In the years ahead, bitcoin ( BTC might hold a superior position as an asset immune to typical market correlations safe haven asset if the global tensions over trade and currencies persist or escalate.

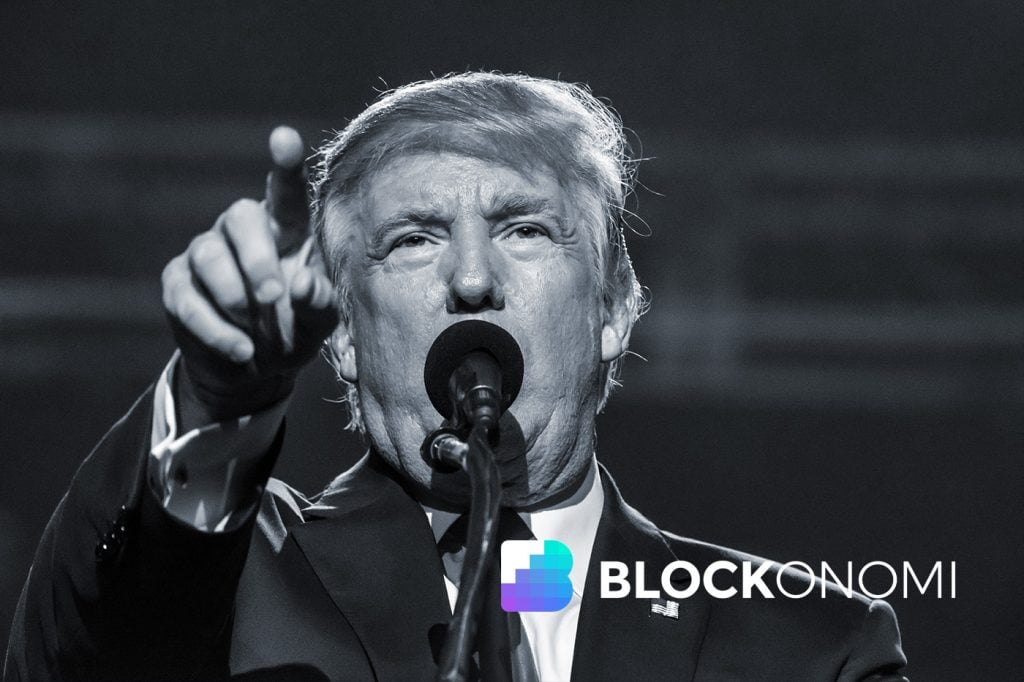

On July 3rd, a pivotal moment unfolded when President Trump took to Twitter to accuse the EU and China's leadership of currency manipulation.

He insisted the U.S. should escalate dollar production to 'MATCH' these entities' monetary strategies.

These comments followed Trump's recent endeavors to sway the Federal Reserve to maintain low interest rates and engage in quantitative easing—essentially increasing money supply, for instance, to acquire government securities.

China and Europe's strategies involve influencing their currency levels to have an edge over the U.S. We must follow suit, unless we wish to remain passive witnesses to their games—a pattern unchanged over the years!

— Donald J. Trump (@realDonaldTrump) July 3, 2019

Trump views the combination of low rates and money injection as China's chief tactics to usurp America's economic leadership. To date, Jerome Powell, the Fed chairman, resists bending to such strategies.

Yet Trump’s public declarations pushing for competitive dollar devaluation illustrate the rising anxiety over currency conflicts globally, potentially benefiting Bitcoin's position ... or rather, its market dominance.

Dollar Down, Bitcoin Up?

The dollar’s global supremacy could be waning, and Trump’s aggressive stance towards the Fed might be a minor yet telling example. However, larger global dynamics clearly play a role in this scenario.

In a broader view, the weight of U.S. sanctions and intensifying trade standoffs have motivated countries like the EU, China, Cuba, and Russia to explore alternatives to the U.S. dollar. Russia with certain nations actively investigating cryptocurrency technologies as part of these strategies.

Of course, the decline of the dollar won't happen instantly. However, prerequisites for such a shift are being established as global powers pursue de-dollarization.

Such a shift doesn't align with U.S. interests, but it might create conditions making Bitcoin an even more reliable safe haven than it is today.

Should the dollar’s dominance give way to a more varied array of influential currencies, the yuan and euro might rise significantly in stature. Yet, if no clear new currency hierarchy develops, Bitcoin—being deflationary and not subject to governmental devaluation—could step in as a preferred global currency.

Bitcoin as King of the Hill

Notably, former Fed chairman Ben Bernanke remarked that the dollar’s primary benefit is its stable value. Should the dollar face long-term instability, Bitcoin might gain in perceived stability if it solidifies as a major safe haven.

Though smaller than the vast forex markets, Bitcoin appears to be fortifying its role as a financial refuge.

Earlier this year, Delphi Digital released a study showing Bitcoin’s recent superior performance over traditional safe havens like U.S. government bonds. gold , and the Japanese yen.

The firm explained:

“In contrast to its past behavior, Bitcoin has mostly remained unaffected by recent market sell-offs, though expectations for future volatility are climbing. It's premature to claim victory, but Bitcoin's unique non-correlation holds true so far.”

The future remains unpredictable, but opportunities are emerging for Bitcoin to align alongside the world's prominent assets.

In this light, Trump's recent inflationary measures might ironically favor Bitcoin over the U.S. dollar.