Even the fiercest critics of cryptocurrencies acknowledge the significant shortcomings of traditional fiat money.

Interestingly, Kenneth S. Rogoff, a former IMF Chief Economist known for his critiques of government-backed money, also opposes cryptocurrencies. He authored a book advocating for the complete elimination of physical cash. The Curse of Cash Rogoff's stance is that paper currency facilitates the transfer of funds into illicit markets rather than supporting legitimate economic activities. He also accuses central banks of inadvertently endorsing such markets through their paper money transactions.

Rogoff, in a Project Syndicate article, argues that cash primarily fuels underground economies rather than the legitimate ones. He highlighted the $100 bill, rarely seen by average Americans, which constitutes the bulk of the U.S. monetary supply and is favored by criminals globally.

According to Rogoff, physical currency contributes to violent crime by encouraging robbery and facilitating illicit trades and immigration due to its ease of use. In The Curse of Cash, he mentions Sweden's decrease in bank heists following a reduction in cash circulation, demonstrating the effectiveness of limiting cash for reducing crime. charged Ironically, while Bitcoin and cryptocurrencies are often accused of enabling crime, physical cash remains the predominant tool for illegal transactions.

Political Exploitation of National Assets

Venezuela Illustrates Why Cryptocurrencies Are Set to Eclipse Fiat Money

Is Paper Currency Obsolete?

Rogoff is the same man who denounced Bitcoin (BTC) As Rogoff noted on Project Syndicate, history demonstrates that private sector innovations are eventually regulated and adopted by the state, and digital currency will likely follow that trajectory. column Initially, banks created paper currencies until governments took them over, recognizing them as a superior payment solution.

Prime Minister Narendra Modi of India concurs with Rogoff. On November 8, 2016, Modi displayed the faults of fiat currencies by rendering 86% of India’s cash invalid overnight.

In a televised announcement, Modi informed Indians that their most significant bills, the 500 and 1,000 rupee notes, were immediately worthless, sparking panic and a cash shortage.

His prediction is that governments will simply takeover cryptocurrency Images emerged of Indians queuing for cash withdrawals.

The Danger when Cash Goes Away

Over a 50-day period, people experienced life without cash, leading some businesses to barter while others camped outside banks and ATMs rumored to have cash. This chaos arose because 98% of consumer transactions in India relied on cash.

Modi demonstrated the inherent flaw of cash as a payment means—its value can be obliterated instantly, akin to an individual's savings beneath a mattress falling victim to theft or fire. A whole country can lose economic power due to a single government decree. reported A key issue with fiat money is inflation, where governments can print limitless amounts, undermining the value of existing money. Post-2008 financial crisis, the Bank of England created more money, illustrating a predicament cryptocurrencies address: Bitcoin’s capped supply at 21 million.

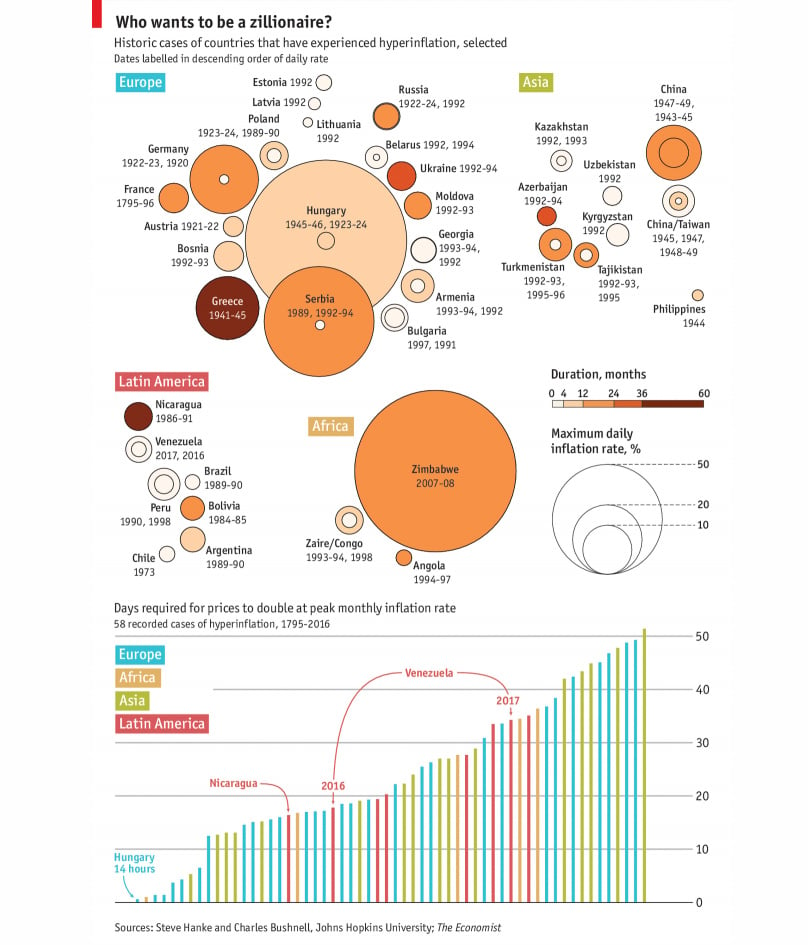

Economist Steve Hanke from Johns Hopkins University reported to The Economist that Venezuela witnessed a 12,875% price increase in 2017, with prices potentially doubling every 52 days. If true, this positions Venezuela among the worst hyperinflation incidents recorded. The International Monetary Fund estimated a 13,000% inflation spike in Venezuela for 2018.

Venezuela’s government is currently printing 100,000 Bolivar notes, but The Economist claims they’re worth less than 50¢ in US Dollars. The black market pegs $1 at 228,000 Bolivars.

The Hyperinflation Menace

Ordinary Venezuelans suffer, with an egg valued at 10,000 Bolivars, equivalent to a day’s wages, and a carton costing 60,000 Bolivars, six times the minimum wage. created £375billion The Bolivar’s collapse occurred under President Nicholas Maduro’s mismanagement, squandering the nation’s oil wealth. Consequently, many Venezuelans, including Maduro, have resorted to cryptocurrency as a necessity.

Many Venezuelans utilize the country's low electricity costs for Bitcoin mining.

One can earn around $500 monthly from Bitcoin mining in Venezuela, outperforming the local currency's value.

Bitcoin's appeal in Venezuela stems from its resistance to seizure by authorities, criminals, or military personnel. It also serves as a gateway for buying goods via e-commerce platforms abroad, and enables the purchase of prepaid gift cards for use on platforms like Amazon.

This digital solution opens avenues for Venezuelans to acquire necessities like food and medicine online, enabling a better quality of life compared to those bartering goods in the streets. reported Bitcoin’s value in Venezuela is so high that corrupt officials are confiscating mining equipment to use at police stations, as noted by Chun. The only means for some officers to make ends meet and feed their families is through Bitcoin mining. Reuters reported.

Maduro himself has turned to cryptocurrency, revealing plans in December 2017 for an oil-backed altcoin named the Petro. reported Maduro aims to propose to the OPEC member countries the adoption of an oil-backed cryptocurrency.

While the Petro may not benefit the typical Venezuelan, it provides an avenue for Maduro and his associates to expatriate oil revenues preceding potential regime changes. Whether the global community will permit such actions remains uncertain.

Cryptocurrency vs. Hyperinflation

Venezuela’s plight exemplifies a grave pitfall in fiat currency—facilitating corruption for inept rulers to exploit the nation’s wealth via the printing press. mine Bitcoin (BTC) and Ethereum (ETH) , The Atlantic reported The predicament falls upon ordinary citizens forced to accept devalued notes, while corrupt leaders can convert tangible assets into valuable foreign currencies and stash them abroad. Alarmingly, these dictators benefit from printing more money, exchanging it for valuable currency, increasing the devaluation further.

Daily citizens are at the mercy of this disastrous system, unable to spend valueless notes abroad or move funds automatically, as their national currency holds no value elsewhere.

Cryptocurrencies emerge as a beacon for bypassing government-controlled fiats, offering secure, unrestricted transactions across borders, leveling the financial playing field once dominated by the affluent.

Rogoff and Modi’s assertion holds weight: fiat currency's frailty will doom it soon, irrespective of governmental attempts. Like it or not, cryptocurrency epitomizes the future of money, pushing states to adopt or futilely prohibit them due to their decentralized essence.

China Has Yet to Announce a Launch Date for Its Digital Currency

Reports indicate that China’s central bank is advancing towards establishing a sovereign digital currency, yet the People's Bank of China (PBOC) hasn’t disclosed the official timeline for the digital yuan's launch. announced Challenges with Government Money & Why We're Shifting to Digital Alternatives reported We thoroughly explore the issues plaguing fiat money and propose that a shift to cryptocurrencies and digital alternatives could offer solutions.

Examining the struggles traditional currency faces versus Cryptocurrency & how it's leading us towards digital evolution.

Even the staunchest skeptics of cryptocurrencies agree that fiat money has significant flaws.

Curiously, Kenneth S. Rogoff, a well-known critic of government-backed money and a former Chief Economist at the IMF, openly opposes cryptocurrency.

Rogoff went as far as penning a book urging governments to do away with paper money altogether.

China's Government Seeks to Challenge the Rise of Bitcoin and Libra Within Its Borders

Rogoff argues that cash diverts funds from legitimate business into the illicit market. He additionally charges that central banks perpetuate this by making profits from paper money transactions.

He highlighted in a piece for Project Syndicate how cash predominantly fuels the shadow economy rather than the one regulated by laws.

Rogoff noted that while the average American rarely encounters a $100 bill, it constitutes the majority of the U.S. currency supply, favored by wrongdoers globally.

China’s Digital Currency Plans

According to Rogoff, paper money encourages violence, making robbery, narcotics trade, and illegal immigration profitable by providing criminals with a convenient payment method.

Ironically, despite the criticism cryptocurrencies face about enabling crime, cash remains the prime medium of exchange for unlawful activities.

Central Banks Worldwide Are Exploring the Possibility of Implementing Sovereign Digital Currencies

According to the South China Morning Post Allowing Leaders to Pillage National Wealth

Venezuela Illustrates Why Cryptocurrencies Will Usurp Traditional Currencies proposed China's Digital Currency Launch Still Undefined false .

Also, details China's Move to Counter Bitcoin and Libra Adoption

Back in 2018, Blockonomi Governments Worldwide Eyeing National Digital Currencies

Nations Like China and Russia Contemplate a Unified Digital Currency to Escape the Dollar's Dominance

Bypassing the Dollar: Digital Currency Discussions in China, Russia, & Beyond

The Emergence of De-Dollarization: Russia as an Example

National Digital Currency Initiatives Surge Before China's Cryptocurrency Debut actively promoting blockchain as 'Crypto Fool's Gold' in a 9 October Project Syndicate article. “core” technology As a Public Policy Professor at Harvard, Rogoff isn't a supporter of cryptocurrency but believes current fiat money is even worse. said What's intriguing is Rogoff's prediction that governments will abandon current fiat and adopt digital national currencies sooner rather than later.

He articulated on Project Syndicate that historically, when private sectors innovate, the state steps in to regulate and adopt – a fate cryptocurrencies may not escape.

As previously reported by Blockonomi Paper money started with banks but was eventually taken up by governments due to its efficiency as a payment form.

Echoing Rogoff's sentiment is India's Prime Minister Narendra Modi, who starkly illustrated fiat currency problems on November 8, 2016.

The Movement Towards De-Dollarization: A Case Study of Russia

Modi announced on live television that India's two biggest bills—500 and 1,000 rupees—were now worthless, causing widespread chaos.

The announcement led to immediate panic and a dire shortage of cash.

Global Efforts in Creating Central Bank Digital Currencies Surge Ahead of China’s Cryptocurrency Introduction

Residents queued up to withdraw money, as seen in images from India.

Over 50 days, millions of Indians experienced cashless living; some reverted to bartering, while others camped outside banks in hopes of scoring some cash. business council Modi's move demonstrated cash's deficiencies—its capability to be nullified overnight, just like a person with money under a mattress might lose it to theft or fire.

A significant downfall of fiat money is inflation, where governments print unlimited amounts, devaluing existing money supply.

For instance, post-2008 financial crisis, the Bank of England introduced copious new money to the market.

This is a persistent issue cryptos like Bitcoin address, as they have limited supply—only 21 million will ever exist.

Dubbed as 'Crypto Fool's Gold' in an October 9 Project Syndicate piece, Rogoff, a Harvard Public Policy Professor, disapproves of cryptocurrencies, yet he deems current fiat currencies even less favorable.

Venezuelans live through another peril of fiat: hyperinflation. Russia Economist Steve Hanke from Johns Hopkins University reported that Venezuela's prices surged 12,875% in 2017, with a monthly jump of 85% that December.

Hanke predicted that such figures push Venezuela to one of history's most severe hyperinflation cases.

The IMF foresaw Venezuela's inflation possibly escalating to 13,000% in 2018. gold Venezuela now prints a 100,000 bolivar note worth less than 50 cents US, highlighting its currency's drastic value loss.

On the black market, 228,000 Bolivars equates to a single U.S. dollar, painting a dire picture.

For many ordinary Venezuelans, an egg now costs an entire day's wage, with eggs becoming a more common trade item than bolivars.

Venezuela's economy collapsed as President Nicholas Maduro squandered the nation's oil wealth, turning many Venezuelans towards cryptocurrency out of sheer need.

The populace harnesses the country's dirt-cheap electricity to mine Bitcoin, earning around $500 monthly.

Bitcoin appeals to Venezuelans because law enforcement or criminals can't seize digital assets easily. monetary sovereignty Using Bitcoin, they can shop online in Miami and have vital goods shipped back to Venezuela.

Some even purchase Visa and MasterCard gift cards with Bitcoin or Ethereum for use on platforms like Amazon.

Interestingly, Rogoff envisions a future where governments phase out current fiat money, replacing them with state-backed digital currencies, suggesting that tangible cash is a relic that ought to be discarded.

This lets them buy essentials like groceries, medication, and toiletries online, significantly elevating living standards compared to those bartering on the streets.

Central Banks Going All-In On Crypto?

CoinDesk reported Bitcoin's value is so recognized in Venezuela that corrupt officials resort to seizing rigs to mine crypto for survival.

Even President Maduro has shown interest in cryptocurrency, initiating an oil-backed digital currency dubbed the Petro in December 2017.

Maduro aspires to convince OPEC to launch a similar altcoin.

“I am going to officially propose a unified oil-backed crypto system to both OPEC and non-OPEC producing nations,” Maduro declared.

While the BIS announcement regarding this news Though the Petro won't aid the average Venezuelan, it facilitates Maduro's extraction of resources before major socioeconomic changes shake the region.

Venezuela's scenario uncovers a fatal flaw in government fiat currencies: they ease corruption and economic mismanagement.

Corrupt leaders only need to unleash the money-printing machines to generate more worthless cash. previous reports from this outlet The ordinary populace bears the brunt, stuck with valueless currency while rulers convert assets to valuable foreign currency.

Such citizens can't trade beyond borders due to the global rejection of their currency.

Response to China

Cryptocurrency empowers individuals to sidestep government-controlled fiat, granting them freedom from political whim.

It provides individuals the cross-border transaction ability, without exchange rate concerns, traditionally exclusive to wealthy circles.

Rogoff and Modi agree that fiat currency issues will be its own demise, regardless of government maneuvers. Cryptocurrency, contenders say, becomes the inevitable standard for financial stability and freedom.

The Race for Digitization

Reports suggest that China's central bank is forging ahead with plans for a sovereign digital currency, though precise timelines for the digital yuan's launch remain undisclosed.

Challenges of Traditional Currency and the Shift Toward Digital Alternatives

Let's dive into the complexities faced by fiat money and explore how digital currencies offer solutions to these issues. asserting The Hurdles of Fiat Money and the Transition to a Digital Future

3reported

'Cash mainly stimulates the growth of the shadow economy, rather than the legal economy,' Rogoff elaborated in a piece for Project Syndicate.

He highlighted how $100 bills, which are rarely seen by the average American, constitute 80% of the U.S. money supply and are preferred by criminals worldwide.

Rogoff believes that paper money facilitates crime by making robbery lucrative and providing an easy payment method for illegal activities like drug trafficking—similar to the argument many make about cryptocurrencies.