ETX Capital ETX Capital has carved a niche for itself as a steadfast and well-regulated broker, overseen by the FCA, boasting a rich history exceeding 50 years in the financial sector. This broker offers traders an extensive array of markets, cutting-edge trading platforms, and highly competitive spreads. Their mission is to create a dynamic trading environment complemented by educational resources for their clients.

ETX Capital opens doors for its clients to engage in trading across more than 6,000 markets with some of the most attractive pricing around, backed by award-winning customer service teams. Although headquartered in London, their customer assistance reaches across the globe.

Monecor (London) Limited stands as the parent company of ETX Capital, utilizing this brand for its trading operations. Registered under the company number 00851820, Monecor (London) Limited operates under the regulatory eye of the Financial Conduct Authority (FCA) with the Financial Services Register number 124721. Established in 1965, it garners respect as a listed entity on the London Stock Exchange.

Important Consideration: CFDs are intricate financial tools accompanied by a significant risk of swift monetary losses due to leverage. A noteworthy 78% of retail investor accounts face losses when dealing in spread bets and CFDs using this provider. It’s crucial to evaluate your understanding of CFDs and measure your capacity to shoulder the high risks of potential monetary loss.

ETX Capital at a Glance

| Broker | ETX Capital |

| Regulation | FCA (United Kingdom) |

| Minimum Initial Deposit |

£100 |

| Demo Account |

Yes |

| Asset Coverage | CFDs, ETFs, Forex, Cryptocurrency, Equities, Bonds, Commodities, Indices |

| Leverage | Leverage of 30:1 for Retail Clients and 200:1 for Professional Clients |

| Trading Platforms | Bespoke Web Interface, Windows Desktop Application, Mobile Apps, MetaTrader 4 |

ETX CapitalTrading Instruments

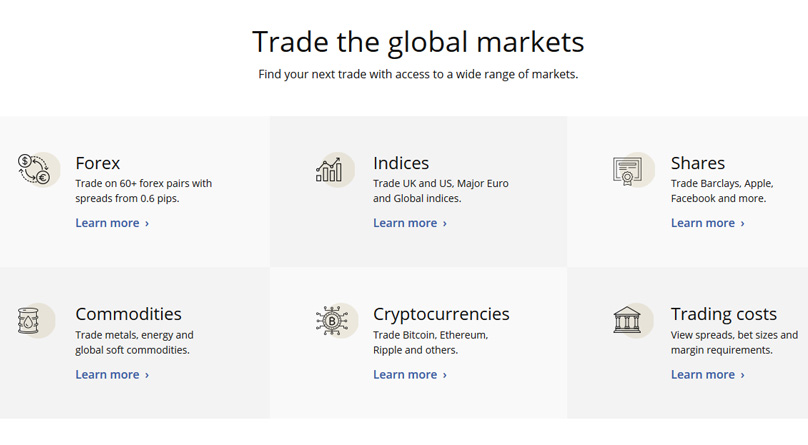

ETX Capital provides traders with the opportunity to dive into a plethora of tradeable markets. Offering an impressive selection of over 50 forex pairs, alongside cryptocurrencies, commodities, equities, and financial indices. In commodities, ETX Capital offers five metal options, five energy assets, and nine soft commodities. Equity trading encompasses CFD stocks from territories such as the U.S., Australia, Singapore, South Africa, or 18 different European nations.

Spreads & Leverage

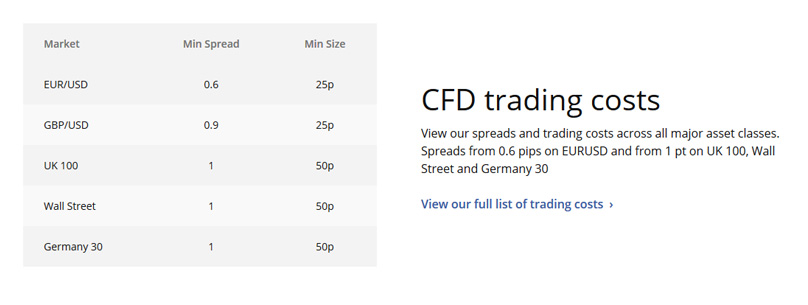

One of ETX Capital's hallmark offerings is competitive spreads with a spectrum of leverage options. Starting with forex trades, EUR/USD spreads can be as low as 0.6 pips, underscoring an incredibly competitive edge. In equities, indicative spreads on some stocks begin at 0.08. As for commodities, the smallest spreads commence at 3 pips, while predominant indices start at just 1 pip.

ETX Capital extends generous leverage thresholds, offering up to 100:1 on numerous products. Their MT4 products grant an even heftier leverage reaching up to 200:1 for professional traders and top out at 30:1 for retail investors.

Accounts Types

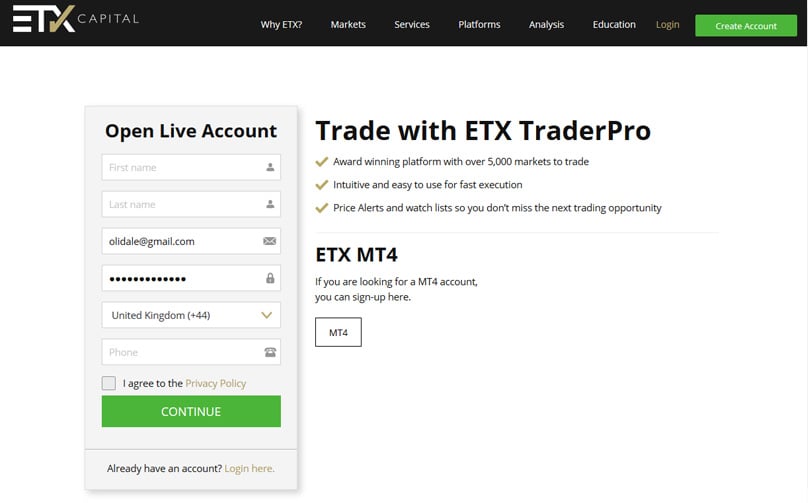

Foregoing distinct account categories, ETX Capital provides two primary platforms catering to diversified trading styles: the flagship ETX TraderPro and the ever-popular ETX MT4. Once you’re signed up via either platform, switching between platforms is seamlessly handled by reaching out to the service desk, having already completed the initial registration security processes.

You're also in a position to maintain more than one account with ETX Capital, potentially harboring distinctive accounts for each trading platform. There's capacity for five live accounts simultaneously, with accommodations for additional account openings subject to compliance review. Opening more accounts is streamlined via logging in and visiting the Profile section.

Demo Accounts

ETX Capital also recognizes the value of practice trading through its demo account feature, available for every platform. Navigate to the ‘Platforms’ section on the website, select ‘Demo’ and follow the instructions to refine your trading skills risk-free.

ETX Capital Deposits and Withdrawals

To augment your MetaTrader 4 account funds with ETX Capital, access your account and select 'Add Funds.' The system guides you smoothly through each step. If withdrawing funds, log in, proceed to 'Your Account,' and choose 'Withdraw Funds.' Complete necessary fields, sometimes needing supplementary documentation to thwart financial malpractices. Internal fund transfers between ETX Capital accounts are facilitated by emailing customer service with account details and required personal information.

A minimum deposit of £100 or local equivalent is mandatory. Fund deposits can occur via wire or bank transfers in currencies like GBP, USD, EUR, and others, requiring one business day for deposit processing and up to three for withdrawals. The same timeline applies to online transfers. Major credit/debit cards, barring AMEX, process within a day for deposits, with withdrawals taking three to five business days, usable with GBP, USD, and the like.

E-wallet enthusiasts will find ample options, including China UnionPay, Skrill, Neteller, Sofort, and GiroPay. Each allows a general processing time of one business day for deposits, and withdrawals post three to five business days. Specific currency limitations exist, such as EUR only for Sofort and GiroPay.

ETX Capital enhances payment security with the globally recognized 3-D Secure protocol, which bolsters online debit and credit card transactions through client-authenticated XML messages sent over SSL. This norm often requires an additional password or a code sent by the bank.

What More Should You Know Concerning Deposits and Withdrawals Procedures?

Note that your ETX Capital account can only accept deposits from personal bank or card accounts; third-party fundings aren’t permissible. Depositing funds in a different currency results in conversion using the spot rate from the prior day's trading close, potentially delaying crediting times.

Withdrawals default to the original funding source. If unavailable, a confirmation process begins, after which customer support will detail required documents. With usual allowance to reverse withdrawals even to expired cards, the fallback is a detailed submission involving situations like closed accounts or card theft. Cancellation requests must go through the specified withdrawal email or via phone.

ETX Capital brings no charge for the first five withdrawals per calendar month, provided minimum fifteen-dollar benchmarks are adhered to. Exceeding this, a ten-dollar fee applies per withdrawal. Similar charges apply for withdrawals below the threshold, with a cap at ten dollars.

ETX Capital Fees

ETX Capital introduces an inactivity fee for dormant accounts, variable across currencies, with specified fees readily viewable on the ETX Capital website's Payments page. Managing 31 currencies, typical fees for most-used currencies include:

- AUD: 30

- CAD: 30

- CHF: 20

- EUR: 20

- JPY: 2,750

- RUB: 1,300

- USD: 25

Overnight financing charges also apply to commodities, indices, and equities. This encompasses a formula of (total position size x 3.5%)/365. Weekend rolls charge a single fee with broadened market spreads for triple-day positions. FX interest calculations hinge on currencies, with sweeping overnight details available in the ETX Capital FAQ section.

ETX Capital Promotions

ETX Capital does come forth with enticing promotions, often time-sensitive. Consult your Account Relationship Manager for current promotion insights, with customer support available for checking status and expiry details via email or phone.

ETX Capital Trading Platforms

ETX Capital facilitates seamless mobile trading with tailored apps for Android and iOS, complementing its desktop counterparts. Its dual-platform offering caters to diverse trading styles across any device.

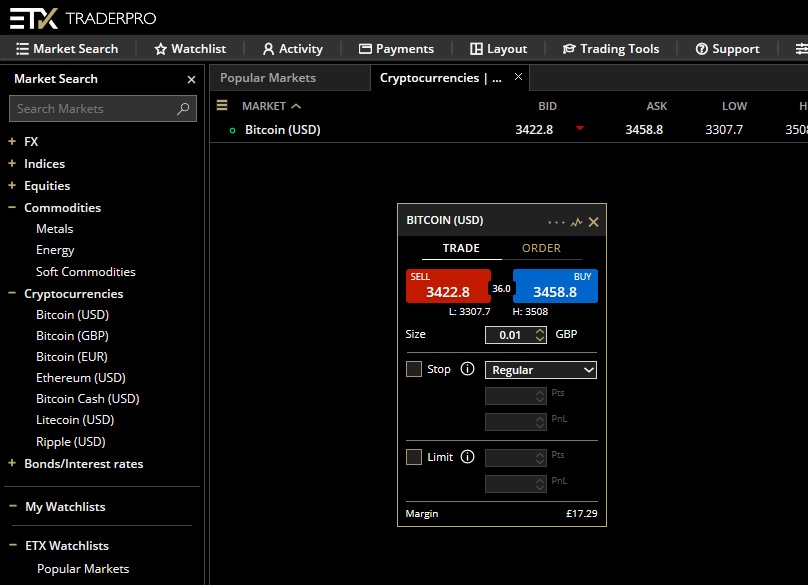

ETX TraderPro, characterized by narrow spreads and customizable trading charts, is crafted for experienced traders pursuing significant returns amidst risk. This flagship platform from ETX Capital features an array of charts and tools alongside a multitude of trading assets.

ETX TraderPro offers traders a selection of chart types and a variety of drawing tools to derive their own trading conclusions, making it ideal for seasoned traders. The platform is intuitive, allowing you to quickly open a chart for a particular product and start trading immediately, which minimizes time wastage and the risk of slippage. You'll find a pip calculator tool included, alongside drag-and-drop features for arranging deal tickets precisely as you prefer. You can also curate personalized watch lists and access detailed product information directly from the platform.

Alternatively, those utilizing ETX Capital can trade via ETX MT4, the broker's own MT4 offering. This platform enables the use of downloaded automated expert advisors. ETX MT4 further allows multiple charts open concurrently, letting traders grasp all necessary market information simultaneously. MT4 accommodates micro lots and hedging, and there is an option to use a Virtual Private Server with MT4, ensuring your copy signal providers and expert advisors are active at all hours.

As you glance at trading panels, you'll observe rates being shown, which are quoted asset prices. Keep in mind, ETX Capital's quoted prices may not reflect exact market prices with possible discrepancies extending to several pips. Nonetheless, the rates displayed are the ones ETX Capital is prepared to deal with. Within the platform, green indicates a price increase while red signifies a price drop regarding these rates.

How to Trade with ETX Capital

To initiate a trade, you need to log into your account. The steps will vary slightly based on which platform you decide to use.

Start trading with ETX TraderPro by first selecting the product you wish to trade and then clicking on 'Trade' on the right. This opens up a trading ticket, showing the current buy and sell levels. You can specify the trading volume, then adjust the amount, and select either 'sell' in red or 'buy' in blue.

For ETX Binary, simply clicking on the intended product opens up the trading ticket. Your tentatively available actions depend on the Binary option's framework. You might find buttons labeled 'Call' and 'Put' or choices between 'Up' and 'Down,' with numbers fluctuating based on the product's current price. There’s also usually a dropdown selection for choosing trade expiration times. You'll be prompted to enter the trade amount. As you adjust the input, the payout calculator updates, revealing potential returns for a successful trade. Once satisfied with the setup, click 'Invest' to execute your trade.

To commence trading on ETX MT4, begin by clicking 'New Order' on the top trading bar, which opens a new window. Here, select 'Symbol' from the dropdown tab and choose the product for trading. Input the trade amount, stop loss, and take profit level. Afterward, decide on 'Sell by Market' in red or 'Buy the Market' in blue.

To establish an 'Order to Open,' click on the 'Order' tab to bring up the New Order window. Determine your purchasing or selling level, refine the other parameters, and hit 'Place' to confirm. Modifying an 'Order to Open' involves accessing your order book, selecting 'Amend,' and then tweaking the particulars in the 'Amend Order' window before confirming changes. Be aware that slippage is possible and limit or stop orders might not be executed at the stipulated prices. Stop Loss orders are not always assured unless otherwise agreed upon.

ETX Capital facilitates locating the minimum Stop Distance for your market of interest. Select the market or search for it using the search bar. Create a deal ticket by hitting 'Trade' and proceed to 'Advanced' and then 'Stop.' Decrease the Stop level using the arrow keys until it no longer reduces, indicating the minimum Stop Distance.

In some markets, ETX Capital offers guaranteed stop loss, however, expect a supplementary fee for it. The charge is clearly shown on the deal ticket when making your selection, eliminating hidden costs or surprises.

When Might ETX Capital Initiate the Closure of Positions?

At times, you may discover previously open positions have been closed. Causes for this can vary, such as a Limit or Stop order being hit and executed, a margin call closing your position, or trading on a futures contract that meets its expiry. To preempt such a scenario, consider calling ETX Capital prior to contract expiration to roll it over to the next expiry date.

If your 'Trade Funds Available' reading appears negative, you have the choice to either close the current position or add more funds to your account. Inaction may lead to the Risk Department closing or partially closing your position.

How Can You Determine the Trading Funds Available at Your Disposal?

Calculate your available trading funds by deducting the margin for open trades from your liquidation value. A positive figure indicates the amount available for trading, while a negative one denotes what's required before re-entering the trading pool.

Can You Hedge with ETX Capital?

Sometimes, traders wish to place opposing directional trades on the same market or hedge. This is permissible on the MT4 platform, and ETX TraderPro includes this feature for some instruments. When available, a 'hedge' notation appears in brackets by the instrument's name.

Minimum & Maximum Trade Sizes

Minimum deal sizes vary by instrument. Generally, you can trade CFDs from merely 0.50 pips per point on a micro lot. Maximum deal sizes change depending on the platform chosen. ETX Capital clients typically place trades of any size as long as they meet the margin needs. If you're unable to transact on the site and unsure why, ETX Capital's support can assist. Remember, maximum deal sizes might adjust under extraordinary market circumstances. in the spread betting platform From Sunday to Thursday, ETX Capital automatically converts daily currency trades to your default currency after midnight. Should this automatic conversion falter, notify ETX Capital. In future cases, inform them in advance when you desire balance conversion.

What Are the Consequences of Not Trading in Your Account's Base Currency?

In MetaTrader 4, go to the Account History tab in the Terminal Box. You can right-click the 'Account History' and set the timeframe you wish to examine. If the Terminal Box isn't visible, open it using CTRL+T.

Reviewing Open Trades and Your Trading History

Keeping an eye on your position's overall loss or gain is easy. On ETX TraderPro, locate the 'Open Positions' tab towards the lower screen. Here, the current positions are listed, each detailing the open time and date. It also includes the sold or bought quantity, reserved margin, and both the opening and current product prices. Beside this, a 'P/L' column displays your current profit or loss level, with profit amounts shown in white and losses in red. Buttons are available to view the product chart, trade more on it, close the trade, or set new alerts.

To see open trades on ETX MT4, revisit the terminal window located generally at the bottom screen of MT4. If it's not visible, regain visibility by selecting 'View' from the menu. Within this window, choose the 'Trade' tab to view open trades and your current account balance. Each trade comes with pertinent information such as opening time, size, type, symbol, and price. Selecting a trade opens a window with additional options, including trade closure.

ETX Capital provides several display styles featuring diverse drawing tools to meet your needs. Additional studies can be added and settings saved by clicking the Chart icon for a specific market, and navigating the Charts tab to manage display preferences.

ETX Capital Charts

Regular charts are also accessible. ETX Capital retains chart data for at least a day. Tick data under one-minute intervals is stored briefly, whereas periods of five to thirty minutes last two weeks, and spans from one to four hours are saved for a few months. Data for daily intervals and beyond are kept indefinitely. Daily candles are reset automatically at midnight in the applicable local market time zone, and price changes apply at midnight in the London time zone. All pricing bases off the official market close.

Adjusting a chart’s style is always an option. Click on the market or use the search bar to open a chart, then go to the Chart icon for customization options. A new browser window can house the chart by clicking the ‘Move to New Window’ icon at the top-right corner.

Numerous indicators are available for ETX Capital charts. Add or remove indicators through the 'Studies' tab on a chart, selecting and adjusting the desired indicators and then applying changes via the 'copy' and close steps.

Charts can be personalized using the left and top window tabs. For future ease, you can save these settings by going to the 'Settings' tab and choosing 'Save Chart Settings.'

ETX TraderPro is designed for traders who love diving deep into the details. The platform has a range of chart options and drawing tools that empower seasoned traders to make well-informed trading decisions independently. It stands out with its straightforward interface, allowing traders to quickly open product charts and execute trades, minimizing time spent and lowering the chances of slippage. User-friendly features like a pip calculator and drag-and-drop deal tickets add convenience, while watch lists and detailed product information help keep traders informed.

Other Trading Tools & Resources

ETX Capital offers an alternative with ETX MT4, a robust platform featuring MT4 hosting. This option lets you integrate automated Expert Advisors and opens multiple charts simultaneously, ensuring you won't miss vital market information. ETX MT4 accommodates micro lots and hedging strategies. There's also the capability of using Virtual Private Server hosting, ensuring that your copy signal providers and Expert Advisors are operational around the clock.

Educational Resources

As you navigate the trading boxes, you'll encounter asset rates provided in real-time. These rates are quotes for assets and might not always align perfectly with exact market prices, as deviations of up to a few pips can occur. Nonetheless, they reflect the prices at which ETX Capital is prepared to offer options. Green indicates a price increase, while red signifies a decline on the trading platform.

Starting a trade requires you to log into your account, with subsequent steps varying based on your chosen platform.

To trade with ETX TraderPro, first select the product of interest, then click on 'Trade' on the right side. This action reveals a trading ticket displaying current buy and sell levels. You can input the desired trade quantity, adjust accordingly, and choose 'buy' in blue or 'sell' in red.

Competitors

For ETX Binary users, selecting the product opens the trading ticket automatically. Depending on the binary option type, you could see 'Call' and 'Put' or 'Up' and 'Down' choices alongside numbers that fluctuate with the product price. A drop-down menu may offer expiration times for your trade, and as you input the trade amount, a payout calculator updates to indicate potential outcomes. Once satisfied with the form, click 'Invest' to place your trade.

ETX Capital Customer Support

On ETX MT4, initiate by selecting 'New Order' from the top trading bar, opening a new window. Choose the product via the 'Symbol' drop-down. Specify the trade amount, stop loss, or take profit levels, then proceed by clicking 'Sell by Market' in red or 'Buy the Market' in blue.

To initiate an Order to Open, navigate to the 'Order' tab, triggering a New Order window. Set the desired buy or sell level, adjust other fields as needed, and confirm by clicking 'Place.' To change an Order to Open, access your order book, click 'Amend,' make the necessary adjustments, and confirm. Be aware that slippage can occur, affecting limit or stop orders unless terms are specifically agreed upon.

ETX Capital Awards

ETX Capital facilitates identifying a minimum Stop Distance for your selected market. Locate the market via search or click directly, open a new deal ticket by selecting 'Trade,' followed by 'Advanced,' then 'Stop.' Use arrow keys to decrease the Stop level to find the minimal allowable distance.

Is ETX Capital Safe?

Some markets offer guaranteed stop losses via ETX Capital at an additional fee. This charge is clearly displayed on the deal ticket, assuring transparency with no surprises.

Conclusion

Occasionally, you might notice a previously open position has closed unexpectedly. This can happen due to reaching a pre-set Limit or Stop order or because a margin call was triggered. Additionally, a futures contract might have expired. To avoid contract expiration issues, consider contacting ETX Capital to extend the contract to the next expiration date.

If your 'Trade Funds Available' display is negative, you have the option to close an existing position or deposit more funds. Inaction might prompt the Risk Department to partially or fully close your position.

To determine your available trading funds, subtract the required margin for open trades from your liquidation value. A positive outcome indicates available trading funds, while a negative result shows the necessary deposit to resume trading.

Important Consideration: CFDs are intricate financial tools accompanied by a significant risk of swift monetary losses due to leverage. A noteworthy 78% of retail investor accounts face losses when dealing in spread bets and CFDs using this provider. It’s crucial to evaluate your understanding of CFDs and measure your capacity to shoulder the high risks of potential monetary loss.

2Comments

On ETX MT4, view open trades in the 'Trade' tab within the terminal window, typically found at the bottom of the screen. If hidden, add it via the 'View' menu. Each trade displays crucial data, like time opened, size, type, symbol, and price. Click a trade to open a window offering options, including the ability to close it.

ETX Capital's display styles and drawing tools can be tailored to your preferences. You can incorporate studies and save your settings. Simply click the Chart icon on a market, select the Charts tab, then click Type to choose your display style.