CRYPTO20 As the pioneer tokenized cryptocurrency index fund, CRYPTO20 allows investors to manage a diversified crypto portfolio without needing to purchase each currency individually. Currently, CRYPTO20 is in its ICO phase, inviting potential backers to join.

CRYPTO20 is Revolutionizing How We Invest

CRYPTO20 aims to simplify investing by streamlining the investment process. Funding from the ICO will be dedicated to acquiring the assets. This index fund offers full transparency thanks to blockchain technology.

CRYPTO20 is designed to demystify the investment process. Rather than extensively analyzing thousands of nascent cryptocurrencies, you can simply invest in CRYPTO20 and gain exposure to the market as a whole. This approach lessens your investment costs because you won't need expert consultations to choose a cryptocurrency. CRYPTO20 harnesses data science and specific hyper-parameters instead of relying on individual advice.

Best of All, There Is No Middleman

CRYPTO20 empowers you with full control over your assets. Unlike many companies that charge for managing your investments, CRYPTO20 eliminates such fees. There's no minimum investment, no exit fees, and you also save on brokerage fees. In essence, CRYPTO20 delivers complete transparency without extra charges for broker advice or using their platform.

Trading with CRYPTO20 is available round-the-clock; exchanging C20 tokens is all it takes. Additionally, CRYPTO20 prides itself on having the lowest fees in the market, charging just a 0.5% annual fee, compared to the usual 3%. The absence of a middleman keeps costs down, as trading is managed autonomously without human intervention.

Blending Cryptocurrencies with The Tried-and-True Strategy of Index Funds

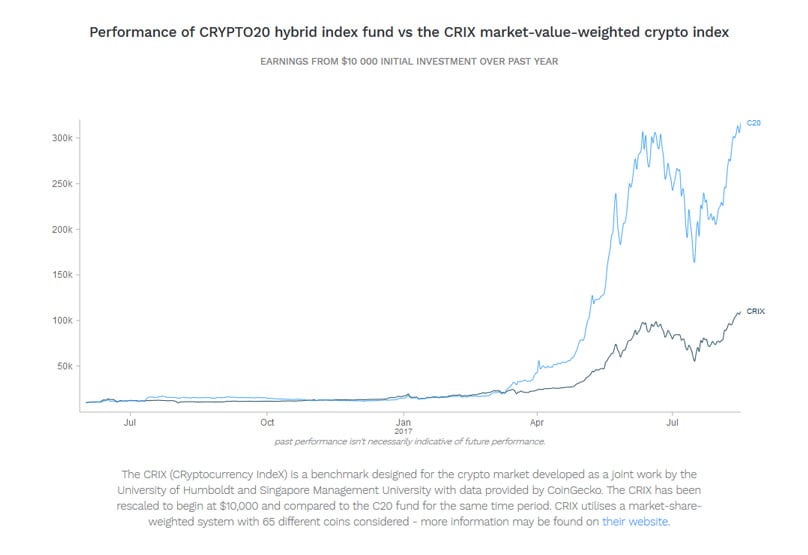

CRYPTO20 is effectively combining the well-established trust of index funds with the dynamic world of cryptocurrencies. Given index funds’ track record in outperforming managed funds, and with CRYPTO20, you can track and benefit from the cryptocurrency market’s overall performance.

What Assets Does CRYPTO20 Hold?

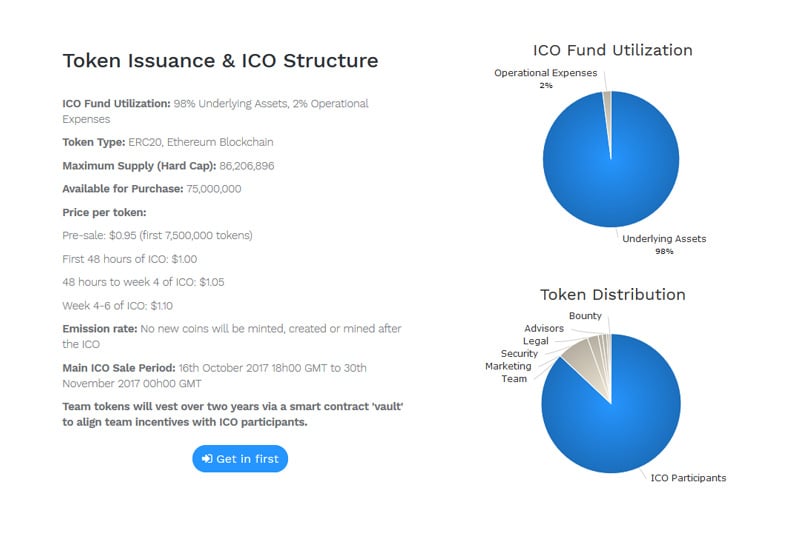

Structured as a hybrid based on an index trading method, CRYPTO20's portfolio allocates all ICO funds towards purchasing the underlying crypto assets. By holding a single token, you essentially invest in the top 20 crypto assets.

Each week, assets are rebalanced based on their market capitalization, with each having a maximum cap of 10% to prevent any single asset from dominating. This provides extensive market exposure, mitigating the significant risks usually linked to cryptocurrencies.

As of August 16, 2017, key players like Bitcoin, Ethereum, Ripple, and Bitcoin Cash each made up 10% of the portfolio. Other included cryptocurrencies, though to a lesser extent, included Dash, Ethereum Classic, and more. The composition will be adjusted weekly.

Whom Will CRYPTO20 Appeal to?

For those striving to grow their wealth, CRYPTO20 presents an intriguing proposition. It offers exposure to cryptocurrencies or indexes while minimizing risks, though short-term losses can occur due to market volatility. Long-term, however, CRYPTO20 aims to capitalize on expanding crypto markets.

About C20 Tokens

C20 tokens are directly linked to the assets they represent on the platform, allowing for a unique liquidation feature that ensures your asset's value never falls below the token's representation of underlying assets.

ICO Details

CRYPTO20's ICO is underway, boasting 2,493 backers and raising a fund of $5,598,802 by selling 5,733,294 C20 tokens. This includes contributions in Ether, Bitcoin, and Litecoin. Following the ICO’s conclusion, tokens will only be available through trading.

How Can You Invest in the ICO?

Participating in CRYPTO20's ICO is straightforward. Simply create or log into your existing account on their website, verify your details to protect against fraud, and submit your ETH wallet address. Investments can be made using ETH, BTC, or LTC, and your balance and C20 amount can be viewed in your account.

Conclusion

CRYPTO20 stands out as a solution for those daunted by the sheer volume of research or wary of massive risks. It offers the lucrative potential of crypto returns while mitigating risk and simplifying involvement.

1Comment

How do you determine the price of the coin when both the percentages and actual amounts adjust?