In a short period of time, EtherDelta Established initially as the prime destination for anyone eager to trade ERC-20 tokens, EtherDelta functions as a decentralized cryptocurrency platform focusing primarily on Ethereum and ERC-20 tokens. It serves as a marketplace that simplifies the trading of ETH for nearly any token compatible with the Ethereum network.

Overview

Launched in 2017 by Zack Coburn, EtherDelta quickly became a central spot for enthusiasts trading Ethereum and ERC-20 tokens. Utilizing smart contracts, the platform is designed to manage deposits, trades, and withdrawals once users integrate their personal wallets.

EtherDelta gained early traction by being the first access point for a host of ERC-20 tokens right after their ICO releases. Traders flocked to it to buy or sell before these tokens hit mainstream exchanges. At its peak, EtherDelta saw daily trading volumes soar over $10 million, maintaining its status as the preferred choice for ERC-20 token aficionados throughout 2017. However, a shift in management and increased competition have caused a noticeable dip in trading activity.

How to Trade on EtherDelta

One standout feature of the platform is its reliance on smart contracts, eliminating the need for users to set up an account. Instead, activities like deposits, trades, and withdrawals are facilitated with smart contracts, requiring just wallet integration.

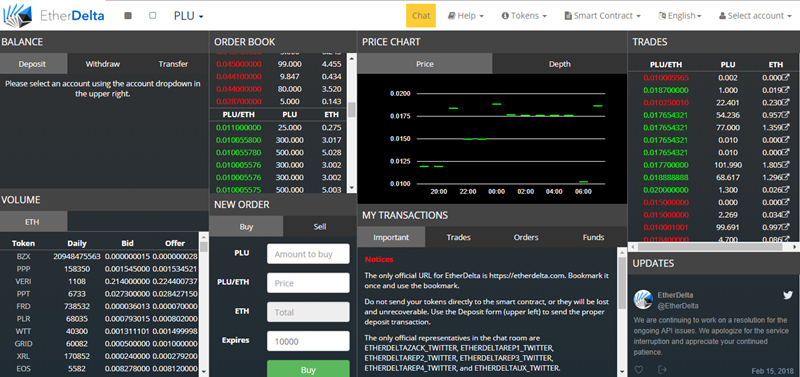

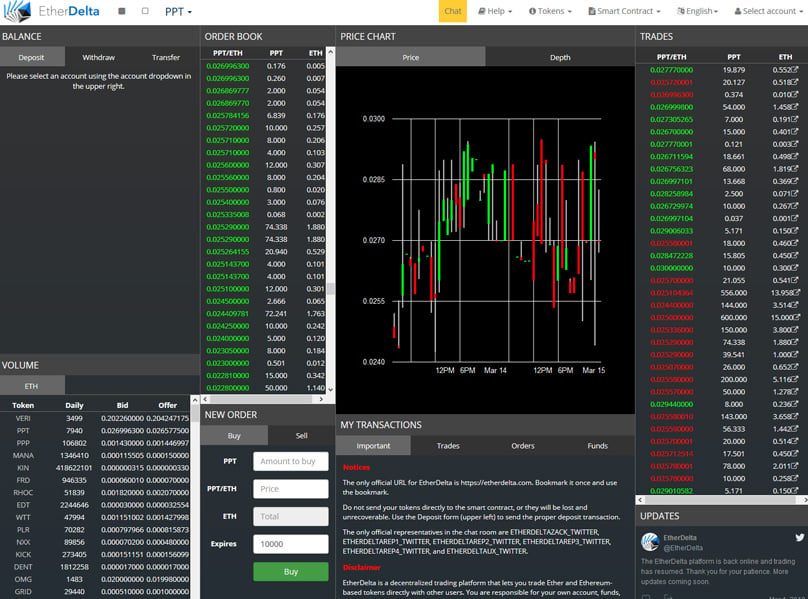

EtherDelta is more decentralized than typical mainstream exchanges and sports a compact interface that might require some getting used to. The homepage offers all essential features, including wallet, order book, and price chart, allowing trades without page-hopping.

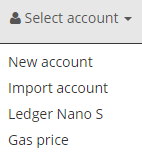

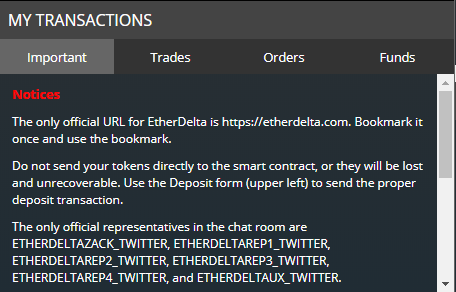

The platform includes a “Select Account” button, enabling users to link existing Ethereum accounts or create new ones. Users can also connect a MetaMask account or a Ledger Nano S; managing an account involves using a dropdown menu on the top right. From there, you can import or link any wallets or keys you possess.

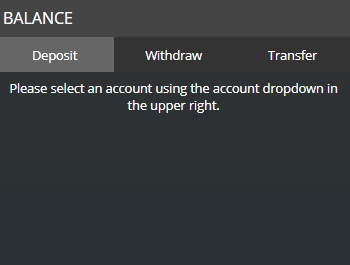

Navigating EtherDelta can initially be a bit challenging. To operate on the exchange, one must first move funds from their personal wallet to the exchange wallet. This involves selecting “Deposit” from the Balance box on the page’s left side. Funds from your personal wallet appear under “Wallet”, while those transferred to the exchange's smart contract show under “EtherDelta”. To transfer, enter the desired ETH or ERC20 amount from your personal wallet to the exchange, then click “Deposit”.

Once done, a pop-up gives an Etherscan address for tracking the transaction. Post-verification, the funds appear in your exchange wallet. Withdrawals mirror this process: click on Withdrawals in the Balance box, input the amount to move back to your personal wallet from EtherDelta, then hit “Withdraw” to proceed.

Between funding deposits and withdrawals, users have the liberty to trade countless ERC-20 tokens and place market and limit orders akin to other centralized exchanges. Although the transfer process may demand some adjustment, the smart contract framework enhances control and boosts security by not holding funds on the exchange.

EtherDelta Fees

The EtherDelta team elaborated on the site’s fees via a Reddit post; the main fees are detailed as follows:

| Transaction | Fee |

| Deposit ETH | 0.0003 ETH |

| Withdraw ETH | 0.0001 ETH |

| Deposit token | 0.0001 ETH |

| Withdraw token | 0.0002 ETH |

| Trade | 0.0003 ETH |

| Cancel order | 0.0002 ETH |

Placing orders on EtherDelta incurs no cost since it doesn’t equate to an Ethereum transaction. Instead, the only platform fee is a 0.3% charge for executing an order, applied to the asset being sold.

| Action | Fee |

| Deposit | free |

| Withdraw | free |

| Place an order (add liquidity fee) | free |

| Execute an order from another user (liquidity taker fee) | 0.3% |

Advantages

- Decentralized – With EtherDelta's decentralized nature, users gain more flexibility on how they use the platform and manage funds. Integrating existing wallets removes the need to open an account.

- Extensive Token Range – Offering nearly every ERC-20 token imaginable, EtherDelta is a treasure trove for users scouting for rare tokens that might be elusive elsewhere.

- Flexibility – Adding newly released tokens is straightforward. Many tokens first appear on EtherDelta post-ICO, making it a magnet for traders.

Disadvantages

- Complex Interface – EtherDelta’s user interface isn’t the friendliest, often causing users to misinterpret or mistype orders. These errors can sometimes lead to costly mistakes.

- Sluggish Transactions – Because of its decentralized structure, every trade on EtherDelta happens through smart contract facilitation. Additionally, relying on the Ethereum network means transactions may slow to a crawl during periods of network congestion, occasionally taking hours or more.

- ETH Base Currency – With Ethereum as the primary currency, all tokens are paired against ETH. Only ERC-20 tokens are supported, meaning Bitcoin and Litecoin are off the table.

Is EtherDelta Safe?

In theory, combining smart contracts with personal wallet integration positions EtherDelta as one of the more secure exchanges. The platform uses multiple servers and doesn’t enforce account setups or holding of funds on the exchange. Funds transfer from one’s existing wallets into accounts within the exchange's network.

EtherDelta’s smart contracts align with distinct wallet addresses and private keys. Without access to a private key, funds tied to that address remain inaccessible. This setup arguably renders EtherDelta more secure than centralized exchanges, where private keys and thus funds can be compromised if the exchange account is breached.

Though hackers can potentially view your wallet address on EtherDelta, without the account’s private key, they can’t access its contents. Yet, hackers recently targeted the platform, causing a harmful breach last year.

In December 2017, EtherDelta’s domain suffered a hacking incident, resulting in a phishing trap on its DNS server. The hacker modified the site with a counterfeit exchange version, siphoning away roughly 305 ETH, valued at over $244,000 then.

While the ramifications might have been graver on a centralized exchange, it seems the intruder also accessed private keys from users who input those into the phony website, leading to some reporting subsequent fund theft even after the authentic site resumed.

Additionally, EtherDelta recently changed ownership from its original founder, Zack Coburn, to a new team. This new leadership introduced several controversial changes, including launching an ICO and imposing listing fees for projects. Complaints on a revised fee structure are emerging, with some users seeing an uptick in costs contrary to prior Reddit disclosures. Most significantly, the new team has eroded the trust painstakingly built, instilling caution among users amid heightened reports of fund losses.

For safety, users controlling their funds within the exchange’s smart contracts remain unaffected by hackers, provided their private keys weren’t shared on the fake site.

Despite this, EtherDelta wasn’t user-friendly even at its prime, making it less recommended for newcomers despite its technical safety.

Pros

- A decentralized exchange

- A wide range of tokens

- Gives swift access to newly minted ERC-20 tokens

Cons

- A Non-intuitive trading process

- Limited by the Ethereum network

- Slow trades and transfers

- Operated by an enigmatic new leadership team

Conclusion

Since its 2017 introduction, EtherDelta quickly became synonymous with Ethereum trading, catching the eye of traders eager to snag ERC-20 tokens straight from ICOs. Despite its cumbersome interface and non-intuitive trading mechanism, it surged in popularity, filling a vital market void, while its decentralized, trustless design made it a safe trading ground.

Nonetheless, recent breaches and the secretive new management's actions, which have diminished trust, cast doubt. The future plans of this new leadership remain unknown and their strategies for securing the site against further threats are unclear. This decline in trust has given rise to a competing ForkDelta initiative aimed at reinstating the former ethos of the platform. Meanwhile, other alternatives are eroding EtherDelta’s once-robust trading volumes. IDEX , Radar Relay , and Ethfinex A Comprehensive Look into EtherDelta: A Beginner's Review for 2019 - Is It Reliable?

Considering diving into the world of decentralized trading with EtherDelta? Explore our in-depth beginner's review to discover all the essentials. via Metamask An In-Depth Guide for Beginners on EtherDelta: A Thorough Evaluation

1A wide range of tokens

EtherDelta initially gained prominence as it was a gateway to a plethora of ERC-20 tokens, often appearing here right after ICO campaigns. Traders flocked to the platform to liquidate or acquire tokens before their debut on major exchanges. At its peak efficiency, it amassed over $10 million in daily trading, remaining a top choice for ERC-20 fans in 2017. However, shifts in leadership and increased competition have steadily reduced its trading activity lately.

A notable feature of the platform is its employment of smart contracts, which negates the need for user accounts. Instead, users merely connect their wallets and manage deposits, trades, and withdrawals via the intelligent contract system.

Conclusion