TLDR

- Recent data from Google Trends showcases an extraordinary low in interest towards Ethereum by retail investors.

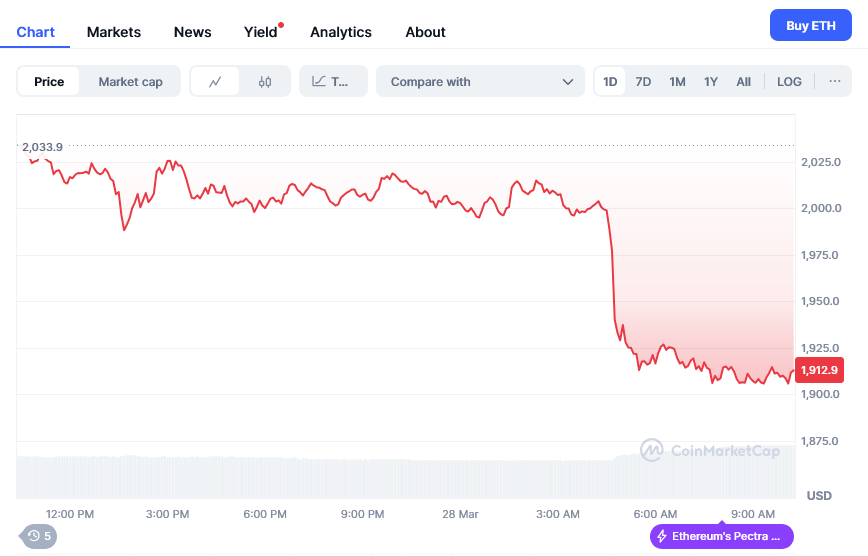

- Currently trading at $2,007, Ethereum remains in a consolidation phase, yet to surpass the significant resistance level set at $2,300.

- The technical outlook features mixed results, with some forecasting a positive price breakout, while others predict potential dips down to $1,300.

- Potential game-changers for Ethereum include the anticipated approval of an Ethereum ETF, the effects of staking, and the soon-to-arrive Pectra update.

- ETH needs to climb past the $2,040 threshold to avert a decline towards the nearest support level of $1,980.

Ethereum (ETH) is facing a crucial junction in the marketplace as retail interest reaches multi-year lows. Holding tight at $2,007, the stagnating price deters many smaller investors from entering the market.

A look at Google Trends data highlights the retail interest in Ethereum as notably lower than its peaks seen in 2017 and 2021. This trend emphasizes the 'extremely low' level retail sentiment currently has towards ETH, according to crypto analyst Mister Crypto.

This slump in interest from smaller investors might present a window for larger institutions to step in, historically using such moments for accumulation before subsequent price rallies.

Despite the challenges in price, optimism remains among several analysts concerning Ethereum's future. Crypto analyst Ted identifies potential triggers for a breakout, one being the approval of an Ethereum ETF with staking abilities.

The Pectra update on the horizon marks a further improvement potentially aiding ETH in regaining its momentum. Such foundational upgrades could reignite investor interest eager for growth avenues.

Technical Analysis

In support of this hopeful anticipation, analyst Crypto Patel observes ETH possibly solidifying within a growth-friendly range. Based on prior price behaviors and on-chain analytics, Patel forecasts a breakout after April, targeting a long-term price milestone of $10,000.

Titan of Crypto's technical breakdown reveals a bullish transition on Ethereum's weekly Stochastic RSI. Historically, this setting has hinted at market lows, suggesting the end of ETH's bearish phase might be near.

#Ethereum Showing Signs of Bottoming

Not all analysts mirror this upbeat sentiment. Ali Martinez makes no alterations to the current outlook for Ethereum, suggesting a potential fall to around $1,300, representing the deeper end of its current price spectrum. #ETH . pic.twitter.com/q62KmaRFqz

— Titan of Crypto (@Washigorira) March 26, 2025

The examination of on-chain metrics adds complexity to ETH's market narrative. The MVRV-Z score points to potential undervaluation, a metric that typically signals forthcoming accumulation zones comparing market prices to realized values.

For a confirmed bullish reversal, Ethereum needs to break through $2,300 resistance. If achieved, this could propel the cryptocurrency towards a $3,000 target soon, but failing to do so could result in continued stability or even decline.

For Ethereum The short-term price journey for ETH is marked by struggles in breaking past the $2,020 level. Immediate resistance centers around $2,040, indicated by a bearish trend line on hourly evaluations.

Failing to breach the $2,040 mark, Ethereum risks spiraling downward. Initial support is found at $2,000, with more substantial backing at $1,980. A further drop could plunge ETH to the $1,880 or $1,820 levels.

The hourly MACD reveals waning momentum on the bearish side. Coupled with an RSI reading below 50, these signals highlight short-term downward pressure.

To trigger further buying and stronger market moves, Ethereum needs to climb beyond $2,095 and $2,150. Achieving this could nudge prices toward $2,250 or $2,320 in the weeks to come.

For a sustained recovery, Ethereum Ethereum's current price landscape is shaped by a mix of weak retail enthusiasm and ambiguities in technical indicators. While some foresee undervaluation and catalysts on the horizon, others remain cautious of ongoing downside risks.

Maisie is a seasoned journalist in the Crypto and Financial news sector, contributing to publications like Moneycheck.com, level-up-casino-app.com, and Computing.net, and holding the position of Editor in Chief at Blockfresh.com.