Deribit This platform places Bitcoin enthusiasts at the heart of trading, allowing global users to delve into the realms of futures and options.

Deribit's unique name derives from melding 'Derivatives' and 'Bitcoin'. Users transact in Bitcoin for deposits, withdrawals, and trading collateral.

With the chance to use up to 100x leverage on Bitcoin futures, Deribit, while not universally known, is fast becoming a favored spot for crypto aficionados keen on futures.

Deribit Overview

Deribit Set in the Netherlands, this derivatives exchange runs its daily operations from Amsterdam. Launched in 2016 as Deribit B.V., it holds an address at Stationsstraat 2 B, 3851 NH, Ermelo, The Netherlands.

Co-founded by CEO John Jansen and CTO Sebastian Smycýnski, Deribit mirrors the aspirations of Bitcoin enthusiasts. The platform's transparent nature is bolstered by CMO Marius Jansen and Chief Developer Andrew Yanovsky.

Though transparent in operations, all platform transactions are in BTC. Deribit isn't a regulated broker yet, as European regulators navigate cryptocurrency's financial territory.

Open to patrons from over 100 nations, Deribit offers fee-less transactions, substantial leverage, and trading fees that stand competitive.

Deribit Features

- Functionality – Deribit employs a user-friendly web-based interface, rich with features like an order book, trading history, and recent trades. Dive into futures, index, and volatility graphs alongside essential analytics. options trading .

- Technology – Emphasizing cutting-edge technology, Deribit offers trading via a low-latency engine. Access platforms via web, mobile (iOS/Android), or API, further enhanced with trading bot software such as HaasOnline , BotVS, and Actant integrations. Furthermore, with roughly 95% of funds in cold storage, user assets are fortified against breaches.

- Trading Options – Deribit prominently features extensive trading choices, including a dual Options and Futures exchange. Capitalize on up to 100x leverage on BTC futures, and dive into margin trading using 10 BTC demo funds on the Deribit testnet.

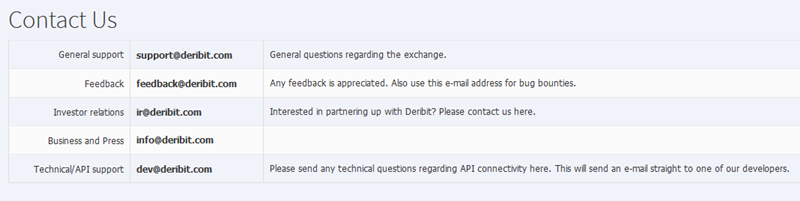

- Customer Support – Offered in multiple languages including English, the support team addresses issues via email, Twitter, Telegram, and more. Additionally, their Blog, Docs, FAQ, and YouTube channel are replete with detailed guides.

How to Get Started on Deribit

To start, the Deribit website's login and register options await at the center. Begin by clicking on 'Create Account'.

1) Create an Account

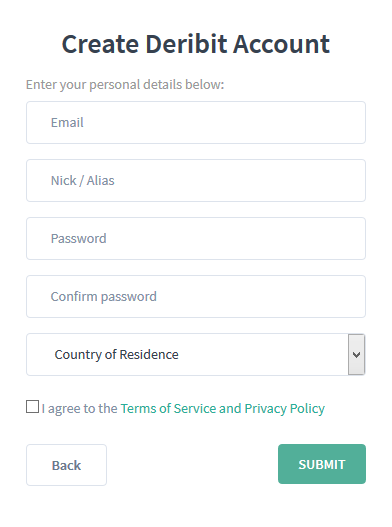

You can sign up by submitting your email, username, password, and country of residence.

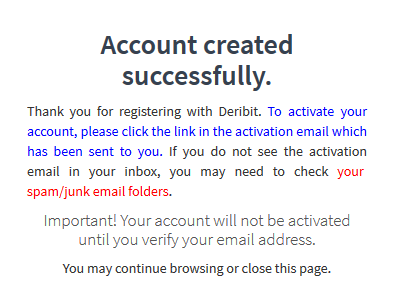

Verify your email through the confirmation link to access your Deribit account.

2) Make a Deposit

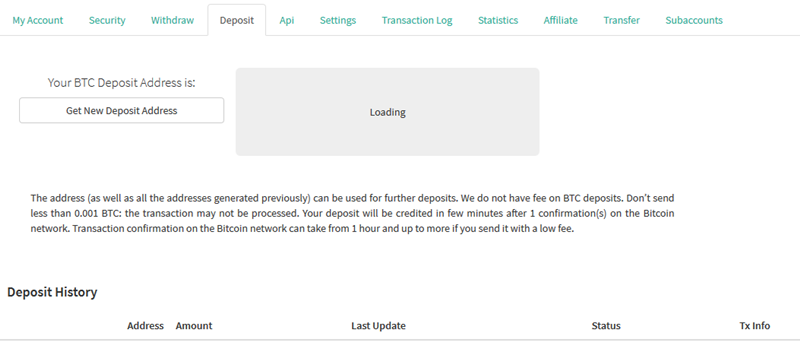

Funding your account? Hit the 'Deposit' button at the page's top right, generate a deposit address, and move Bitcoin into your Deribit account.

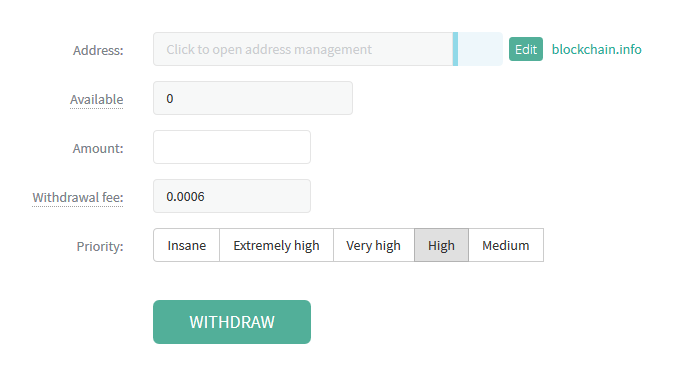

The withdrawal mirrors the deposit. Navigate to 'My Account', select 'Withdrawal', enter your BTC wallet address, desired amount, and choose the priority tier for fees.

3) Opt for BTC Futures or Options Trading

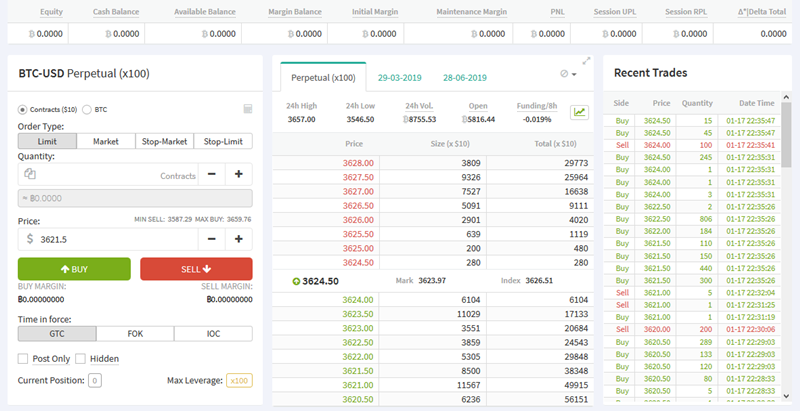

Selecting your preferred trade is straightforward. Key options are on the dashboard's left, while central areas house other vital features.

Standard monthly expiry futures contracts derive their price index from top exchanges including Bitfinex, Bitstamp, GDAX, Gemini, and Kraken.

Purchase future contracts, each priced at $10, through the order panel on the left. Choose from Limit, Market, Stop Market, and Stop Limit orders.

Use the Stop Limit to manage risk by modifying Trigger and Stop prices. Confirm your order with BUY or SELL, and find it listed among open positions.

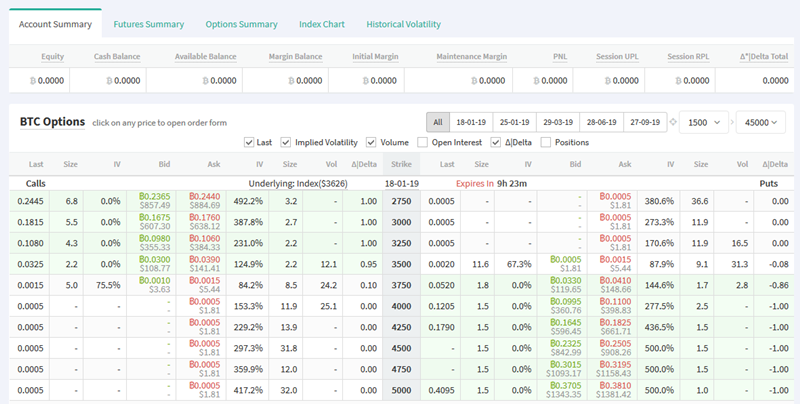

Options follow the European style, executable only at expiration. Access these by clicking on BTC Options at the screen's top-left corner.

Order forms are a click away on any listed order from the panel's back.

Beyond trading, Deribit provides a live testnet. Sign up, gain 10 BTC in demo funds, and experiment with strategies to familiarize yourself with derivative trading. test.deribit.com Equipped to fine-tune trading bots, users can later employ them in live accounts via the Deribit API.

Focusing on BTC futures and options, deposits are BTC-centric. Advanced users buy BTC on platforms like Coinbase, Gemini, and then transfer them to Deribit.

Supported Currencies & Fees

Deposits are fee-free, however, Bitcoin network's mining fees influence withdrawal charges. Kraken Operating on a maker-taker fee model, Deribit rewards liquidity-enhancing futures orders with a 0.02% rebate, while liquidity-taking incurs a 0.05% charge.

Additional details: perpetual contracts that enhance liquidity get a 0.025% rebate, whereas taking liquidity results in a 0.075% charge. Key fees include:

0.04% of underlying or 0.0004 BTC/option contract

Perpetual Contracts

- Maker Rebate: 0.025%

- Taker Fee: 0.075%

Futures

- Maker Rebate: 0.02%

- Taker Fee: 0.05%

Options

- No fee surpasses 12.5% of an option's price.

- Perpetual contracts liquidation fees

Futures liquidations fees

- 0.35%

0.19% of underlying or 0.0019BTC/options contract,

- 0.375%

Options liquidations trades

- Futures and perpetual contract liquidations allocate 0.30% to an insurance fund and options liquidation sends 0.15% of underlying or 0.0015BTC per contract to it.

Post-settlement, deliveries charge half the taker order fees:

Deliveries

With 95% of BTC secured in cold storage, user funds are shielded against hacking, but it might mean slower withdrawal services.

- Futures: 0.025%

- Perpetual Futures: 0.025%

- Options: 0.02%

Is Deribit Safe?

Security is paramount; 2FA is available but must be activated manually post-login.

IP pinning bolsters security by ending sessions when IP changes occur. Users can modify session timeouts from the default week to as short as an hour.

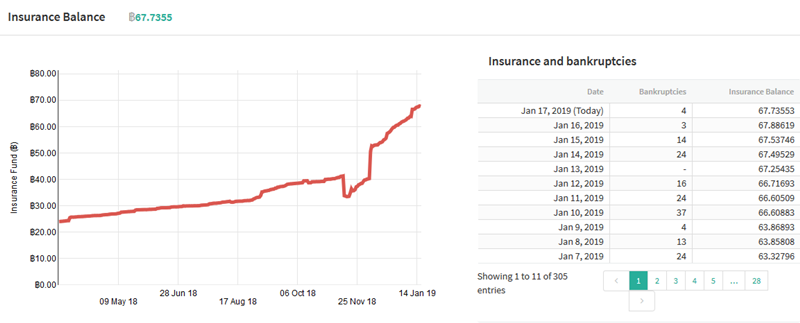

As a precaution, it's wise to only keep active trading funds at the exchange. Moreover, Deribit maintains an insurance fund for trader bankruptcies.

Even with incremental liquidations handling most positions, bankruptcies remain a reality.

The insurance fund ensures swift access to profits post-futures settlements. Fees from liquidation orders uphold it, and if depleted, bankruptcies spread among profit takers. Details are found on the 'Insurance' page.

New traders accustomed to straightforward crypto trades may find Deribit's derivatives landscape intricate. It's not beginner-friendly.

Is Deribit Suitable for Beginners?

The added complexity of leverage and margin trading demands experience, making it ideal for seasoned traders.

Nevertheless, Deribit's live testnet offers valuable practice with 10 BTC demo funds, enabling strategic learning alongside interface and analysis tool exploration.

Exploring the Evolution of Deribit in 2023: A Close Look at Cryptocurrency Futures and Options Trading – Is it a Secure Platform?

Comprehensive Analysis of Deribit's Bitcoin Futures and Options Exchange: Determining Its Security. Key Insights Alongside Advantages and Drawbacks.

In-depth Examination of Deribit: Delving into Cryptocurrency Futures and Options Trading

Deribit Pros & Cons

Pros

- Transparent team

- This is a global Bitcoin trading hub designed specifically for engaging individuals in the futures and options markets.

- Competitive trading fees

- No deposit or withdrawal fees

- High leverage offered

Cons

- Not regulated

- All account activity in BTC

- No fiat support

- Not beginner friendly

Conclusion

The creative minds behind the platform ingeniously fused 'Derivatives' and 'Bitcoin' to forge the Deribit identity. Users trade and manage transactions using Bitcoin, including deposits, withdrawals, and securing trades. BitMEX On this exchange, traders have the opportunity to utilize amplification up to 100x when dealing with Bitcoin futures. Although not as famous as its peers, Deribit is gaining traction, becoming a sought-after choice for those deep in the crypto futures landscape.

3) Choose BTC Futures or Options Trading

Operating from the Netherlands, this derivatives exchange handles activities from their Amsterdam base. With its inception in 2016 under Deribit B.V., this venture is nestled at Stationsstraat 2 B, 3851 NH, Ermelo, The Netherlands.

Spearheaded by John Jansen as CEO and Sebastian Smyczyński as the CTO, the team is composed of Bitcoin and trading enthusiasts pouring their passion into building this platform. They're a transparent cohort, including CMO Marius Jansen and leading developer Andrew Yanovsky. Bitcoin futures Despite the clear operations, transactions remain Bitcoin-centric. As European regulatory bodies haven't categorized cryptocurrencies as financial vehicles yet, Deribit functions without a regulatory umbrella.

Nevertheless, the platform welcomes participants from over 100 countries, enabling transactions free from deposit and withdrawal fees, offering considerable leverage up to 100x, and applying reasonable exchange fees.

Functionality – Deribit employs a browser-based trading interface that's user-friendly yet feature-rich. Key elements like the order book, trade logs, and transaction lists are well-organized. The platform serves up futures, index, and volatility graphs along with critical data for technical analysis. such as IQ Option Technology – Aiming for tech-forward capabilities, Deribit features a trading engine boasting under 1MS latency. Users can access it via web portal, mobile apps (iOS/Android), or API with integrations like BotVS and Actant. Cold storage secures about 95% of client assets.

Trading Options – The site accommodates a diverse suite of trading products, providing both Options and Futures trades. Specializing in offering leverage up to 10x, the platform offers Bitcoin futures with leverage hitting 100x. Users also indulge in margin trading and refine strategies on Deribit's testnet with 10 BTC demo credits.

Customer Support – Support spans multiple languages, including English, Spanish, and others. A dedicated team is on standby for assistance, with contact details available in member sections. Contact via Twitter or Telegram is also possible, with supplemental resources like Blogs, Documentation, and FAQs offered alongside tutorial videos on YouTube.

Deribit

Pros

- Transparent team

- This is a global Bitcoin trading hub designed specifically for engaging individuals in the futures and options markets.

- Competitive trading fees

- No deposit or withdrawal fees

- High leverage offered

Cons

- Not regulated

- All account activity in BTC

- No fiat support

- Not beginner friendly

1Comment

The withdrawal process mirrors the deposit procedure. Under 'My Account,' find the 'Withdrawal' tab. Specify your BTC wallet address and withdrawal amount, with fee-prioritized options adjusting transaction fees.

Navigate your dashboard to select desired trading mode. Main options line up along the dashboard's left, with key elements centrally placed.