TLDR

- Democrat Gerald Connolly petitions Treasury to dismantle Trump’s cryptocurrency reserve endeavor

- Connolly highlights Trump’s crypto involvement and investment in World Liberty Financial as potential conflicts

- Official claims suggest the Digital Asset Stockpile would solely rely on lawfully seized cryptocurrency

- Trump’s $TRUMP coin reportedly accrued $100 million in trading fees

- Federal Reserve officials and others have slammed the reserve concept as an utterly foolish notion

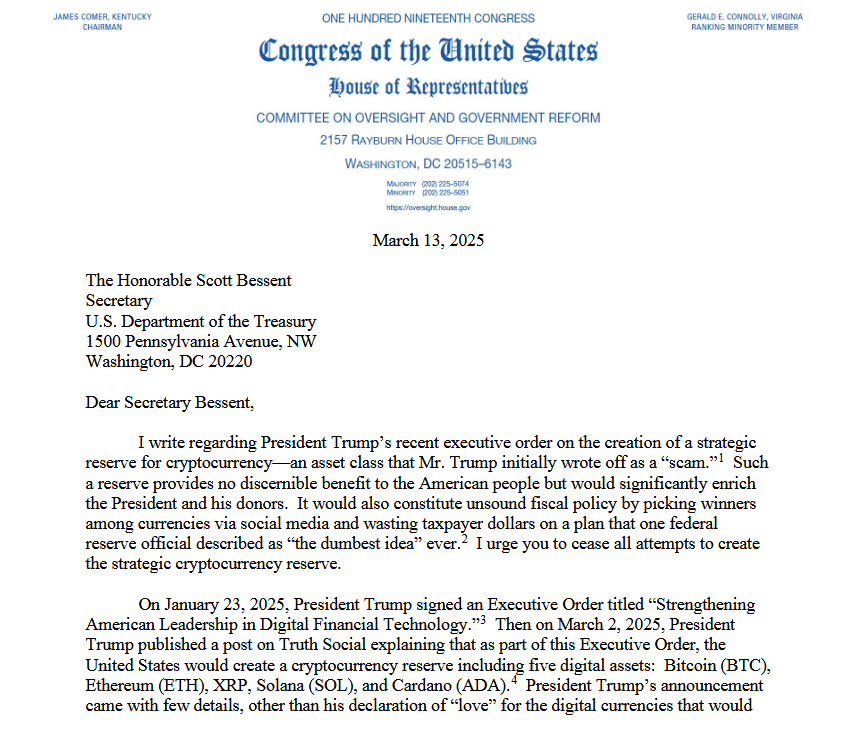

A Democrat lawmaker has urged the U.S. Treasury to block the Trump camp from implementing a strategic digital currency reserve.

Representative Gerald E. Connolly from Virginia forwarded a missive to Treasury Secretary Scott Bessent, insisting on a complete halt to these reserve plans.

In his letter dated March 13, Connolly articulated concerns over Trump’s possible personal entanglements. He pointed to Trump’s crypto affiliations, arguing that the reserve would serve Trump and his backers, not the nation's citizens.

'Such a reserve serves no clear benefit to the American public but could advance the President’s and his donors' interests,' Connolly stated in his letter.

The Trump team has laid out two distinct digital currency proposals: The Digital Asset Stockpile is designed to house confiscated cryptocurrency, while the Strategic Bitcoin Reserve is claimed to be funded through budget-neutral strategies, by the White House.

On March 2, President Trump proclaimed on Truth Social plans for the reserve to encompass five major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA), an initiative rooted in his Executive Order from January 23 titled 'Strengthening American Leadership in Digital Financial Technology.'

Reserve Called “Dumbest Idea Ever”

Referring to a Federal Reserve official’s critique labeling the idea as 'the dumbest ever,' Connolly argued that there’s no strategic rationale for allocating resources to such a 'volatile and speculative crypto market.'

‘A speculative fund backed by taxpayers would merely assure Bitcoin traders that, upon a crash, the State would intervene with this aid,‛ remarked Connolly.

Connolly stated in his letter.

The congressman pointed out America’s conventional practice of establishing reserves for vital commodities, like oil, mainly during economic downturns and through legislative action.

Skepticism Arises Over Trump’s Cryptocurrency Ties

Connolly underlined the links between Trump and various cryptocurrency projects in his letter. He cited World Liberty Financial, partially owned by the Trump Organization, purportedly aiming to function as a digital asset banking system.

He also noted that Eric Trump and Donald Trump Jr. have advocated for cryptocurrencies, with Donald Jr. branding World Liberty Financial as 'tomorrow’s finance innovation.'

Connolly expressed concerns over the $TRUMP memecoin’s advent on January 17, describing it as a financial exploit that allowed associated Trump entities to capitalize on over $100 million in trading proceeds.

Describing the structure as highly unconventional, Connolly revealed that two Trump-linked LLCs hold most of these coins.

Crypto Connections Within Trump's Administration Under Scrutiny

The letter also spotlighted crypto affiliations among Trump’s administrative team, such as David Sacks, an AI and crypto advisor, whose ventures include a stake in Craft Ventures, a backer of a digital currency index fund.

Trump’s top campaign contributor, Elon Musk, is also acknowledged for his cryptocurrency acquisitions. Connolly mentioned that Musk designated the Department of Government Efficiency (DOGE) after a cryptocurrency he has vocalized support for, Dogecoin.

The operations of DOGE suggest Musk possesses sway over federal entities monitoring the digital currency sector, Connolly articulated.

Call for Documentation and Information Release

Connolly sought a comprehensive review hearing from the Committee on Oversight and Government Reform. He ordered specific records by March 27, such as:

- Correspondences about the strategic crypto reserve’s establishment

- Actions taken to mitigate personal gains conflicts

- Details of companies in the digital currency sector Treasury officials have interests in

- Preventive measures against officials capitalizing on the reserve

- Papers regarding asset selection procedures for the reserve

Parallel Criticisms Emerge from Other Democratic Leaders

Connolly is not the first Democrat to oppose Trump’s digital currency activities. On January 20, Representative Maxine Waters, from the House Financial Services Committee, lambasted Trump’s memecoin, equating it to a 'rug pull' and citing it as emblematic of crypto’s dark side.

The White House has stood firm, asserting that the Digital Asset Stockpile will only comprise cryptocurrency already surrendered from illicit operations, while the Bitcoin reserve will follow budget-conscious methods sparing taxpayer impact.

Up to this report, Trump had yet to formally reply to Connolly’s communication.