With the cryptocurrency scene flourishing, backed by endorsements from celebrities and market giants in the S&P 500, users find themselves spoiled for choice in selecting the right platform.

The emergence of Decentralized Exchanges (DEX) has simplified navigating the vast array of cryptocurrencies, but balancing the merits of DEXs and Centralized Exchanges (CEX) adds a layer of complexity to decision-making.

The Orion Protocol It's a piece of the larger puzzle, instrumental in reintegrating and revitalizing the market.

The fragmented market landscape poses challenges for newcomers bewildered by countless options, and also for seasoned investors who must juggle complexities to seize the best deals and maximize profits.

Previously, users faced tedious hurdles: acquiring tokens on specific exchanges, then transferring to a designated wallet, only to reverse the process later. Such fragmentation wastes time and resources.

Orion Protocol: Optimizing Markets Through Consolidation

Orion Protocol was specifically designed This solution aims to streamline the crypto ecosystem's liquidity into a singularly decentralized, secure, and adaptable platform, utilizing the most advanced liquidity aggregation technology available.

Most DeFi protocols and DEXs were born to dismantle emerging monopolies, but those meant to unify have lagged, sometimes becoming part of the issues they sought to fix.

Rather than rival existing markets or bolster individual projects, the Orion Protocol functions to integrate them, benefiting DEXs, CEXs, and swap pools alike, fostering synergy across the cryptospace.

By unifying DEX and CEX liquidity on one platform, Orion Protocol enables investors to refine their strategies without conceding any benefits.

Geared for both B2B and B2C interactions, Orion Protocol bridges centralized and decentralized realms without acting as a central authority.

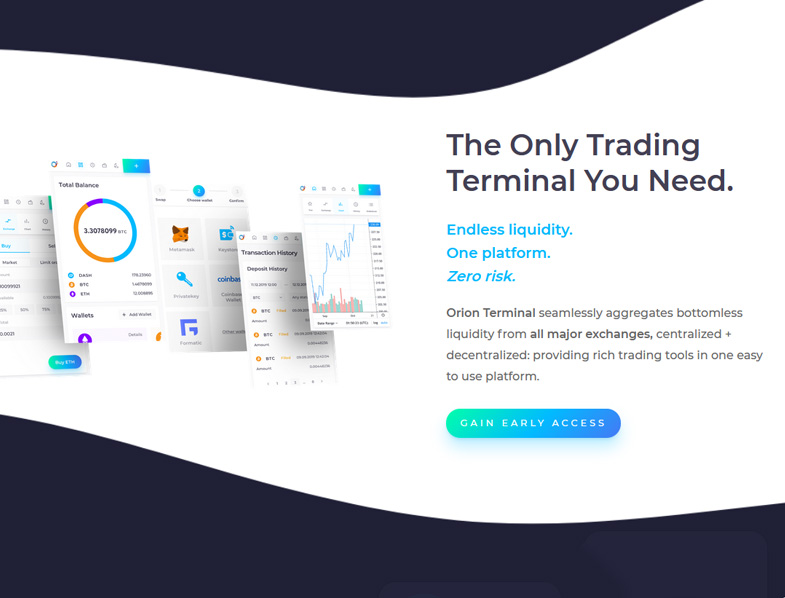

This DeFi strategy led to Orion Protocol launching its initial live product: The Orion Terminal, offering users a hub for trading, deposits, and withdrawals.

Though Orion Terminal caters to users and professionals leveraging market aggregation, Orion is poised to launch its B2B venture, the Orion Enterprise Trade Widget, soon.

Orion Protocol is also crafting its own price oracle, granting investors automated access to real-time, quality data from blockchain sources.

A Chain is Only as Strong as Its Links

Despite its chain-neutral nature, Orion Protocol allies with various blockchains to enhance flexibility, applicability, and security, with partners like Elron aiding in trade validation, speed, and scalability.

The fast execution and low latency of Elrond's smart contracts are key reasons Orion Protocol partners with them, aiming to boost Orion Terminal's efficiency.

Future initiatives include lending, the price oracle, a liquidity plugin, and the Orion Enterprise Trade Widget, all set to operate over the Elrond blockchain, benefiting both participants and ecosystems.

Governance of the protocol relies on a unique staking method, 'Delegated Proof of Broker,' powered by a network using the ORN token, operated through brokers.

Orion’s Broker Network stands among the top tier of brokers, with entities like KuCoin and Chainlink participating, servicing CEX, DEX, and Non-Exchange markets.

Certik continuously audits Orion Terminal’s mainnet code, ensuring security by identifying and eliminating exploitable vulnerabilities.

How Does Orion Terminal Work?

Orion Protocol focuses its essence on four core principles: Liquidity, custody, accessibility, and scalability, tailored to meet its transformative vision for the crypto market.

By leveraging decentralized liquidity aggregators like 1inch for DEX liquidity, alongside brokers like KuCoin for CEX supply, Orion Terminal delivers the best of both trading paradigms.

Distinct from most centralized custodial schemes, Orion Terminal requires no asset custody transfer, offering users a straightforward integration with their wallets to execute orders.

Despite Ethereum's gas fees hindering mass adoption by smaller investors, Orion Terminal's broader asset support encourages inclusive growth across diverse blockchain networks.

Orion Terminal efficiently handles high-demand scenarios without future Layer 2 reliance, differentiating from precedents like Uniswap.

Pooling every order book, Orion Protocol assures top-tier pricing and minimal fees, eliminating spread and slippage, all integrated into one convenient platform.

The Past, The Present, and the Future

Conceived in 2018 by Alexey Alexey Koloskov and Kal Ali, Orion Protocol launched with $300K from self-funding and family, later raising $3,450,000 via a standout Initial Coin Offering in 2020.

CEO and Co-Founder Alexey Koloskov's rich experience in traditional and DeFi realms, including his role in creating Waves DEX, informed Orion Protocol's development.

This background steered Mr. Koloskov towards building a unique, non-custodial crypto gateway: the Orion Protocol.

The Orion Terminal's launch marked the achievement of Orion’s early 2021 goals, which also previewed ORN staking, the Orion Oracle, and various other innovative toolkit features.

These advancements lay the groundwork, enhancing crypto access and bolstering the ecosystem's future, with upcoming DeFi innovations enriching investor strategy options.

With DeFi's growth surge in 2020, the evolving crypto and blockchain landscape sets the stage for ongoing expansion and increased system efficiency; Orion Protocol aims to complement this evolution.