eToro is known for its diverse toolkit for traders. copy trading If you're considering a more secure entry into leveraged trading, copy trading might suit your needs.

There's a multitude of options when it comes to trading financial assets. However, many who engage in high-leverage trading often end up losing. Most platforms offering high leverage have limited success stories.

Copy trading lets you explore other traders' histories and mimic those whose strategies resonate with you. This method comes with varying outcomes.

By spreading investments across multiple successful traders, copy traders can buffer against large losses, a potential pitfall of leveraged trading. eToro's platform is designed with both novice and seasoned traders in mind.

(Please be aware, some of this information may not apply to US residents.)

eToro Risk Notification: 75% of retail investor accounts face losses when trading CFDs with this provider. Ponder over your ability to handle the potential loss of your money.

Copy Trading Brokers

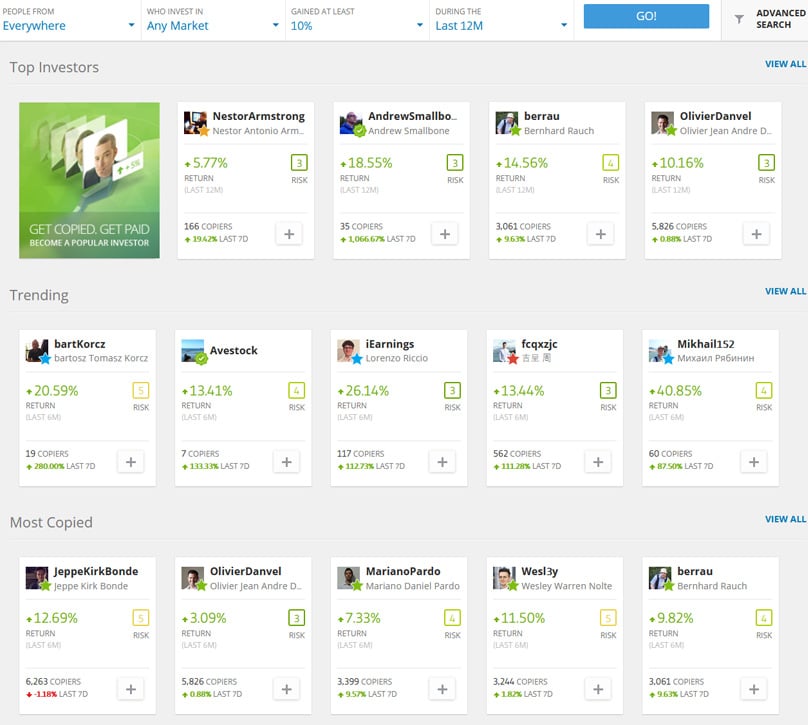

Numerous brokers now offer copy trading, and this feature is increasingly common. Here are some of our top recommendations from our findings. Top Brokers guide .

| Broker | Regulation | Asset Coverage | Leverage | Trading Platforms |

eToro 75% of retail investor accounts face losses when trading CFDs with this provider. Reflect on your capacity to handle potential financial losses. |

|

|

|

|

Pepperstone |

|

|

|

|

FXTM |

|

|

|

|

Copy Trading at eToro: How it Works

Joining eToro's social network could earn you the title of a 'Popular Investor'. The results one achieves significantly boost their standing.

To join eToro's social trading community, all that's needed is an eToro account. Once your account is active, simply register for the network.

To achieve verification on the social network, you'll need to use your actual name and have eToro's team verify your personal details.

How to Select a Leading Investor and Their Strategy

eToro gives you the ability to filter Popular Investors using tools like Profit Percent, Traded Assets, Successful Weeks, Location, and more.

There's no definitive way to choose which Popular Investor to follow. They will manage your funds in a passive manner.

One limitation of the platform is the non-disclosure of Popular Investors' account balances, making it hard to gauge their wealth.

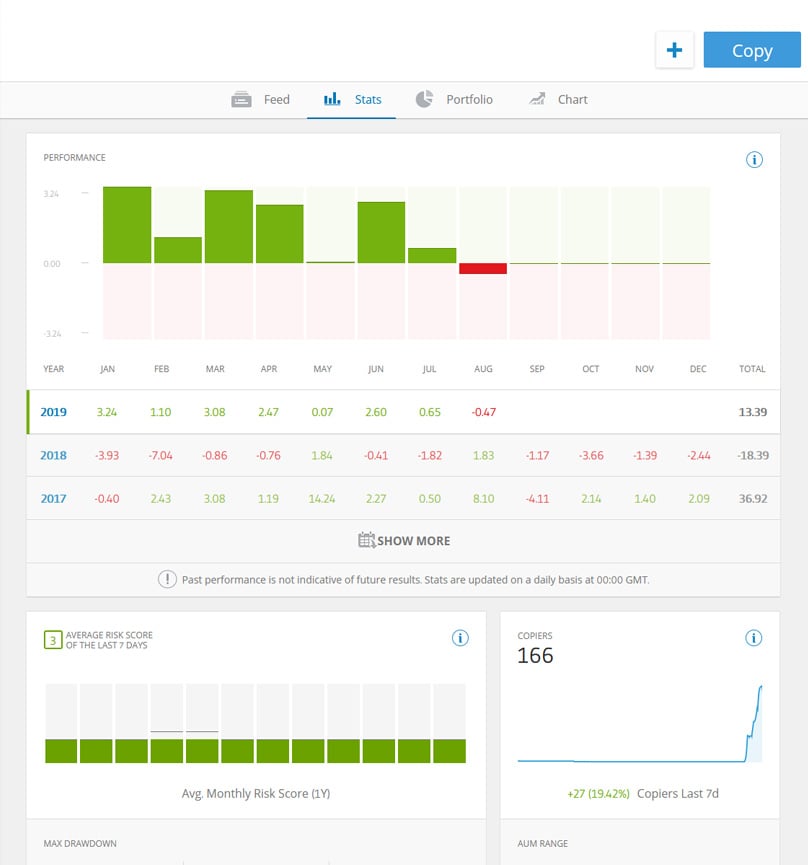

Various performance metrics evaluate Popular Investors. Besides a 1-year risk metric table crafted by eToro, there's a chart showing the increase of copiers over time. Investors' trade volumes, profit rates, and top-traded items are available too.

Current open trades and portfolio allocations are visible and can assist in determining whether the investors' market decisions appeal to you.

Putting Your Money to Work

Choosing a few Popular Investors to follow is simple; designate the funds you wish to replicate alongside them through the platform.

Using eToro's social platform is cost-free, though typical brokerage fees apply to mirrored trades. If you seek visual insights into a trader's past performance, the chart feature can aid you.

With eToro, it's feasible to track a Popular Investor's past performance over varied timelines and compare against preferred indices and stocks. A $200 minimum per trader applies, and a singular trader can only occupy up to 40% of your portfolio.

Tips for Using Copy Trading

- Choose Multiple Traders to copy

- Study their trading strategies thoroughly.

- Diversify by selecting traders from varied sectors.

- Opt for traders with extended proven track records.

- Reinvesting returns can help leverage the power of compounding.

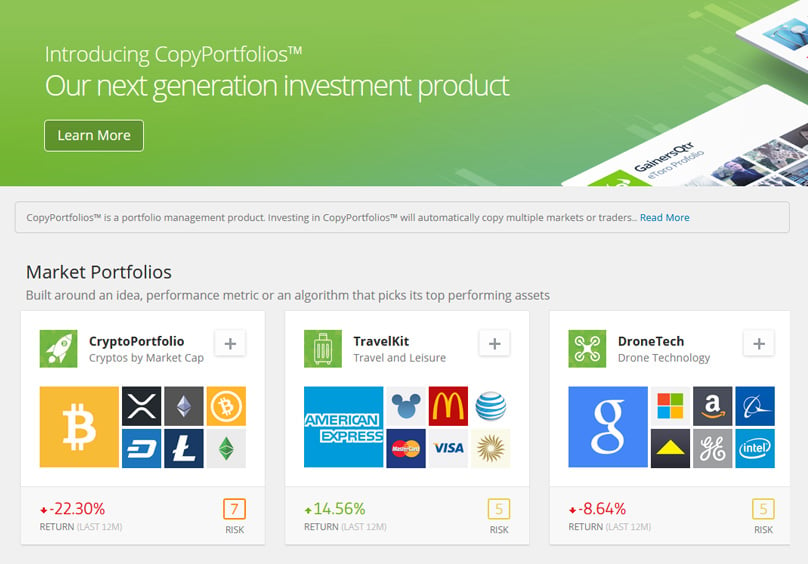

The Copyportfolios

Copyportfolios are another forward-thinking feature by eToro. They allow you to invest indirectly through a 'Market Copyportfolio' or a 'Top Trader Copyportfolio'.

Market Copyportfolios reflect ETF structures geared towards a specific investment thesis. It's advisable to test these waters before diving in.

The Top Trader Copyportfolio operates with eToro's highest achievers. It's a strategy to distribute funds across skilled traders, mitigating severe losses.

Taking Leverage and CFD Strategies into Account

Whatever route you pick for exposure, acknowledge the inherent risks. leverage Leverage may multiply profits but equally increases the chances of significant losses during unfavorable market shifts. A Popular Investor dictates risk levels in copy trading, thereby removing a critical angle of risk handling from your control.

It's vital to ensure Popular Investors you mimic have solid experience. Likewise, diversifying your investments shields against adverse shifts.

A trader following a trend may seem lucrative in backtesting, yet if trends reverse, losses could quickly accumulate. With leverage, gains can be significant, but risks are also magnified, and losses can happen swiftly.

Discover more details on 'Contracts for Difference'.

Read our guide to CFDs eToro offers clients a wealth of trading instruments, alongside a social network facilitating copy trading.

eToro Provides Access to a Vast Array of Markets

For those interested in macro market speculation or who prefer trades managed by experts, eToro makes a compelling option. Transitioning between markets is straightforward, and placement into copy trade accounts offers a passive investment avenue.

eToro doesn’t enforce minimum investments post-account setup. The broker provides ample leverage across major markets, potentially attracting some traders.

Explore this broker more if intrigued.

Read our complete review of eToro here Copy trading is a captivating breakthrough, and eToro has crafted a user-friendly platform for anyone.

Is Copy Trading Good Fit for You?

Though backtesting a trader's results is an option, caution remains paramount with leveraged investment options. Predicting "down" phases for traders is impossible, and copying their trades means absorbing their downturns.

Copy trading may add strategic risk to portfolios, especially in hedging against broad market drops.

As with all investments, diversification mitigates significant losses. Keep this in mind when aligning investment funds in the markets. eToro’s copy trading may effectively navigate leveraged scenarios without exhaustive self-led research and trading.

eToro distinguishes itself as a platform allowing multi-asset investment, such as with stocks and cryptocurrencies, alongside CFD trading.

CFDs pose complexities and high financial risk due to leverage. 75% of retail investor accounts face losses when trading CFDs with this provider. Make sure you grasp CFDs' operations and assess if you can financially bear significant losses.

Cryptoassets involve volatility, experiencing sharp changes within tight timeframes and may not be suitable for every investor. Except for CFDs, trading these assets lacks regulatory oversight.

History doesn't guarantee future outcomes.

eToro USA LLC doesn't offer CFDs and disclaims any accuracy or completeness regarding this publication, prepared by a partner using general public information on eToro available to non-specific entities.

Nicholas Say hails from Ann Arbor, Michigan, having led an extensively traveled life, resided in Uruguay for numerous years, and currently lives in the Far East. His works span the web with an emphasis on pragmatic development and upcoming technological advances.

1Comment

Exploring the World of Copy Trading: An In-Depth eToro Guide