If you’ve been following along with my writings recently, you'll have noticed we've delved into a wide array of cryptocurrencies and explored numerous mining algorithms. However, there's a critical aspect that often goes unnoticed in mining discussions: the process of deciding which cryptocurrency to focus on. It's not just about picking a coin to mine; it requires a strategy in place before even purchasing any mining equipment or jumping into the mining process.

Within this guide, I aim to navigate you through formulating an effective strategy prior to investing in gear, as well as exploring the various mining strategies available when you embark on your mining journey.

Note we will not be covering ASIC It's important to note that this guide will cover mining predominantly through using GPU units.

Choosing Your Equipment

Prior to settling on which graphics card and brand to purchase, it’s essential to conduct thorough research and devise a comprehensive long-term strategy.

At present, there are primarily two distinct routes to kickstart your mining adventure. You can opt to acquire Nvidia GPUs, which perform optimally with Equihash algorithm-based coins, compatible with both Linux and Windows operating systems. Alternatively, if you're interested in Cryptonight algorithm coins, AMD GPUs serve as a better choice, primarily functioning on Windows systems.

The fundamental question is about where you want to direct your mining efforts. Should your goal be Ethereum or Ethash-based coins, these can generally be mined with both Nvidia and AMD cards. Worth noting is Ethereum's impending transition to a Proof of Stake (POS) model, so this discussion will sidestep Ethereum for now.

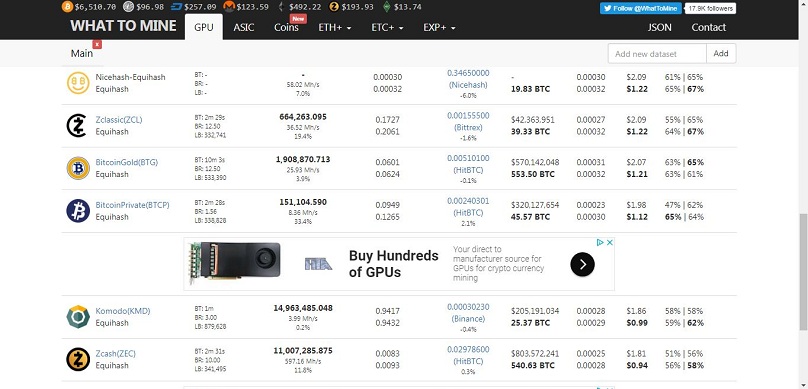

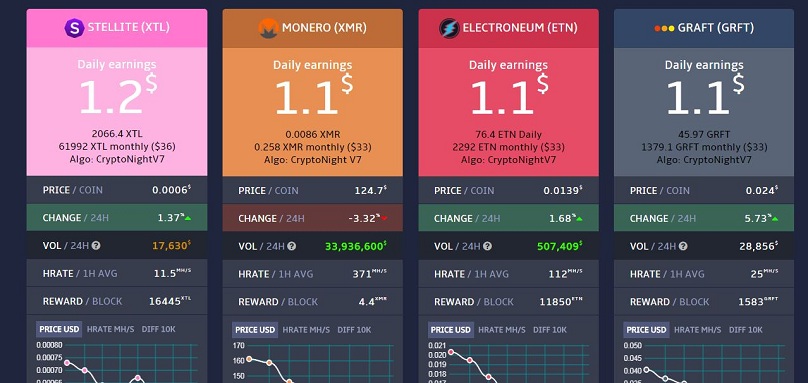

Unraveling this matter requires engaging in a bit of research into different coins using each algorithm. Websites like whattomine are excellent resources to compare options, yet for Cryptonight coins, cryptunit is preferable as it provides a broader roster compared to whattomine. Equihash coins

or only Cryptonight Although the list isn't exhaustive, it encapsulates the primary coins within those algorithms. To expand your knowledge beyond that, exploring forums, mining pools, and cryptocurrency exchanges proves beneficial. For those curious about Equihash, a look into bitcointalk and Reddit forums can be illuminating.

They list about 23 coins right now.

Base your decisions not solely on immediate profitability; consider which coins might hold greater value in the future. We'll delve more into this aspect shortly in the forthcoming sections. https://pool.miningspeed.com/ and https://www.leafpool.com/ Upon selecting a mining algorithm and acquiring your hardware, it's crucial to reassess and adapt your strategy as needed. Strategies can be tweaked at any point, and I typically switch methods every few months.

Here’s a rundown of common mining strategies:

Different Mining Strategies

Choosing to mine a cryptocurrency you predict will appreciate in value (speculative mining)

Mining the most lucrative coin, then trading it to purchase coins with higher future potential (a variant of speculative mining) is my favored technique and the one I regularly employ.

- Mine the most profitable coin

- Focusing on new coins with low hashrates to accumulate them before they gain traction or get listed on exchanges.

- I've experimented with each of these tactics at different points in my mining journey. Occasionally, the most financially rewarding coin aligns with what I perceive as a profitable long-term investment.

- There's no definitive solution here. Having dabbled in various strategies, my approach is to blend techniques to achieve optimal results. This is my process:

Also when selling

- Do I sell it and keep the bitcoin?

- Do I sell it and buy altcoins?

I typically concentrate on mining the coin most profitable for my setup. There’s little sense in mining a different coin otherwise. Often, you may find that the most lucrative coin isn’t the one you deem a worthy investment, so it makes sense to weekly liquidate it for other desired coins on exchanges. Keep a close watch on transaction fees—cross-exchange transfers can incur significant costs, and it’s best to account for such when planning your coin conversion.

Which Strategy to Use?

Bear in mind that many profitable coins have a small market capitalization. This requires frequent exchange sales because keeping them too long could result in a rapid dip in value.

My current strategy involves mining high-profit coins for my setup, then weekly selling and reinvesting in coins I trust.

Although purchased with Bitcoin profits, my focus isn’t on reclaiming BTC. This process is lengthy, likely exceeding a year. Besides, there's potential in altcoins that promise better yields than Bitcoin.

My Strategy

Should you follow this path, ensure you track how much you are selling on exchanges to gauge if you've regained your expenditure in BTC terms.

Buying altcoins in this method resonates with me, as it encourages measured accumulation, averaging out expenditures instead of hefty lump-sum buys in BTC.

Occasionally, it’s wise to halt expenditures. When your coin undergoes a fork, holding might yield benefits in obtaining forked coins. Yet, this only holds if potential gains surpass anticipated losses due to coin devaluation.

At times, it’s strategic to retain BTC mining rewards rather than convert them into altcoins. For instance, if an altcoin you frequently purchase seems overpriced, waiting for a price drop before resuming buys might be judicious.

Bitcoin Mining – Is it Worth it?

During bear markets, holding Bitcoin is often the better strategy, given that altcoin prices typically dive in such conditions.

Though selling mined coins for BTC or other altcoins is common, paying off mining rigs often takes a while. It might help to devote specific days each month to mining fledgling low-hash-rate coins. Early access can yield more coins compared to high-hash-rate periods. These assets are largely unfamiliar and not typically exchange-listed, so price predictions are uncertain. They're seldom forks since pre-fork news is widespread.

Some months back, an unknown coin had low awareness and hashrate, representing prime examples of potential.

Mining New Coins (Speculative Mining)

Vigilance in identifying new mineable coins is key, and while time-consuming, it's rewarding. Constantly peruse... Ravencoin Discover information about coins right as they're released. Additionally, make use of mining pools and smaller exchanges to locate new listings.

There’s loads of guidance in response to this question. Fundamentally, begin with the coin's website, peruse the whitepaper, or at the very least glance through it. Assess the team, verifying their expertise and proportionate roles. Teams skewed towards marketing with minimal developers should be scrutinized. Bitcointalk announcements thread Ensure they possess an accessible product or notable plans for one. Consider if blockchain is a requirement or if conventional platforms suffice. Blockchain redundancy should prompt exploring alternative coins. Reddit’s GPU mining section also has some information.

How to Choose Good Coins

Query if the coin acts as a utility token, essentially currency locked within a service ecosystem, justifying its necessity over using Bitcoin as a transactional medium. Utility tokens thrive on transaction velocity but lack substantial holding incentives, periodic price speculations aside. Seek cryptocurrencies with intrinsic value well beyond mere transfers, promoting usage and additional functionalities.

Tokens under the NEP-5 or ERC20 umbrellas should feature plans to evolve into standalone coins soon. Most top-ranking cryptocurrencies either are or plan to transit into being coins.

Utility Tokens

Research your coin’s rivals, evaluating their competitive edge. Consider also any established partnerships with prominent firms and institutional backing. POS Analyzing coin metrics uncovers optimal buying moments—for example, a solid circulating supply relative to total supply. Ideally, aim for at least a 50% circulation ratio to mitigate supply-induced devaluation. Typically, a baseline 30% threshold suffices adapting to distinct coin types amidst fluctuating conditions.

Guide to Cryptocurrency Mining: Strategies Like Speculative Mining and Beyond https://coinmarketcap.com/ An In-Depth Guide for Newcomers Exploring Various Cryptocurrency Mining Techniques, Including Speculative Mining – Discover What Suits You Best

If you've been reading my articles lately, you're surely aware that we've delved into a multitude of coin options and employed various mining algorithms. What seems to be missing from a lot of mining YouTube channels and publications is guidance on how to choose which coin to mine. The process is more intricate than it appears, requiring a clear mining strategy before investing in equipment and embarking on different coin mining.

In this guide, I'll discuss how to establish a sound strategy before purchasing your mining gear, along with an overview of the different mining strategies available once you get going.

This article focuses purely on GPU mining.

You will want to use https://coinmarketcap.com/ for this

Consider this: before selecting a brand or model of GPU, it's crucial to research and conceive a thorough long-term plan.

At present, there are generally two main avenues you might embark on in your mining journey. You could opt for Nvidia GPUs, which are particularly compatible with coins using the Equihash algorithm and work well with both Linux and Windows, or you might choose to focus on Cryptonight coins, which perform better with AMD GPUs and are predominantly Windows-based.

That's your first decision to make. Now, when it comes to mining Ethereum or other Ethash coins, these typically function similarly on both NVIDIA and AMD platforms, thus allowing flexibility in your choices. Since Ethereum is transitioning to POS soon, we'll skip diving into its specifics for this article.