Historically, money markets have been entrenched in traditional finance, yet the advent of crypto technology birthed its own variant. Compound Finance .

Compound is an Ethereum-powered decentralized The crypto money market allows participants to gain interest on their deposits and procure loans using collateral, with rates influenced by the forces of supply and demand. However, having some technical know-how is beneficial to maximize its potential.

For those new to this ecosystem, several intuitive graphical wallets have been developed to streamline the process.

Join us as we traverse the foundational aspects of Compound Finance and guide you on how to embark on your journey of earning and borrowing within it.

Compound Finance: The Basics

Envision Compound Finance as an extensive reservoir of funds governed by clear-cut rules. Anyone can participate by contributing Ethereum-based assets, such as ETH or suitable ERC-20 tokens. With its fully decentralized and automated structure, there are no KYC scrutinies or application denials. Anyone equipped with an Ethereum wallet can engage with Compound directly or via apps that support platform integration.

Here’s how it works…

- By infusing your crypto into the pool, you start earning interest automatically after each Ethereum block processes (typically every 15 seconds).

- The interest you earn originates from borrowers utilizing the pool, who pay a higher interest than what you accrue by depositing.

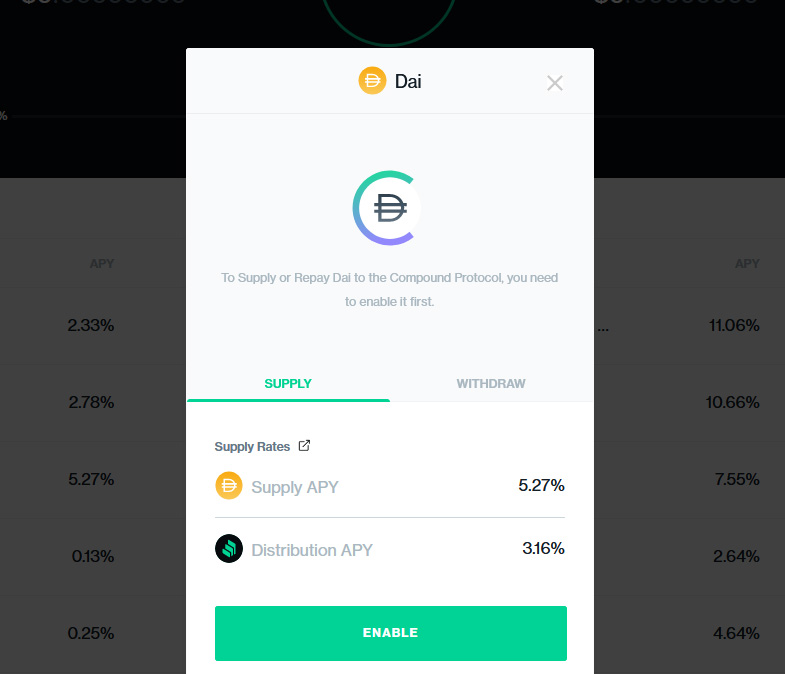

- Unlike a traditional bank account, deposits in Compound transform into a newly minted Ethereum token known as a C token.

- To illustrate, suppose you deposit USDC, you receive cUSDC in exchange – an alternative ERC-20 asset. This cUSDC is engineered to gain value incrementally as interest accumulates in the pool.

- Given the autonomy over your deposit, you are free to withdraw your funds at any time to claim your interest. Alternatively, you can trade your cUSD (or another C token) on marketplaces that support them.

Securing loans on Compound is a tad more complex compared to straightforward deposits but employs similar core principles. Initially, you need to deposit collateral, akin to the process to earn interest. All loans on Compound are over-collateralized. This implies, for example, that if you wish to borrow WBTC, you need to deposit a more considerable value of a different crypto asset such as ETH or DAI. This setup ensures borrowers have protection in scenarios where a loan isn't repaid.

Interacting With Compound Finance

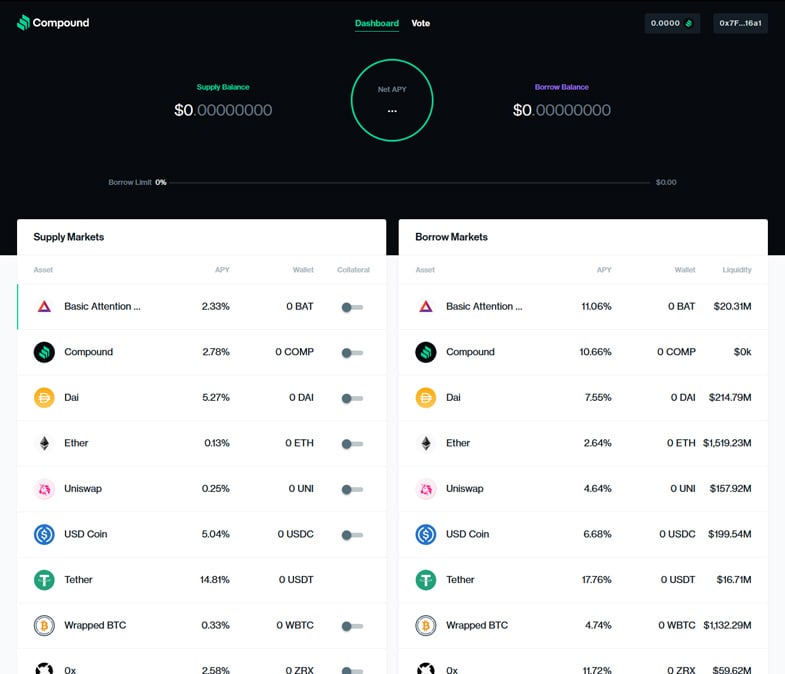

There is a multitude of avenues to commence your journey with Compound Finance. A favored approach is using the platform’s native web application, accessible at app.compound.finance. After visiting the website, connect an Ethereum-compatible wallet.

Primary options include Metamask, Coinbase, Ledger, and Wallet Connect. You can link either through a browser extension or by scanning a QR code using a mobile application.

Upon establishing a connection, you can begin interacting with the network and initiate deposits. Similar to other platforms linked to an Ethereum wallet, each transaction necessitates individual approval.

For a simpler and more visual experience, several wallets feature integrated Compound Finance functionality. Take, for instance, Exodus Exodus, a widely favored graphical desktop and mobile wallet. When using a recent Exodus version, just click on the Compound Finance icon.

Subsequently, adhere to the on-screen cues to start earning interest via DAI. While Exodus presents a user-friendly experience compared to other methods, it currently only supports DAI for interest-earning deposits. Currently, loans are not available.

For those desiring an even more streamlined experience, consider Argent Argent wallet, which now includes Compound Finance support and accommodates a broader range of assets than Exodus. Nevertheless, Argent also seems not to support loans at this time.

How Much Can You Earn With Compound?

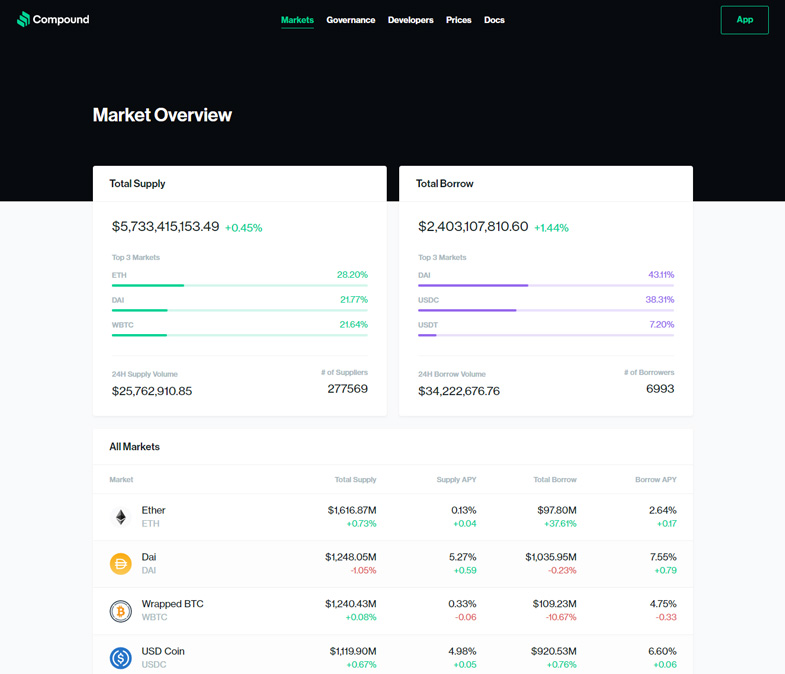

Interest rates on Compound are solely dependent on demand. If there's a high demand for a particular asset, depositors will enjoy increased interest rates. Conversely, limited borrowing interest results in reduced deposit rates; the reverse holds true for borrowers.

You can find the current interest rates for supported assets on app.compound.finance, and through wallets or apps with integrated Compound services like Argent or Exodus. Our findings indicated that TUSD offers the best interest rates for earners, peaking at just over 17%.

DAI, another stablecoin, lags behind at a bit over 5%. Meanwhile, prominent cryptocurrencies like ETH and Bitcoin (via WBTC, an ERC-20 token) are considerably lagging at under 0.20%. Examining 30-day averages, these rates seem typical.

In comparison to other DeFi applications and platforms, Compound’s interest offerings aren't particularly competitive. However, the interest available for TUSD deposits stands out as superior. Interest for other ERC-20 tokens typically ranged between 1% and 5%. Thus, Compound Finance may not be the ultimate solution for all DeFi deposits. Instead, prioritize actual interest rates to determine what aligns best with your financial goals.

Interest rates are perpetually fluctuating. Once you've deposited, you'll continue to earn interest as long as you possess your C tokens, regardless of rate shifts.

What Potential Pitfalls Should You Be Aware Of When Engaging with Compound Finance?

Relative to other cutting-edge DeFi platforms, Compound Finance seems to offer a reliable choice regarding trust, based on our findings. The platform declares on its homepage that comprehensive audits have been conducted. The California-based firm behind Compound also maintains an active bug bounty initiative. Throughout its existence, Compound hasn't been reportedly subjected to hacks, thefts, or other security breaches.

Another factor worth noting about Compound pertains more to legal than technical concerns. Being a US-based entity – a nation with a complex stance towards crypto projects – the platform's future relations with primary regulatory agencies like the SEC remain uncertain. However, no interactions have been reported yet.

Regarding safeguarding against market volatility, the platform has been thoroughly assessed by Gauntlet. In a 44-page report report, Gauntlet indicates: “…the protocol’s current configuration appears sufficiently robust to sustain expansion to at least triple the existing borrowing volume, provided ETH price volatility remains below historical extremes.” Essentially, an extraordinary, rare event would be necessary to jeopardize Compound.

As with any DeFi initiative, it's crucial only to invest what you can afford to lose. From our perspective, Compound seems a safe choice. Always conduct your due diligence and familiarize yourself with the project before investing.

Is Compound Finance your go-to DeFi platform, or do you prefer another? We encourage you to share your experiences in the comments below.