For those investors looking for an extra thrill beyond the usual crypto market swings, margin trading may be the answer. This method lets you amplify your potential earnings through leverage but beware, as it also intensifies your risk exposure, possibly leading to losses that surpass your initial investment. Consequently, some platforms enforce more stringent protocols for margin traders, including rigorous ID checks and set qualification standards.

Let's break down what margin trading entails, its execution, and the inherent risks and rewards involved.

Margin Trading, Simplified

Trading cryptocurrencies on margin is akin to leveraging other commonplace financial instruments like equities or bonds. You begin by using borrowed funds to enhance your base investment, typically depicted as a leverage ratio. For instance, a $5 stake at 5:1 leverage metaphorically elevates your market position to $25. The downside? This borrowed capital requires repayment, usually with added interest. Thus, the aim is to ensure your returns sufficiently cover both the loan principal and ancillary costs.

Margin trading splits into two notable segments. The first category revolves around spot market margin trading, wherein your borrowed capital must be settled upon trade closure. Typically orchestrated via a P2P lending framework within the platform, it's crucial to meet payment obligations with any due interests.

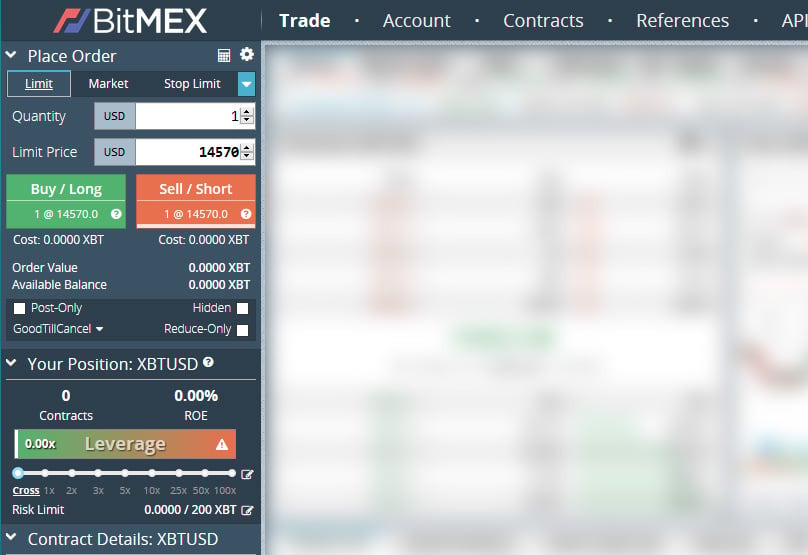

BitMex Discover Margin Trading on Crypto Exchanges

This scenario introduces the liquidation point—a critical checkpoint. If your trade position dips into hazardous areas, a margin call from the loan provider might ensue, demanding recovery of the advance. It operates through twin tiers: an initial margin boundary to deter untenable positions, and a lower one that will automatically prompt a margin call should your trade sink further.

The secondary segment of margin trading encompasses derivatives. By nature, derivatives are financial constructs layered over a core asset. Futures, for instance, fall within this category. Engaging in derivatives margin trading means the underlying asset stays inert; instead, parties stakes opposite sides of a futures agreement. derivatives trading Although no direct loan repayment exists, exchanges uphold precautions against trades delving into the red. Each platform has unique measures, ranging from absorbing negative balances through insurance funds to assuming trading positions during margin calls.

Read our guide to Derivatives

Central to margin trading is deciding whether to go long or short. Opting for a long stance bets on the asset appreciating, while a short bet speculates on depreciation. Both methods can capitalize on leverage.

The Long and the Short of It

Taking a long position seems intuitive: you snag cryptocurrency hoping the price bypasses your purchase point. It's the quintessential 'buy low, sell high' approach.

Shorting may baffle at first, as you essentially vend assets you don't yet possess using financial tools, aiming to repurchase them later at diminished rates.

If you're lost, liken the process to gambling: going long means laying a bet on ascending value whereas shorting anticipates a decline.

Whether you opt-in or not, margin trading invites considerable risk due to leveraging. Nothing is gratis, notably in financial domains. Traders must aim for significant returns to cover borrowed funds and linked expenses.

Risk and Rewards

Risks mount with margin calls. Not only does this jeopardize your initial stake, but it can also accrue further losses, turning what began as a bet into potential debt. Familiar from stories of loan sharks, such gambles tread fine lines as outcomes determine substantial gains or losses.

While not always ruthless, moodiness lurks within margin trading, occasionally leading exchanges to manipulate surroundings for financial gain.

Crypto trading Short squeeze tactics, where a crypto facing steep short interest gamehaftement undergoes rapid liquidation, exemplify such manipulations. This sends prices soaring, possibly leaving traders with profoundly altered outcomes.

Some platforms allegedly exploited stop-loss movements to gain margin call payouts. Often, 'whales'—substantial market movers—can prompt short squeezes by deftly maneuvering vast short positions and reshaping markets to their benefit.

Be careful of Whales when margin trading

Given the intricacy of margin disciplines and potential for considerable investor and exchange calamity, only select sites provide these options. Many necessitate proof of accredited investor status, infusing a slice of self-regulation in the typically untamed crypto sphere. The hazards amplify when unsupervised, multiplying unfavorable effects and threatening market stability.

A Professional Game

Navigating margin trading requires a seasoned touch. Understanding its mechanics is beneficial, regardless of your trading expertise, as phenomena like short squeezes can abruptly impact any crypto holdings.

Amidst industry stalwarts, the Editor-in-Chief of Blockonomi steers Kooc Media, a UK-originated online conduit, championing open-source, blockchain, and equitable internet practices.

References

- https://masterthecrypto.com/margin-trading-derivatives-crypto-exchanges-manipulating/

- https://cryptopotato.com/bitcoin-altcoins-margin-trading-beginners/

- https://www.thebalance.com/long-and-short-trading-term-definitions-1031122

- https://cryptocurrencyfacts.com/basics-margin-trading-cryptocurrency/

- "a-wrap a-wrap-base a-wrap-6 a-wrap-bg">