TLDR

- Estimates indicate that Bitcoin will become a long-term asset for about 25% of S&P 500 companies by 2030.

- It was in 2020 that MicroStrategy propelled a new approach to corporate finance with Bitcoin at its core, seeing astronomical growth exceeding 2,000% in its stock value thereafter.

- In a bold financial shift, GameStop recently revealed plans to raise $1.3 billion through a convertible note, with intentions to pursue a Bitcoin-centric treasury model.

- At present, around 90 publicly traded enterprises have embraced Bitcoin as part of their financial strategy, yet among those, only Tesla and Block are part of the S&P 500.

- With the shifting tides in finance, treasury managers might feel the pressure to explore Bitcoin, fearing missed financial opportunities.

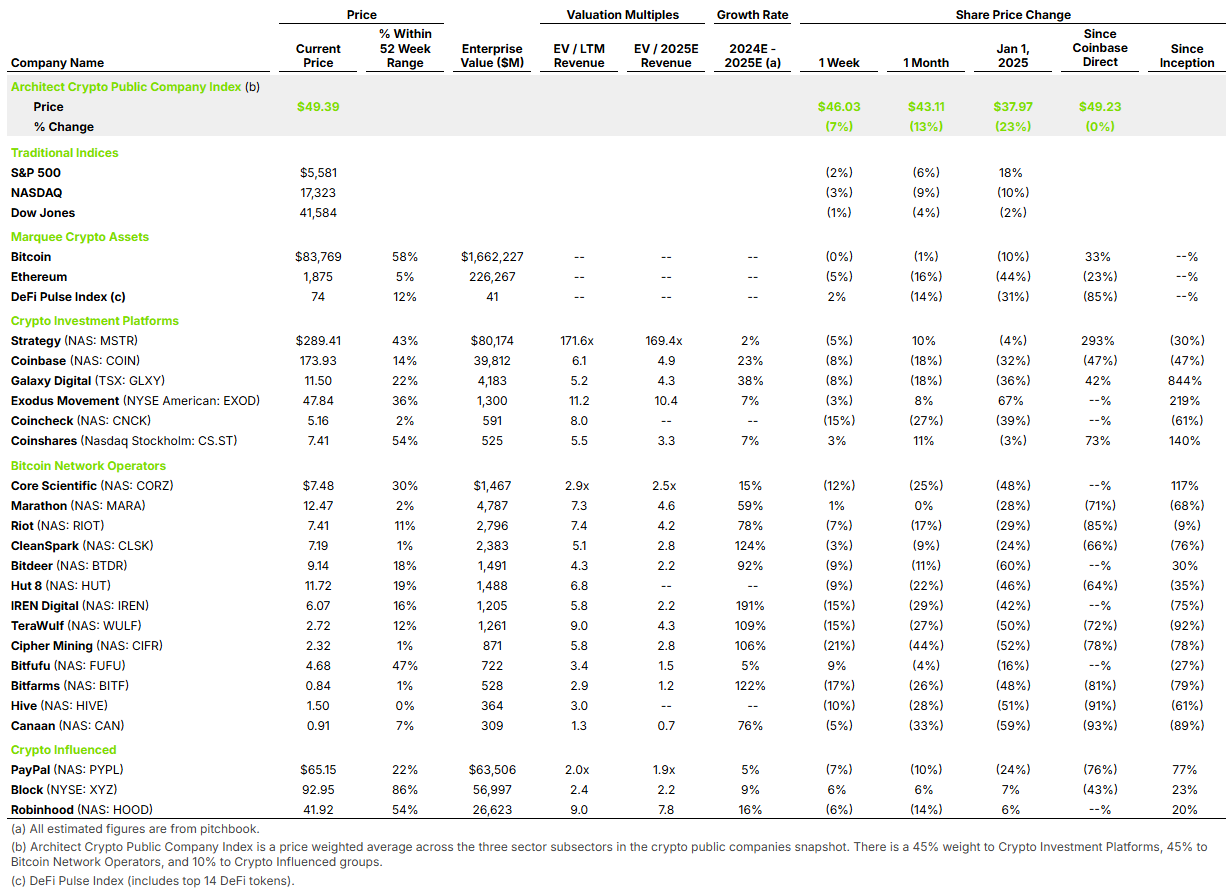

More publicly listed firms are waking up to the potential of Bitcoin on their balance sheets. As indicated by bitcointreasuries.net, there are now 90 such companies, making Bitcoin a fundamental treasury asset.

The intriguing journey began with MicroStrategy’s adoption of Bitcoin as a primary treasury reserve on August 20, 2020. Beyond expectations, the company’s shares rocketed over 2,000%, outperforming both Bitcoin and the S&P 500 significantly.

GameStop took its own step into this financial adventure, revealing a strategy to purchase Bitcoin with proceeds from a $1.3 billion convertible note offering disclosed on March 26, 2025.

Their leader expressed his enthusiasm, suggesting GameStop is poised to redefine its financial landscape and stand at the forefront of the gaming sector’s embrace of Bitcoin, although their share value took a 20% dive post-announcement.

Enterprises leverage Bitcoin for strategic reasons such as hedging against potential fiat currency devaluation, notably the US dollar, while also diversifying treasuries for risk mitigation—advantages Bitcoin holds over classic assets like gold.

Unlike gold, which requires physical safekeeping, Bitcoin's digital nature makes it agile and easy to move, giving it an edge with its tangible yet liquid qualities recognized under GAAP.

MicroStrategy found additional benefits in their Bitcoin-centric direction, offering asset managers a chance to gain Bitcoin exposure when direct ownership wasn't viable.

Aiming to ride the projected appreciation of Bitcoin’s value, MicroStrategy benefited from branding itself as a trailblazer, where CEO Michael Saylor's optimistic view on Bitcoin’s future added advantage.

Corporate Bitcoin: Risk vs. Reward

Neither Tesla nor Block hold exclusivity in Bitcoin investments in the S&P 500 sector, but for predictions of growth to materialize, many more companies need to follow suit by 2030.

Visionary tech figures and investment leaders including ARK Invest's Cathie Wood, Galaxy Digital's Mike Novogratz, Coinbase's Brian Armstrong, and Block's Jack Dorsey forecast Bitcoin's potential climb to as much as $1 million by 2030.

Elliot Chun from Architect Partners, a financial advisor with a tech focus, considers Bitcoin strategies compelling enough to force treasury managers to take notice, suggesting a win-win—try and succeed, you excel; try and stumble, at least you attempted; ignore, and it could cost your position.

Chun cautions, differentiating firms that genuinely seek treasury diversification using Bitcoin from those pivoting their core business models, warning against expecting MicroStrategy-like success.

First-mover advantage worked in MicroStrategy’s favor, providing institutional investors Bitcoin access when direct options were limited.

This exclusivity dwindled after January 10, 2024, with the SEC's approval of several Bitcoin spot ETFs, opening fresh avenues for Bitcoin exposure among investors.

Even as interest grows, companies find using Bitcoin for treasury remains a 'questionable approach,' considering price instability that presents both golden opportunities and financial hazards.

There's a growing movement towards educating firms about this opportunity. Recently, an entire day during the New York Bitcoin Investor Week was dedicated, and MicroStrategy hosted a similar conference in Las Vegas.

Bitwise has taken an innovative step by introducing the Bitwise Bitcoin Standard Corporations ETF, targeting firms that allocate a significant share of Bitcoin in their corporate reserves.

As more explore Bitcoin’s potential, the forthcoming years will determine if it becomes a central element of corporate finance or if its adoption remains niche.

Maisie brings seasoned insight to the world of crypto and finance journalism, having penned features for Moneycheck.com, level-up-casino-app.com, and now spearheading editorial direction at Blockfresh.com.