Before diving into the world of crypto exchanges, let's revisit the fundamentals of cryptocurrency. While the core idea is straightforward, the mathematics and technology involved are not. In essence, a cryptocurrency is a form of digital money that employs cryptography to ensure safety and integrity.

Cryptography also plays a crucial role in controlling the creation of new units, preventing the digital currency ecosystem from spiraling out of control. One of the standout features of cryptocurrencies is their independence from governmental oversight. Among digital currencies, Bitcoin leads the pack, closely followed by Ethereum.

What Are Cryptocurrency Exchanges?

Digital currencies find their marketplace in crypto exchanges. These platforms facilitate the buying and selling of cryptocurrencies like Bitcoin, allowing transactions in traditional currencies like USD, Euros, or Pounds, or even in other crypto assets. For instance, you might exchange Bitcoin for USD or swap it for Ethereum. Such exchanges are pivotal to the thriving growth of the digital money world.

Exchanges vary - some are exclusive and operate on an invite-only basis, while others are open to the public. Local options exist too. While some are user-friendly, others require more navigation skill; particular platforms offer the convenience of trading digital currencies directly through popular messaging apps like Telegram.

Key Considerations for Selecting the Optimal Crypto Exchange

Here are crucial elements to weigh when selecting the right crypto exchange that suits your trading ambitions.

Charges – Nearly every exchange levies fees for facilitating trades. Thus, when choosing a platform, ensure you are fully aware of its fee structure.

Verification and Security Protocols – Knowing the ins and outs of these is essential before stepping into an exchange. Most will ask for personal identity checks through documents like passports, driving licenses, or proof of residence. More thorough checks typically equate to greater platform safety.

Conversion Rates – These are critical, too. Avoid platforms with exorbitant charges for exchanges or transactions, because such costs can hit your wallet hard.

Standing – Top-rated exchanges, despite potential hiccups, generally maintain a positive reputation. A solid reputation bolsters trader trust.

Geographical Compatibility – Ensure the chosen platform operates in your region. Some might cater to South American countries but not Asian ones, or vice versa. For instance, if you're based in Russia, opt for a platform supporting your local legal framework.

Now, let’s explore some standout options in the realm of crypto exchanges today.

Security

A priority in choosing a crypto exchange is evaluating its security setup. Numerous exchanges, including some well-known ones, have suffered breaches in the past, leading to significant repercussions. Mt Gox exchange Bear in mind that unless you control the private keys to your digital wallet, the coins stored on an exchange aren't entirely yours. Essentially, you're entrusting another entity to safeguard your assets.

Fortunately, sensible steps can bolster your safety on exchanges. Prioritize never holding funds on an exchange that you can't afford to lose. If your balance is significant, it's best to transfer coins to a personal wallet for enhanced protection.

Comprehensive Ledger Nano S Insights use a Hardware wallet to secure these funds.

Ensure you leverage every available security feature, prominently two-factor authentication (2FA). Use apps like Authy or Google Authenticator rather than SMS options, which are vulnerable to sim-swapping attacks that compromise accounts.

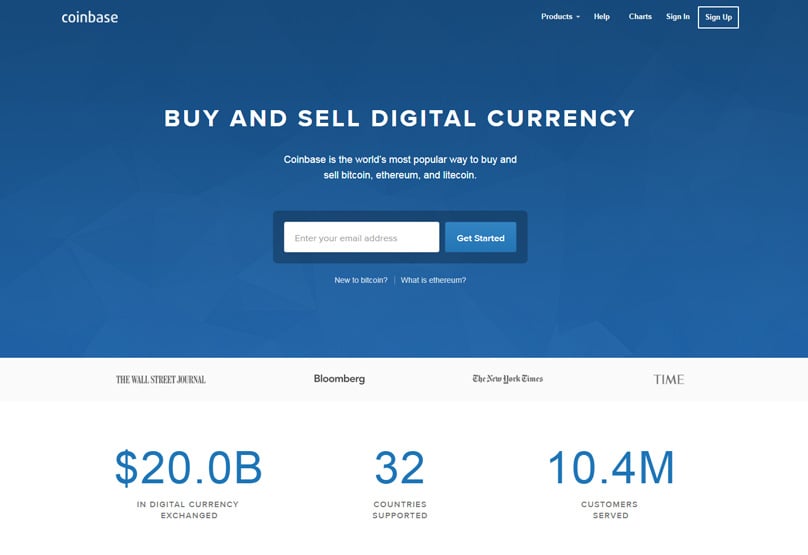

Coinbase stands as one of the most respected and expansive cryptocurrency trading hubs globally, supporting over 32 nations and boasting a vibrant user base exceeding four million. It's compatible with payments from bank accounts, credit cards, PayPal, and other methods. To start trading on Coinbase, establishing an e-wallet is necessary, alongside linking a legitimate bank account for Bitcoin transactions.

Coinbase

Coinbase In the current setup, U.S. users can hold up to 50,000 Bitcoins each day. Coinbase enjoys a stellar reputation within trading circles, with most transactions incurring just a 1% fee on top of standard payment-related charges.

Platforms like CEX restrict initial purchases to a trio of coins—Bitcoin, Ethereum, and Litecoin. To expand your crypto portfolio, consider leveraging conversion services.

A plus of joining Coinbase is granted access to its partner platform, enabling more sophisticated trading including margin trades and order types like Market, Limit, & Stop Orders, all with reduced fees. Changelly Delve deeper and uncover more comprehensive insights at

Binance, although fresh on the scene, has rapidly built a following due to its diverse crypto offerings and user-friendly interface. Its flexible fee structure and instant trading access without verification are applauded, although ID verification is necessary for higher withdrawal levels. Coinbase Pro exchange At the moment, Binance is highly regarded in public opinion, with users lauding the website's efficiency, simplicity, and low charges.

Read our full Coinbase Review Emerging from South Korea, this new platform excites with its rapid listing of altcoins straight after ICOs, offering early profit opportunities. Coinbase’s security measures here .

Binance

Sleek and modern, the interface outperforms clunkier predecessors.

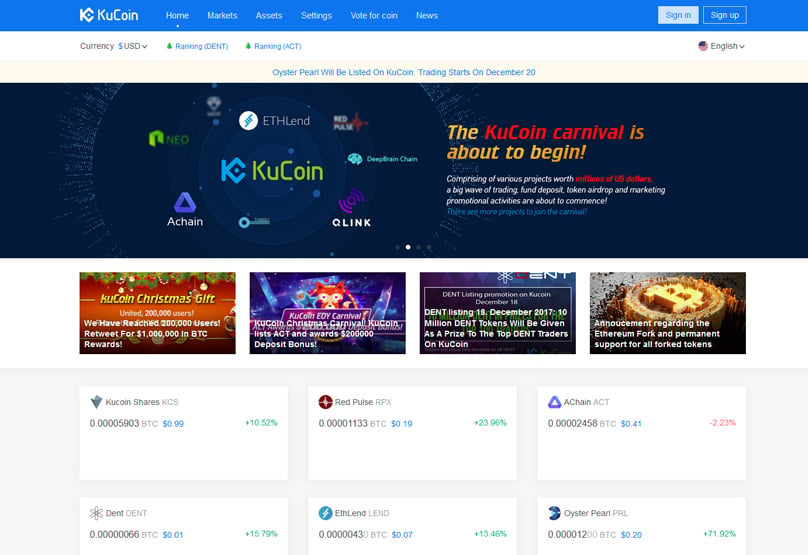

Their unique token, KCS, provides daily profit shares to holders from the site's transactional activities, making it an attractive investment.

For more details you can read our complete review of Binance here .

KuCoin

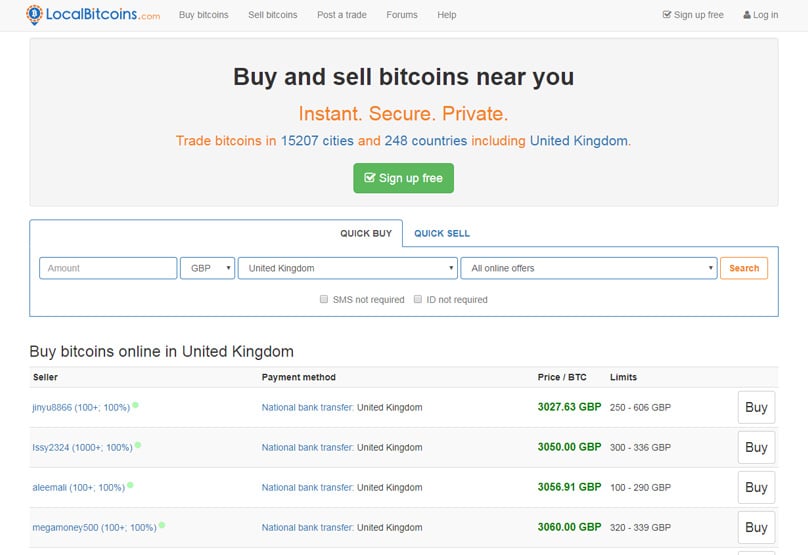

KuCoin LocalBitcoins operates as a peer-to-peer crypto exchange available in numerous global metropolises. Users can connect with local traders to exchange in person, supported by PayPal, Square, direct bank transfers, and various other payment channels. An optional fee per transaction is set at 1% where sellers use custom rates.

LocalBitcoins employs a public trader rating akin to Uber's for transparency. Each trade advances through escrow to prevent fraud, releasing funds post-verification while subtracting a 1% commission from the sale price.

CoinMama offers a straightforward Bitcoin acquisition process using credit or debit cards, coupled with competitive fees. Users can purchase up to $5,000 per day or $20,000 monthly, surpassing Coinbase's limits.

LocalBitcoins

LocalBitcoins Post account set up, CoinMama facilitates Bitcoin purchases through the profile section, enabling users to select desired amounts and methods, completing trades post-email and phone verification. Government ID is largely unnecessary for most.

As one of the industry's oldest exchanges, CEX.IO primarily supports Bitcoin and Ethereum trades. For broader currency options, utilize CEX combined with alternative services.

Take a look at our LocalBitcoins Review to find out more.

CoinMama

CoinMama Top Picks for Beginner-Friendly Crypto Exchanges in 2020

Guide to Buying Bitcoin, Ethereum, and Other Cryptos for Beginners via Debit or Credit Card

Read our complete CoinMama Review here .

CEX.IO

CEX.IO Newcomer's Guide to Crypto Exchanges Changelly to convert them to many other cryptos.

Before we dive into the exchange landscape, let's take a step back and briefly revisit what cryptocurrencies are all about. In essence, a cryptocurrency is a digital or virtual form of money that leverages cryptographic techniques for secure transactions. The underlying ideas are fairly straightforward, even if the math and tech involved are not.

Cryptographic principles also play a pivotal role in controlling the generation of more currency units, helping to maintain market stability. One significant draw of cryptocurrencies is their independence from government oversight. Bitcoin spearheads the digital currency revolution, with Ethereum closely following.

Read our indepth CEX Review here to learn more.

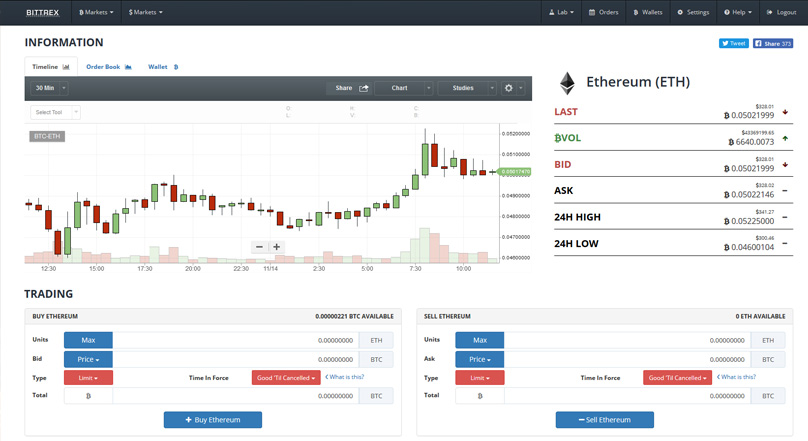

Bittrex

Bittrex Navigating the World of Cryptocurrency Exchanges: Key Considerations

Read our full review of Bittrex here .

Digital currencies are traded on cryptocurrency exchanges, which are specialized platforms enabling you to swap between digital coins and traditional currencies like dollars, euros, and pounds, or other digital currencies. For instance, you can trade your bitcoins for euros or swap bitcoins for ether, playing a crucial role in the growth of virtual currencies.

Different types of exchanges cater to various needs: some are invite-only and highly exclusive, while others are open to the general public. Localized exchange platforms also exist, with some offering ultra-convenient features like direct trades through chat apps like Telegram.

Conclusion

When selecting a cryptocurrency exchange, several factors merit your attention to ensure it meets your trading interests and goals.

Fees – Almost every platform imposes fees for usage. It's crucial to thoroughly research the fee structure before registering or committing to a specific exchange.

15Comments

Hi, thanks for this article.

I’m confused.

Security measures are a critical aspect when choosing a cryptocurrency exchange for trading or purchases. The risks are real, with notable past breaches leaving lasting impacts.

Remember, unless you control the private keys to your cryptocurrency wallet, your holdings are essentially in someone else's hands as a custodian.

Luckily, adhering to some basic safety practices can help. Notably, only keep as much in an exchange wallet as you're willing to lose, withdrawing significant balances to personal storage.

An In-Depth Analysis of the Ledger Nano S

Exchanges serve best for transitory purchases of cryptos or trading amounts you’re comfortable with. They were never meant to function as primary wallets.

Engage all available security measures, such as enabling Two-Factor Authentication (2FA) using apps like Authy or Google Authenticator. Avoid receiving codes via SMS due to potential sim-swap hacks.

Coinbase ranks highly as one of the most trusted and vast platforms for digital assets worldwide, covering 32+ countries with a user base exceeding 4 million. It offers diverse payment options including bank accounts, credit cards, PayPal, and more. Setting up an e-wallet is essential for engaging in trading on the platform.

Thanks a lot! Really helpful for beginners!!!

Fully verified U.S. residents have a daily purchase limit of up to 50,000 bitcoins. Coinbase enjoys a strong reputation with a low 1% transaction fee, plus any additional costs from chosen payment methods.

Hello

Through CEX, trade possibilities are limited to Bitcoin, Ethereum, and Litecoin, requiring further conversion for other currencies.

Signed Novice

Registering with Coinbase provides additional perks like accessing Coinbase Pro—owned by the same company—offering sophisticated trading tools like margin trading, at lower fees.

I'm still very green on how they work.

Thanks

Learn more here, including a comprehensive review of

Although newer, Binance is a user favorite for its wide cryptocurrency selection and intuitive switching between basic and advanced views. Low fees and immediate post-registration trading without account verification are highlights, with up to 2 BTC daily withdrawal limits.

Hi Ross,

Public perception of Binance remains favorable, commending its swift operations, ease of use, and competitive fees.

A fresh South Korean exchange exciting the market, akin to Binance, featuring rapid altcoin listings post-ICO for early investment opportunities.

Boasts a clean, contemporary interface that surpasses the usability of older exchanges.

Offering a proprietary token, KCS, which rewards holders with daily platform profit shares, it's a beneficial asset mirroring diverse traded currencies.

LocalBitcoins serves as a peer-to-peer exchange operating globally, facilitating local meet-ups for trading. Purchases are facilitated through PayPal, Square, direct transfers, and more, with sellers setting exchange rates.

Hope this helps.

Mirroring ride-sharing ratings, LocalBitcoins assigns public ratings to its traders, coupled with an escrow process to thwart fraudulence, taking a 1% commission from each trade.

CoinMama stands as a sizable brokerage for obtaining coins via debit or credit cards, offering higher purchase limits compared to Coinbase. Users can secure up to $5,000 daily or $20,000 monthly, requiring an account setup and personal details.

Post-setup, users choose the amount of bitcoin they wish to acquire, add payment methods, and verify their phone and email. Unlike others, CoinMama skips government ID uploads, seamlessly guiding users through purchase following verification.