Many might believe that trading cryptocurrencies is the sole route to profit from your digital assets, but that's not all there is to it.

In fact, crypto investing includes various alternatives, such as digital currency lending, creating a symbiotic environment where borrowers and lenders can exchange value with appealing interest rates and reinforced security.

With the ongoing evolution of the cryptocurrency space, we're witnessing traditional financial instruments seeping into this innovative market.

Consequently, cryptocurrency enthusiasts now have avenues for margin lending, crypto-for-crypto, and crypto-to-fiat loans, facilitating not just the accrual of interest on loaned coins but also enabling access to cash for investments, significant transactions, or day-to-day finances.

This piece intends to illuminate crucial factors in the crypto lending arena while offering a meticulous analysis of the leading digital currency lending platforms presently available.

How Crypto Lending Works

For those exploring crypto lending services, the process is generally simple: Lenders place a portion of their crypto assets onto the platform, which borrowers can then access for a fee set as interest.

Borrowers can then establish an account and secure a loan for an established duration. Upon maturity of the loan, the borrower is responsible for returning the borrowed amount along with the agreed-upon interest.

To ensure reliability and counter risks like default, most crypto lending outlets have systems in place, such as requiring collateral or implementing loan guarantees.

Borrowers typically use these lending services for either daily expenses or engaging in margin trading. Unlike routine expenditures, margin trading involves leveraging borrowed capital for potentially high-stake trades.

A favorable trading decision could yield substantial returns, although a less successful trade necessitates covering losses personally while also repaying the loan amount.

The **benefits** of engaging in crypto lending are noteworthy:

- Extremely low transaction fees

- Relief from rigid banking protocols

- Reduced bureaucracy

- No need for a bank account

- Diversified loans

- Minimal restrictions based on nationality or citizenship factors when choosing services.

- Quick approval times.

There are, however, certain **risks** tied to crypto lending:

- Lending platform safety

- A tendency towards higher delinquency when compared to conventional money loans

The volatile nature of cryptocurrencies, which could lead to debtors repaying way more than they initial borrowed, or lenders facing diminished returns due to market upheavals.

Top Crypto Lending Platforms

So without delay, let's dive into a detailed exploration of the most sought-after cryptocurrency lending platforms out there:

Nexo

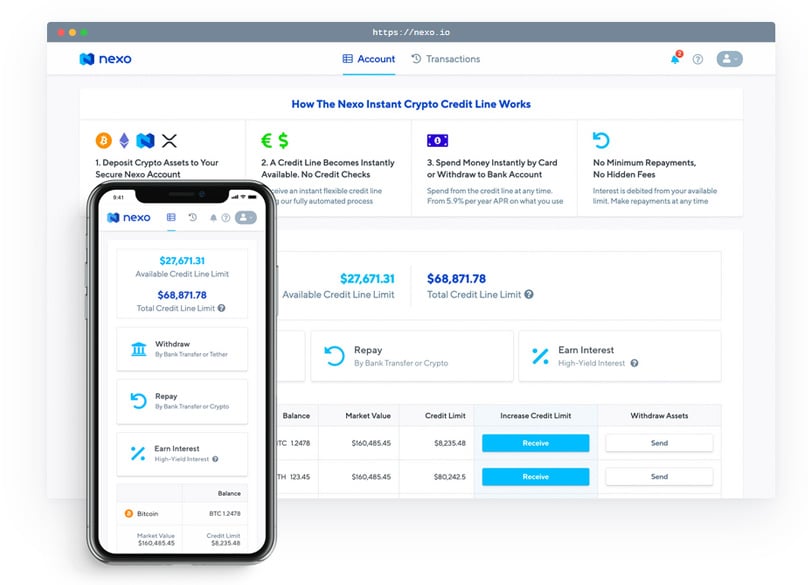

At this point in time, Nexo is widely recognized as one of the top crypto lending brands. Its platform has facilitated over $700 million in transactions, serving a community of more than 200,000 users.

With a strong compliance framework, it operates in over 300 regions and backs over 45 fiat options. The footprint of processed instant crypto loans exceeds $1 billion over a decade.

The company aims to identify and address inefficiencies in the lending sector utilizing blockchain's innovative solutions.

Lending features

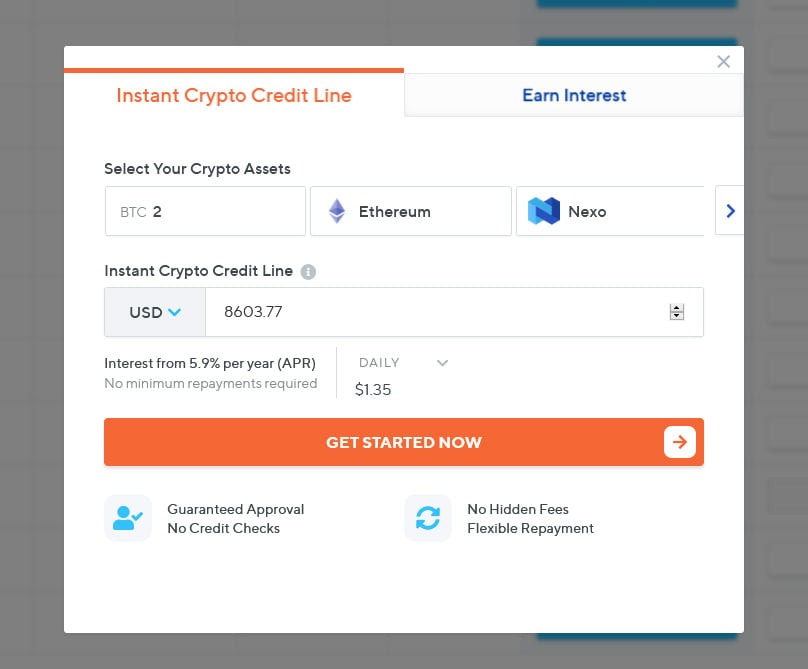

Nexo's instant crypto credit line offers loans without traditional credit checks by using crypto collateral.

This model is designed to unlock the inherent value of digital holdings while maintaining ownership through low-cost, tax-effective borrowing solutions. Instant liquidity is ensured via blockchain-backed agreements that provide secure transactions for everyone involved.

Along with the credit line, Nexo offers a card allowing easy global access to credit. Use it for ATM withdrawals or transactions with retailers, both online and in-store.

The Nexo card includes unlimited virtual cards and cashback perks. There are no foreign transaction or maintenance fees except for the interest rates, which start from 5.9% APR.

Interest

For the investor, Nexo is quite appealing. The platform facilitates earning up to 8% on EUR, USD, and GBP deposits, secured by full asset backing for generating passive income reliably.

Funds can be accessed instantly, unlike the unpredictability of banks and other alternatives, coupled with daily compounded interest and a $100 million insurance policy on deposits.

Stablecoins including USDT, TUSD, USDC, PAX, and SAI are also eligible for interest earnings.

Ease of use

To obtain a loan with Nexo, borrowers contribute cryptocurrency to their account, securing the funds as collateral, followed by instant credit.

Borrowers decide whether to access the funds via the Nexo card or transfer them directly to their bank account. Loan repayment is flexible in timings and amounts, whenever manageable.

After loan completion, the borrowed collateral is re-accessible to the user.

Supported coins

Nexo's supported currencies are extensive and include Bitcoin, Ethereum, Nexo's own token, BNB, XRP, Litecoin, Tron, Stellar, Bitcoin Cash, EOS, Cardano, Dash, IOTA, Ethereum Classic, Zcash, Tezos, Monero, VeChain, KIN, NEO, and Tezos, to name a few.

Read our full Nexo Review here .

BlockFi

Founded in 2017, BlockFi is an established New York entity offering USD loans underpinned by crypto collateral.

BlockFi's mission revolves around boosting liquidity in crypto spaces and assisting borrowers with everyday finance needs. Their offerings attract many traders pursuing margin trading.

Initially founded in 2017, BlockFi quickly gained traction, elevating its status as a frontrunner in the American crypto lending sector.

Lending features

BlockFi shares similarities with other platforms, offering a 50% loan-to-value ratio starting from a 4.5% interest rate. Terms adjust with variables like the loan amount and origination fees, but repayment terms are clear from inception.

Their general loans span 12 months, with options to prepay or refinance at term end.

BlockFi's lending use cases span various scenarios such as real estate acquisitions, vehicle purchases, worldly travels paid via crypto, diversifying investments, or settling credit card liabilities.

Beyond lending, BlockFi presents a platform for transactions among couples like BTC/ETH, LTC, USDC, and GUSD.

Interest

Cryptocurrency owners eager to grow their holdings further can deposit coins on BlockFi and receive interest rates as high as 8.6% yearly.

Milestone aspects of BlockFi include their company-backed status and interest disbursed directly in crypto currency, with no ICO tokens for platform usage or allocations to exchange lending.

Ease of use

The platform is straightforward, requiring potential borrowers to create an account and stake crypto for loan eligibility. With just a few steps, funds are immediately credited.

Supported coins

As of now, BlockFi accommodates Bitcoin, Ether, and Litecoin for collateral but also engages with stablecoins like USDC and Gemini dollar (GUSD).

Read our full BlockFi review .

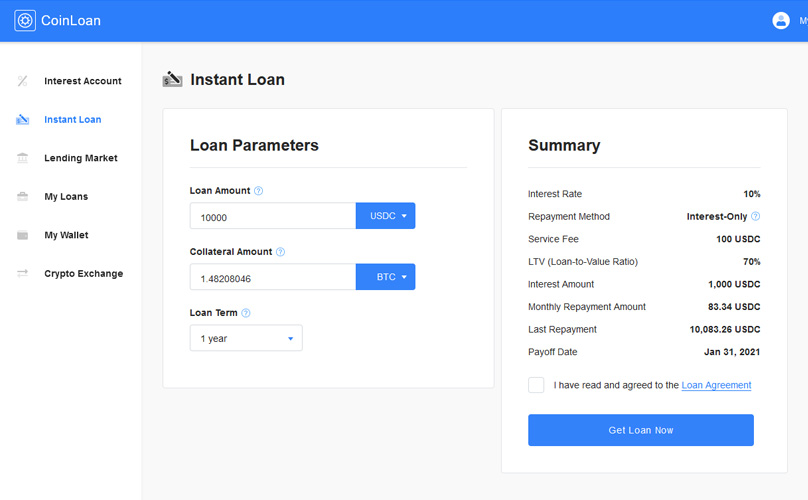

CoinLoan.io

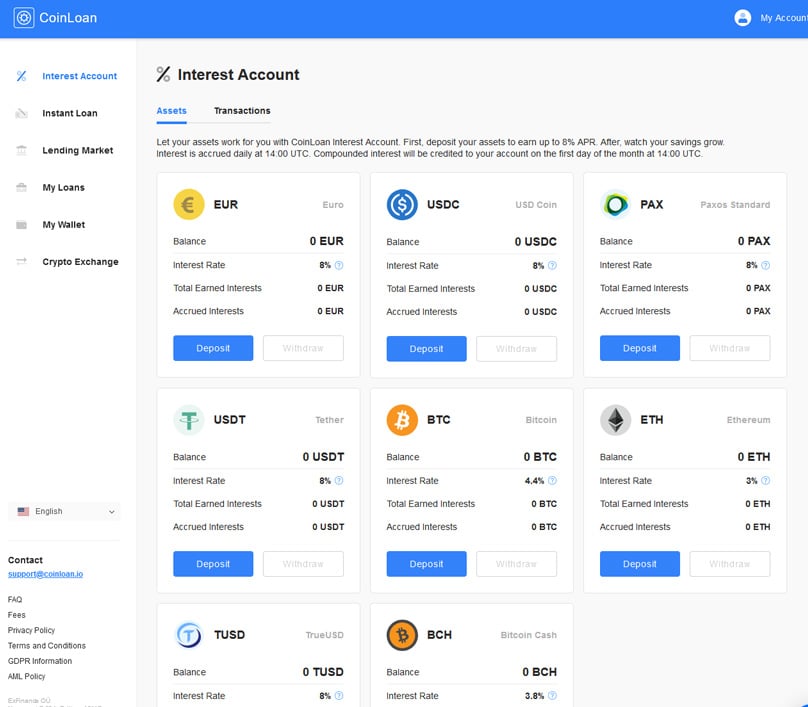

CoinLoan.io is an intuitive peer-to-peer service from Estonia catering to crypto collaterals. Banking-level security, multi-currency support, alongside the P2P framework, distinguish it as a notable European crypto lending platform.

Lending features

CoinLoan.io provides an intuitive lending solution where borrowers can secure a line of credit against their cryptocurrency deposits, using them as security. Depending on various factors like the amount borrowed and type of crypto collateral, a loan-to-value ratio of roughly 70% is established.

One of the standout features of this platform is its commitment to transparency. When contemplating a loan, borrowers are presented with the exact figures they need to make an informed decision.

For example, if you were to consider a loan of 10,000 EUR for a week, you'd need to put down 1.60 BTC as a safeguard. The interest for this week-long term stands at 23.33 EUR or 12%, along with a 100 EUR service fee for this transaction. They currently offer loans for periods extending up to three years.

Taking out a loan through Coinloan.io comes with numerous perks for those borrowing. It allows you to hold onto your crypto if you're investing, zero credit checks, adaptable loan terms, and withdrawal methods that cater to your needs.

You have the flexibility to pay back your loan either monthly or in one go.

The lending services here are perfect for individuals needing cash for everyday expenses, traders working on margin, legal businesses, or even large-scale investors. Collateralized crypto provides security against market downturns through early repayments or adding collateral to adjust loan-to-value.

Interest

For those keen on earning from the CoinLoan platform, it provides a global, trustworthy, and user-friendly interface for lenders seeking returns.

Interest rates can fluctuate based on chosen parameters, although they typically advertise a 9% APR for most deposits. Lenders can retrieve their investment at the end of the term using options like SWIFT, SEPA, or AdvCash transfers.

CoinLoan gives lenders peace of mind with several assurances: being legitimately registered and regulated by EU financial laws, ensuring consumer protection. If borrowers fail to repay, their collateral is sold to recoup funds, and all transactions are safeguarded with SSL encryption.

This platform strictly adheres to European AML/KYC standards to mitigate illegal financial deeds, reinforcing a verification system.

Ease of use

CoinLoan.io’s system is straightforward for both those lending and borrowing. Potential borrowers start by setting up an account and completing KYC procedures before making deposits in supported cryptocurrencies.

Once that's done, users can set their loan terms, like amount and currency, preferred interest, and period. A heftier interest rate can accelerate loan approvals. Thereafter, borrowers may either initiate a P2P loan request or accept an existing marketplace offer.

The process mirrors this for lenders. After account setup, lenders deposit in fiat, crypto, or stablecoins, define loan terms and either create an offer for the marketplace or respond to an existing request.

Supported coins

Depositors can use BTC, BCH, ETH, LTC, XMR, CLT, and ONT for their contributions, while lenders can fund with various fiat, cryptos, and stablecoins, from USD to BTC.

Thanks to its vast selection, CoinLoan presents one of the widest options in the sector for crypto, fiat, and stablecoin transactions.

Read our full Coinloan Review here .

YouHODLER

YouHodler, with roots in Cyprus and Switzerland, is dedicated to offering tailored lending options to cryptocurrency 'HODLERS' globally.

Their suite includes instant crypto loans, a turbocharge feature for leveraging larger digital funds, depositor interest, and the MultiHODL system for growth through risk.

Also offered is a wallet app where users can manage, trade, and utilize up to 12 cryptocurrencies, 4 stablecoins, and a couple of fiat currencies.

The platform has processed transactions for over 10,000 clients, moving more than $20 million in EUR, USD, USDT, and BTC.

Lending features

When stacked against other players, YouHODLER’s lending options shine with LTV rates stretching to 90%, 70%, and 50%. This means you get more credit for less deposit.

Say you have 1BTC as collateral; you'd be eligible for an $8.8K loan, with a 30-day term and an LTV of 90%. If needed, loan durations can extend with a fee.

YouHODLER's setup gives you swift cash through fiat reserves, eliminating the need for peer creditors. Security is robust with a custodian solution plus a $1 million fund. Loans are accessible on desktop or via mobile apps on Android/iOS.

The platform prides itself on transparency, with no hidden charges. Loan contract specifics are clear before signing.

Interest

The system lets crypto users earn returns on dormant assets. Depositors can earn up to 12% annually, paid monthly, secured by a $1 million safety net and can use deposits to enhance liquidity.

Current APR stands at 12% for stablecoins, 7.2% for BTC-based deposits, and 4.2% on BNB.

Ease of use

Using YouHODLER is user-friendly, full of convenient tools. To secure a loan, just open an account and upload collateral to the wallet. Once agreed upon, loan approvals happen momentarily. You can withdraw funds in EUR, USD, USDT, and BTC through multiple channels including SWIFT, credit cards, or direct crypto addresses.

Loan management tools provide options to increase LTV, tweak duration, set profit points, extend limits, exit without repaying, or augment with additional Bitcoin.

Supported coins

Collateral acceptance spans BTC, ETH, BNB, XRP, XLM, LTC, BCH, BSV, DASH, EOS, LINK, REP, and BAT, with loans available in EUR, USD, USDT, and BTC.

Interest-based deposits can be in USDT, USDC, TUSD, PAX, BNB, and BTC.

Crypto.com

Crypto.com, established in 2016, plays a key role in cryptocurrency finance, offering everything from exchange trading and investment tools to crypto payments, Visa cards, and lending.

With a mission to quicken global digital currency adoption, they've hit several milestones, increasing their market presence, and have plans to expand card offerings into regions like Europe and Asia.

Lending features

Mirroring other industry platforms, Crypto.com ensures a seamless crypto lending experience, granting instant credit without cumbersome procedures like credit assessments, and zero repayment pressure.

The straightforward model involves users attaching crypto as security. Presently, they provide credit lines equalling 50% of collateral's value, making a $100,000 crypto deposit translate to a $50,000 instant credit line in PAX or TUSD.

Funds can be utilized via Crypto.com's Visa card, with several tier options. The basic card secures credit with 1% MCO rewards on card expenditure. Higher MCO stakes open benefits including complimentary Spotify/Netflix and increased ATM limits among others.

Interest

In keeping with crypto lending platforms, Crypto.com allows investors to gain returns on deposits. Crypto earns 8% interest, while stablecoins earn up to 12% annually.

Annual interest adjustments hinge on the MCO staked: 50 MCO or fewer equate to slightly reduced rates.

Ease of use

This lending service has devoted a lot of attention and investment to making sure users have a smooth journey when interacting with it. You can easily navigate on a desktop, or if you prefer mobile, there's an app for both iOS and Android.

To start lending crypto, you need to set up an account and deposit some of your cryptocurrency. This deposit will become your collateral. As soon as that's done, you can get a credit line ready for you, which you can use with a Crypto.com Visa card.

Supported coins

Crypto.com currently lists several cryptocurrencies that they accept as collateral: BTC, ETH, XRP, MCO, CRO, and LTC.

For those interested in earning yearly interest from their cryptocurrency deposits, options include Bitcoin, Ethereum, Litecoin, Ripple, Binance Token, ChainLink, Maker, Pax Gold, TrueUSD, Paxos Standard, USD Coin, Tether, and others. Crypto.com aims to expand this list regularly.

Celsius.Network

Celsius Network stands out as one of the beloved crypto lending platforms at present. It was launched in 2017, riding on blockchain technology to give users economic empowerment, more financial freedom, and to bridge the income gap.

Up to now, Celsius Network has generated more than $4.2 billion in loans and oversees about $300 million in assets. Over 40,000 wallets are bustling with activity on the platform, underscoring its popularity.

Lending features

The platform serves well for those who need liquidity without giving up their crypto holdings. It supports crypto-backed loans, allowing flexibility.

Customers can choose to place their collateral in popular cryptocurrencies, with options for a Loan-to-Value rate of 25%, 33%, and 50%.

You have flexible loan durations to choose from: 6 months, 1 year, 2 years, and 3 years. Interest rates are linked to the choices you make at the start.

For example, getting a $1,500 loan backed by 0.61 BTC with a 25% LTV for 6 months could have an APR of 3.46% if you repay using CEL tokens, or 4.95% if you prefer using regular money.

Celsius.Network sets a minimum loan amount at $1,500, leaving plenty of room for larger loans upon extra review. Interest rates kick off at 3.47% APR, with free extensions on loan terms anytime. There are no awkward penalties, but not settling the loan means your collateral will be sold.

Like most crypto lending platforms, Celsius does not require a credit check. Application processes are quick, and you could be approved in as little as a minute.

Celsius.Network opens doors to multiple services like the CEL Token, which is utilized within the app to unlock benefits and cover service payments, alongside CelPay for the rapid transfer of different cryptos.

Interest

It's tailored for those wanting to gain interest on their existing crypto assets. You could place more than 25 cryptocurrencies and get up to a 12% yearly interest.

Remember that interest rates fluctuate with several factors like the deposit amount, chosen cryptocurrency, the duration, and whether you receive interest in standard currency or CEL. Opting for CEL tends to yield higher rates: Bitcoin, for instance, could fetch a 2.53% fiat interest rate, or an 8.43% CEL token rate annually.

Right now, there are no constraints on deposit size. Access to interest services comes free, and your funds remain accessible at any point.

Ease of use

Celsius.Network has engineered a user-friendly interface for easy navigation. To get a loan, you create an account and undergo a quick KYC check. They use a straightforward Typeform, letting you set your terms and deposit with ease. Your credit line quickly gets activated afterward.

From then on, you can handle your monthly repayments. Once the full amount is settled, you can reclaim your cryptocurrency collateral. All repayment and interest details are readily available.

Supported coins

Crypto holders can place their collateral in various cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin, and Dash, with loans disbursed in Tether, Fiat, TUSD, CEL tokens, among other stablecoins.

Should you aim to earn interest, consider depositing: CEL, BTC, ETH, LTC, XRP, OMG, BCH, ZRX, BTC, ZEC, XLM, DASH, TUSD, GUSD, PAX, USDC, DAI, ORBS, USDT, TGBP, TAUD, TCAD, THKD, EOS, MCDAI.

Clearly, Celsius.Network prides itself as a diverse, crypto-friendly lending hub with its broad array of supported coins.

Bottom Line

Taking into account what's been discussed, the crypto realm teems with various digital currency lending services.

Although the structures and processes of these platforms might share resemblances, picking a crypto lender means assessing the subtle differences, like LTV offerings, interest rates, and loan durations.

Platforms vary greatly in their supported coins, so it's wise to choose the one that aligns with your crypto of choice.

Lastly, it's crucial to read the fine print of all potential lenders you're considering. Comply with your local laws—ensure crypto loans are permissible in your jurisdiction and understand your tax obligations before borrowing.