Thanks to a remarkable surge in cryptocurrency value recently, there's a fresh wave of eager faces joining the world of Bitcoin and its peers.

This increase in enthusiasm also means an influx of beginners who need to quickly get acquainted with a rather complex crypto universe; it might feel overwhelming at first, but that feeling won't last long.

One of the initial challenges every crypto greenhorn will confront is becoming familiar with the specialized language and lingo that's pervasive in the crypto community. Initially, it could seem as if everyone is conversing in an unknown dialect, but you'll get the hang of it, especially once you familiarize yourself with the crucial terms outlined in this article.

Let's jump in then: we'll guide you through the key and frequently used cryptocurrency terms so you can confidently engage in discussions with fellow traders in no time.

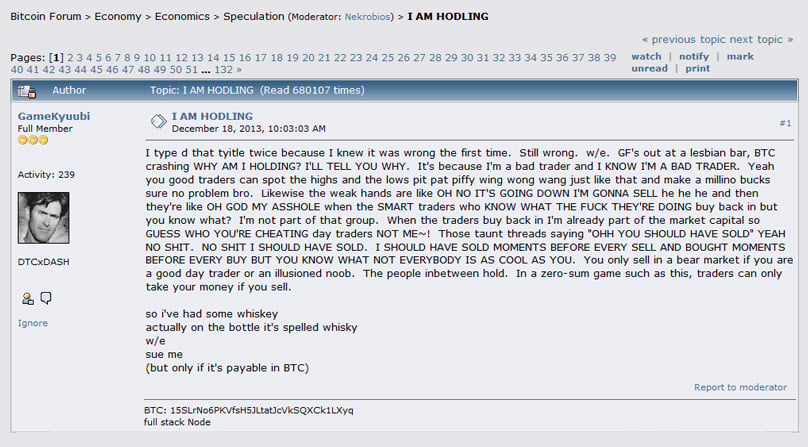

HODL

'Hodl' is simply a typographical error for 'Hold,' reflecting the mindset of today's crypto enthusiasts.

This term emerged from a post on the Bitcointalk forum titled 'I AM HODLING.' I AM HODLING Here, a participant named 'GameKyuubi' inadvertently misspelled the word while sharing his trading perspectives after enjoying some whiskey.

Some have mistakenly attributed the meaning 'Hold on for dear life' to this term. Although that interpretation fits, it's not the term's actual origin.

If you don't adhere to 'hodling' and let emotions dictate your day trading actions, you could end up significantly reducing, if not completely depleting, your crypto portfolio.

Hence, hodling is recommended as a superior portfolio strategy, especially for novices and traders unfamiliar with the intense volatility that accompanies cryptocurrency day trading.

Reflect on how a few individuals continue to hodl from as far back as 2009 and 2010. Their numbers might be small, but they are there. Chainalysis, a blockchain analytics firm, has provided insights that some long-term holders started transacting with their newly acquired Bitcoin Cash following the split on August 1st. holding bitcoins The strategy is to stay put and not lose your holdings due to erratic market activities. Should the value of cryptocurrencies skyrocket over the decades, waiting patiently will prove to be a wise choice. Therefore, HODL!

These users, then, are the OG hodlers.

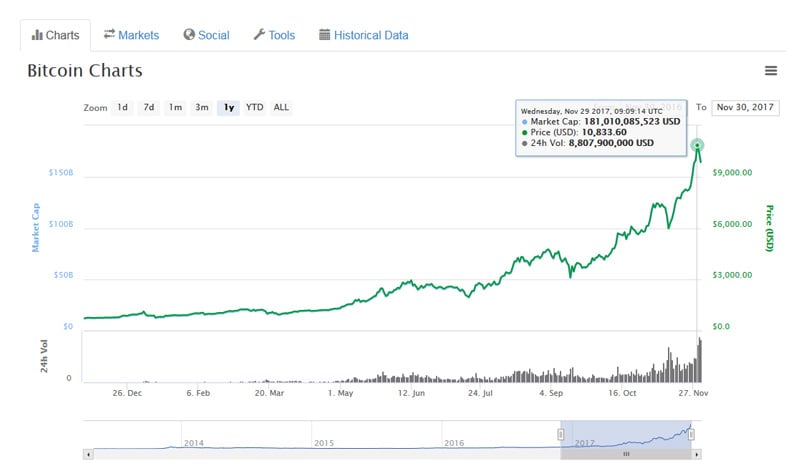

'ATH' stands for the 'all-time high,' signifying a coin or token's historic peak price.

ATH

Take the recent bull market as an example—a few years ago, Bitcoin reaching $11,000 USD was unimaginable, yet it recently hit this 'ATH.' Simple enough, right?

Bitcoin has recently been quite the rollercoaster, breaking several all-time highs within mere days; from $9,000 all the way to nearly $12,000.

And these all-time highs tend to be fleeting, as expected. Take ether, the 'fuel' coin for Ethereum, which set its all-time price high at $420 back in June 2017. It wasn't until recently that ether breached that ATH, as ETH, the second largest crypto by market cap, soared. Not too long ago, we saw another significant ATH for ETH at $509 on November 29th.

Here's a tip: when cryptocurrencies hit new ATHs, it's common to see profit-taking shortly thereafter. Following an ATH, it's typical for cryptocurrencies to experience a short drop known as a correction.

'FUD' stands for 'fear, uncertainty, and doubt,' with some interpreting it as 'fear, uncertainty, and despair.'

FUD

This term voices the heightened panic and concern that can spread through the crypto community like wildfire—sometimes for valid reasons and sometimes not.

There's genuine FUD, like when a significant issue rattles the community. For example, hacks or regulatory announcements like China's ICO ban once sparked widespread concern.

Then there's manufactured FUD spread by so-called FUDsters, often for particular reasons.

It can arise from basic rivalries too. For instance, Bitcoin proponents quickly highlight any issues within the Bitcoin Cash network, and the reverse is also true. This is akin to competitive FUD.

Moreover, FUD can originate from individuals who stand to gain from a price drop. Suppose someone is secretly shorting BTC; spreading panic might align with their interests, instigating a brief price dip and fulfilling their bet.

Remaining balanced and critical when faced with FUD is essential. You need to conduct your own analysis to discern real threats from imagined ones.

'FOMO' is the aptly named 'fear of missing out.'

FOMO

If panic selling triggers price drops due to traders losing their nerves, FOMO drives prices up as investors scramble to participate in short-lived price surges.

If you're venturing into cryptocurrencies, consider your motives. Perhaps a friend's success story about Bitcoin led you here?

That's FOMO—you didn't want to miss the wave. didn’t want to miss out For example, picture BTC experiencing a momentary price surge in a single day, gaining 10% within just a couple of hours. You'd see numerous traders switch from altcoin positions to bitcoins. Consequently, altcoin prices would drop significantly while bitcoin gains upward momentum.

That’s essentially what FOMO is.

This phenomenon is FOMO—the fervent enthusiasm to benefit from an impressive price hike of a particular cryptocurrency. Expect to see even more FOMO-driven activity as crypto continues to captivate mainstream, institutional, and retail sectors like never before.

Yet beware of FOMO—getting carried away might lead to unwanted results.

Bagholders are individuals who purchase a cryptocurrency at its peak or during bullish phases; they become bagholders when prices fall, leaving them in a predicament where selling would lead to a loss. Typically, the best move is to wait until prices rebound, at which point they can sell their 'bags.'

Bagholder

'Bears' and 'bulls' are terms borrowed from traditional stock markets, representing bearish and bullish market conditions. Crypto bears have a pessimistic market outlook, while crypto bulls are optimists.

Bears, Bulls, and Whales

Now, these terms are often used to describe a person's market attitude. For example, you might call someone 'overly bullish' if they are irrationally optimistic about a particular project while ignoring its shortcomings.

Then you have 'whales'—cryptocurrency investors with massive holdings, such as thousands or even millions of coins. There's frequent chatter about whales influencing the market for personal gain, using tactics like erecting buy walls to prevent selling at certain prices or selling large quantities quickly to crash the price and trigger stop-losses, which fuels further downward movement, allowing them to buy in at lower prices.

Bitcoin's enigmatic creator, Satoshi Nakamoto, could be considered a whale due to reportedly holding a BTC wallet with over one million bitcoins.

While owning a million bitcoins isn't a prerequisite for being a whale, it's a pretty whale thing to do if you have them.

William M. Peaster is an expert writer and editor focusing on topics like Ethereum, Dai, and Bitcoin in the crypto sector. His work has appeared in Blockonomi, Binance Academy, Bitsonline, and more. He enjoys keeping tabs on smart contracts, DAOs, dApps, and the Lightning Network, and he's even taking steps to learn Solidity. Reach out to him on Telegram at @wmpeaster

2Comments

Best wishes with your trading adventures!

Both enlightening and amusing, thanks a bunch 😉

Adam

level-up-casino-app.com delivers content strictly for informational purposes and doesn't constitute an offer to buy or sell or a solicitation of an offer to buy or sell any security, service, product, or investment. Opinions on this platform aren't investment advice, so independent financial guidance is recommended where needed.