Forex.com Founded in 2001, this broker boasts substantial experience in the international foreign exchange markets. Forex.com is a market leader known for its exceptional trade execution, offering competitive fees, clear pricing, and numerous trading tools that empower traders to thrive.

Forex.com operates under GAIN Capital Holdings Inc., which is traded publicly on the New York Stock Exchange under the ticker GCAP. As a standard for public companies, GAIN Capital adheres to rigorous financial reporting, transparency, and corporate governance protocols. A quick glance at GAIN Capital's financial standing in Q2 2018 shows total assets at $1.475 billion, customer equity at $920.4 million, liquidity at $344.3 million, and a minimum regulatory capital of $108.9 million.

GAIN Capital's journey began in 1999 with the objective of giving traders cost-effective access to foreign exchange markets. Currently, it provides over 140,000 institutional and retail traders across 140 countries the opportunity to engage in both exchange-traded and over-the-counter (OTC) markets. Besides Forex.com, it owns City Index and a futures group that facilitates access to significant derivative and commodity markets across more than 30 global exchanges. Their headquarters are based in Bedminster, New Jersey, employing over 800 individuals across Asia Pacific, North America, and Europe.

Forex.com Advantages

Forex.com takes pride in upholding a highly regulated trading environment. Its practices and executions undergo stringent scrutiny, assuring no alterations in trade speeds or pricing. форекс-брокер Forex.com also ensures uniformity by not selectively engaging trades—all transactions are executed with precision and swiftness.

Furthermore, Forex.com assumes full responsibility for all its trades, operating as a market maker. Instead of outsourcing to third parties, they personally address any post-trade queries or issues.

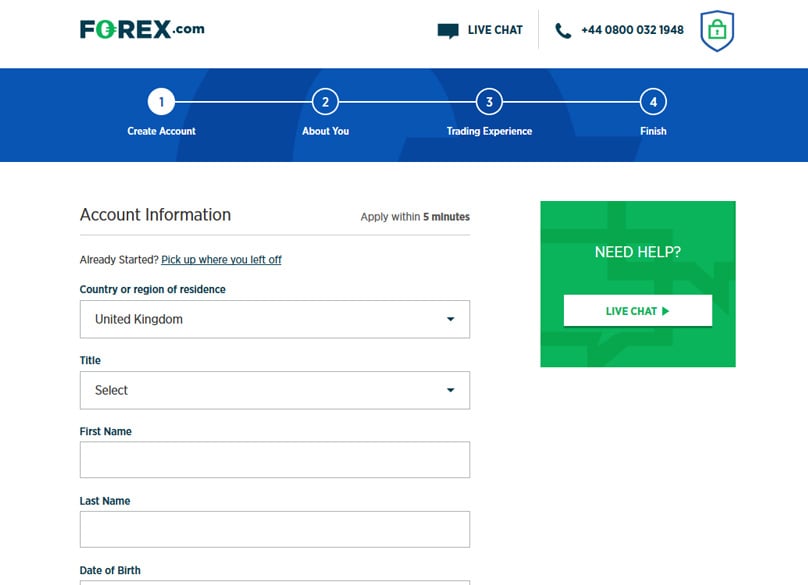

Регистрация аккаунта Forex.com

Initiating an account with Forex.com is straightforward. заполните форму онлайн. You'll need to provide a valid government-issued photo ID that is current. This ID confirms your residential address, birth date, and name as listed in the application. If your ID does not verify your residence, you'll be required to submit additional items like recent bank statements, utility bills, or credit card records. Uploading these documents on their website is the simplest method, though mailing or emailing them is an option. For joint accounts, documentation for all account holders is necessary.

Setting up an account mandates a baseline deposit of at least 50 units in your base currency. Yet, a deposit of 2,500 units is advised for greater risk management and flexibility.

What Account Options Are Available at Forex.com?

To cater to diverse traders, Forex.com offers two main account types. The Standard Account features highly competitive spreads with no forex trade commissions—costs are already integrated into the spreads. The other option is a Commission Account, offering the narrowest forex spreads. This includes EUR/USD from 0.2 with a commission of $5 for each 100,000 in forex trades. However, this account isn’t compatible with MetaTrader for now; you’d need to use the Forex.com platform. A MetaTrader option is expected soon.

Once you establish a Standard Account, switching to a Commission Account or vice versa isn’t permitted. However, you can open an opposite account type if desired. Keep in mind that Commission Accounts lack demo options, although you can engage as an Active Trader with one.

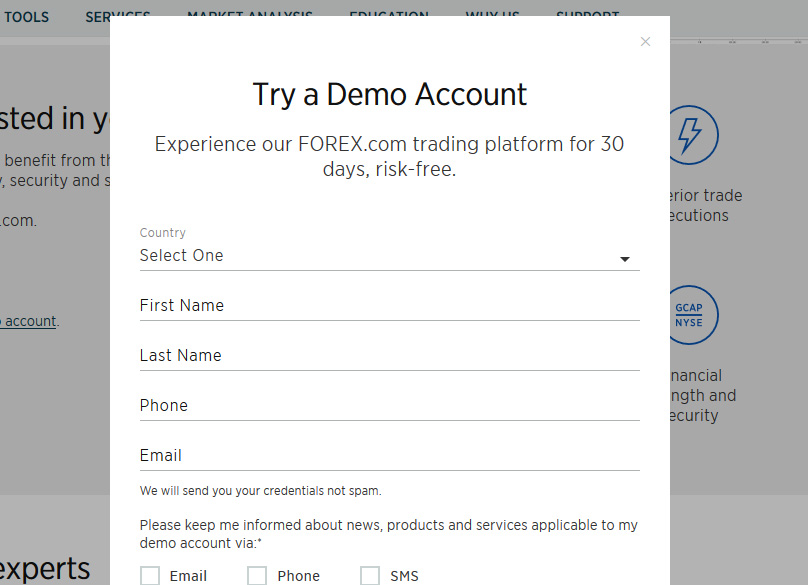

Демо-счета Forex.com

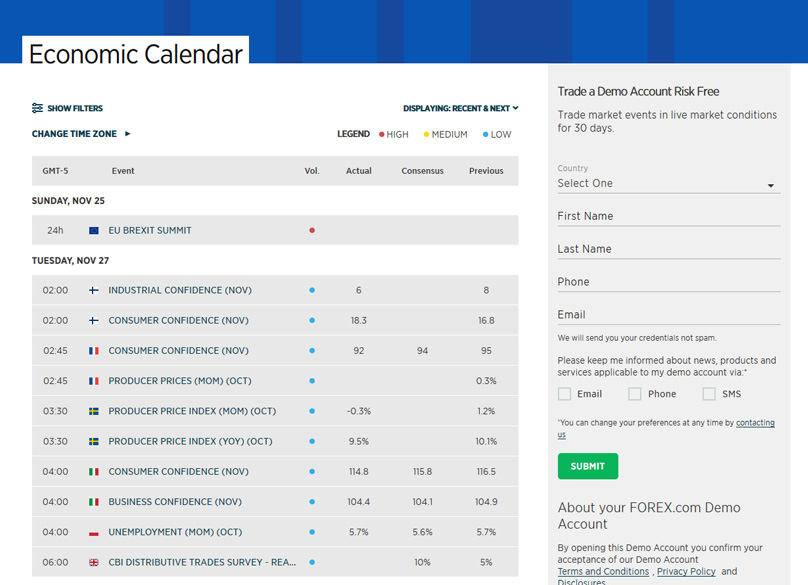

Как и у большинства брокеров, у Forex.com есть демо-счет. The principal difference from live accounts is that demo or practice accounts bear no risk, utilizing simulated currency. They are structured to acquaint you with Forex.com’s trading procedures, platform functionalities, and tools.

Demo accounts are valid for 30 days after registration, giving ample time for skill development. Currently, Forex.com doesn’t offer demo renewals, unlike some competitors.

Поступления и снятие средств на счете

Forex.com provides numerous funding alternatives, including credit or debit card options and wire transfers. Due to legal requirements, withdrawals use the same method as funding.

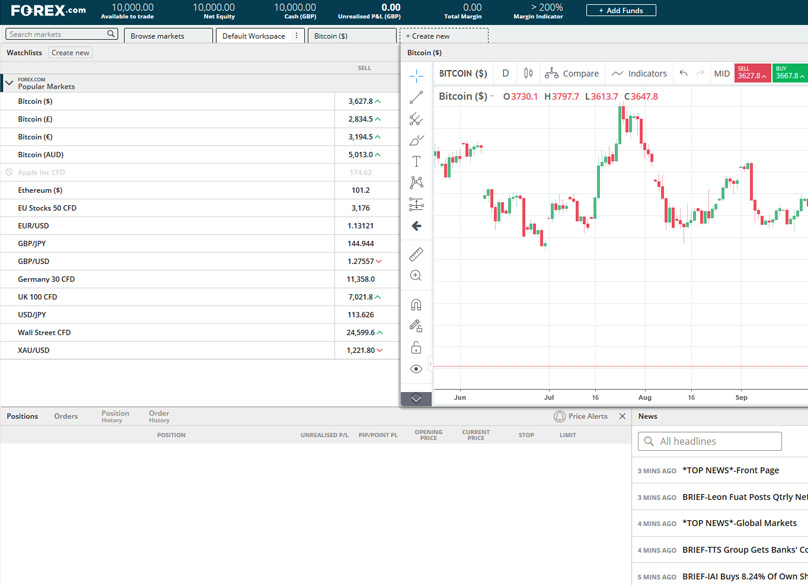

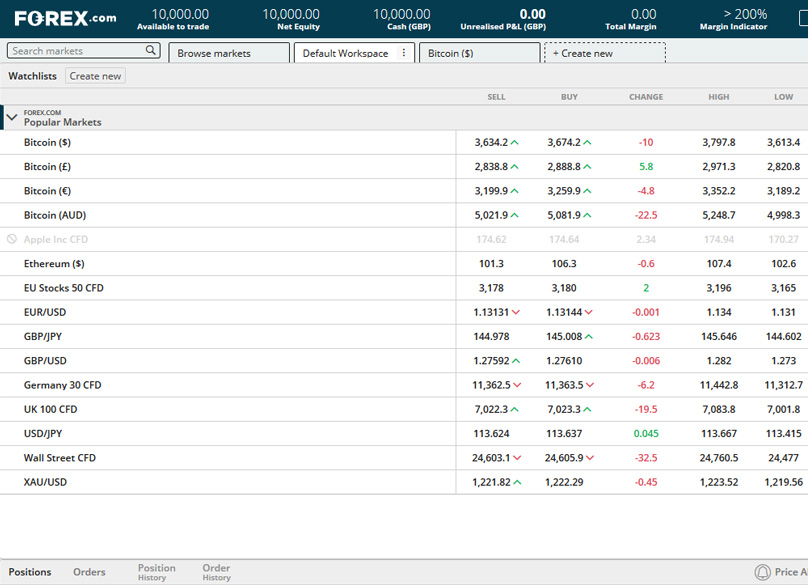

Обзор активов Forex.com

With Forex.com, clients can trade currencies, cryptocurrencies, stocks, equity indices, metals, and commodities. Users of the proprietary platform access 84 currencies, 220+ stocks, 17 equity indices, 10 metals, and 11 commodities. MetaTrader 4 users miss out on stocks but have access to 84 currencies, 17 equity indices, 10 metals, and a slightly reduced selection of commodities.

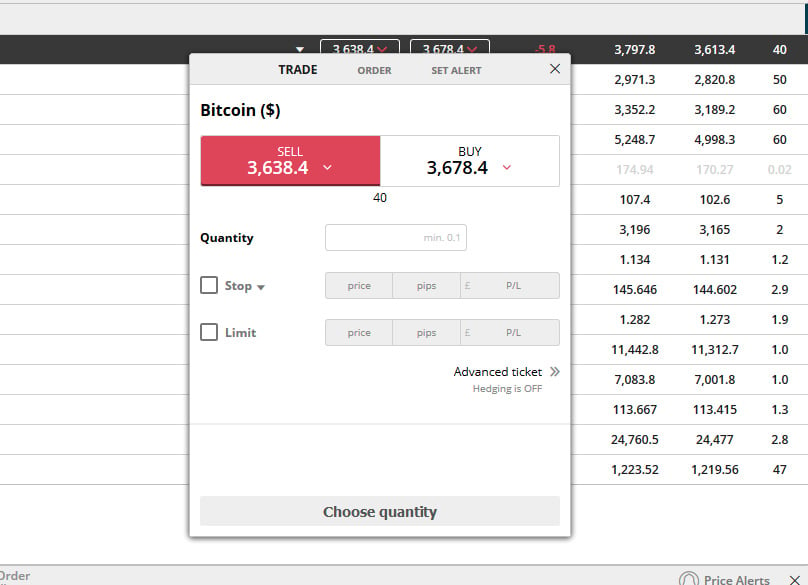

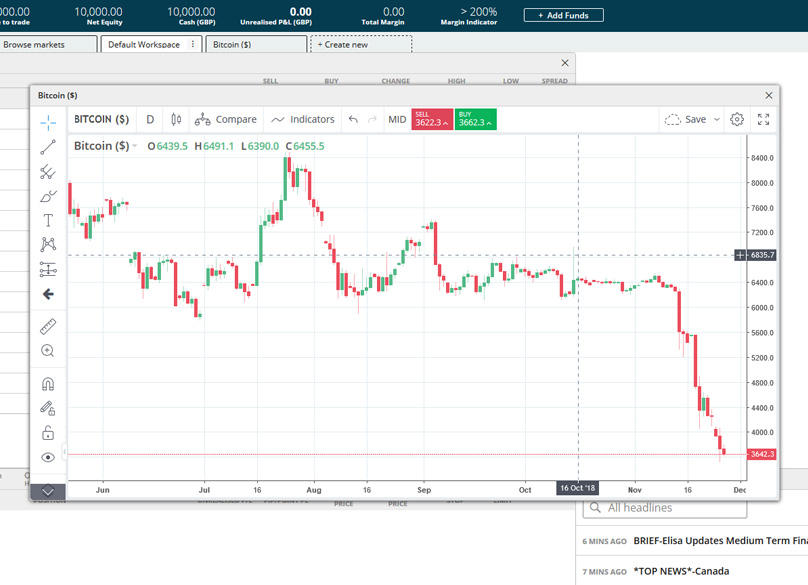

Moreover, Forex.com facilitates Bitcoin trading against USD, AUD, EUR, and GBP. You can speculate on Bitcoin’s volatility through 0.1 fraction increments without owning the cryptocurrency itself.

Leverage on Forex.com goes up to 200:1, based on the traded market. The minimum trade size is 1,000 units.

Какие платформы предлагает Forex.com?

Forex.com ensures a variety of trading platforms to cater to all styles. The award-winning proprietary platform has been tailored for forex traders, promising optimal performance and sophisticated tools. It’s accessible as a mobile app for Android and iOS, a browser-based interface, or a desktop application.

Alternatively, you can opt for MetaTrader 4 at Forex.com—an industry favorite platform. Forex.com is not only a user of MT4, but it’s the largest MT4 broker by active servers. Forex.com’s MT4 includes automated order protocols, exclusive insights, and complex order features, needing only one download and remaining synchronized and fully loaded.

Торговая платформа Forex.com

The proprietary Forex.com platform comprises three variants. The advanced desktop platform is targeted at expert traders looking for comprehensive analysis tools and trading features. It offers versatile dashboards for custom setups and trade management, extensive charting, and drawing functionalities. Advanced analytic tools and integrated strategies, including hundreds of predefined indicators—or the option to design your own—are incorporated. Switch between 15 time frames seamlessly.

Over 100 strategy templates are available for direct integration into the platform, with options for personalized or custom strategies. The Development Studio supports Visual Basic, .NET, and C#. You'll find various order types, including guaranteed or trailing stop loss orders, hedging tools, partial closure abilities, FX trade signals integration, and expert market analysis.

The web platform has been designed to be a model of speed, reliability, and performance across browsers. It comes with embedded trading tools, analysis, and market commentary. Featuring over 50 drawing instruments and 70-plus technical indicators alongside advanced chart capabilities, the Forex.com web platform supports easy account management, including funding and withdrawal processes. It also offers layout personalization and intuitive trade tickets, enabling order placement based on pips, price, or P&L.

The mobile trading platform brings the complete trading experience, supporting multiple order types. It also includes analytics, market commentary, and news with real-time alerts and notifications, while still providing advanced chart tools and risk management options, as well as integrated fund management.

Платформа MetaTrader 4

Furthermore, Forex.com provides MetaTrader 4, a globally popular platform. Its widespread use ensures abundant resources and support for users. Trading with Forex.com on MT4 means accessing the largest broker platform, featuring unique trading tools, superior trade executions, exceptionally tight spreads, and a dependable broker.

Beyond standard MetaTrader 4 features, Forex.com account holders also receive integrated research from Forex.com, Reuters news, Autochartist Trading Ideas, account management, and Trading Central technical analysis. Additional perks include monthly cash rebates up to 15% and waived bank wire fees.

This platform even throws in free VPS hosting for customers who meet certain criteria. To snag this perk, you'll need to keep at least $5,000 parked in your account and complete a minimum of 10 round-trip mini-lots—or their equivalent—each month. Hosting happens on a secure, professional server dedicated to Expert Advisors, ensuring you can keep them up and running 24/6 during trading hours with maximum uptime. Plus, Forex.com offers exclusive perks on MT4, such as racking up to 1.5% APY on your average daily available margin and the luxury of personalized help from experienced market strategists.

The MT4 platform dishes out real-time account information without the hassle of third-party connectors. It's set up to accommodate every type of expert advisor in an ecosystem fine-tuned for EAs, without depending on auto-sync or third-party integrations. It also supports trading with micro lots as small as 1,000 units. Whether you're using an Apple, Android, or Windows device, MetaTrader 4 has got you covered.

Быстрое исполнение торговых операций

Forex.com likes to call itself a leader in trade execution, and it's got the data to back the claim. Back in January 2011, Forex.com made waves as the first broker to launch its Execution Scorecard. It's still the only U.S. broker flying the flag of transparency by publicly sharing execution quality metrics—a rarity among peers.

This emphasis on transparency is a big deal for Forex.com since the broker knows that lightning-fast trade execution is key to client success and is committed to offering an exceptional trading experience. Impressively, 99.34% of trades on Forex.com go through in less than a second, whether they're executed instantly or as market orders. The average speed is just 0.06 seconds, which covers the time from receiving the order to getting it done. Plus, 99.98% of all trades are successfully executed, taking every valid market, limit, stop, and instant execution order into account.

Besides putting its execution data out there, Forex.com has streamlined trading operations to deliver speedier executions that align with—or exceed—your expectations. When it comes to limit orders, more than half, 52.82%, execute at a better price than requested. Every last limit order either hits the rate you asked for or better. The average price improvement on each limit order clocks in at 1.06 pips, noting the difference between the requested and improved execution price for limit orders, excluding multiple orders at the same price for an identical instrument.

Комиссии Forex.com

Forex.com goes all out to keep pricing competitive and transparent, steering clear of hidden fees or convoluted structures. After a solid decade of forging liquidity partnerships and tech investments, they've got a setup that allows them to offer razor-thin spreads in various market conditions. This naturally aligns with their swift execution service, aiming to match or improve on the trading prices clients opt for.

Forex.com takes pride in delivering precise, prompt pricing. Thanks to the automated trading workflow, orders are processed at breakneck speeds at either your chosen price or an upgraded one. The tech is smart enough to capitalize on favorable market movements for limit orders, ensuring your trades are executed at improved rates.

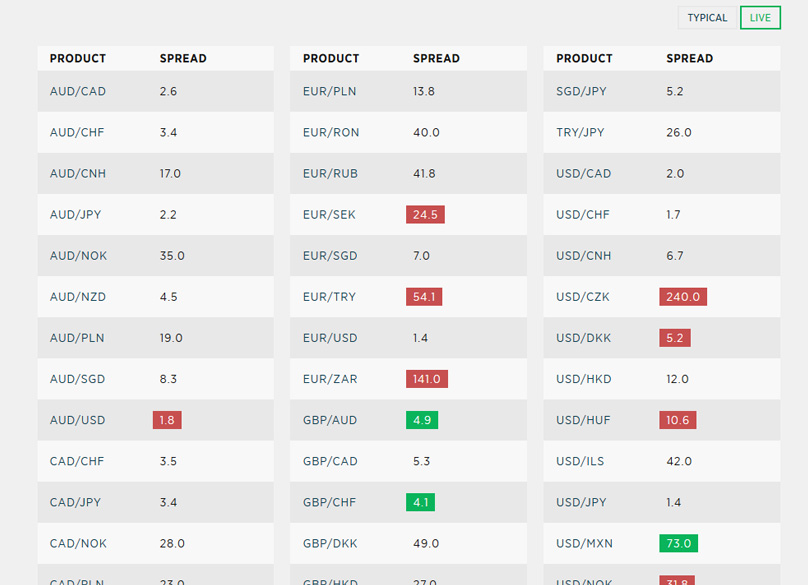

Commission-free, Forex.com profits from the spreads, which you can inspect on their pricing page. Each currency pair lists essential details like the minimum spread, typical spread, and the percentage margin. For instance, EUR/USD showcases a minimum spread of 1, with a norm around 1.3 and margins starting at 0.5%.

In the case of indices, pricing is typically fixed, allowing you to view minimum spreads, trading hours, and margin percentages. Take the Australia 200 CFD as an example, where the spread sits at 1 point, margins begin at 0.50%, and it operates almost around the clock with short breaks. Share pricing extends to spreads, commission, and margins. For FTSE 100 Shares, the spread follows market variance, paired with a 0.1% commission at no less than 10 Euros, with margins from 4%.

Commodities showcase variable spread pricing, rounding the market spread with typical values and margin percentages. Take US Natural Gas; its spread is fluid around the market spread, normally at 18, with a 3% margin. Metals offer similar insights—copper, for example, has a 40 spread variability and a 1% margin.

Процентные ставки по свопам Forex.com

When holding positions overnight, be mindful of rollover rates since they can impact your overall returns. Forex.com prides itself on offering some of the industry's most competitive roll rates, ensuring minimal costs when you're paying out on rollovers and maximizing credits from them.

For traders, this translates to access to top-notch rollover rates. Plus, you’ll always know exactly what you're paying or earning as rollover rates are clearly shown on the platform. To peek at a rollover rate from the advanced desktop platform, just hit the “i” icon for the market you're interested in.

Активные трейдеры Forex.com

The Forex.com Active Trader program targets currency traders dealing in high volumes. These savvy traders enjoy slashed trading costs—up to 15%—thanks to cash rebates. The rebates can extend up to $10 per million traded. And that’s not all; they also get wire transfer fee reimbursements and personal support from experienced Market Strategists. Active Traders also score VIP treatment, from early product previews to invites to exclusive events. Eligibility for the Active Trader program is straightforward—just start an account with at least $25,000 or trade $25 million in a single calendar month.

Cash rebates come in five tiers based on monthly trading volume, with rebates from $3 to $10 per million traded and average savings between 4% and 15%. These cash rebates reflect in your account at the start of each month.

Торговые инструменты Forex.com

Forex.com offers a diverse array of order types, both complex and simple, with reliable execution. Professional charting is available with customizable indicators and drawing tools, allowing you to trade straight off the charts. The platform is an all-in-one hub, integrating analysis, trading ideas, and news for actionable insight.

Forex.com's proprietary platform syncs seamlessly with advanced analysis tools, showcasing automated assessments from partners like Recognia, Faraday, and Autochartist.

Leveraging Autochartist’s automated tools provides you with a curated selection of the most promising trading opportunities, a feed of emerging patterns in your markets, and predictive volatility analysis.

Through Recognia Technical Analysis, accessible via a portal, you will encounter short-term trade ideas with insights into resistance and support levels, pivot points, and strategies, complete with contingency plans if market conditions shift.

Faraday Research tools delve into forex markets, furnishing you with timely trading opportunities via daily emails complete with entry and exit points, detailed reasoning, and an integrated portal on the Forex.com desktop platform. Expect real-time push notifications via the app as well.

If desired, qualifying clients can engage with a one-on-one expert market strategist to tailor a trading plan that fits their specific needs. These pros provide personal demos of advanced trading tools and charting software, while also imparting techniques in fundamental and technical analysis to help you make well-informed decisions. With continuous support, they aid in enhancing your trading performance. Forex.com further enriches its offerings via comprehensive market analysis on its website, presenting the latest news and effects on the market or dives into specifics when analyzing particular markets.

Анализ рынка

Forex.com dedicates a segment of its site to market analysis, breaking it down into various subsections. The main page delivers the freshest insights with top stories, news, and analysis tied to trading. It also houses an economic calendar, which you can filter events on based on a multitude of criteria. This calendar provides details on each event, scheduled time, the impacted country or currency, actual values against consensus and previous marks, and whether the significance is high, medium, or low.

You’ll also find live trading sessions in the market analysis section, featuring 30-minute webinars helmed by Forex.com's global analysts. These sessions deliver real-time insights, market commentary, actionable trade ideas, and live Q&A segments. Joining is a breeze; simply fill out the registration form on the relevant page.

API-торговля

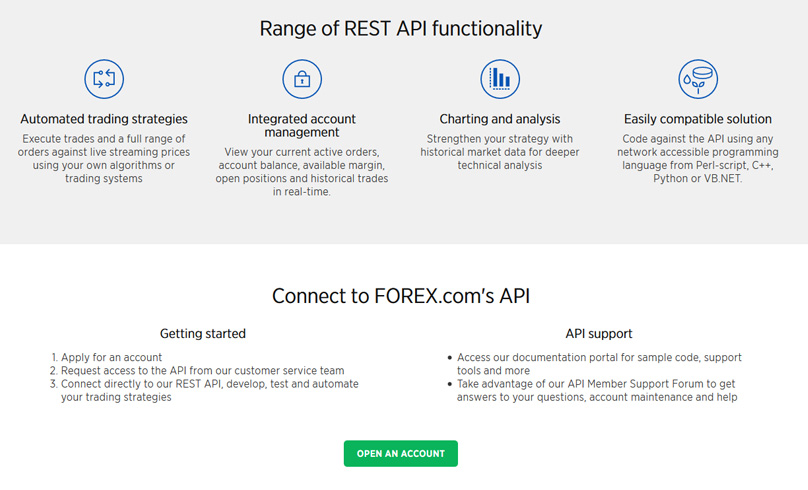

Keeping an edge, Forex.com provides API trading via its REST API. This tech allows you access to live streaming prices, advanced order types, and trade executions across over 180 of the most actively traded markets worldwide. The REST API offers full developer support and access to a complete range of currencies, commodities, Bitcoin, and shares. You can deploy algorithms and trading systems to execute trades and orders efficiently.

The REST API provides automated trading strategies that enable you to conduct trades and place a variety of orders using your trading setups or custom algorithms, all while receiving real-time price updates. Furthermore, it offers a seamless account management experience, where you can monitor your account balance, check active or pending orders, assess available margin, track open positions, and review your historical trades—all processed in real-time. The API is equipped with tools for charting and data analysis, leveraging historical market data for deeper insights.

The Forex.com API boasts broad compatibility, allowing interaction with the API via any network-accessible programming language, be it VB.NET, C++, Python, or Perl-script, providing flexibility for developers.

To utilize the Forex.com API, first set up a Forex.com account and contact their customer service for API access. This opens the door to the REST API, aiding in the development, testing, and automation of trading strategies. Comprehensive support is available through a dedicated documentation portal, complete with support tools, sample code, and an API Member Support Forum.

On the other hand, Forex.com also offers a FIX API tailored for institutions desiring to grant their clients access to Forex.com’s liquidity and market scope.

Программа вводных брокеров

Much like its competitors, Forex.com runs a program for introducing brokers, where those introducing clients stand to earn as trades are executed by these new clients. The program offers multiple compensation models that are quite attractive, along with an easy-to-use partner portal for tracking your growth seamlessly.

Образовательные ресурсы

Forex.com has a wealth of educational resources available for traders at any level of expertise. A quiz on the educational page helps identify what kind of trader you might be, guiding you to materials tailored for your journey. You can also explore content based on your experience—whether you’re a beginner, intermediate, or advanced trader—leading to resources specifically suited to your level.

If you're interested in specific trading topics, Forex.com covers a broad range, including risk management, trading concepts and strategies, technical and fundamental analysis, and platform tutorials for both Forex.com and MetaTrader. Each topic contains numerous articles, such as 'Understanding Different Order Types' and 'Qualities of a Successful Trader.'

Поддержка клиентов Forex.com

Forex.com provides several ways to get in touch with customer support. You can initiate a chat from any website page, or reach out via provided email addresses and phone numbers catered to both client support and new account inquiries.

Что такое новый Forex.com?

Midway through September 2018, Forex.com enhanced its service offerings by incorporating new markets and advanced platforms, including cryptocurrencies and shares. These updates introduced an active trader program and broadened market access, alongside launching an advanced desktop trading platform and mobile apps for better stability and speed. Accounts established before July 13, 2018, were seamlessly updated to this enhanced service. Detailed information on these updates can be found in Forex.com's support section.

Конкуренты

Forex.com stands in competition with other brokers we've previously examined, as described:

Forex.com Licenses & Regulations

Regulated by the Cayman Islands Monetary Authority (CIMA) under the Securities Investment Business Law, Forex.com is also subject to oversight from its affiliates in multiple jurisdictions worldwide, including the UK's Financial Conduct Authority (FCA), Japan's Financial Services Authority (FSA), the U.S.'s Commodity Futures Trading Commission (CFTC), Australia's ASIC, and Canada's IIROC. Additionally, Forex.com's affiliate is part of the U.S.'s National Futures Association (NFA).

Is Forex.com Safe?

Forex.com adheres to rigorous regulatory standards, ensuring customer funds are kept separate from operational capital. These funds are held in top-tier banks across a custodial network, maintaining segregation through trust letters. GAIN Capital Holdings Inc.’s Risk Committee sets strict monitoring guidelines, and it’s notable that Forex.com eschews proprietary trading.

Conclusion

Ranked among the forefront of forex trading, Forex.com extends its offerings beyond currencies to include commodities, cryptocurrencies, and indices.

With regulation across numerous jurisdictions, Forex.com assures clients that their funds are safe, bolstered by its status as a GAIN Capital subsidiary—an acclaimed multinational entity publicly traded on the New York Stock Exchange.

The broker's proprietary trading platform for web and mobile is feature-rich and well-constructed, alongside the option to utilize MetaTrader 4.

Hosting a trove of educational content, trading tools, and resources, the site equips you with everything necessary for informed trading decisions.

It’s important to acknowledge that forex trading carries substantial risk of rapid financial loss. We strongly advise practicing with a demo account and thoroughly reviewing all site materials before proceeding with actual trades.