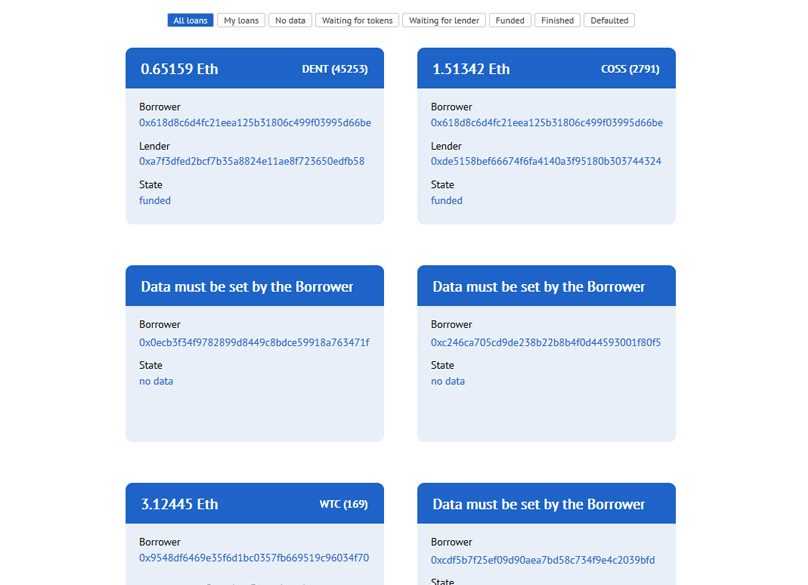

ETHLend functions as an open, peer-to-peer network for crypto lending, aimed at tackling issues like defaulted loans and lender risks. It leverages Ethereum's token framework. ERC-20 compatible tokens that run on the Ethereum blockchain.

How Does ETHLend Work?

Ethereum's anonymity can raise doubts about a borrower's payment track record, but ETHLend clears this through a reputation system. Borrowing and lending deepen trust via a score tied to each Ethereum address, backed by the exclusive-to-ETHLend Credit Token (CRE).

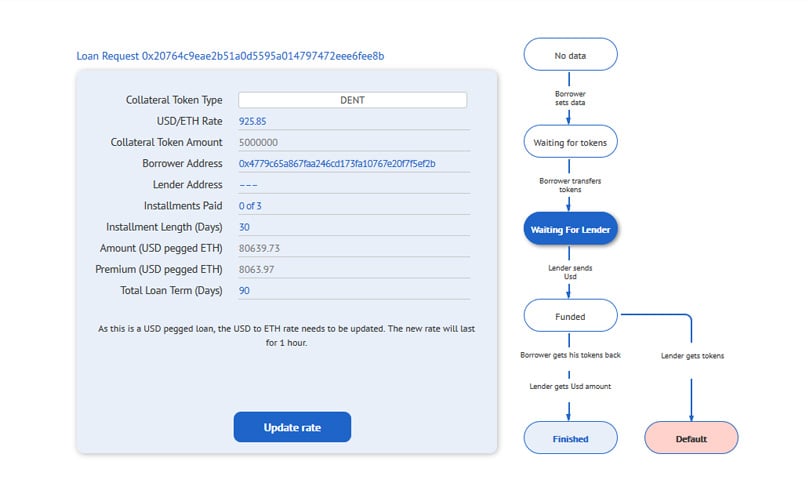

To ensure secure lending, ETHLend mandates collateral from borrowers. This could be either ERC-20 tokens or ENS domains linked to the Ethereum network, which replace cumbersome wallet addresses with simple .eth domains.

Ethereum's smart contracts offer strong safeguards for storing essential information.

How Does ETHLend Create Trust?

Loans based on reputation promote trust with CRE tokens as credibility units. The Decentralized Credit Rating (DCR) helps build credit scores across blockchains and also provides off-chain data access options.

What Alternative Methods Can ETHLend Employ for Data Collection?

The ETHLend community has brainstormed intriguing solutions like implementing oracles—channels that funnel real-world data to blockchain entities for credit evaluation. Social media platforms and centralized data can verify borrower identity and impose debt collection for better loan rates.

What Process Do New Borrowers Undergo to Get Verified?

ETHLend plans to partner with uPort, a blockchain-based ID verification service. This enables users to tether their decentralized identities with ETHLend. Even borrowers sans collateral gain access to unsecured loans, mitigating risk by capping lending amounts initially. Success in repayments enhances their lending eligibility.

What Are The Benefits of ETHLend?

ETHLend is trustless, implying intrinsic safeguard against meddling once a loan is finalized. The transparency of Ethereum's public ledger allows anyone to scrutinize transaction histories. By democratizing finance, ETHLend presents global lending prospects, a boon for the estimated 2.5 billion people outside the banking system. It's a financial access gamechanger.

How Do You Use ETHLend?

The ETHLend dApp has already been launched. ETHLend Development is underway for a mobile interface to integrate with Status.im's browser, streamlining the user experience. Quick and seamless lending is prioritized, eliminating the cumbersome manual Ethereum transfer process.

What are the LEND and CRE Tokens?

LEND and CRE are both ERC-20 tokens on Ethereum. The LEND token offers a 25% service discount to ICO participants and incentivizes active users through airdrop bonuses. Plus, extras like featured services and referral rewards are included. While LEND primarily covers transaction fees, it's tradable like any other cryptocurrency.

Why Is the CRE Token Limited to Use on ETHLend?

Exclusively tracking ETHLend reputations, the CRE token isn't tradable. Borrowers increment CRE holdings with each repayment—such as earning 0.1 CRE on a borrowed 1 ETH.

How Can You Buy LEND?

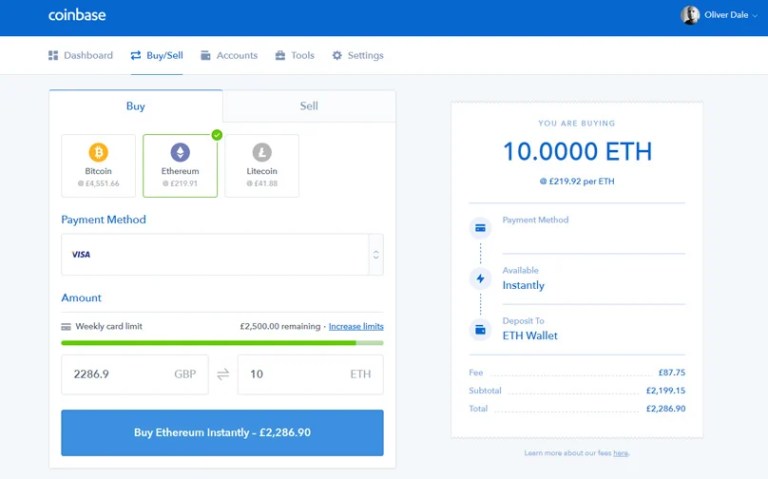

Purchasing LEND requires initial acquisition of cryptocurrencies like Bitcoin or Ethereum via platforms like Coinbase before trading on exchanges such as Binance.

Register at Coinbase

For crypto novices, Coinbase is a recommended entry point, known for regulatory compliance and instantaneous purchase capabilities with bank transfers or cards. Card purchases incur higher fees but offer immediate transactions.

Identity verification is mandatory at registration, aligning with financial compliance.

Make sure you use our link to signup A $10 Bitcoin bonus is added after a first $100 purchase.

Begin by hitting 'Sign up' and filling the registration with your name, email, and password.

Purchase Ethereum

On Coinbase, hit the 'Buy / Sell' tab, select 'Ethereum,' and choose your payment method while entering your desired purchase—either in USD or Ether.

After transaction confirmation, possibly involving card verification, the acquired Ethereum reflects in your account.

Purchase LEND at Binance

You can now send your Ether over to Binance Here's a guide on purchasing LEND—details on signing up and trading on exchanges are included. review of Binance here This platform can extend its crypto-use beyond fundraising to real-world financial systems, converting tokens into a stable USD equivalent. Through tokenization, standard assets can convert into ERC-20 blockchain assets, opening them for collateral use.

How Can ETHLend Be Utilized?

Lender functionalities involve offer-based or on-demand loans, specifying terms like collateral and interest rates. Another is crowdlending, with multiple lenders and decreased risk per loan. Bitcoin and altcoin lending will feature, and APIs will encourage developing lending bots. Bidding functions are in progress, offering lender auctions where they compete for more attractive borrower interest terms.

What is The Roadmap?

ETHLend will introduce Plans exist to expand decentralized lending and credit systems beyond Ethereum. The concept of decentralized insurance, letting insurers assess risk profiles and craft custom policies, is on the horizon.

What Future Enhancements Are Anticipated for the dApp?

ETHLend addresses decentralized lending challenges by minimizing risks while offering tangible benefits to platform users. It taps into an underexplored financial realm, opening new client possibilities. Louis at Blockonomi, a web developer and blockchain enthusiast, brings you insights.

Conclusion

iExec: The Foundation of Trust for DePIN and AI Technologies