This week, the concept of the “ exit scam The cryptocurrency community was shaken when Confido, a startup connected with escrow services—ironically named 'I trust' in Italian—went silent, vanishing with investors' funds and leaving many with nothing.

As the scam unfolded and panic spread, the value of Confido's CFD token plummeted. crashed virtually 100 percent It nosedived from $0.68 on Sunday, November 21st, down to around a mere cent in just under two days.

With the value of CFD collapsing entirely, investors were left in shock as the token, once seen as reliable and promising, dealt a severe blow to numerous investment portfolios.

Raising awareness on the potential warning signs of exit scams, today we're guiding you through what the community overlooked with the Confido case. It's not about pointing fingers but learning to better spot such deceitful schemes in the future.

Let's delve into some critical insights.

First and foremost: use LinkedIn to effectively evaluate crypto teams from now on.

If LinkedIn hasn't been your tool of choice for vetting teams before your crypto investments, it's time to make it one starting today.

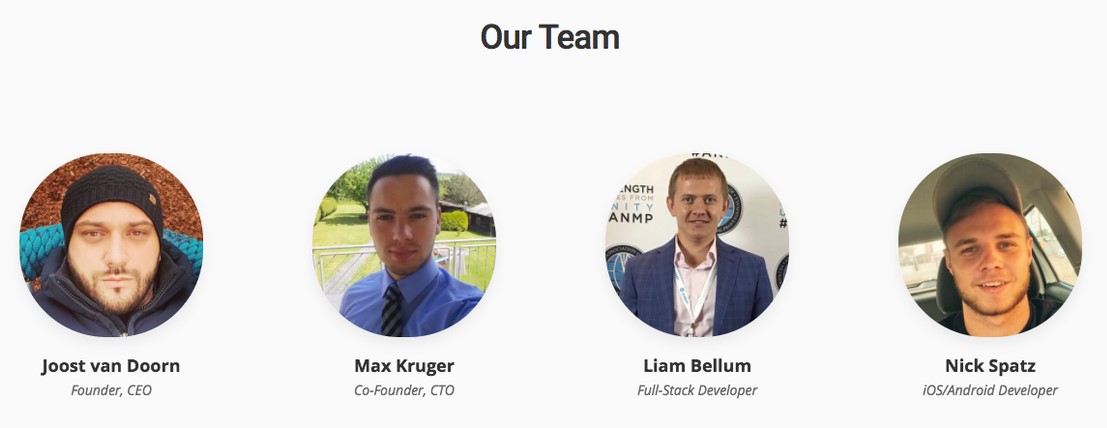

Despite early whispers within the crypto community about the suspicious nature of Confido's LinkedIn presence, widespread realization of its fraudulent nature came too late.

The scam was glaringly exposed through the new and sparsely connected LinkedIn pages of the primary scammers—two developers and two executives.

Confido's so-called team – Image via Mashable

Real experts in crypto startups usually have far more extensive connections and verifiable work histories than the fake LinkedIn accounts suggested.

Moving forward, make it a habit to identify key figures in new crypto projects and scrutinize their LinkedIn profiles thoroughly.

Genuine profiles typically showcase a robust network and a credible professional background.

Be vigilant about the claims swirling around, whether from developers themselves or the general user base.

Those engaged in crypto forums before CFD's legal news might recall Confido's purported collaboration. ChainLink It was allegedly tied to an innovative ERC-20 token enabling a decentralized Oracle service.

Rallying cries of 'Confido and ChainLink collaboration!' reverberated among promoters.

However, there was no substantial partnership; CFD's team merely made claims about using ChainLink for oracles, not an actual collaboration fitting the narrative.

Yet, this didn't prevent misleading promotion of a fictitious alliance with ChainLink.

This highlights the need to critically appraise each major claim about any crypto asset you're considering.

A bit of skepticism goes a long way in the burgeoning crypto landscape.

The absence of a Minimum Viable Product (MVP) at CFD's ICO launch should have been a major red flag.

No Working Product = Big Problem

ICO launches without tangible products on the market fall short of real viability.

Henceforth, it’s best to avoid any ICO Launching an ERC-20 token doesn't equate to launching a functioning product.

The company assisting Confido's ICO claimed transparency concerning 'proof of token creation and distribution,'

TokenLot But such distribution of an ERC-20 token doesn't constitute a functional end product.

An ICO in itself is not equivalent to a product release.

Place your trust in projects with clearly defined, community-verified progress milestones.

Small fundraising cap ICOs are easily prone to manipulations similar to those executed by the CFD team.

Beware of Microcap ICOs

Not every small-cap project is a scam.

However, approach microcap ventures with stringent scrutiny henceforth to avoid blind decisions driven by high earning potential.

Confido cunningly exploited this enticing prospect, proudly proclaiming modesty:

\"We believe the current ICO ecosystem is flawed; firms accumulate millions without viable products or customer bases. We've consulted financial experts, concluding $400,000 suffices for our aims. ICOs offer valuable project funding, but we aim for responsible usage.\"

Ultimately, the Confido team grossly misused community excitement, and their calculated deceit is alarming.

Let's not allow future scammers the same opportunity to deceive us.

A promising crypto investment appearing out of the blue with overwhelming interest is likely too good to be true.

Stay cautious of cryptocurrencies suddenly launching aggressive promotional campaigns.

Confido’s extensive promotional efforts over recent weeks exaggerated their legitimacy, obscuring numerous obvious warning signs from the community. There's no denying the team paid forum users to propagate their narrative.

Scammers banked on investor enthusiasm to do the rest of their dirty work.

Now, it's imperative for us all to adopt a more cautious, investigative approach. Scrutinize new crypto marketing stories, avoiding tokens hyped beyond their merit.

Many fell for Confido's trap by heeding unvetted advice. But remember the adage: if you want something done right, you must do it yourself.

Basic Investment Safety: Arm yourself with diligent research practices.

In crypto, this timeless principle rings true—you must verify facts personally before laying down an investment. Comb through LinkedIn, scour Twitter, and check platforms like Piccolo Research. Stay relentless in your quest for trustworthy information.

Questionable projects won't withstand thorough examination. Meticulous research can spare you—and potentially the entire crypto community—from significant loss if you can identify and share red flags early.

The Confido incident is indeed a heavy blow for the crypto community.

Yet, it's a pivotal lesson underscoring the need for stricter standards in crypto investments.

William M. Peaster, a skilled writer focusing on Ethereum, Dai, and Bitcoin within the cryptoeconomy. His work appears in Blockonomi, Binance Academy, Bitsonline, and more. He tracks smart contracts, DAOs, dApps, and the Lightning Network while learning Solidity too! Reach him on Telegram at @wmpeaster.