So you’ve tried centralized cryptocurrency exchanges like Coinbase and Binance After dabbling in centralized exchanges, you might be curious about expanding your trading options. Have you thought about exploring a decentralized exchange?

Decentralized exchanges, often referred to as DEXs, enable users to engage in peer-to-peer transactions, meaning your digital currencies remain your own and are not held by a third-party entity. This direct trading method protects your investments from the risks associated with third-party breaches and financial mishaps.

The magic of decentralized exchanges lies in their ability to eliminate intermediaries altogether through automation. Trustless transactions are made possible via measures such as multi-signature escrows and proxy tokens.

To help you better navigate the realm of decentralized trading, we're diving into some prominent DEXs and highlighting emerging trends and future possibilities in this innovative space.

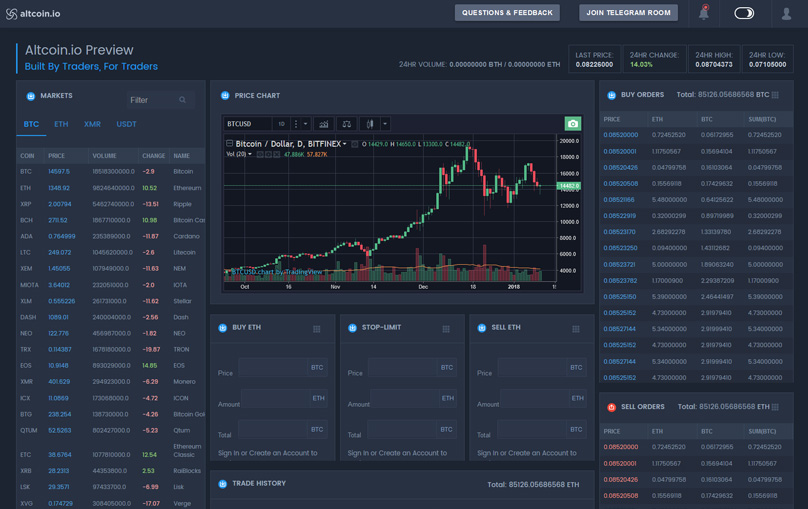

Altcoin.io

An upcoming decentralized exchange promotes itself with bold claims: 'A truly decentralized cryptocurrency exchange utilizing Atomic Swaps.' Interested users can pre-register for an atomic swap wallet, offering a glimpse into a future without middlemen. Altcoin.io This revolutionary approach is opening up new avenues for peer-to-peer cryptocurrency exchanges. we covered recently A DEX renowned for its popularity, available to traders globally except for regions like New York State and North Korea.

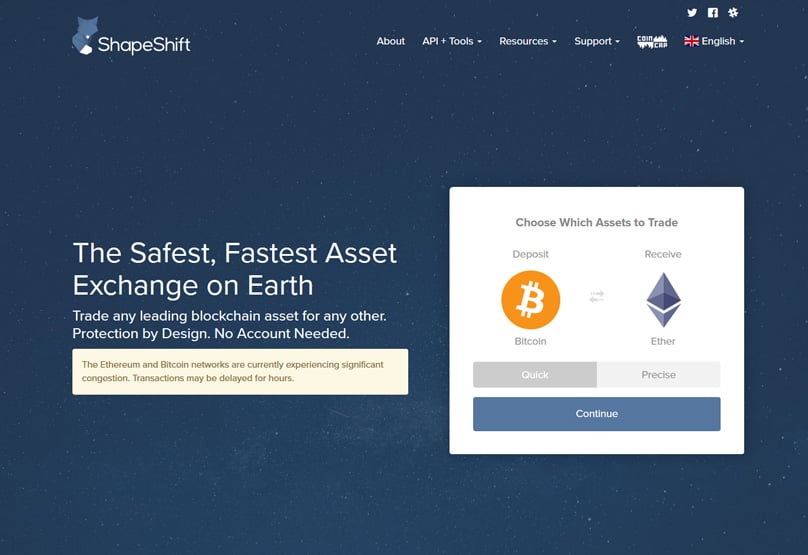

Shapeshift.io

Shapeshift On Shapeshift, transactions circumvent traditional currencies like dollars or euros, focusing instead on direct crypto swaps. Users can choose between swift, basic trades or delve into more precise, customized transactions.

The platform's coin offerings fluctuate weekly based on liquidity. Yet, they consistently feature leading projects and regularly add new ones as they become liquid.

Simply send your digital currency and receive your chosen crypto back: it's as straightforward as that.

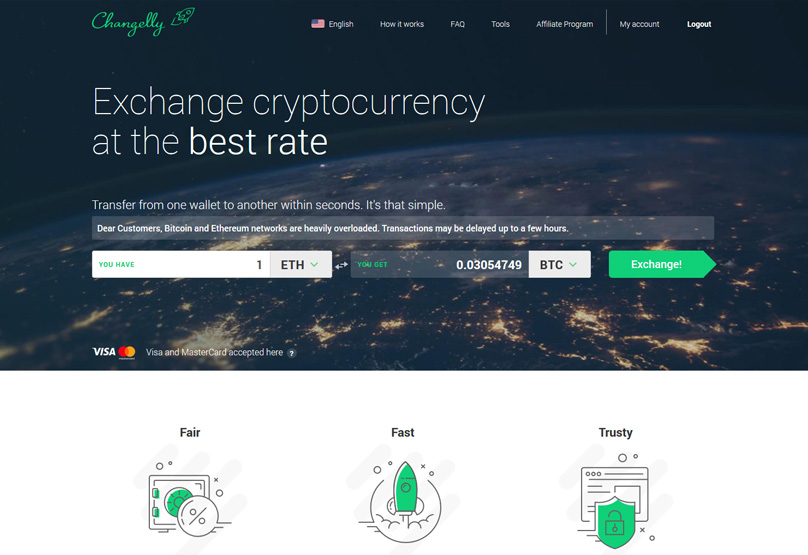

Changelly has cemented its place as a well-known DEX within the crypto ecosystem. Its system aggregates market prices across exchanges, allowing traders to access fair, averaged rates.

Changelly

Changelly Changelly's simplicity extends to its fee structure: a consistent 0.5% is applied to all trades, regardless of the cryptocurrency's liquidity.

Even more intriguing, Changelly provides APIs for merchant sites to facilitate crypto trades through a user-friendly widget.

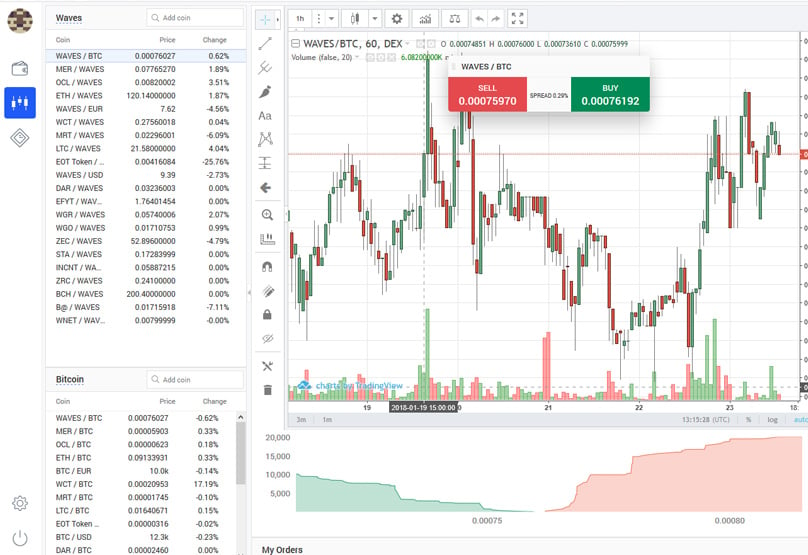

Launched in April 2017, the Waves platform embarked on creating Waves DEX, advocating decentralized blockchain tokens over their centralized counterparts.

Waves DEX

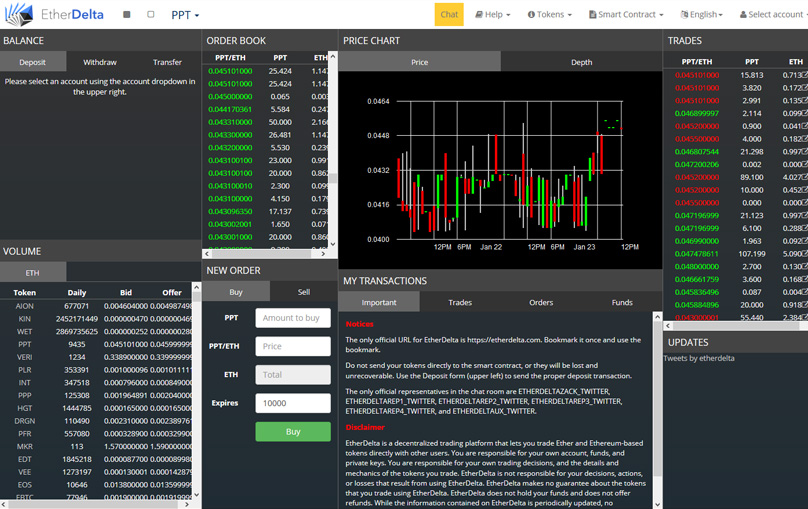

Waves DEX marries centralized efficiencies with decentralized security, enabling quick and private trades." "The platform was recently compromised, highlighting the importance of staying vigilant and checking social media updates before trading on any DEX. announced Despite setbacks, EtherDelta remains crucial for trading Ethereum-based ERC20 tokens, particularly those debuting shortly after initial coin offerings (ICOs).

The Waves DEX In this respect, EtherDelta continues to be a DEX worth watching.

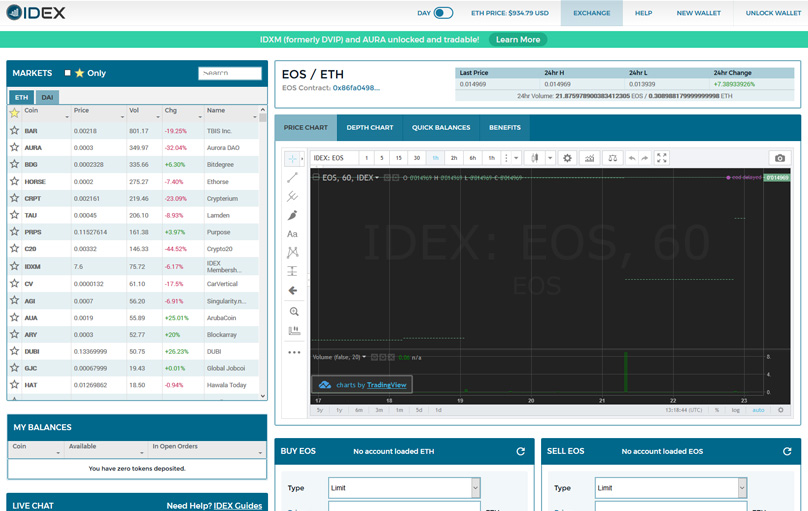

Known as the ‘Decentralized Ethereum Asset Exchange’, IDEX has been generating interest as it focuses on the P2P trading of ERC20 tokens.

EtherDelta

*Word of caution: EtherDelt IDEX may involve depositing coins similar to EtherDelta, unlike Changelly or Shapeshift, providing a more traditional exchange experience.

IDEX recently achieved a daily trading volume milestone indicative of its growing adoption.

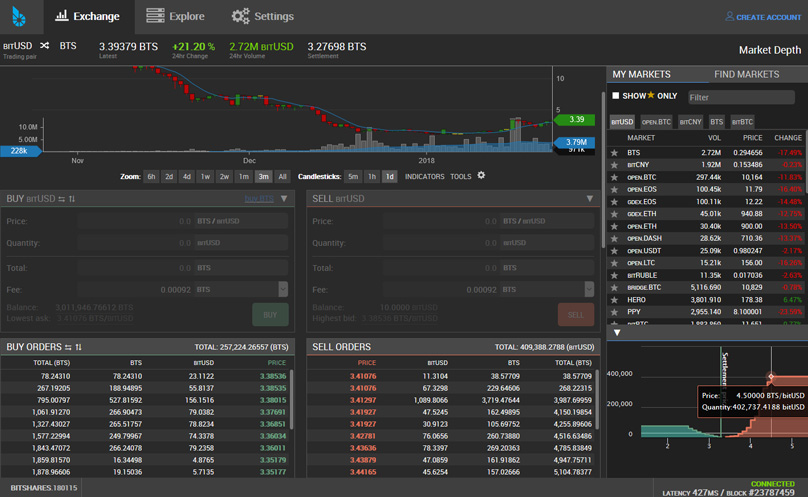

A shining example of DEX capability, the BitShares Asset Exchange, built on the BitShares blockchain, boasts swift order settlements comparable to those on the NASDAQ.

IDEX

IDEX The OpenLedger DEX, leveraging the same blockchain, allows seamless withdrawals via debit cards, money transfers, and soon, options like Ripple and PayPal.

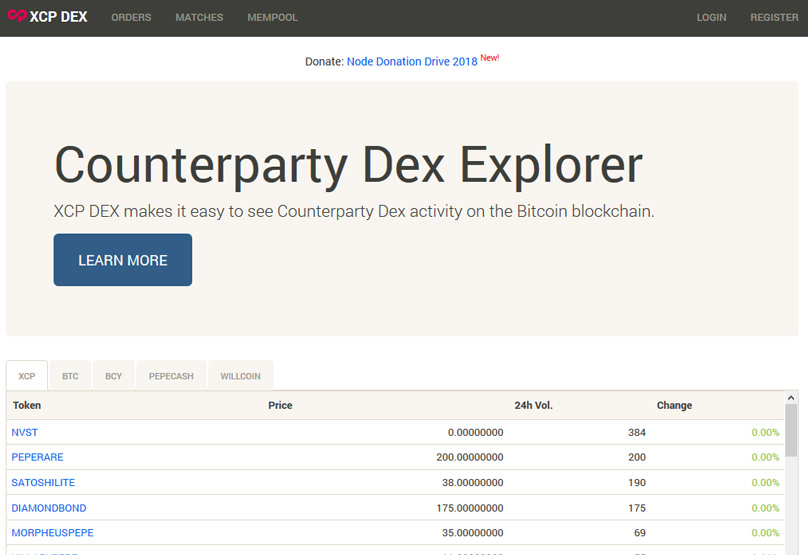

For P2P cryptocurrency trading, Counterparty leans on the Bitcoin blockchain.

At press time, IDEX had just passed the $1,000,000 USD Billed as a 'financial platform,' Counterparty's DEX fosters a comprehensive ecosystem for peer-to-peer apps built on Bitcoin.

BitShares Asset Exchange and OpenLedger DEX: Leaders in the DEX Landscape

A fascinating facet of Counterparty is the creation and trading of new digital assets, ushering in a wave of tokenization possibilities.

Two related orders are synced by protocol when trading P2P on Counterparty. SmartCoins CryptoBridge poses an interesting case among DEXs, as BridgeCoin holders profit from the exchange's transaction fees.

Counterparty DEX

The Counterparty DEX 50% of all decentralized exchange profits are distributed to BridgeCoin owners, deriving from a scrypt-compatible coin developed in July 2017.

Security is paramount on CryptoBridge, with users maintaining control over their private keys, ensuring no employee access to funds.

While all DEXs maintain user privacy, one exchange explicitly centers its brand on privacy-focused services.

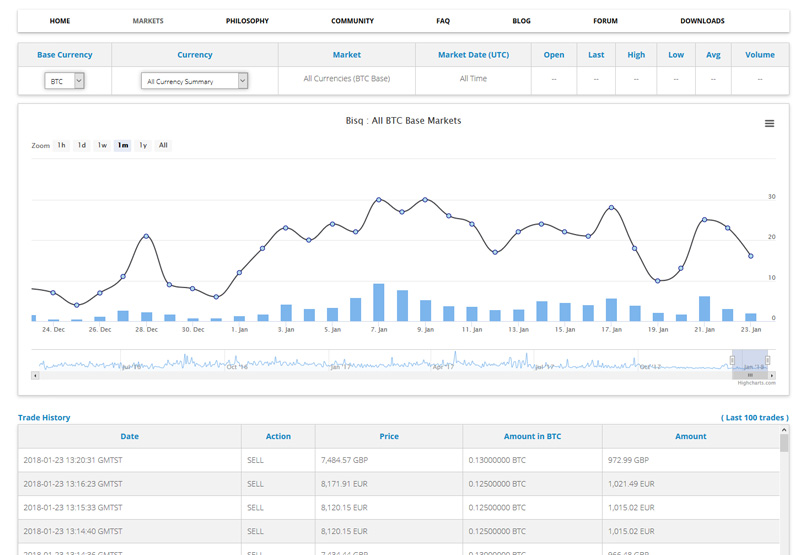

Bisq caters to traders who value maintaining control and privacy over their financial activities, with transactions viewed as confidential speech shielded from external oversight.

CryptoBridge

With its visually engaging interface, Bisq offers a user-friendly trading experience—whether it's familiar or refreshingly new is for users to decide.

Per the Cryptobridge launch post :

Traders must prepare before trading, whether by creating an account or utilizing Python, Solidity, or Web3.

Described as an 'Ethereum blockchain liquidity pool,' the Oasis DEX facilitates ERC20 token exchanges without counterparty risks via smart contracts.

Bisq

Emerging as part of a trend among DEXs to support Ethereum-based ERC20 token trades, Oasis is gaining momentum. Bisq Utilizing the 'Swap protocol,'

As the Bisq network website explains:

Similar to Oasis, this platform spotlights ERC20 trades. At this pace, Ethereum will require swift scaling.

AirSwap enhances trader experiences with a unique approach, avoiding front-running issues common to many exchange designs.

Oasis DEX

You can only interface with the Oasis DEX through a MetaMask extension As the ERC20-focused DEX segment becomes crowded, AirSwap needs to deliver quickly to remain competitive—bolstered by blockchain experts like ConsenSys.

Entering the scene as a ‘next-gen’ DEX, one exchange seeks to revolutionize trading on Ethereum’s Ropsten testnet through smart contracts.

Bancor will soon join the realm of platforms trading user-generated tokens, making it worth monitoring as it progresses.

AirSwap

Undoubtedly, tokens are currently all the rage. AirSwap Poised to reshape future DEXs. Project 0x stands out with its open protocol, allowing developers freedom to create DEXs for token exchanges, paving the way for ZRX's broad adoption. .

The protocol relies on 'Relayers' handling off-chain order books, compensated with the ERC20 ZRX token. explains ZRX ensures governance and fee management on 0x, with distinguished advisors, enhancing the project’s prospects.

Top Decentralized Crypto Trading Platforms to Explore in 2020

Other noteworthy DEXs include the Kyber Network and Bancor Protocol. These platforms deserve recognition for their unique contributions.

Kyber Network Decentralized crypto exchanges offer several perks over their centralized counterparts. Here's a curated list of the top DEXs worth exploring this year.

Then there’s the Bancor protocol Leading Decentralized Platforms for Crypto Transactions

Exploring new avenues in your crypto journey? Decentralized exchanges might be your next stop.

Looking Ahead: Project 0x (ZRX)

Project 0x Referred to as DEXs, these platforms enable peer-to-peer trading without handing over control of your digital assets to external services. Given the recent history of hacks and sudden collapses of such services, this is a significant advantage.

The allure of decentralized exchanges lies in their trustless nature, eliminating intermediaries through automation. Multi-signature escrow setups and proxy tokens are just a couple of methods employed to achieve this.

To help you stay ahead, we'll delve into some widely-used DEXs, alongside future trends and developments expected in decentralized trading.

BitShares Asset Exchange & OpenLedger DEX

Noteworthy mentions: Kyber Network and Bancor Protocol

Looking Ahead: Atomic Swaps

Atomic swaps 'A purely decentralized crypto exchange, powered by Atomic Swaps,' is a tagline for a new DEX set to launch this year. Early registration for an atomic swap wallet is open, with notifications for the platform's go-live date available.

Atomic swaps represent a groundbreaking approach to trading cryptos, eliminating the need for intermediaries entirely.

It's arguably the DEX of choice, accessible globally except for New York and North Korea. here .

Conclusion

At Shapeshift, you won't find fiat like dollars or euros. It’s all about private, P2P crypto trades. Users can opt for either quick trades or more precise ones.

- lack of liquidity

- lackluster customer support

- Their coin and token offerings fluctuate based on liquidity. Typically, they stock leading crypto projects, and newly liquid projects get quickly listed.

Trade your chosen digital assets and receive your desired crypto in return—simple as that.

Changelly stands as another popular DEX, notable for its automated system that sources digital asset prices from multiple exchanges to provide traders with an average rate.

Next time you get the trading itch Changelly is known for its straightforward fee structure: a flat 0.5% on all trades, applied uniformly across supported cryptocurrencies. Changelly or Shapeshift Changelly also provides merchant APIs, enabling websites to facilitate crypto transactions with a convenient widget.

14Comments

In this light, EtherDelta remains a DEX to closely monitor.

Known as the Decentralized Ethereum Asset Exchange, this emerging DEX is garnering positive attention.

Similar to EtherDelta, IDEX caters solely to ERC20 tokens. Unlike others like Changelly or Shapeshift, users must deposit coins, mirroring traditional exchange setups.

Achieving a daily trading volume milestone, IDEX shows signs of adoption, hinting at significant future growth.

>$3M yesterday.

Backed by the BitShares blockchain, the BitShares Asset Exchange boasts impressive metrics, asserting the capability to handle NASDAQ-like volumes with instant order settlements.

Similarly, OpenLedger DEX utilizes the BitShares blockchain, providing users with the option to withdraw funds directly to cash through an all-in-one debit card or money transfer.

No Radar Relay? ERC Dex? ParaDex?

Integrating with the Bitcoin blockchain, this platform enables decentralized, P2P crypto trading.

Counterparty brands itself as a financial platform with its DEX advancing its vision for a P2P application ecosystem atop bitcoin.

U can try this too… WandX

What about KOMODO? The barderdex

yea, it is great project !

Even better, Counterparty allows the creation of new digital assets, easily traded on its DEX, embodying the tokenization trend.

For P2P trades, Counterparty’s protocol aligns corresponding orders.

CryptoBridge introduces a unique approach among DEXs: BridgeCoin owners earn significant shares of its exchange trading fees.

Receiving 50% of profits, BridgeCoin holders benefit from a coin created to fund this decentralized exchange.

CryptoBridge ensures security as traders maintain control over private keys throughout use.

Though all DEXs ensure privacy, this platform emphasizes its privacy-focused branding.