growth lately, largely because it benefits both those seeking loans and those offering them. From the borrower's perspective, these platforms simplify borrowing, eliminating the bureaucracy of endless paperwork.

For potential lenders, P2P lending platforms provide a means to earn fixed interest by offering their funds. It was inevitable that such systems would soon evolve to accommodate cryptocurrency-based finance.

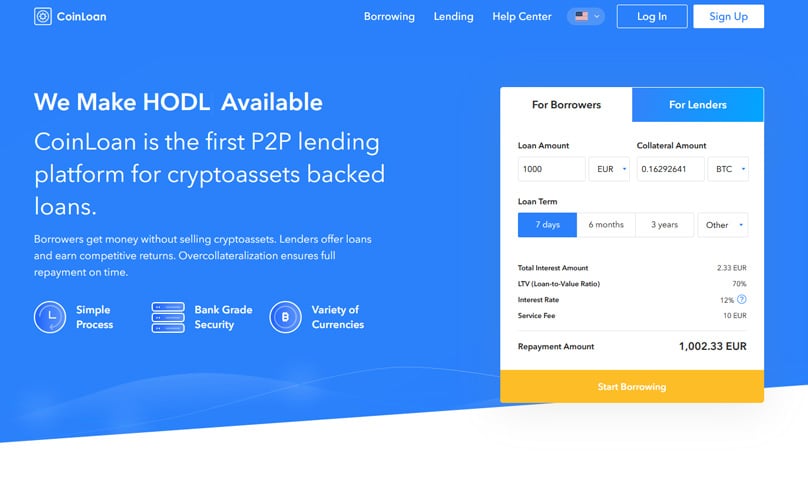

At the forefront of this is Coinloan Heralding itself as a pioneer, this platform offers loans secured by digital assets.

Essentially, Coinloan enables users to borrow against their cryptocurrency reserves, with Loan-to-Value ratios reaching up to 70%. For those aiming to earn passively, the platform often promises attractive double-digit returns when the investment consists of fiat or stable coins.

Curious if this peer-to-peer lending service aligns with your financial goals? Our Coinloan review has all the details you need.

What is Coinloan?

In its most basic form, Coinloan This platform, aimed at both loan seekers and investors, functions similarly to secured loans for borrowers; collateral comes in the form of your cryptocurrency assets.

You can access up to 70% of your cryptocurrency's LTV, a feature that also affords the luxury of bypassing credit evaluations, making it feasible even for individuals with poor credit histories.

Coinloan allows flexibility in borrowing through its wide range of terms, from a minimum of 7 days up to 3 years. As with any financial institution, interest on borrowed funds applies.

Coinloan also caters to those looking to earn through passive investments. By channeling fiat or stable coins into the system, investors receive funds to Coinloan borrowers with the promise of an appealing 12% annual return. Yet, as we'll delve into shortly, rates can fluctuate based on different parameters.

Founded in 2016 and situated in Estonia, Coinloan operates under the regulation of the Estonian Financial Supervision Authority, holding necessary European licenses.

To thoroughly understand Coinloan's offerings, we’ll consider its features from both borrower and investor perspectives.

Using Coinloan as a Borrower

Borrowing from traditional banks can be quite cumbersome, often involving extensive paperwork and thorough credit checks, which can negatively affect your credit score.

In scenarios where your credit report is less than stellar, loan rejections may occur promptly.

For those with cryptocurrency holdings, platforms such as Coinloan present attractive alternatives. Keep in mind, approval hinges on depositing your cryptocurrencies, with borrowing potential linked to their market value at deposit time.

Let's delve into the key aspects.

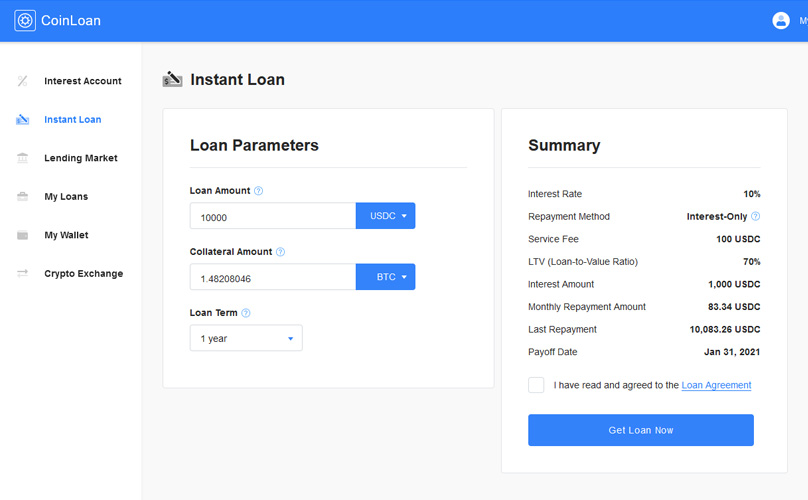

Loan Size

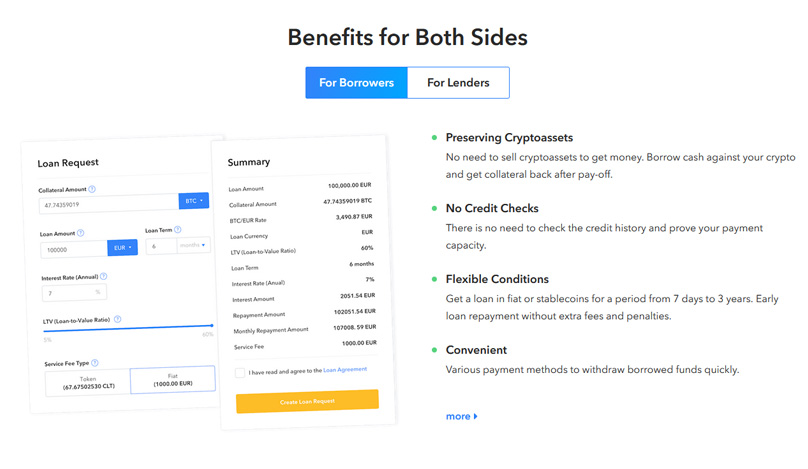

Coinloan bases its financing products By leveraging the LTV of your cryptocurrency wealth, you can borrow up to 70%, a significant figure. Consider using $10,000 worth of Bitcoin; you could borrow $7,000 if you qualify for the maximum permissible LTV.

It is crucial to note that LTV is pegged to immediate market value at the time of cryptocurrency deposit. Given cryptocurrencies' volatility, LTV can fluctuate daily. Opting for a lower LTV can provide a buffering safety net.

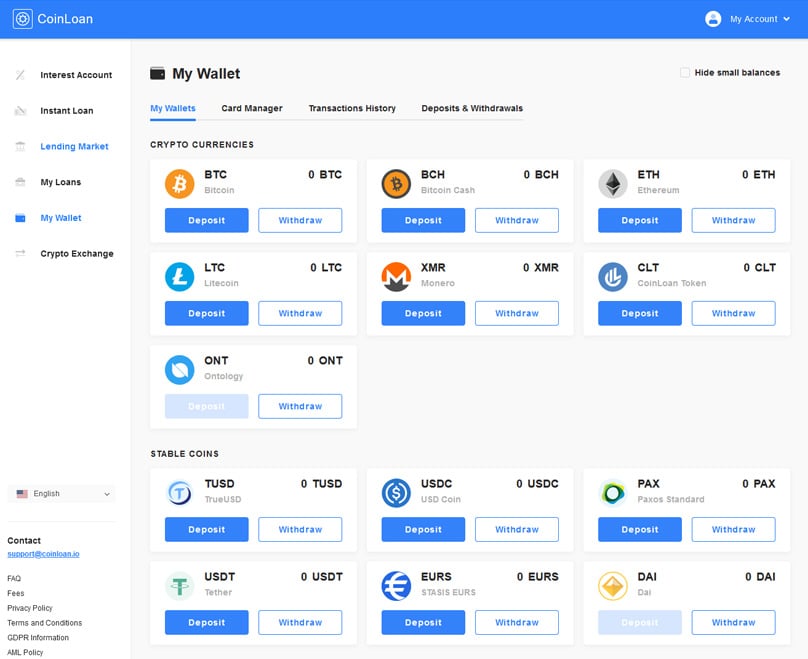

Supported Cryptocurrencies

Currently, the platform supports seven digital assets as collateral options, including:

- Ethereum (ETH)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Monero (XMR)

- Ontology (ONT)

- CoinLoan Token (CLT)

Coinloan intends to broaden its supported cryptocurrencies list soon. Additionally, Coinloan boasts its proprietary digital currency, the CoinLoan Token (CLT).

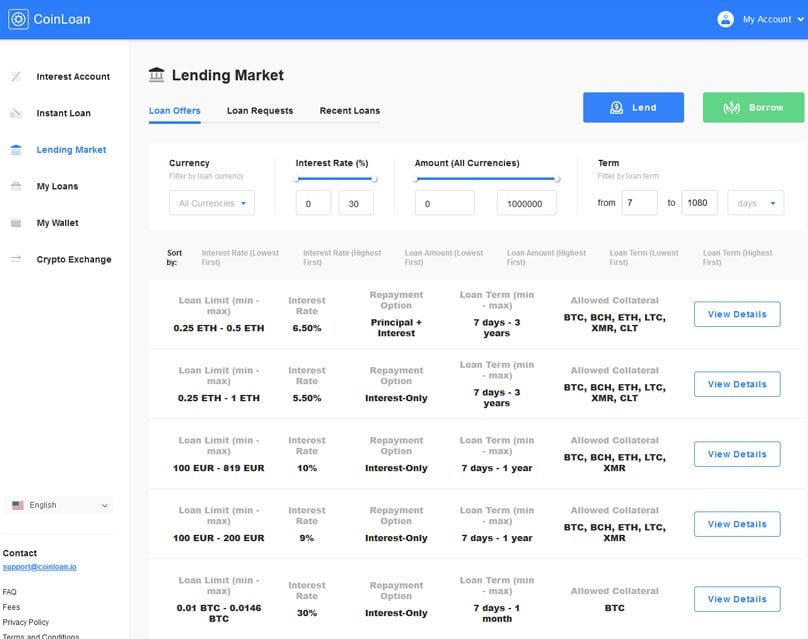

Interest Rates

At Coinloan, interest rates aren't standardized but vary for each transaction, contingent on factors like loaned amounts, terms, collateral types, and LTV sizes.

Adhering to the spirit of P2P lending, final interest rates mirror market dynamics. As investors pick and choose loans to fund, interest rates fluctuate accordingly.

You can opt between an Interest-Only or Principal + Interest repayment plan. Choosing the former means payments cover only interest initially, with the principal due at loan conclusion.

How are my Coinloan Funds Paid?

Once your loan is sanctioned by the platform , several fund withdrawal options become available: fiat currency, stable coins, or cryptocurrencies.

Fiat Currency

Funds can be withdrawn in EUR, USD, GBP, or RUB.

For withdrawals, Coinloan offers several payment gateways:

- SEPA

- SWIFT

- AdvCash

- Alfa-Bank

Stable Coins

Should you wish to receive stable coins, options include:

- TUSD

- USDC

- USDT

- PAX

- DAI

- EURS

Cryptocurrencies

Loan proceeds can also be dispensed in these cryptocurrencies:

- BTC

- ETH

- LTC

- XMR

- CLT

Scheduled Repayment Commitment for Coinloan Borrowings

Initially, the loan application phase at Coinloan allows selection of loan term length.

You can choose from the following

- 7 days

- 14 days

- 1 month

- 3 months

- 6 months

- 1 year

- 2 years

- 3 years

Regardless of selected duration, repayments are required in the original borrowing currency. For example, borrowing in USD mandates repayment in fiat. Similarly, Bitcoin loans necessitate BTC repayments.

Your initial payment is due 30 days post-funds reception, with subsequent payments at similar intervals. For loans under 30 days, full repayment is required by loan completion. For instance, a 14-day loan requires settlement by day 14.

Managing LTV Fluctuations and Staying on Track with Repayments

Understanding the nuances of Coinloan’s borrowing risks is crucial. Loan amounts correlate with cryptocurrency market value at the point of deposit. Due to volatility, asset values and an ensuing shift in LTV can lead to potential ‘liquidation’ states.

Here’s how it works:

- Consider a Coinloan assessment with a 70% LTV – the highest available.

- With $8,000 Bitcoin as security, securing a $5,600 loan becomes possible.

- Should Bitcoin downgrade to $7,000, then, given the borrowed $5,600, your LTV breaches 80%.

- Coinloan will warning you about impending liquidation risks.

- You can either reimburse portions of the loan to lower your LTV or choose inaction.

- Should you decide against intervention and Bitcoin’s price continues to dwindle, Coinloan may liquidate your holdings to recalibrate the LTV.

Conversely, if cryptocurrency value appreciates, resulting in lower LTVs, more borrowing potential arises.

With a borrower’s perspective now clear, let’s evaluate Coinloan as an investment platform.

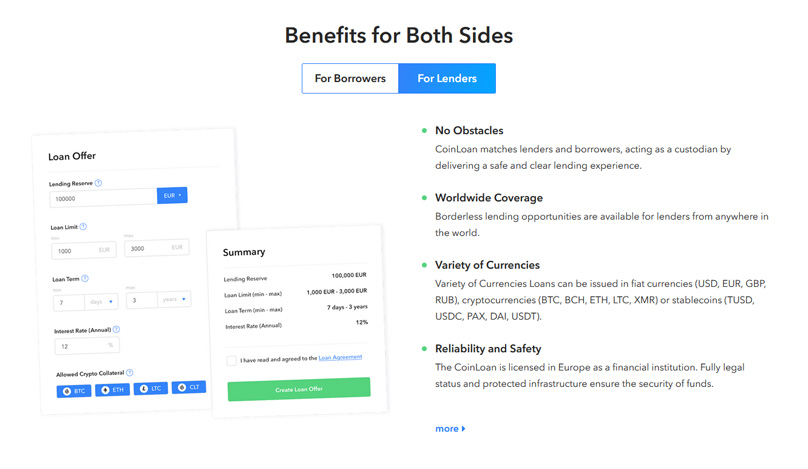

Using Coinloan as an Investor

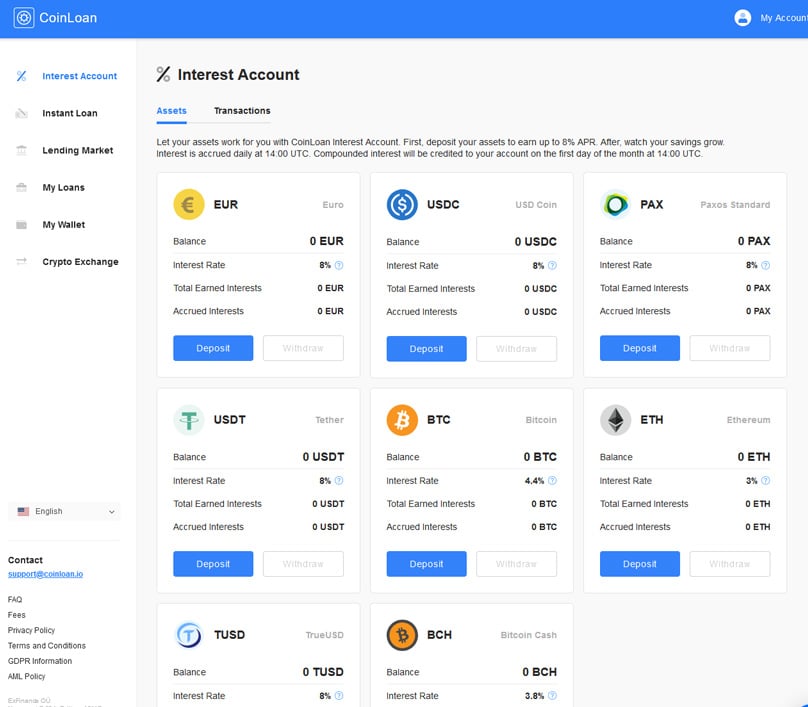

For casual investors eyeing passive income, Coinloan is worth a look due to its competitive double-digit returns.

Coinloan's advertised 12% annual interest rate underscores its investment appeal.

Step 1: Create Your Account and Verify Your Identity

Coinloan functionality mirrors that of other P2P platforms.

First and foremost, you’ll need to create an account Next comes the KYC (Know Your Customer) segment, mandated due to Coinloan's fiat dealings and regulatory adherence.

This step involves submitting valid ID documentation—passport or national ID—or, for U.S. residents, a driver’s license is acceptable, all paired with a selfie for identity verification.

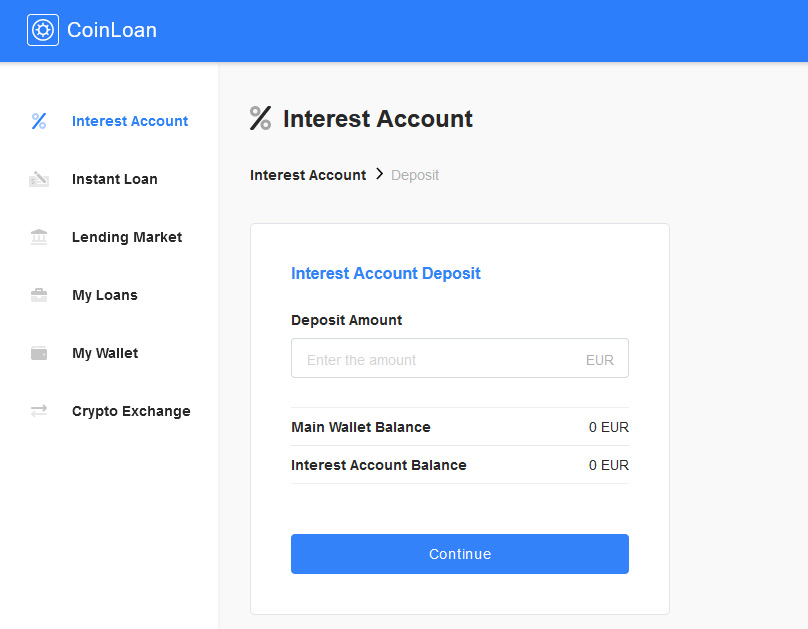

Step 2: Deposit Funds

Investors can access varied deposit methods, such as SWIFT/SEPA bank transfers or card transactions, though caution is advised as cards might incur cash advance fees. Such fees could impact Coinloan earnings directly.

Coinloan Overview: Innovating P2P Loans through Cryptocurrency

Step 3: Invest in a Loan

Coinloan revolutionizes peer-to-peer lending by connecting savvy investors with those in need of funds. Dive into our comprehensive analysis, complete with detailed insights on the advantages and drawbacks.

Peer-to-peer lending has skyrocketed in popularity, and it's easy to see why. It's a mutually beneficial arrangement: bidders gain uncomplicated access to capital without the labyrinth of paperwork, while lenders have an opportunity to earn a fixed return.

For individuals wanting their money to work for them, these P2P platforms invite everyday investors to earn returns by lending out funds. Naturally, this fruitful concept has been adapted for the digital currency world.

Step 4: Receive Your Repayments

Coinloan stands out by claiming to be the pioneering platform offering loans secured by crypto holdings.

In essence, users can leverage their cryptocurrency assets to secure loans, with a possibility of borrowing up to 70% of the asset's value. If you're aiming for passive income, consider that Coinloan frequently provides returns in double digits when investing with either regular or stable coins.

Coinloan Interest Account

Curious to find out if Coinloan aligns with your financial goals? Make sure you read through our detailed Coinloan assessment. Coinloan Interest Account Breaking new ground, CoinLoan positions itself as the first platform to offer peer-to-peer loans secured by crypto assets.

FAQs: Repayment Terms for Your Coinloan Balance

Is my Money Safe at Coinloan?

Understanding LTV Implications and the Consequences of Default

Here's How to Get Started: Sign Up and Verify Your Credentials

- FVR000111

- FRK000091

- FFA000241

This platform is designed for both those seeking loans and those looking to invest. When borrowing, consider it akin to a secured loan, where your crypto is the safety net.

You can potentially access up to 70% of your cryptocurrency's market value as cash without the hassle of a credit score check, making it open to those with less-than-stellar credit histories.

For those borrowing through Coinloan, loans range from just a week to a full three years. Remember, as with any loan, interest is due over the term of your borrowing.

Customer Support

On the flip side, Coinloan is ideal for individuals looking to generate passive income. By investing fiat or stable coins, your funds will be allocated to borrowers, with promises of returns reaching an enticing 12% annually. Yet, as we'll cover soon, rates may fluctuate based on several factors.

Since its inception in 2016, Coinloan, headquartered in Estonia, operates under the oversight of the Estonian Financial Supervision Authority, equipped with all necessary European licenses.

Coinloan Review: The Verdict?

In summary, Coinloan Understanding Coinloan's offerings involves evaluating its services from both a borrower’s and an investor’s perspectives.

Those familiar with traditional loan processes know the challenges: a barrage of documentation and inevitable credit checks that may haunt your history.

Receiving a rejection due to a tarnished credit score can be disheartening.

That's why considering alternative platforms like Coinloan is beneficial, particularly if you hold cryptocurrencies. As previously stated, crypto deposited at Coinloan determines your eligible borrowing amount.

CoinLoan

Pros

- Let’s simplify the essentials.

- Easy to Use

- Well Designed

- Your cryptocurrency plays a critical role, allowing for potentially high Loan-to-Value ratios up to 70%. For instance, with $10,000 in Bitcoin collateral, borrowing $7,000 could be within reach.

- Great Returns on Offer

Cons

- Doesn’t show info on defaults