As this year wraps up and the crypto world market capitalization is on the brink of a $2 trillion valuation, crypto enthusiasts have many reasons to celebrate. With groundbreaking mainstream acceptance, substantial institutional backing, and thrilling technological advances, 2023 has been a landmark year of growth in the industry.

Yet 2023 wasn't all smooth sailing — it was marked by some significant controversies. Three prominent cryptocurrency pioneers were at the center of these, facing accusations of legal breaches. FTX's Sam Bankman-Fried, Binance's Changpeng 'CZ' Zhao, and Celsius' Alex Mashinsky were all embroiled in legal troubles, casting long shadows over their reputations.

Though they've faced varying outcomes, the aggregate impact on the crypto landscape has been notable, prompting discussions about the future regulatory tightening likely to reshape the industry landscape.

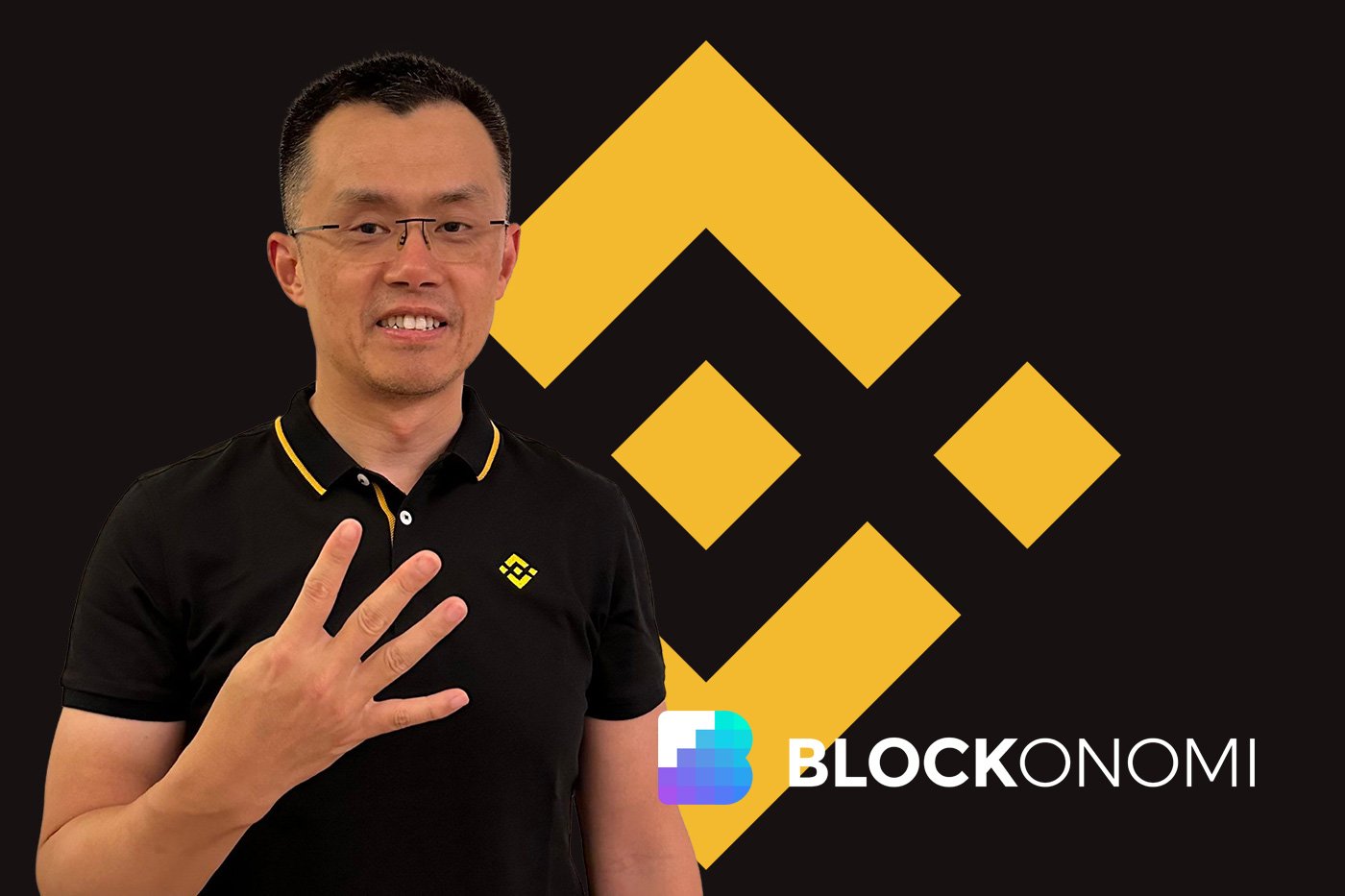

Changpeng “CZ” Zhao

Holding the reins at the helm of the world's largest crypto exchange, CZ was a towering figure in cryptocurrency. Nevertheless, his stature took a hit when his involvement in FTX's downfall came to light.

Failing to rescue FTX, CZ opined that the platform's demise might actually serve the greater good, purging the industry toward a healthier trajectory. This sentiment was echoed a year later when Kraken's Co-Founder Jesse Powell shared similar thoughts after CZ's resignation and substantial fine of $150 million.

The regulatory scrutiny further led to Binance shelling out $2.7 billion in settlements with the Commodity Futures Trading Commission after a settlement sanctioned by a U.S. court addressed anti-money laundering and sanction law infringements.

Sam Bankman-Fried

Once hailed as crypto's 'prodigy,' FTX's Sam Bankman-Fried witnessed his $24 billion empire unravel within days due to what he termed as a $8 billion 'error,' yet the Department of Justice saw it as outright fraud.

Bankman-Fried's maneuvers were intended to mask investment disasters and inflate financial statements. Post-revelation, he found himself extradited, facing charges back in the United States, where former allies became adversaries.

Convicted in November, Bankman-Fried faced charges of fraud and conspiracy, with a potential sentence reaching up to 110 years, as the prosecution labeled FTX's operations as fraudulent from inception.

Alex Mashinsky

Sharing parallels with Bankman-Fried's narrative, Celsius CEO Alex Mashinsky cultivated a savior image within the crypto scene. However, as his platform gained traction, grim realities surfaced.

Boasting high returns, Celsius' popularity came at a cost — a liquidity crisis in 2022 led to frozen withdrawals. Economic turbulence from the LUNA crash was pivotal in bringing Celsius to bankruptcy filings.

Accusations also pointed to Mashinsky utilizing investor funds for personal gains, exacerbating his company's woes. Yet, despite his arrest, restructuring plans were initiated with optimism for Celsius' rebirth.