Cryptocurrency exchanges are being catered to with advice to stay vigilant at all times. The Securities and Exchange Commission is targeting operations that don't have a centralized authority or office.

Robert Cohen, leading the SEC's new cybersecurity team, declared on November 11 that employing blockchain for creating an cryptocurrency exchange exchange without a centralized control center doesn't exempt the owner from responsibilities towards clients.

A growing trend shows exchanges drifting away from traditional corporate setups like Coinbase – like the one having its headquarters in San Francisco – opting for blockchain-operated platforms alone, leading to no human oversight while automated processes or decentralized exchanges smart contracts take over. The SEC intends to curb these types of exchanges, asserting they could endanger customers, their assets, and privacy.

Take Your Job Seriously

Cohen explained:

The focus isn't on labels or technology in use but rather the function and operation of the platform. Regardless of being decentralized or smart contract-based, the essence is being an exchange.

He further reiterated that though developers may not directly manage exchanges, they remain accountable like any executive running an organization. Cohen insists developers cannot just create code and abandon ship; their duty to their customers is undeniable and must be fulfilled.

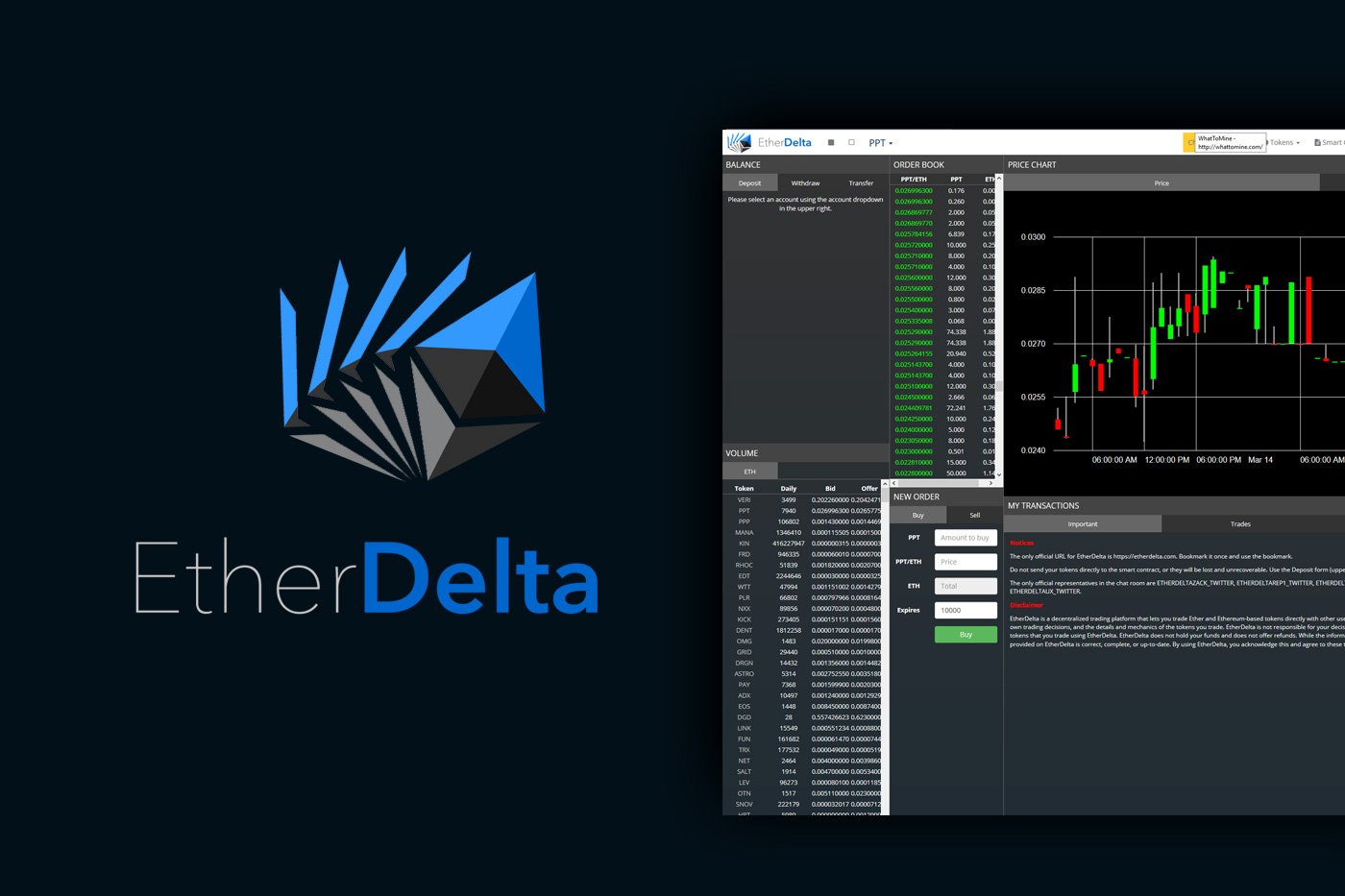

EtherDelta Founder Fined

These remarks follow a recent event where the SEC charged Zachary Coburn, the founder of a decentralized token exchange known as EtherDelta . His company executed nearly four million trade orders from mid-2017, with the latest on November 9, Friday at 3:07 PM EST.

Read: EtherDelta Review

Coburn settled charges for running an unlicensed cryptocurrency exchange last Thursday with the SEC, agreeing to pay approximately $300,000 in disgorgement, $13,000 in interest, and a $75,000 fine, though he didn't concede to the allegations. Notably, his exchange remains operational while Coburn cooperates with the SEC.

Why Is This So Significant?

Dina Ellis Rochkind from Paul Hastings LLP in New York elaborated on the significance of the SEC's proceedings against EtherDelta:

This represents an important step by the SEC, marking its first enforcement against an unlicensed exchange. It emphasizes that securities trading—including most ICOs—must occur on registered alternative trading systems or national exchanges, potentially opening doors to further enforcement actions.

Things Like This Have Happened Before

Incidents parallel to EtherDelta's encompass a case tied to the Decentralized Autonomous Organization (DAO). Here, a collection of smart contracts operating on the Ethereum blockchain faced a situation where the code acted unexpectedly, causing a $60 million transfer to an inadvertent third-party's account.

Read: What is the DAO?

Although the DAO wasn't formally charged by the SEC, this event led to the formation of the SEC's new cyber unit and contributed to Ethereum's historic bifurcation, establishing Ethereum alongside its elder sibling, Ethereum Classic. The DAO has since enhanced its functionality to bolster its code and enhance customer security.