As the realm of cryptocurrency expands, millions globally are exploring crypto investments to tap into diverse income-generating avenues.

CryptoTaxCalculator It's engineered to guide crypto investors across the US, Canada, New Zealand, the UK, and Australia in effortlessly and automatically discerning the taxes pertaining to their crypto ventures.

You can rest easy knowing you're staying on the right side of the IRS or your local tax authorities.

With the rise in crypto investments worldwide, governments have not only begun regulating crypto purchases but are also taxing them similar to other forms of property.

The US, for instance, through the IRS, treats cryptocurrencies as property, meaning investors face capital gains taxes for any crypto sold, traded, or used for payments.

CryptoTaxCalculator: Simplifying Your Crypto Investment Experience

Navigating taxes is notoriously convoluted in any nation, and crypto transactions add an extra layer of complexity to this tedious annual ritual.

Even though many tools are available for tax calculations, uncertainties prevail, and few platforms are truly equipped to handle crypto-specific tax features.

What is CryptoTaxCalculator?

Launched shortly after the 2017 ICO surge, CryptoTaxCalculator emerged as a refined alternative for those tangled in intricate crypto transaction mathematics.

Shane Brunette, a software savant with a rich academic background and an eye on crypto, first floated the concept on Reddit, refining the idea with community feedback into what is now CryptoTaxCalculator.

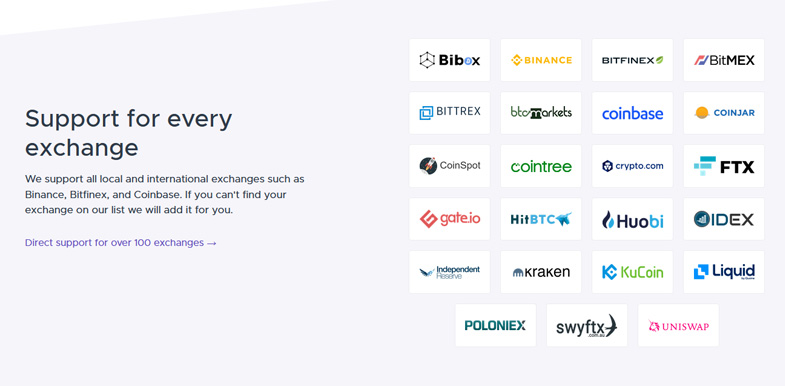

The upgraded version, rolled out in 2020, seamlessly caters to over 100 crypto exchanges, eliminating the need for challenging calculations.

Without CryptoTaxCalculator, crypto aficionados would otherwise have to spend exhaustive hours on manual bookkeeping and tax calculations, especially if involved in DeFi.

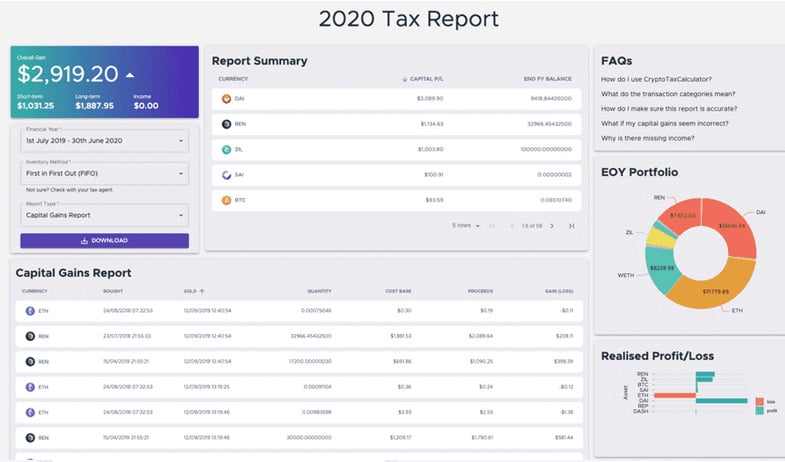

CryptoTaxCalculator automates tax computation by connecting directly to users' crypto exchange accounts, meticulously organizing transaction data, and generating necessary reports.

How Does CryptoTaxCalculator Work?

Whether via APIs or CSV uploads, CryptoTaxCalculator's simplicity defies the technical jargon, enabling straightforward integration with your wallet or exchange data.

Once connected, the service imports all relevant data and processes it to craft a tax report tailored to the user's unique obligations, making tax tasks effortless.

Linking up with over 100 different exchanges, CryptoTaxCalculator performs automated data imports, offering unparalleled ease for users.

It functions across top platforms like Binance, Coinbase, Kraken, and more, effortlessly integrating with a slew of exchanges for comprehensive tax solutions.

If your preferred platform isn't listed, contact their dedicated support to swiftly help you import the necessary data for your tax documentation.

Additionally, CryptoTaxCalculator extends its services to cater to NFTs, a burgeoning aspect of the crypto landscape that many platforms overlook.

What Are the Costs Involved with CryptoTaxCalculator?

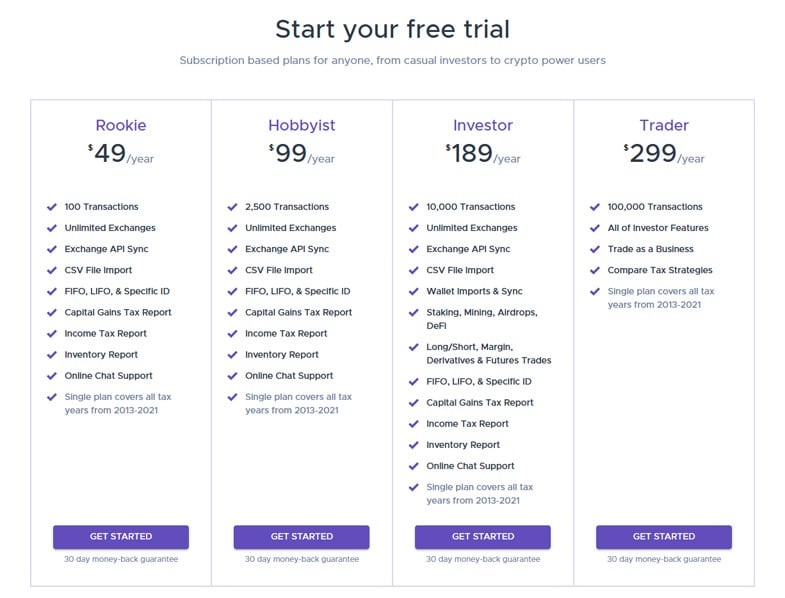

Operating on an annual subscription model, CryptoTaxCalculator lets you generate comprehensive reports spanning previously overlooked tax years without extra charges.

This model means that revising reports due to minor oversights won’t result in additional fees.

The service offers four pricing tiers, all inclusive of a 30-day refund policy if you're not satisfactorily served by the platform's features.

Currently, these tiers span from $49 annually, expanding up to $299, primarily based on transaction counts enabled.

The 'Rookie,' 'Hobbyist,' and 'Investor' plans share core functions but vary in transaction limits—100, 2500, and 1000 respectively—with benefits detailed per tier.

- Unlimited Exchanges

- Exchange API Sync

- CSV File ImportFIFO, LIFO, & Specific ID

- Capital Gains Tax Report

- Income Tax Report

- Inventory Report

- Online Chat Support

- Covers all tax years from 2013-2021

The priciest 'Trader' plan, supporting up to 100k transactions, encompasses all lower-tier benefits while adding advanced features like business trading support.

Meet the Minds Behind CryptoTaxCalculator

Shane Brunette's firsthand taxation obstacles in 2017, amidst Australia's pioneering crypto tax regulations, inspired the inception of CryptoTaxCalculator.

With credentials stretching across AI, psychology, and economics, Shane leveraged his vast expertise to spearhead this venture into the crypto taxation arena.

Alongside Shane, CTO Tim Brunette, Shane's sibling, brings years of software engineering experience, complemented by a rich academic background.

Tim's professional journey, including tenure at Accenture, together with his Master's in AI and a degree in Space Engineering, shapes the technical backbone of the platform.

Beyond the Brunette siblings, a dedicated team of accountants and engineers perpetually enhances the platform based on invaluable user insights, ensuring stellar service.

Who Needs CryptoTaxCalculator?

CryptoTaxCalculator caters to both accountants and crypto investors encountering rigorous taxing standards globally, simplifying tax obligations aligned with crypto transactions.

The tool is invaluable for DeFi investors, day traders, and crypto-curious parties, automating the taxing ordeal amidst continually evolving crypto regulations worldwide.

While primarily available in English-speaking regions like the US, Canada, and others, expanded international support could be a future enhancement.

Take a Look at CryptoTaxCalculator

Regardless of experience or tax familiarity, tax season remains universally daunting, gaining complexity with cryptocurrency's burgeoning presence.

As governments grow accustomed to the crypto sphere, investors face added scrutiny to comply with still-maturing regulatory frameworks.

Tools like CryptoTaxCalculator provide an accessible safety net for investors looking to fulfill tax obligations correctly, avoiding any future legal predicaments.

When choosing a crypto tax tool, prioritize those offering strong support, alignment with your tax obligations, and awareness of the digital asset landscape.

Employing these tools could safeguard against compliance issues and even boost financial returns by unearthing tax efficiencies through crypto transactions.

Whether you seek convenience, detail, or more leisure time, CryptoTaxCalculator emerges as a prime choice for meeting diverse needs.