Bitcoin has surpassed the $16,000 USD mark for the first time in years. PayPal has rolled out cryptocurrency services to its entire U.S. customer base. Ethereum's ecosystem is thriving, with Eth2's transition just around the corner.

This is merely a glimpse of the significant advancements currently driving the cryptoeconomy.

Taking a closer look, Ethereum's DeFi sector—a key player in the crypto space—is flourishing amidst the market's bullish vibes. Let's delve into the statistics for confirmation.

DeFi Hits New TVL Record

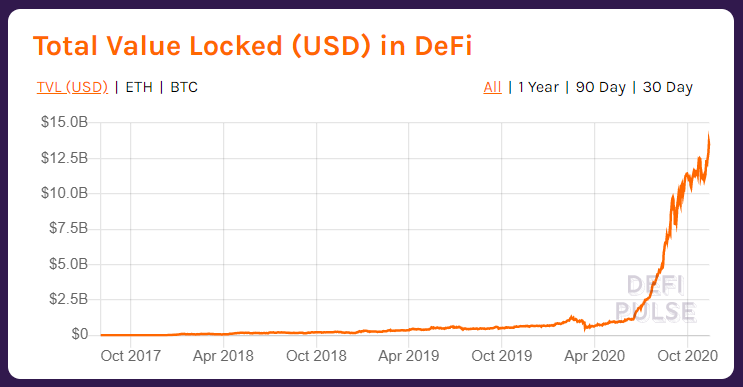

Total value locked TVL, a term popularized by DeFi Pulse, reflects the total value of crypto assets managed or locked within a specific DeFi protocol or across the whole DeFi landscape.

Back in February 2020, DeFi's TVL reached the $1 billion landmark for the first time. By summer, it had skyrocketed, indicating a tremendous surge.

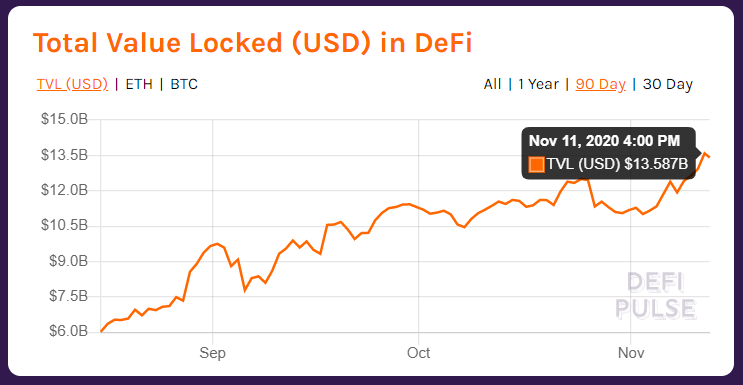

Even though there were fluctuations, interest and activity have continued to escalate, with DeFi's TVL hitting a record $13.58 billion on Wednesday, November 11th. This indicates increasing trust in decentralized protocols.

Inside the Action

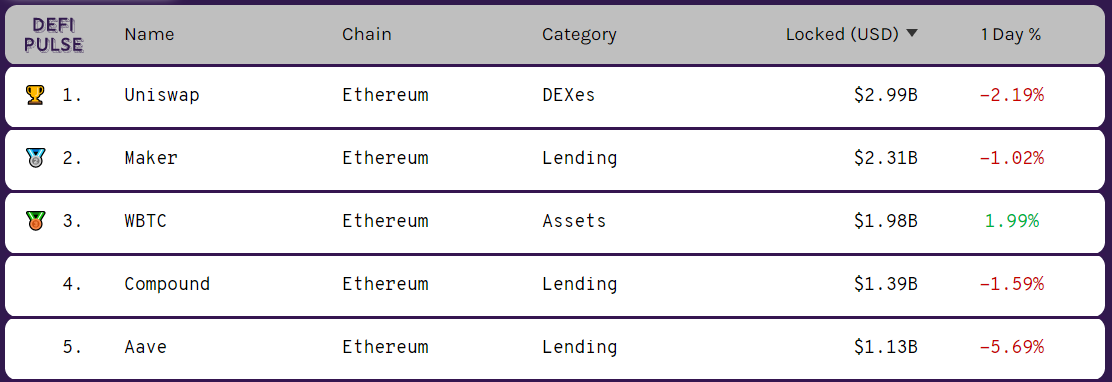

Not too long ago, no DeFi platform boasted a TVL surpassing $1 billion. Currently, there are five, namely: Uniswap, Maker, WBTC, Compound, and Aave.

Uniswap, a decentralized trading protocol and arguably Ethereum's standout innovation this year, has been leading the dApp chart in terms of TVL for several weeks. I recently anticipated Uniswap's surge. $10 billion TVL at some point in 2021, but that forecast is starting to look increasingly conservative as Uniswap’s already risen to $3 billion before the end of 2020.

Runner-up by TVL is Maker, standing at $2.31 billion. As DeFi's longest-standing lending protocol, Maker secures its heavyweight status due to its robust system and the rising use of its mainstay, the Dai stablecoin, which just hit a $1 billion market cap milestone.

Then there's WBTC, the project that tokenizes bitcoin for Ethereum's DeFi terrain, currently nearing a $2 billion TVL. With bitcoin's bullish trend and PayPal's endorsement, WBTC remains a significant gateway for DeFi activity.

Completing the top five are Compound and Aave, with TVLs of $1.39 billion and $1.13 billion respectively. Despite their differences, both have grown impressively as pioneers in the DeFi arena.

As the sector matures, the once-imposing $1 billion TVL milestone may become commonplace as more protocols confidently surpass it. This week alone, projects like Harvest Finance at $900 million and Curve at $850 million are on the verge of joining this league.

Looking into the future, the DeFi sector is poised as a formidable force. It remains in its nascent stage, and projects are finally aligning with product-market demand, potentially propelling them into the mainstream limelight.

Companies like PayPal are likely to evolve into gateways for accessing DeFi.

— Paul Razvan Berg (@PaulRBerg) November 12, 2020