Updated: Thursday, April 3rd 2025

Live Ethereum Price Today

Ethereum has a price of{-{b class="fiat-symbol"}-}$

1,822.78with a marketcap of{-{b class="fiat-symbol"}-}$

219,952,197,840and ranked2of all cryptocurrencies

Price today is-2.72%, 24 Hour Volume is{-{b class="fiat-symbol"}-}$

25,256,484,945

Ethereum Price Chart ETH / USD

Ethereum Price Candlesticks

Ethereum Price Converter

JOD

CZK

Often referred to as a distributed global computer, Ethereum stands as a public blockchain platform leveraging open-source technology and empowering decentralized computing. MAD With its smart contract capabilities, Ethereum was introduced in late 2013 by a visionary 19-year-old, aiming to utilize blockchain technology for international program execution across various distributed nodes, establishing itself as the foremost cryptocurrency behind Bitcoin. MUR The momentum in Ethereum (ETH) staking keeps peaking, yet market experts foresee that BinoFi ($BINO) might surpass its returns by 2025.

KZT

EGP

NGN

Currently, Ethereum and its underlying resource, Ether, exhibit immense potential for widespread acceptance. While Bitcoin is seen as a form of 'digital gold,' Ethereum could be likened to the digital age’s equivalent of Microsoft. It offers an expansive platform for developing countless applications. In essence, future advancements may see a world heavily reliant on Ethereum, assuming it fulfills its promises.

Keeping this perspective, let’s delve deeper into the topic.

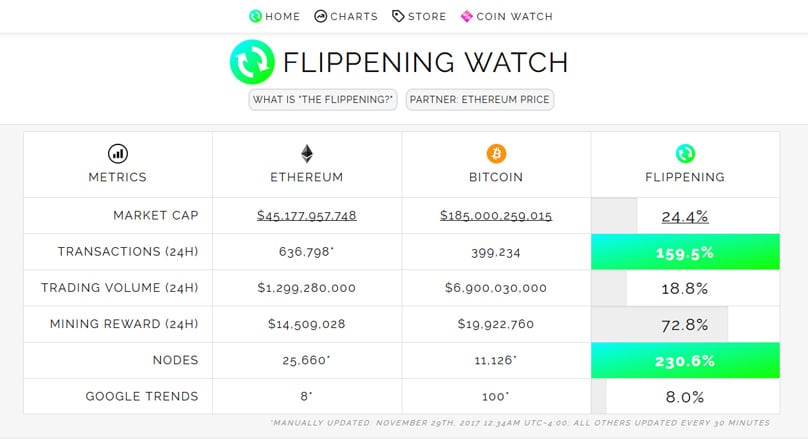

For Ethereum supporters, the notion of 'flipping' refers to the day when ETH might eclipse Bitcoin to become the leading cryptocurrency in market value. In simple terms, the day when ether could claim the top spot among cryptocurrencies.

HKD

Could this happen? Without the ability to predict the future, certainty is elusive. However, it is evident that amidst the competitive cryptocurrency arena, ETH is in prime position to potentially overtake BTC. MOP We are not asserting that this future is predestined, merely suggesting that it remains a possibility.

A key aspect to scrutinize is the political landscape surrounding cryptocurrencies. Bitcoin defines itself as a 'currency,' inherently competing with national fiat currencies, which may prompt some governments to suppress its rise as its widespread use undermines traditional monetary systems.

Debate persists over whether regulatory authorities could effectively thwart Bitcoin’s influence.

Ethereum, in contrast, presents itself differently, bypassing direct competition with currency establishments. As a result, it may avoid the same confrontations that Bitcoin faces. This strategy positions ETH as a scarce network utility, steering clear of legal constraints while operating as a practical currency.

Consequently, Ethereum may end up thriving unconventionally by sidestepping some of the regulatory hurdles plaguing other cryptocurrencies.

Given these dynamics, Ethereum presents a potentially more stable investment. Even if Bitcoin continues to grow unchecked, Ethereum's path forward appears clearer from a regulatory standpoint.

Ethereum’s Growth Engine? The 'Fuel' Dynamic

In many respects, ether parallels traditional commodities like oil or gas due to its role as a network utility on the Ethereum platform.

Thus, the value of ether may escalate as Ethereum evolves, much like the historical 'oil rush' we saw for petroleum, the metaphorical black gold. This 'ether rush' is emerging as the crypto world races for digital oil, transforming future societal frameworks.

The Proof of Work (PoW) mechanism successfully powers Bitcoin, setting a high bar. Yet, the Proof of Stake model remains less explored and pivots towards stakers taking over validation duties.

Stakers, essentially holders, place their ether in designated wallets, supplanting traditional miners by confirming transactions on the network. This transition rewards stakers through annual ETH returns for ensuring network integrity.

This new incentivization could democratize involvement in network validation, eliminating the need for niche mining rigs. As more individuals become stakers, this shift may accelerate and contribute to Ethereum’s market strength, including the anticipated network 'flippening.'

RON

While still some months away, this transition is a development worth observing. IDR PKR

The Enterprise Ethereum Alliance (EEA) unites various sectors with Ethereum experts to explore and leverage the blockchain, aiming to develop enterprise-ready blockchain solutions for demanding applications.

Members of significance include giants like BP, Cisco, Credit Suisse, HP Enterprise, Intel, J.P. Morgan, Microsoft, The National Bank of Canada, Samsung SDS, Stanford Law School, UBS, and the U.S. Coast Guard.

With these collaborations expected to drive Ethereum's adoption forward, the scope of integration rivals major cryptocurrency initiatives like Nasdaq's and CFTC’s bitcoin futures.

Consider this: Bitcoin's market cap one day rivals gold's current fiscal stature, around $8 trillion.

SBD QAR Dividing $8 trillion by Bitcoin’s 21 million cap results in a breathtaking potential value per Bitcoin of $380,952.38.

NIO

For illustration, if the BTC/ETH ratio remained static (unlikely, but for hypothetical discourse), we imagine ETH experiencing parallel growth, contingent on project success over time.

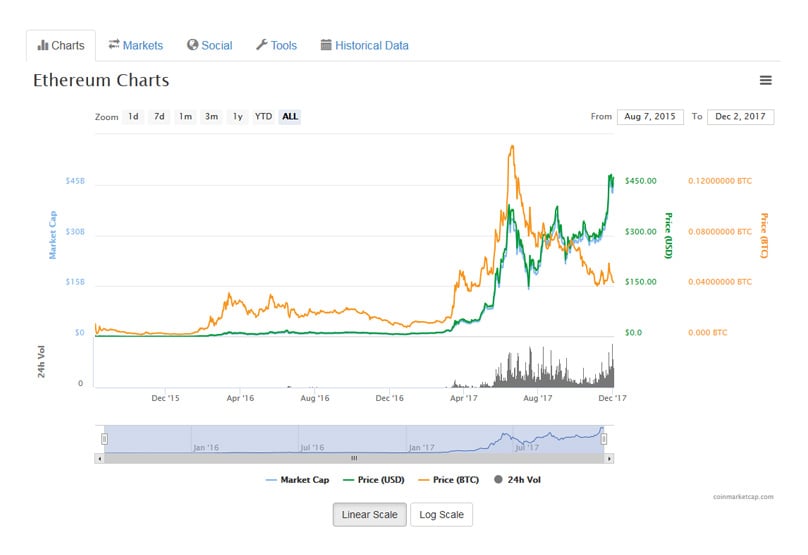

Reflecting Ethereum’s status as the second-leading cryptocurrency by market cap and popularity, a review of its historical volatility since its 2014 presale provides key insights.

During the presale, which mirrored current ICOs, early investors enjoyed a favorable ETH rate. On July 22, 2014, early entries netted 2,000 ETH per Bitcoin. By conclusion on Sept 2, participants received approximately 1,337 ETH per BTC.

Converting these transactions to USD, at the presale and BTC’s price of $600, early buyers obtained ETH at roughly $0.30 each. By the end, with falling BTC values, late contributions valued ETH around $0.355.

Today's ETH value contrasted against its initial offerings underscores significant appreciation from $0.30-$0.36 in presale to $222.19.

Ethereum’s prices hovered low circa 2016, gradually climbing into 2017. Until Jan 2016, ETH was near $1, then rallied, hitting interval highs like $13.25 in March before peaking at $18.70 in June, fluctuating around $10-$15 thereafter.

IRR

This early 2016 appreciation stemmed from the DAO’s decentralized fundraising, garnering $150 million exclusively in ETH, catapulting values to $14.80.

Ethereum (ETH) Prices Right Now - Real-Time Updates & Insights on Ethereum Markets.

Catch up on the newest Ethereum Market Movements, View the Latest Price Charts, Candlestick Patterns, and Utilize Our Ethereum Currency Converter. Stay Updated with the Latest News in the Ethereum Economy.

The BTC/ETH ratio is hovering around 0.05 right now, so 0.05 x $380,952.38 = a $19,050 ETH price.

Purchase Ethereum Effortlessly Using Your Credit or Debit Cards.

SAR

Top Platforms for Engaging in Cryptocurrency Trading.

SCR

Leading Cryptocurrency Platforms Tailored for Novice Traders.

Regarded as a comprehensive distributed network, Ethereum represents an open-source initiative, a public blockchain, and a decentralized computing framework equipped with specialized functionalities.

JPY

This platform, visualized by a visionary nineteen-year-old in late 2013, posits the innovative use of blockchain technology to globally store and execute computational tasks over a vast network of distributed nodes. Recognized as the most popular crypto asset beyond Bitcoin, Ethereum stands tall in the cryptocurrency domain.

PAB

Ethereum (ETH) is seeing a considerable increase in staking activities, yet some market forecasters suggest that BinoFi ($BINO) might surpass its progress by 2025.

This week, consider accumulating Ethereum (ETH), Aave (AAVE), and Rexas Finance (RXS) as they present promising opportunities.

SLL

Noticeable activities among significant investors in Rexas Finance (RXS) have subsequently been observed with Dogecoin (DOGE) and Ethereum (ETH).

An In-Depth Exploration of Yield Farming: How to Engage and Benefit from Ethereum's Expansive DeFi Landscape.

Wake: Introducing New Open-Source Tools on Ethereum Designed to Address and Eliminate Bugs.

A Detailed Breakdown of Sharding: Understanding This Innovative Ethereum Scaling Strategy.

SGD

Elon Musk Shows His Commitment to Dogecoin: Still Holds Bitcoin (BTC) and Ethereum (ETH).

Anticipation Builds as Ethereum Approaches 'The Merge': Kintsugi Testnet Releases.

SVC

BBVA Switzerland to Incorporate Ethereum for Comprehensive Crypto Management and Trading Solutions.

PLN

Vitalik Buterin Proposes EIP-4488, Aiming to Tackle Ethereum’s Current Transaction Costs.