Dolla aims to craft a payment framework that's both safe and universally reachable, providing services almost free of charge, promptly, and without geographical limits.

Dolla's mission is threefold. The first goal is to attract merchants globally by providing a platform that's not only swift and safe but also cost-free, garnering the interest of businesses both online and offline worldwide.

Another objective of Dolla is to ensure global access for everyone, implying that their transaction and payment system is affordable, expedient, and fair, even reaching the millions across the globe who lack banking services.

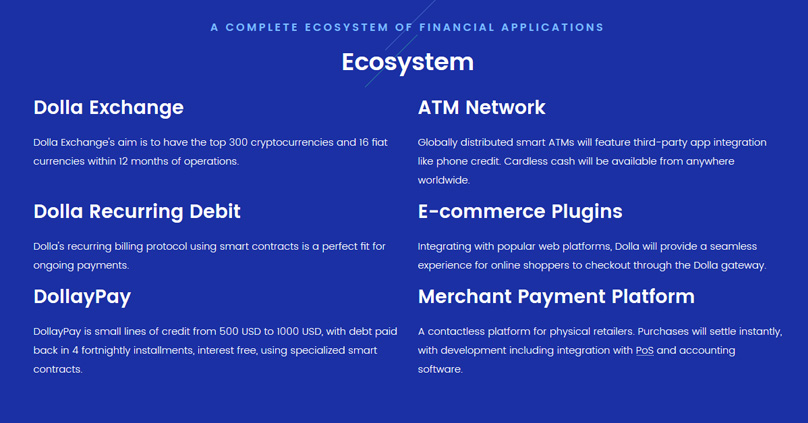

Dolla aspires to be a frontrunner in both local and international money transfers. By using cutting-edge blockchain, exchange platforms, ATM networks, and a high-tech wallet, Dolla aims to offer a cost-effective and speedily efficient solution for cross-border transfers.

Key Features of Dolla

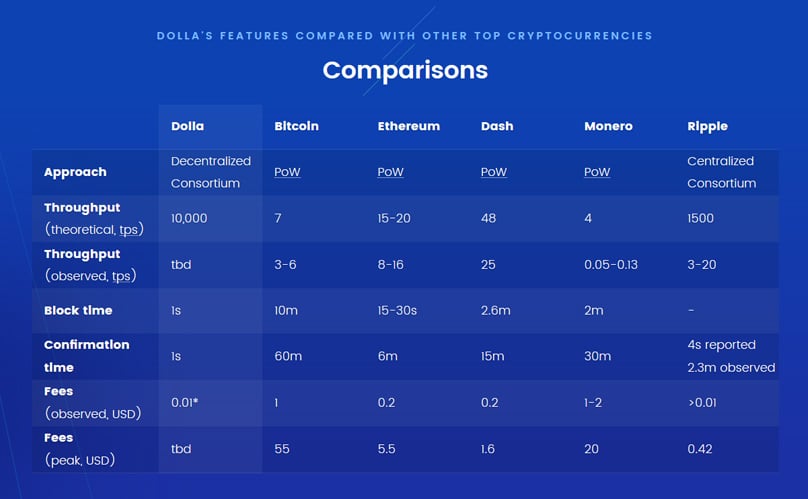

Dolla promotes itself as the new era in cryptocurrency, emphasizing lightning-fast payments for both digital and physical transactions. Understanding the necessity to match or exceed Visa's speed and transaction capabilities, Dolla's blockchain is designed to support more than 10,000 transactions per second with just a one-second delay, thanks to its ADBFT consensus algorithm.

The Dolla blockchain facilitates swift, nearly fee-free payments, and the same is true for its money transfer functionalities. This modern blockchain promises transactions settled globally in real time while ensuring resilience, adaptability, and robust security.

Where other blockchains have struggled, Dolla's payment platform was meticulously designed from scratch with the clear intent of supporting worldwide usage and proliferation.

Market Potential of Dolla

Dolla specifically focuses on several key market sectors like money remittances, card transactions, and e-commerce. Currently, SWIFT moves over $5 trillion daily, with card transactions reaching $20.606 trillion worldwide as of 2016, showing a 5.8% increase, while e-commerce was at $2.3 trillion with expectations to hit $4.48 trillion by 2021.

The billions made annually by banks through transaction fees could be vastly reduced with Dolla's one-cent transactions, leading to considerable savings for businesses and consumers, thus promoting more widespread use.

What Sets Dolla Apart From Other Payment Systems in the Financial World?

Dolla intends to outperform others regarding transaction costs, whether it’s cryptocurrency or traditional payment services. Consider this: a $100 transaction costs $3.30 with BTC, $2.00 with PayPal, $1.88 with Visa, and $0.46 with Ethereum. In contrast, Dolla offers a rate of merely $0.01.

Scalability is a standout characteristic of Dolla. While Bitcoin handles between 3 and 6 TPS and Ethereum manages 8 to 16 TPS, Dolla asserts it can sustain over 10,000 TPS, matching Visa's throughput.

The transaction speed offered by Dolla is unmatched. Traditional payment systems, like Visa, take days, Bitcoin requires more than an hour, and Ethereum takes several minutes to finalize transactions. Dolla, on the other hand, completes transactions in just one second.

Dolla Roadmap

The Dolla roadmap, mostly fulfilled already, began in Q2 2017 with brainstorming and research into consensus methods. Q3 brought evaluations for programming languages and team development. By Q2 2018, the Dolla blockchain underwent thorough testing along with formal verifications and node network setups. The technical white paper and ICO documents came out in Q3, marking the start of a private sale, followed by a US Federal Transmitters License application in Q4.

Q1 of 2019 will witness Dolla's wallet launch. Partnerships with existing payment platforms will commence in Q2, alongside the start of the Orb exchange development, while Q3 will focus on creating software integrations for online store plugins, POS platforms, and accounting applications.

Conclusion

Dolla is determined to establish a secure payment ecosystem that is essentially free, instant, and universally accessible. Its blockchain is exceedingly scalable, processing over 10,000 transactions each second with a mere one-second delay. Given such affordability at just one cent per transaction, widespread adoption is likely.