Premier Choices for Cryptocurrency Trading Platforms

So, you've just acquired your first batch of bitcoins and ether, and you're eager to diversify into some appealing altcoins. Welcome aboard the innovative wave of cryptocurrency traders. cryptocurrency exchanges Here's some exciting news. There's a fascinating array of altcoins currently available for trading, and global trade volume is soaring to unprecedented heights. Even better, a variety of trustworthy exchanges have the liquidity and listings you need to truly diversify your investments.

While every platform offers something unique, you'll notice each has its distinct benefits and drawbacks. It's up to you to determine which exchange aligns best with your trading style.

For now, let us guide you through the leading cryptocurrency exchanges to help you start forming your own opinions.

Binance

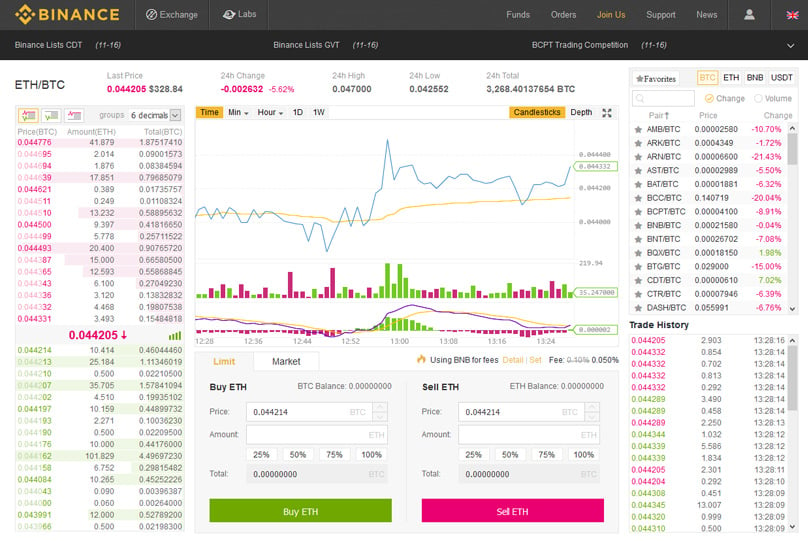

Based out of Asia, Binance Though relatively new, having launched in 2017, the exchange hasn't stopped booming in popularity. It's a leading exchange for offering new altcoin listings earlier than most others in the market.

Here at Blockonomi, we're enthusiastic supporters of Binance and have recently included it in our rundown of the Best Exchanges for Beginners. If you're eager to invest in altcoins right after the ICO stage, preceding many other investors, setting up an account on Binance is a wise choice. .

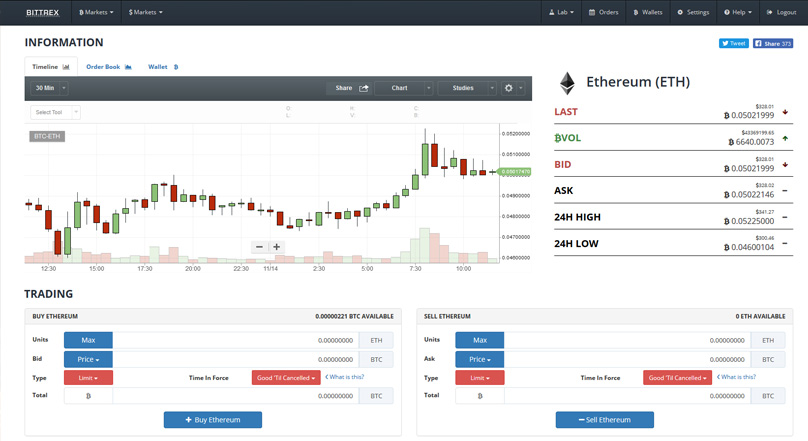

Unlike some other exchanges, Binance offers you the option to navigate through two different trading interfaces. They have a basic version, and a more intricate, advanced version. While there's a learning curve, mastering them provides a host of advantages, like performing in-depth technical analyses on cryptocurrencies at your own pace.

Read our full review of Binance here .

In terms of verification, Binance is pretty straightforward. New users who haven't reached the first verification level face a daily withdrawal limit of 2 bitcoins, which is quite reasonable. Reach level 2 verification, and the limit jumps to 100 bitcoins daily. Essential for those handling large trades.

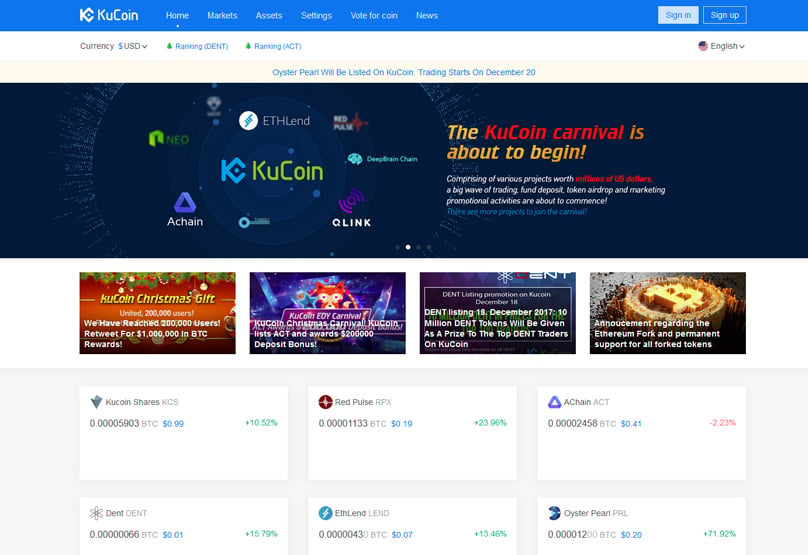

Emerging from South Korea, this new cryptocurrency exchange mirrors Binance by listing new altcoin projects earlier than most global exchanges.

An impressive feature? KuCoin ensures your crypto deposits are processed almost instantaneously, letting you start trading immediately. This is because KuCoin commits to reflecting digital asset credits on your account moments after the initial transaction confirmation.

KuCoin

KuCoin KuCoin's uniqueness lies in its KuCoin Shares (KCS) ERC-20 token. By trading with KCS, users receive attractive discounts on platform fees compared to using BTC or ETH.

What's more, 90% of the platform's fees return to users via the KCS token, offering them 'dividends' of ETH simply by holding KCS.

One of KuCoin's standout features is its 24/7 customer support, solving issues in a matter of minutes.

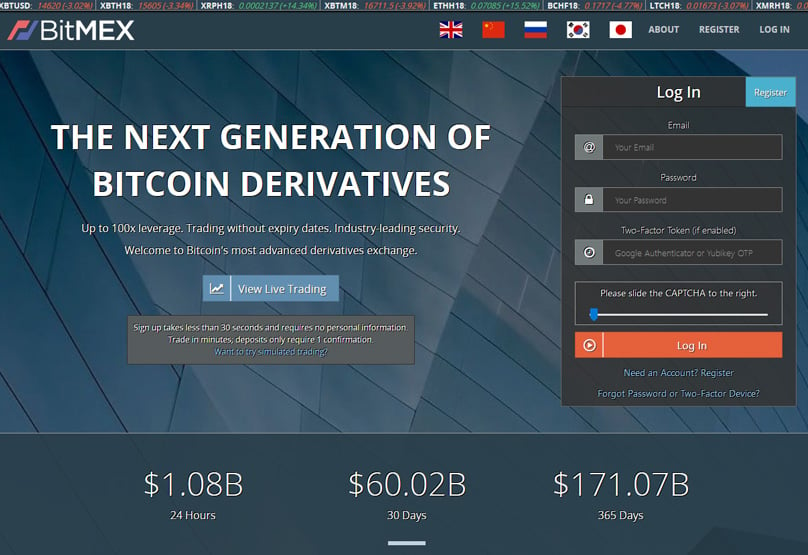

For experienced traders, this exchange offers margin trading, letting you engage with a leveraged balance and speculate on Bitcoin's price movements in both directions. Before diving into BitMex, we suggest reviewing the platform thoroughly.

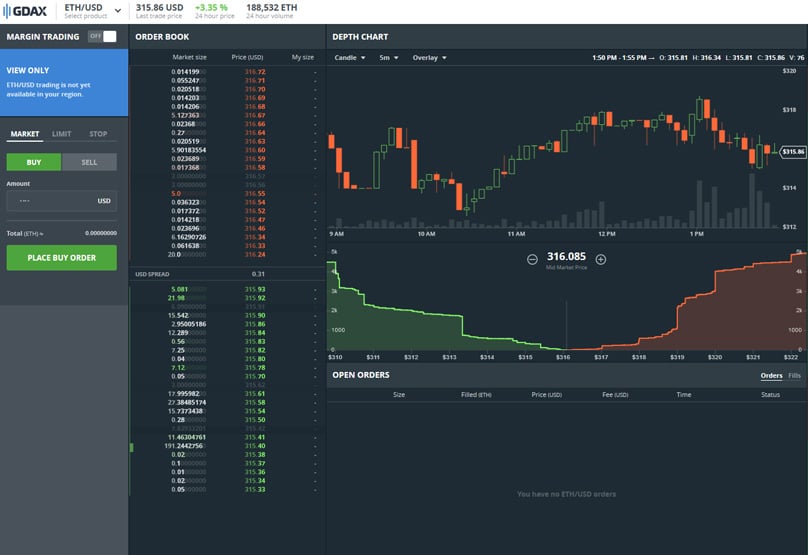

Recognized as the premier U.S. cryptocurrency exchange, GDAX stands out by offering fewer trading pairs compared to its competitors, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and fiat money like USD and EUR. Its substantial trading volume and professionalism have set a standard for others to follow.

BitMex

BitMex A notable update is Coinbase's planned support for Bitcoin Cash (BCH) starting January 1st, 2018, in line with its broader strategy to expand its range of altcoin offerings. our detailed review When purchasing crypto on Coinbase, you have two main payment methods. The simplest is using a credit card. For larger transactions, linking your bank account is an option. This involves Coinbase verifying your account with two small transactions. Once you confirm the transaction amounts, your account is ready to use.

GDAX

GDAX is the associated trading outlet of Coinbase Arguably the most secure platform, Coinbase remains a leading cryptocurrency exchange, especially given the rigorous standards mandated by its U.S. base compared to many offshore counterparts.

Positioning itself as a 'next-generation digital asset exchange,' this platform caters exclusively to American investors, so consider that before registering.

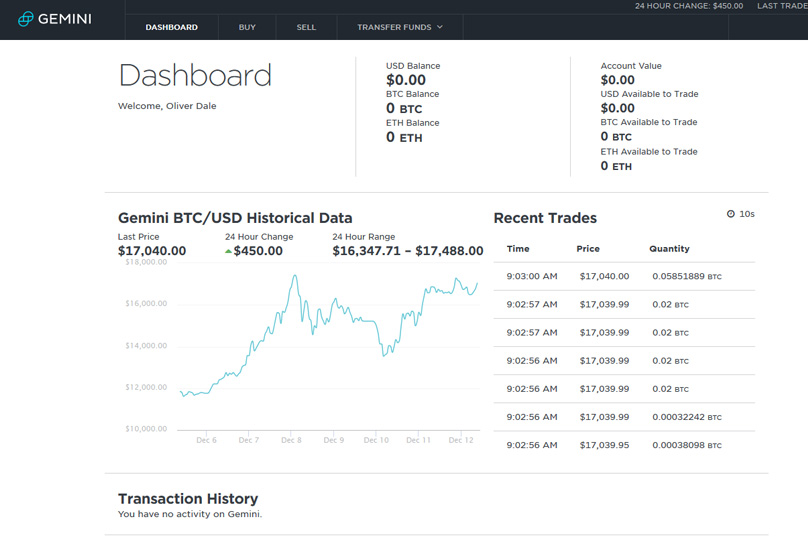

The Winklevoss twins established this U.S.-centric exchange in 2015, aiming to offer American traders an accessible entry point into cryptocurrency trading.

Registration for Gemini is straightforward, requiring only an email address initially. They provide a 'registration token,' used during site registration, where you'll also set up your phone and two-factor authentication. A text message will follow containing a code, completing your setup.

One appealing feature is the absence of deposit and withdrawal fees. The single charge is a trading fee of 0.25% per transaction.

Gemini

Based in the U.S., this trading platform offers over 250 trading pairs, an extensive range of altcoins accessible through a single exchange. Gemini Bittrex shines in its wide array of trading pairs and enjoys a solid reputation for crediting customers' accounts with hard-forked coins. This reliability has earned them user trust.

BTC and ETH are Bittrex's most traded currencies. Not offering fiat-to-crypto transactions currently, investors can access USDT (Tether tokens) through bank transfer for crypto trades. Full verification and a minimum deposit of $10,000 USD are necessary, though we advise against using Tether due to ongoing controversies.

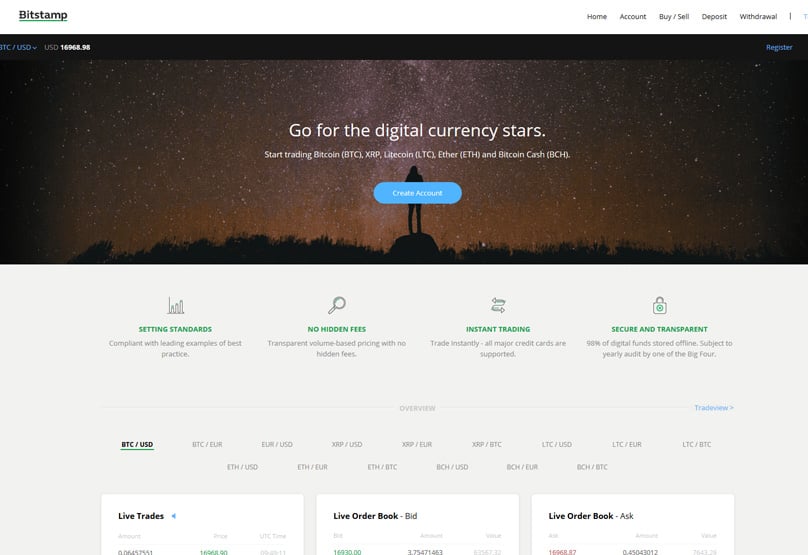

Located in Luxembourg, this exchange serves European clients. Although U.S. dollar trading is currently available, it supports the EU's SEPA system, enhancing convenience.

The exchange's API customization is a huge perk for frequent traders, allowing tailored account management.

Read our Full Review of Gemini Here .

Bittrex

Bittrex As one of the oldest in the market, Bitstamp began in 2011 aiming to rival Mt. Gox. Demonstrating its reliability, Bitstamp remains a top pick.

Although not beginner-friendly due to its complex interface, Bitstamp is an excellent choice for adept European traders, given its support for European banking services.

Read our full review of Bittrex here .

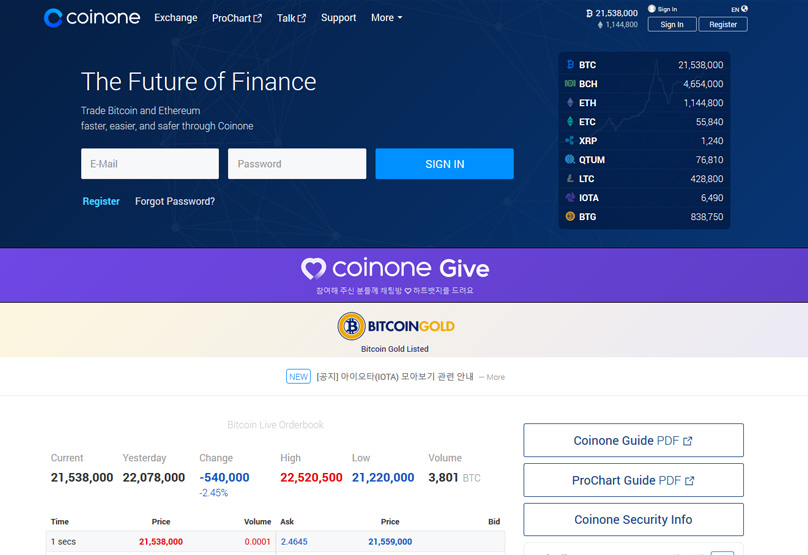

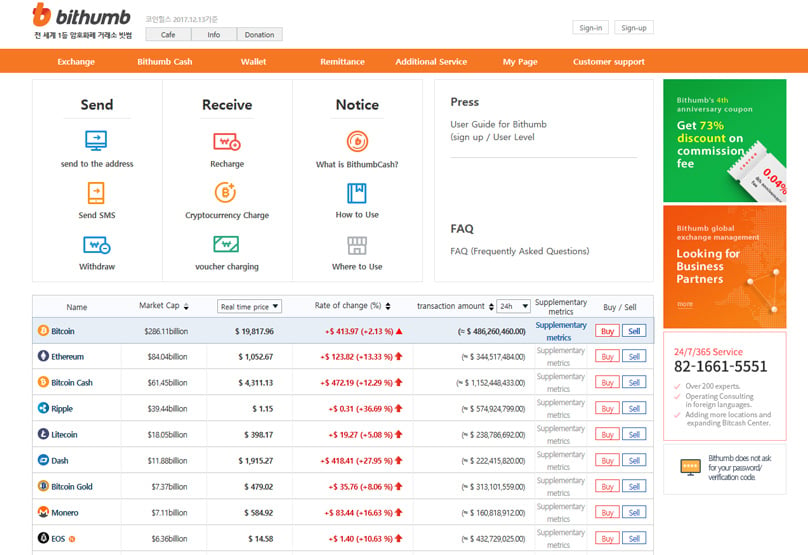

Ranking as South Korea's third-largest cryptocurrency exchange, the platform handles significant volume thanks to Korean investors' considerable contribution to the global crypto trading scene.

The exchange offers trading in the Korean won (KRW), so it's crucial to be mindful of the currency pairing.

Bitstamp

Bitstamp Coinone features widely-used currencies like Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Ripple, QTUM, Litecoin, and IOTA, along with low fees. This attracts users who trade euros or dollars into bitcoins to later purchase KRW for remittances.

Opening its doors to users in America, Canada, Europe, and Japan, this exchange supports trading pairs with USD, EUR, GBP, and JPY.

Claiming the title of 'world's largest bitcoin exchange by euro volume and liquidity,' this platform has made a name for itself.

Security is a hallmark of Kraken, which is meticulous in safeguarding users' deposits by keeping most of its bitcoins offline in 'cold' storage. This approach averts devastating cyber-attacks prevalent on less secure exchanges.

Coinone

Coinone Following the collapse of Mt. Gox, Kraken undertook a third-party audit confirming its possessions’ integrity through cryptographic verification. Beyond that, its infrastructure, guarded with advanced security measures, extends across multiple secured locations, ensuring untouchable server safety.

The Top Platforms for Cryptocurrency Trading in 2019

When considering trustworthy platforms, there are numerous exceptional cryptocurrency exchanges available. Many savvy traders diversify by using multiple exchanges. Here's a curated selection of the top exchanges for 2019.

Kraken

While operating out of the U.S., Kraken Leading Cryptocurrency Trading Platforms

Top Platforms for Cryptocurrency Trading

And Kraken You've just dipped your toes into the world of bitcoin and ether, and now you're eager to broaden your cryptocurrency investments by exploring various emerging altcoins. Welcome to the bustling arena of new-age crypto enthusiasts.

Here's the upside: countless intriguing altcoins are ripe for trading at this very moment, and global trade volume is skyrocketing at an unprecedented pace. Even better? There are numerous respectable exchanges out there

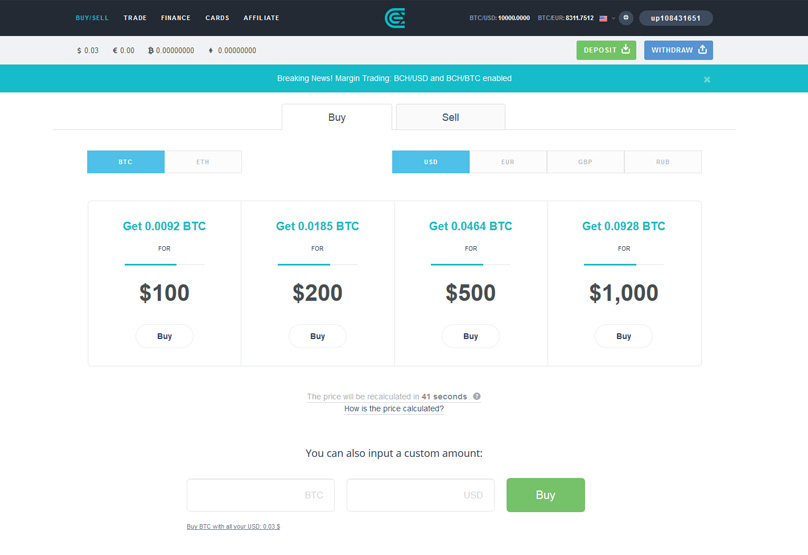

CEX.IO

Formerly a cloud mining company, CEX.IO boasting the liquidity and array of listings that enable you to explore diverse opportunities in investing.

While each exchange has its own unique offerings, they also come with their own set of advantages and drawbacks, allowing you to choose the option that best suits your needs.

Read our Full Review of CEX here .

In the meantime, we’ll guide you through some of the best-known cryptocurrency exchanges to help you form your own opinion.

Though it made its debut in 2017, this platform has rapidly gained traction in the crypto circle. It's a trailblazer, often listing new altcoins before its competitors.

Bithumb

Bithumb Binance has our endorsement at Blockonomi, and we've included it in our recent

Roundup of Premier Exchanges for Newcomers

Thus, if you're eager to get involved in altcoins right after their ICOs—often before others can—make sure you register with Binance.

With Binance, you'll find a unique experience as it offers two distinct trading interfaces: one basic, the other advanced. While the terminology might suggest simplicity, both interfaces are more complex compared to other popular exchange platforms.

Poloniex

Poloniex However, once you master these interfaces, the advanced set-up provides superb tools. It allows you to conduct both historical data analysis and projective technical evaluations on various cryptocurrencies.

Regarding verification levels, Binance keeps it straightforward. Newbie users are initially limited to a daily withdrawal of up to 2 bitcoins. Achievable and fair. Yet, by moving up to level 2 verification, the ceiling leaps to a limit of 100 bitcoins per day, beneficial for heavy traders.

hails from South Korea and brings its own exciting elements. Like Binance, this exchange is focused on pushing altcoin projects early on, offering an edge over other global platforms.

One of the standout features? KuCoin ensures speedy confirmation of crypto deposits. Thus, traders can commence their operations almost instantaneously. This is owed to KuCoin's promise to credit digital assets to accounts within mere seconds of transaction confirmation.

- address

- phone number

- ID scan

- a picture of you holding your ID

A fascinating exclusive feature here is the KuCoin Shares (KCS) ERC-20 token. The exchange encourages their use by offering discounts on trading fees when they’re being traded instead of opting for BTC or ETH.

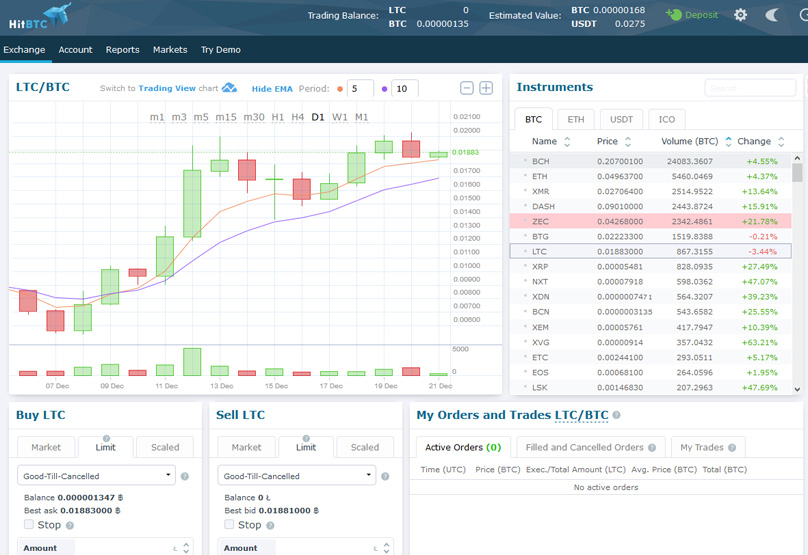

HitBTC

Moreover, users benefit significantly since 90% of trading fees are handed back through KCS tokens. This means holders are rewarded with ETH 'dividends’ for simply maintaining their KCS balance. HitBTC Another feature setting KuCoin apart is its 24/7 customer support, swiftly handling client issues.

Caters to experienced traders interested in margin trading, allowing transactions with leveraged balances to take longer or shorter market positions on Bitcoin, effectively speculating on price movements. It’s advisable to familiarize yourself with

before beginning to trade on BitMex.

America's preferred exchange for cryptocurrencies.

Words Of Warning For Traders

GDAX distinctly offers fewer trading pairs than many leading exchanges—you can swap between Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and mainstream currencies such as USD and EUR. Even so, it delivers the professional volume and decorum that other platforms aspire to achieve.

Exchanges have been hacked in the past An emerging highlight is Coinbase's impending support for Bitcoin Cash (BCH) from January 1st, 2018. This aligns with the company's ambition to expand its range of altcoin offerings.

When purchasing through Coinbase, you have a couple of payment methods. The simplest and direct choice is a credit card. For more substantial transactions, linking your bank allows for greater activity after verifying two small transactions from Coinbase.

What really sets apart Coinbase is its security reputation. Being anchored in the U.S., this platform adheres to strict regulations unlike offshore-based competitors. This creates a more secure environment compared to typical exchanges. in a hardware wallet Promoting itself as the ‘next-generation digital asset exchange,’

caters exclusively to U.S. traders as membership is only open to American investors. Be aware before signing up.

Established by the Winklevoss twins, tech venture capitalists, in 2015, this platform serves to provide U.S. traders with an intuitive cryptocurrency trading interface.

Setting up with Gemini couldn’t be easier. Just supply your email, receive a ‘registration token,’ set up two-factor authentication and your phone. Gemini then sends you a code to confirm, completing your registration. your hard-earned crypto trove will be safe and sound indefinitely.

12Comments

Bittrex demands full verification, and a substantial $10,000 USD for bank transfers in USDT—a proposition we’re currently cautious about due to Tether-related controversies.

A Luxembourg-centric exchange catering to European clientele. Trading remains open in USD, aligning with EU SEPA systems, streamlining transfers.

API customization enables traders to personalize their account management, advantageous for high-volume investors.

Known for its longevity and trust, Bitstamp has stood its ground since 2011, competing against the ill-fated Mt. Gox exchange, proving its reliability.

Not particularly suited for novices due to its intricate user interface, Bitstamp is better matched for Europeans ready to tackle its learning curve.

Commands the spotlight as South Korea's third-largest exchange, thanks in part to the region's significant contribution to global trading volume.

The availability of Korean currency-based trading pairs (KRW) is a distinct feature to consider.

Major cryptocurrencies including Bitcoin, Ethereum, and Litecoin, grace Coinone, whose low fee structure attracts global users for unique currency conversions.

Serves investors across America, Canada, Europe, and Japan with crypto trading pairs in USD, EUR, GBP, and JPY.

Boasts being the ‘world’s largest Bitcoin exchange by euro volume and liquidity.’

Known for enforcing robust security protocols, storing most assets offline in ‘cold’ wallets to mitigate risks of digital attacks. This keeps only necessary funds online for trading to enhance safety.

Post Mt. Gox's downfall, Kraken completed a third-party audit verifying its assets cryptographically. Servers are spread across numerous locations, utilizing advanced security to prevent unauthorized access.