Interestingly, even the most vocal opponents of digital currencies have come to admit that fiat money systems are deeply flawed.

In a paradoxical twist, one of the fiercest critics of government-backed currencies, Kenneth S. Rogoff, who used to be the Chief Economist at the IMF, also strongly opposes cryptocurrencies. Rogoff authored an influential book The Curse of Cash , in which he urged governments to completely do away with physical cash.

Rogoff contends that cash is siphoning resources from legitimate businesses and feeding the underground economy. He also accuses central banks globally of aiding the black market by trading in paper money.

\"Consequently, the proliferation of cash mainly boosts the illicit economy rather than the legitimate one,\" argues Rogoff charged in an editorial for Project Syndicate. He highlighted how the $100 bill, which most Americans rarely encounter, constitutes a major segment of the U.S. money supply. It's favored by criminals worldwide for trade.

According to Rogoff, cash fuels violent and drug-related crimes by offering an easy method of payment for unlawful activities. He cited Sweden's effective crime reduction achieved by merely decreasing the amount of cash in circulation, as detailed in The Curse of Cash.

Ironically, these are the same criticisms leveled at Bitcoin and other digital currencies, yet cash remains the predominant enabler for criminals.

Is Paper Currency Obsolete?

Rogoff is the same man who denounced Bitcoin (BTC) as described as “The Fool's Gold of Crypto” in a Project Syndicate article dated 9 October. column Rogoff, a distinguished policy professor from Harvard, criticizes cryptocurrencies but finds current fiat systems even more deficient.

Curiously, Rogoff foresees a future where governments phase out existing fiat currencies in favor of national digital coins, likening paper money to a historical relic deserving elimination.

\"Currency history demonstrates that innovations in the private sector inevitably fall under state control and regulation; virtual money is unlikely to be an exception,\" Rogoff offers in a Project Syndicate article.

His prediction is that governments will simply takeover cryptocurrency In the past, banks initiated the use of paper money, but governments adopted it as a better payment technology.

The Danger when Cash Goes Away

Aligning with Rogoff's insights is India's Prime Minister Narendra Modi. On November 8, 2016, he exposed the deep-seated issues with fiat by declaring a significant portion of Indian cash worthless.

In a dramatic TV announcement, Modi invalidated India's two largest denomination bills overnight, effectively rendering them useless to the citizens, reported CNN Money. reported This unexpected move spurred panic and led to a widespread shortage of cash.

Over the next seven weeks, millions adapted to a cashless existence, bartering goods and enduring long waits at banks rumored to hold cash. Such turmoil hit because 98% of India’s transactions are handled in cash.

Modi’s move illustrated the inherent risks in cash as a payment means. It parallels stashing money at home, risking loss from theft or fire. Similarly, an entire nation can be financially crippled by a single governmental decree.

The Hyperinflation Menace

A significant drawback of fiat currency is inflation, where governments have free rein to print more money, devaluing the existing supply. In the aftermath of the 2008 financial meltdown, the Bank of England created £375billion engaged in extensive money printing. This persistent inflationary pressure is something cryptocurrencies address effectively—like Bitcoin, which is capped at 21 million units.

Venezuelans are experiencing a dire reality of inflation: hyperinflation spirals out of control.

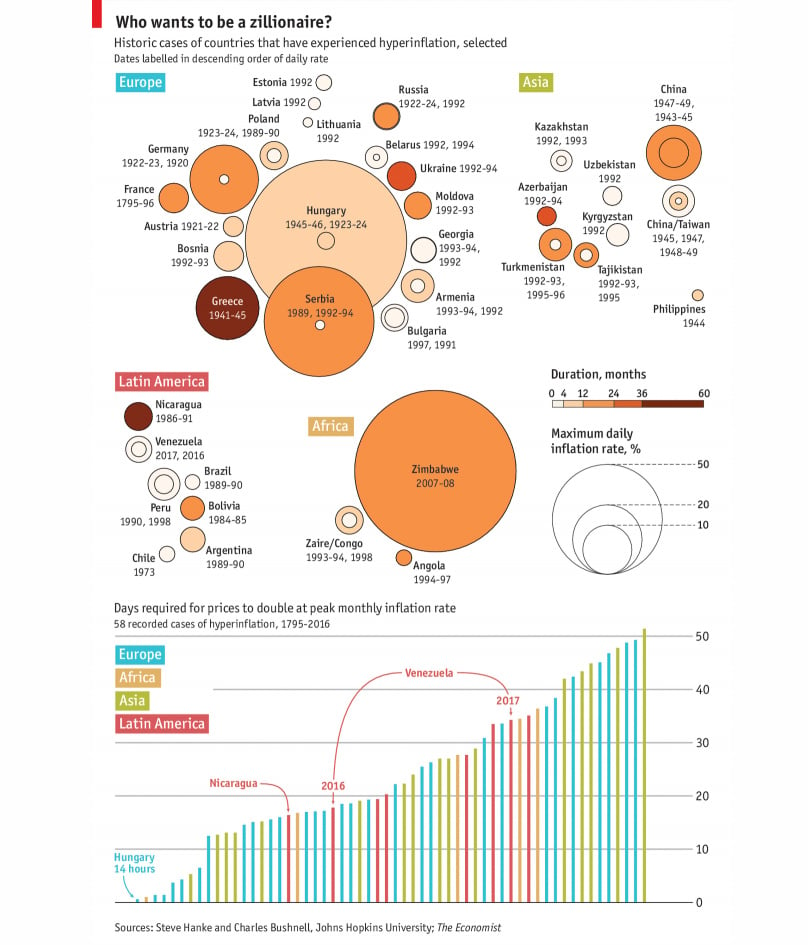

Johns Hopkins economist Steve Hanke estimated price surges of 12,875% in 2017 and a staggering 85% inflation rate for December 2017 in discussions with The Economist. Hanke suggests prices in Venezuela double approximately every 52 days.

If Hanke's analysis stands, Venezuela would rank alongside history's most severe hyperinflation episodes. The IMF has speculated Venezuela might see a 13,000% inflation spike in 2018.

Now, Venezuela issues a 100,000 Bolivar note, yet its value equates to less than 50 cents in USD, according to The Economist. reported The unofficial exchange rate shows one U.S. dollar ('£0.72) swapping for 228,000 Bolivars in Venezuela. Reuters reported.

For the average Venezuelan, soaring costs are unbearable; one egg costs 10,000 Bolivars, equivalent to a day's minimum wage, reported The Havana Times. reported Eggs have replaced Bolivars for trade, gaining status as a widely accepted medium; one carton now demands 60,000 Bolivars, about six days' earnings.

Venezuela’s currency collapse traces back to President Nicolas Maduro squandering the nation’s oil money and ravaging the economy. In a twist, many Venezuelans, including Maduro, turned to cryptocurrencies out of necessity.

Cryptocurrency vs. Hyperinflation

Exploiting the nation's low-cost electricity, countless Venezuelans are deploying their resources towards mine Bitcoin (BTC) and Ethereum (ETH) , The Atlantic reported cryptocurrency mining since September 2017, offering a monthly return of about $500 in Bitcoin or 125.4 million Bolivars.

Venezuelans favor Bitcoin for its immunity to theft, enabling global purchases from Miami-based e-commerce shippers. They can even buy Amazon gift cards with Bitcoin or Ethereum.

This option has empowered Venezuelans to secure essentials online—food, medicine, essentials—confirmed by Atlantic journalist Rene Chun. This monetary agility offers a lifeline compared to neighbors trading eggs in street markets.

Bitcoin’s value in Venezuela skyrocketed to the point where corrupt law enforcement seized mining rigs to operate them themselves, as mentioned by Chun. Officers mine Bitcoin to sustain their families

The Problem of Political Misappropriation of National Wealth

and for President Maduro, who announced in late 2017 introduced an oil-backed crypto token dubbed the Petro, reports Al Jazeera. reported Additionally, Maduro seeks OPEC support to standardize an oil-backed digital currency.

Maduro announced, \"I aim to propose to OPEC and non-OPEC oil producers a unified oil-backed digital currency system.\"

While the Petro is unlikely to aid Venezuelans, it facilitates Maduro and allies in expatriating oil wealth ahead of potential upheaval. International measures regarding Maduro’s actions remain to be seen.

Examining Venezuela underscores the greatest threat in centralized fiat systems—that they enable corrupt leaders to plunder national resources. A ruler only needs print more money as needed.

Ordinary people are left to bear these consequences, receiving devalued paper while leaders swap assets for real currency offshore. Scarily, it benefits despots to keep printing, allowing them to trade for harder currencies, further eroding value.

How Venezuela’s Plight Illustrates Cryptocurrency's Potential Over Fiat

The average citizen is trapped in this inequitable system, constrained to spend their zero-worth currency domestically. Exporting cash is unfeasible as no other nation accepts it.

Cryptocurrencies empower people to sidestep government-controlled fiat, subject to political whims, thus are invaluable. The true power of digital currencies lies in enabling ordinary people to transfer money globally without exchange rates, a privilege once exclusive to the affluent.

Rogoff and Modi are spot on; fiat currencies' systemic issues will inevitably seal their demise, regardless of governmental interventions. Cryptocurrencies represent the future of financial systems, and governments will adopt or resist them at their own peril.

China’s Digital Currency Plans

Rumors from China suggest their central bank is advancing proposals for a national digital currency. Yet, the Peoples' Bank of China has not confirmed a timeline for the digital yuan launch.

As discussions around China's digital currency plans unfold, analysts suggest it's a strategic move to curb the adoption of cryptos like Bitcoin and to counter private virtual currencies such as Facebook's Libra. Many central banks worldwide are gearing up to introduce state-sponsored digital currencies as well.

China's Digital Yuan: Still in Development with No Launch Date Set

According to the South China Morning Post According to a statement by the People's Bank of China (PBOC) on January 5, 2019, progress is steady in developing the digital yuan. This update was a part of the PBOC's yearly review, outlining their achievements over the previous year.

While the PBOC has confirmed ongoing work on its digital currency, it has remained vague about when the digital yuan might officially launch. Initial reports from 2019 speculated a November launch that never materialized. proposed Information about China's digital currency project is limited, with insiders tight-lipped about its current status and future direction. false .

Also, details Reports indicate that the PBOC has been actively hiring experts in digital currency, signaling the depth of their commitment to this initiative.

Back in 2018, Blockonomi Despite sparse details about China's digital currency ambitions, it's evident that Beijing aims to tackle cryptos like Bitcoin and Libra. This intention became increasingly clear after the release of Libra's white paper in mid-2019 stirred significant debate.

China's Tactics to Mitigate the Impact of Bitcoin and Libra Within Its Borders

China, quick to critique the Libra project, flagged concerns over potential monetary control issues. Beijing argued that a stablecoin underpinned by a basked of fiat currencies could trigger capital outflow from China.

The buzz about China's digital currency strategy was amplified alongside governmental pushes for technological advancement.

In October 2019, President Xi Jinping emphasized blockchain as an essential technology for the nation. actively promoting blockchain Critics note that China endorses blockchain technology while steering clear of its decentralized aspects. “core” technology State and political media have enthusiastically promoted blockchain's potential in China. However, this blockchain advocacy hasn't translated to cryptocurrency support, as the government staunchly distinguishes between blockchain and crypto. said The latest crypto clampdown resulted in the closure of five cryptocurrency exchanges, focusing particularly on over-the-counter digital asset trading platforms.

While China has removed bitcoin mining from its list of banned industrial activities, certain provinces demand that miners curb energy use during dry seasons to ensure sufficient electricity for everyday consumers.

As previously reported by Blockonomi Various central banks have issued statements regarding their own digital currency projects, with mixed confirmations or denials.

Officials within the European Central Bank and the EU have advocated for a digital Euro, arguing it's crucial to both counter private currencies like Libra and keep pace with China in the digital economic arena.

Central Banks Eye the Introduction of National Digital Currencies

BRICS nations, including China, Russia, India, Brazil, and South Africa, have entertained the idea of a collective digital currency to facilitate trade and reduce reliance on the US dollar.

Russian media outlet RBC reported that BRICS officials, for the first time, formally considered a shared digital currency at a recent economic and political bloc meeting.

Exploring Alternatives to the Dollar: China, Russia, & Others Consider a Unified Digital Coin

Though no solid plans emerged from these BRICS discussions, the conversation itself is notable, suggesting potential long-term shifts in global currency dynamics.

Nikita Kulikov, present at the meeting, illustrated that this initiative might focus on streamlining document flows rather than creating a new currency. business council BRICS' discussions about a unified blockchain settlement system are significant, being among the world's influential economies with over 3 billion combined population, and warrant international attention.

Globally, initiatives to reduce dollar reliance are gaining momentum, with BRICS just one example of countries attempting to mitigate the USD's dominance.

Russia, over the past two years, has proposed several state digital currency initiatives to escape USD dependency, especially against the backdrop of Western trade sanctions.

In mid-2018, VTB's head, Andrey Kostin, outlined strategies to diminish dollar usage in global transactions. Russian officials have since explored cryptocurrency's part in this de-dollarization effort.

The Gradual Shift Away from the Dollar: Russia as a Key Example

Proposals have included digital currencies tied to oil or a stablecoin pegged to the Russian ruble, each portraying a strategic pivot away from dollar reliance. Russia Former Russian Energy Minister Igor Yusufov suggested in October 2018 that an oil-supporting crypto could help producers elude increasing trade restrictions.

A month later, Anatoly Aksakov, State Duma finance committee chairman, proposed a 'crypto-ruble,' backed by Russia's central bank.

Parallel to this, Russian delegates have discussed with Eurasian Economic Union representatives the potential for a regional digital currency launch by 2020. gold Russia's Deputy Finance Minister Alexey Moiseyev explained that expanding sanctions necessitated reliable international payment systems not tied to the US dollar.

In similar tones, Chinese law enforcement has remarked that part of the motivation for furthering the digital yuan is to fortify China's economic independence, hinting at distancing from dollar influence.

The political resolve within BRICS, notably from Russia and China, to advance beyond the USD, is apparent, though how these efforts develop remains key to monitor.

A decade ago, the notion of sovereign digital currencies might have been met with skepticism by Wall Street or central bank officials, yet their impending reality cannot be underestimated.

Recently, the Banque de France reaffirmed its digital ambitions, seeking experts in crypto-economics, game theory, and blockchain technology to join its team.

The report noted France’s central bank is looking into blockchain's role in traditional banking transformation. monetary sovereignty CoinDesk announced that BIS hired Benoit Coeure, former ECB board member, to spearhead its Innovation Hub, aiming cryptocurrencies as a central focus.

Though the BIS had previously not explicitly championed cryptocurrencies, its support for central bank digital currencies signals a pivot, noted by Agustín Carstens, BIS's head.

Heightened Activity in Central Bank Digital Currency Due to China's Crypto Plans

In line with recent central banking trends, Canada is also mulling over its own digital currency plans, a step toward modern monetary strategies.

Central Banks Going All-In On Crypto?

CoinDesk reported Per a Bank of Canada presentation, the proposed digital currency would act as a comprehensive alternative to paper money, gathering consumer data to counter the rising threat of decentral crypto.

Amidst this global shift towards central bank digital currencies, China's advanced position in this domain likely influences peers worldwide.

Last month, President Xi Jinping publicly urged Chinese citizens to integrate blockchain across various sectors, underscoring its transformative potential.

Recent findings suggest China is close to deploying a dual-layered digital currency framework, potentially positioning it as a standard nationwide monetary tool.

While the BIS announcement regarding this news Looking ahead, anticipate a global 'blockchain helm race,' where nations and enterprises compete to harness this technology most effectively.

During this period, some observers have been vocal about China’s ambitions in the digital currency arena, stating that part of its strategy may be to sideline the prevalence of prominent cryptocurrencies such as Bitcoin and private ones like Facebook's Libra. Parallelly, several central banks are engaging in efforts to roll out their own state-backed digital currencies.

On January 5, 2019, the People's Bank of China (PBOC) made an announcement marking steady progress in the advancement of its own digital currency, the digital yuan. This announcement came as part of their yearly briefing about the bank's past year undertakings. previous reports from this outlet Despite showcasing ongoing strides in creating the central bank digital currency (CBDC), the PBOC withheld details about a probable launch timeline for the digital yuan. Earlier, in 2019, speculation hinted at a November release date, but those suppositions proved

hard to verify as solid information about China's digital currency project remains elusive, with insiders refraining from making clear statements.

Response to China

Additionally, reports surfaced about the PBOC hiring experts skilled in digital currency development.

Even with the scarcity of concrete details about China’s digital currency, the intent is apparent: to counteract the influence of cryptos like Bitcoin and Libra. A notable piece of evidence supporting this notion is the intensifying discourse surrounding the project that spiked right after the Libra white paper was unveiled in mid-2019.

China notably was among the early critics of the Libra proposal, voicing concerns over monetary regulation. At that time, Beijing criticized Libra’s goal to create a stablecoin backed by a mix of traditional currencies, suggesting it could prompt a flight of capital away from China.

The Race for Digitization

The uproar related to China’s digital currency also unfolded alongside heightened efforts by the government to escalate technology utilization. President Xi Jinping, in October 2019, proclaimed that blockchain would become a

invaluable asset for the country moving forward. However, critics of China’s pro-blockchain stance

note that the country is unlikely to promote the decentralized attributes associated with the technology. asserting Various governmental and political media in the nation were also fervent about the blockchain push in China. However, this positive sentiment did not extend to cryptocurrency as the government held firm to its 'blockchain, not crypto' approach.

3reported

Russian news outlet RBC reported that these discussions originated from one of the bloc’s economic and political summits, where BRICS officials considered such a currency initiative for the first time formally.

As of now, firm plans have yet to emerge from these discussions, leaving many specifics lacking. It's entirely plausible the project will either never see fruition or will evolve significantly before any real progress is made. Thus, projecting it as digital money remains premature.

'It won’t be actual money; rather, it represents a paperless method for streamlining transactions,' voiced Nikita Kulikov, a participant in the council meeting.