ForexTime is a forex broker Established by Andrey Dashin in 2011, FXTM caters to traders of diverse skill levels.

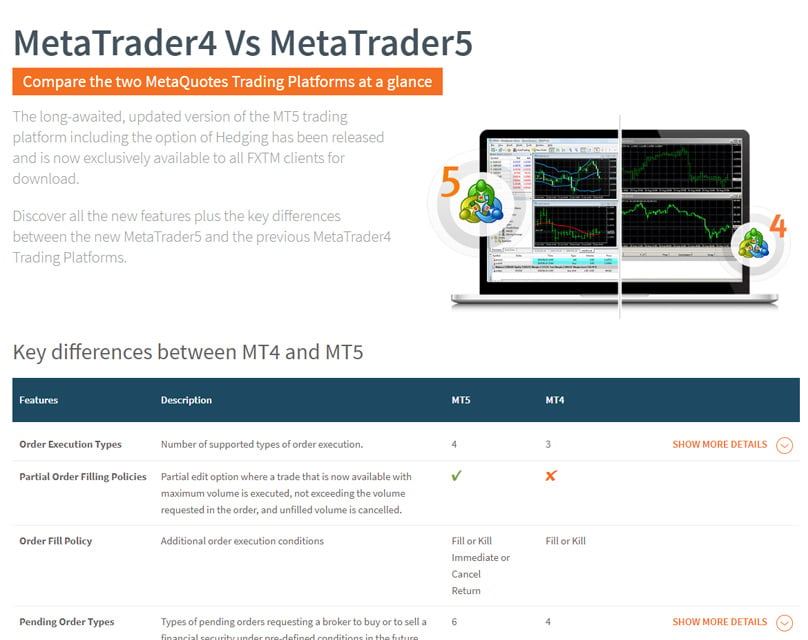

ForexTime (FXTM) delivers a reliable trading experience powered by MetaTrader 4 and 5, featuring a wide array of trading tools like Forex, CFDs on Indices & Commodities, Spot Metals, and Stock CFDs.

Well-respected in the financial sphere, ForexTime boasts competitive spreads and is regulated in the UK by the FCA and in Cyprus by CySec.

Despite being relatively new on the scene, ForexTime has quickly expanded its influence and collected numerous accolades over time. Continue reading for our genuine review of the ForexTime broker.

ForexTime at a Glance

| ⭐ Broker | ForexTime |

| 💼 Regulation | FSCA (South Africa), FCA (UK) & CySec (Cyprus) |

| 📈️ Minium Initial Deposit |

$/€/£ 10 |

| 🚀 Demo Account |

Yes |

| 📊 Asset Coverage | CFD offerings: Foreign Exchange, Indexes, Commodities, Spot Metals, Shares |

| ⚖️ Leverage | 30:1 Retail & Up to 1000:1 Professional |

| 💻 Trading Platforms | MetaTrader 4 & MetaTrader 5 |

Licenses & Regulations

- ForexTime Limited (forextime.com/eu) operates under the regulation of the Cyprus Securities and Exchange Commission with CIF license number 185/12.

- Authorized by the Financial Sector Conduct Authority (FSCA) in South Africa, with FSP No. 46614.

- Registered with the UK's Financial Conduct Authority, bearing registration number 600475.

- Exinity Limited (forextime.com) is governed by the Financial Services Commission of Mauritius with an Investment Dealer License numbered C113012295.

- Forextime UK Limited (forextime.com/uk)

operates under the authorization and regulation of the Financial Conduct Authority, with firm reference number 777911.

ForexTime Trading Instruments

With FXTM traders have access to a diverse range of instruments.

- There are more than 50 currency pairs.

- For those who seek to diversify, there are options to trade CFDs, spot metals, share CFDs, and commodity futures CFDs.

- Furthermore, traders can venture into CFDs on indices and ETFs.

- This includes more than 180 US shares.

- You have access to 59 exotic currency pairs, 5 spot metals, 14 spot CFDs, and 3 commodity CFDs.

ForexTime's dual focus on stock and stock CFD trading has attracted a broad spectrum of traders.

ForexTime's dual focus on stock and stock CFD trading has attracted a broad spectrum of traders.

Engaging in stock trading with FXTM presents a way to diversify your investment mix while embracing risk. It also liberates you from the time constraints tied to stock CFDs.

To initiate stock trading with FXTM, an FXTM Pro MT5 Account is necessary. It awards you tight spreads starting from 0 pips, swift execution, and the choice between mini, macro, or standard lot sizes.

ForexTime Trading Terms

ForexTime prides itself on offering excellent trading terms. Enjoy rapid execution and explore both micro and mini lot sizes.

A minimum deposit remains comfortably low, alongside a No Dealing Desk (NDD) architecture. FXTM further enhances trading with substantial interbank liquidity and supports Expert Advisors and Logarithmic Trading.

Floating leverage can extend up to 1:1,000. Spreads may compress to as low as 0.1 pips, contingent on specific market scenarios and the selected account type.

FXTM's floating leverage model allows traders to significantly increase potential profits by trading larger volumes, with leverage up to 1:1,000, acknowledging the associated risks.

ForexTime's competitive spreads empower traders by lowering initial trading costs substantially.

FXTM guarantees prompt executions since transactions are processed instantly, ensuring optimal price acquisition.

NDD technology allows ForexTime to collaborate with various liquidity networks, providing ultra-competitive bid and ask prices, while ensuring vast interbank liquidity and instantaneous trades.

Visit ForexTime’s website's \"Trading Instruments\" section to review detailed contract specifications for all trading tools, then head to \"Contract Specifications.\"

Available insights cover forex, spot metals, U.S. share CFDs, spot commodities, stock trading, and spot indices. Gain knowledge on canonical or average spreads, pip values, swaps, and session timings.

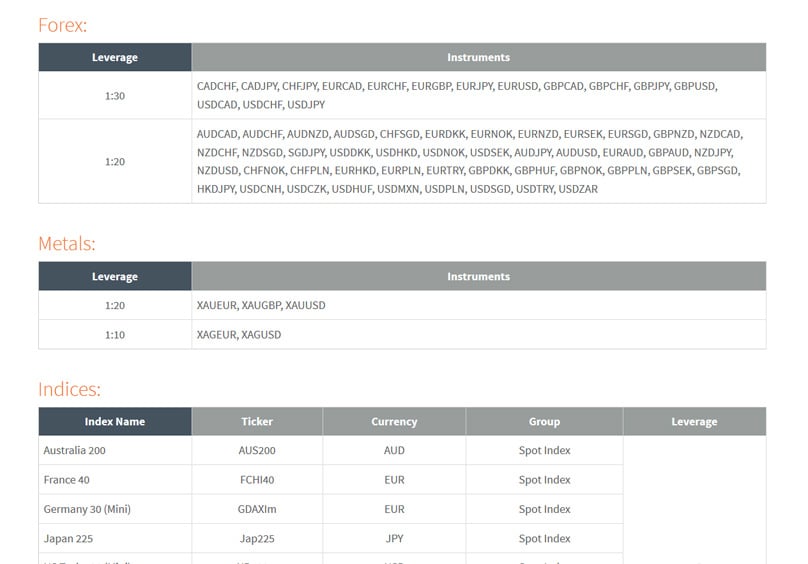

ForexTime Margin & Leverage

Access comprehensive margin and leverage criteria for trades with ForexTime on the broker's portal under \"Trading Accounts.\" on the appropriate page Standard, ECN, and ECN Zero Account margin and leverage prerequisites stand under FX majors, minors, exotics, spot metals, and cryptocurrencies like BTCUSD, ETHUSD, LTCUSD, and RPLUSD.

For each, observe the notional value for USD, EUR, GBP, or NGN, and the provided leverage with floating margin percentages.

The same data follows for FXTM Pro MT4 Trading Accounts, subsequently for FXTM Pro MT5 Accounts.

The commissions from FXTM differ per account type. There are zero commissions on Standard, Cent, Shares, ECN Zero, and FXTM Pro Accounts. However, ECN Accounts incur a $2 commission per lot.

FXTM Comissions

Certain accounts have dynamic commissions. For instance, the ECN MT4 commission depends on trading volume and equity, with reduced fees for larger volumes and equities.

Floating commission rates are detailed under the \"Commissions\" section on the Trading Accounts page, including stock trading commissions via PRO MT5.

A multitude of deposit and withdrawal avenues exist

Example Commissions on ECN MT4

| Equity (USD) | Trading Volume (million USD) | |||

|---|---|---|---|---|

| Less Than 100 | 100 – 150 | 150 – 250 | Over 250 | |

| 0 – 2,999 | 20 | 19 | 18 | 15 |

| 3,000 – 4,999 | 19 | 18 | 17 | 14 |

| 5,000 – 19,999 | 18 | 17 | 16 | 13 |

| 20,000 – 49,999 | 17 | 15 | 13 | 11 |

| 50,000 – 199,999 | 16 | 13 | 11 | 9 |

| 200,000 – 499,999 | 14 | 12 | 10 | 8 |

| 500,000 – 999,999 | 13 | 10 | 8 | 6 |

| 1,000,000 – 4,999,999 | 12 | 9 | 6 | 4 |

| Over 5,000,000 | Determined on an individual basis | |||

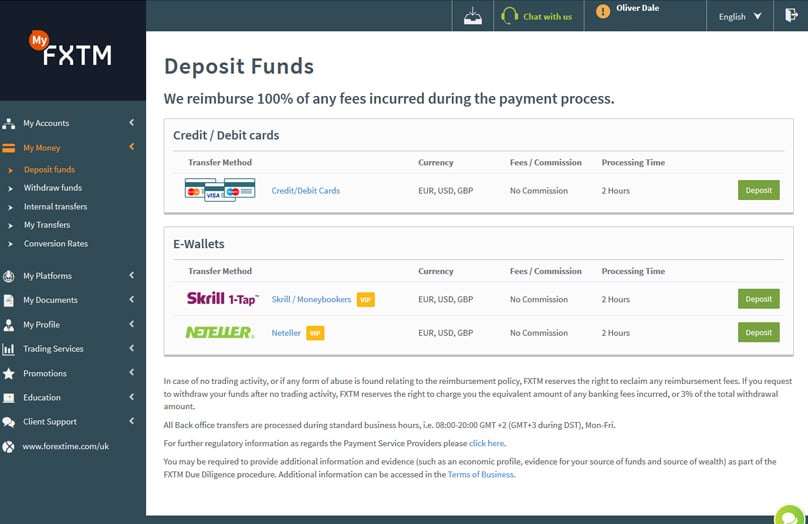

ForexTime Deposits & Withdrawals

ForexTime to cater to varied clientele. Payment options cover FasaPay, Ghana's local transfers, Nigeria's banking channels, Algeria's local transfers, Kenya's methods, and Indonesia's systems. Additionally, there are local facilitation services for Pakistan, India, Indonesia online banking, Malaysia's platforms, Local Exchange Houses, and Afghan transfers.

Furthermore, Laos local transfers, Nganluong (a wallet and banking portal), Baokim, GlobePay, Egypt’s channels, Iraqi local banking, and Bangladesh's networks.

There are also Palestinian services, Thailand and Vietnam's online banking, China's platforms, and Tanzanian BRK Transfers.

Visa, Mastercard, or Maestro allow deposits as well. Neteller or Skrill/Moneybookers serve VIP clients.

Every client can also deposit via cryptocurrencies, Dusupay, Alfa-Click, Dixipay, WebMoney, Yandex.Money, QIWI, Perfectmoney, Bitcoin through Skrill, Bitcoin, or Konnexone. Bank wire transfer is available too.

All such deposit methods remain commission-free. Processing ranges from immediate to a maximum of 24 hours for most, whereas bank wires require three to five business days.

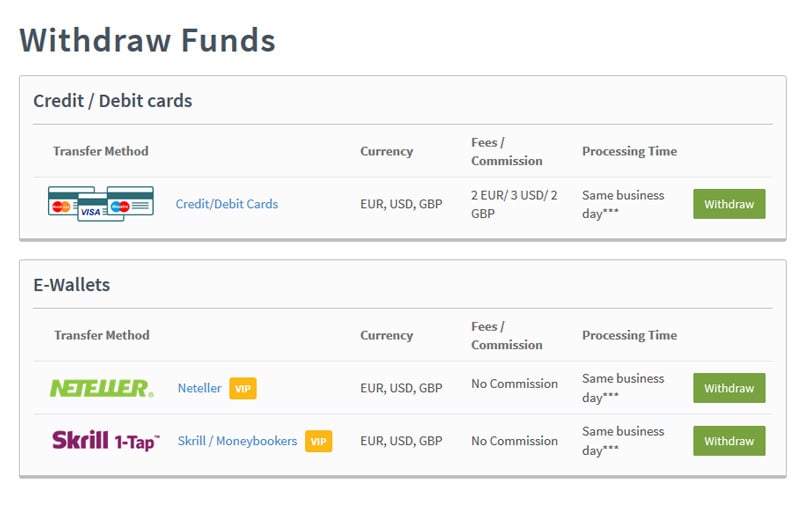

Withdrawal methods resemble deposits with slight deviations. For instance, China Union Pay addresses withdrawals, while Alfa-Click and Cash U don’t. Withdrawals generally process in 24 hours, except for China's online banking at 48 hours.

Other notes: Konnexone requires up to one business day; cryptos, Bitcoin, or Bitcoin via Skrill need 24 to 48 hours. Certain withdrawal methods charge commissions, which might be flat fees or low transactional percentages. Numerous withdrawals remain commission-free.

It's advisable to verify ForexTime’s withdrawal or deposit-associated fees and timings.

The deposit thresholds on ForexTime vary based on selected account types.

Minimum & Maximum Deposits

For Standard, Shares, ECN, and ECN Zero Accounts, a minimum deposit of $/€/£ 100 or ₦20,000 is required, without a maximum limit.

- Cent Accounts initiate with a minimal deposit of $/€/£ 10 or ₦1,000 and lack a deposit cap.

- FXTM Pro accounts require a minimum investment of $/€/£ 25,000 with no upper boundary.

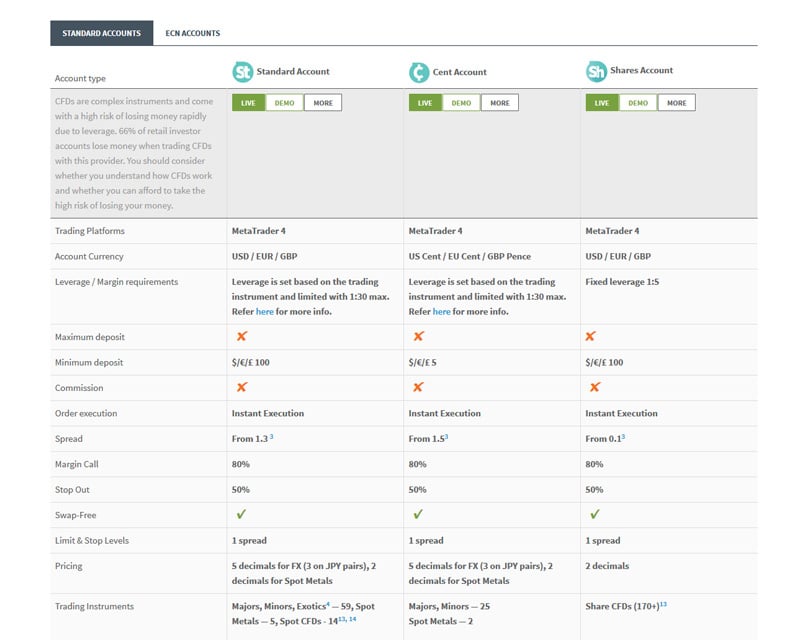

- Standard Accounts encompass a Standard, CENT (featuring micro lots), and a Shares Account.

ForexTime Account Types

ForexTime truly offers an account for everyone .

The ECN roster includes the ECN MT4 and MT5 Accounts along with an ECN ZERO Account.

Additionally, there are ECN Manager Accounts, FXTM Pro interpretations, FXTM Pro MT5, and ECN Zero MT5.

Standard Accounts supported by MetaTrader 4 offer tight floating spreads, adjustable leverage up to 1:1,000, immediate execution, hedging potential, a SWAP-free scope, and are commission-free. Choose currencies like USD, EUR, GBP, or NGN.

- Cent Accounts , compatible with MT4, spotlight immediate execution, tight floating spreads, and a SWAP-free alternative. Available in EUR cents, GB pence, USD cents, or NGN kobo, and feature Cent Lots with a modest deposit of 5 EUR/USD/GBP.

- Shares Accounts , also functional with MT4, render a SWAP-free scheme, instant execution, and approve hedging without commissions. Fixed leverage stands at 1:10, unlocking over 180 US shares. Applicable in USD, EUR, GBP, or NGN.

- MT4 or MT5-based ECN Zero Accounts can integrate FXTM Invest. They bring forth tight floating spreads, no commissions, market execution sans requotes, and floating leverage of up to 1:1,000.

Additional Trading Accounts

A SWAP-free choice completes the offering, alongside GBP, USD, EUR, and NGN. Both scalping and hedging are permissible.

2023 FXTM Evaluation: A Deep Dive into Its Trustworthiness and All the Advantages and Shortcomings

Contemplating the Forex Time Broker? Want to know if it's reliable or fraudulent? Discover everything you need through our extensive review, covering every perk and pitfall.

FXTM Evaluation: Exploring Its Credibility, Along with All the Highs and Lows

FXTM is a financial trading platform packed with various instruments and attractive spreads. Dive into our comprehensive analysis.

It caters to traders of different expertise levels and was established in 2011 by Andrey Dashin.

ForexTime (FXTM) provides a robust trading experience powered by MetaTrader 4 and 5, featuring a diverse array of instruments like Forex, CFDs for Indices & Commodities, Spot Metals, and Shares CFDs.

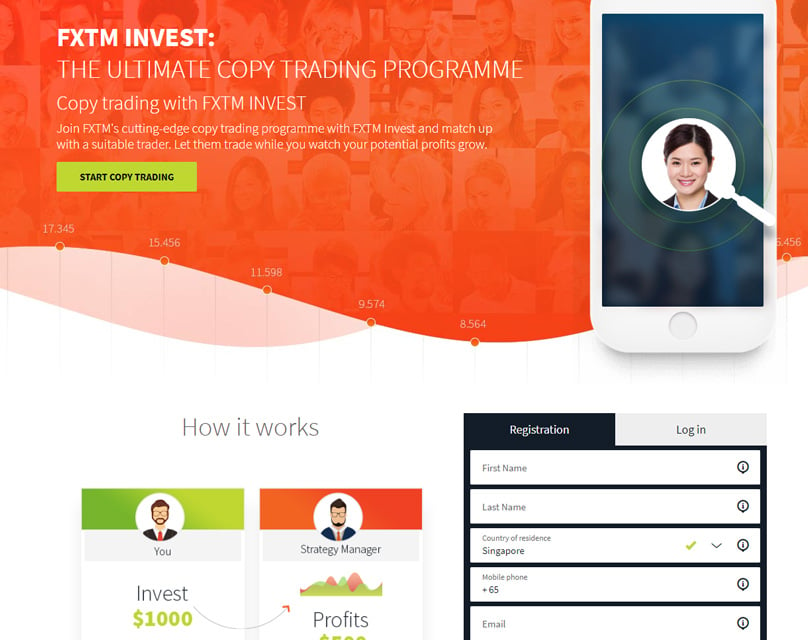

FXTM Invest ( Copy Trading )

FXTM Invest Recognized in the industry for its competitive spreads, ForexTime is regulated by the FCA in the UK and CySec in Cyprus.

While relatively new in the scene, ForexTime has experienced rapid growth, garnering numerous accolades over the years. Keep reading for our frank evaluation of the ForexTime brokerage.

Risk Notice: CFDs are intricate tools with a high risk of swift financial loss due to leverage. Around 81% of retail investor accounts lose funds when trading CFDs with this broker. Assess whether you comprehend how CFDs operate and if you can afford the substantial risk of losing your capital.

CFD Markets Available: Forex, Indices, Commodities, Spot Metals, Shares

Different FXTM entities provide varying leverage levels due to regulatory constraints. Leverage is adjusted based on the client's expertise, experience, and residency. Thus, FXTM offers versatile leverage options.

ForexTime Limited is under the regulation of the Cyprus Securities and Exchange Commission, holding CIF license number 185/12.

Licensed in South Africa by the Financial Sector Conduct Authority (FSCA) with FSP No. 46614.

Also registered with the UK's Financial Conduct Authority, bearing the registration number 600475.

Exinity Limited is regulated by the Financial Services Commission of Mauritius with an Investment Dealer License numbered C113012295.

Forextime UK Limited is authorized and regulated by the Financial Conduct Authority with firm reference number 777911.

Traders have access to a broad spectrum of instruments within this platform.

For those wishing to diversify, ForexTime allows trading in CFDs, spot metals, share CFDs, and CFDs on commodity futures.

Furthermore, CFDs on Indices and ETFs are available for trading.

Automated Trading

Offering the ability to trade up to 59 exotic currency pairs, 5 spot metals, 14 spot CFDs, and 3 CFDs on commodities.

A lot of traders value the opportunity for both stock trading and stock CFD trading through ForexTime.

Investing in stocks via FXTM is an excellent way to diversify your investments while accepting some inherent risk, freeing you from the time restrictions of stock CFDs.

A FXTM Pro MT5 Account is required to trade stocks with zero-spread from 0 pips, lightning-fast execution, and your pick of mini, macro, or standard lots.

There’s rapid execution available along with micro and mini lot sizes.

Trading Restrictions

The minimum deposit is conveniently low, featuring No Dealing Desk (NDD) technology. FXTM boasts deep interbank liquidity and permits Expert Advisors and Logarithmic Trading.

Floating leverage can scale up to 1:1,000, with spreads narrowing down to 0.1 pips depending on market stipulations and account type.

The 1:1,000 leverage option is part of FXTM’s variable leverage system, allowing traders to enhance potential gains by trading larger volumes, albeit at higher risk.

Leverage Disclaimer: Leverage is provided based on your knowledge and proficiency. Leverage/Margin requirements might change due to regulations in your residing country.

Low initial trading costs are ensured with FXTM’s tight spreads.

FXTM guarantees quick transaction execution, so timing issues won't interfere with snagging the best rates.

FXTM Trading Platforms

Those with ForexTime accounts ForextTime’s NDD technology works with various liquidity providers to grant clients the best bid and ask prices. This ensures comprehensive interbank liquidity and instant trade execution.

To peruse the complete trading instrument contract specifics, head to the Trading Instruments section on ForexTime’s site, then browse Contract Specifications.

You’ll find detailed data for forex, spot metals, US share CFDs, spot commodities, stock trading, and spot indices, including minimum/typical spreads, pip values, swaps, and trading sessions.

All leverage and margin prerequisites for ForexTime trades are visible on the website, under the main Trading Accounts category.

Standard, ECN, and ECN Zero Trading Accounts have listed margin and leverage requirements, viewable by currency pairs, spot metals, BTCUSD, ETHUSD, LTCUSD, and RPLUSD.

You can identify the notional values in USD, EUR, GBP, or NGN, alongside offered leverage and floating margin percentages for each category.

The same information follows for FXTM Pro MT4 and FXTM Pro MT5 Trading Accounts.

FXTM’s commissions vary with account type, with no commissions for Standard Accounts and others like Cent, Shares, ECN Zero, and FXTM Pro Accounts, while ECN Accounts charge $2 per lot.

In select cases, there are adjustable commissions. For ECN MT4 accounts, for example, commission varies based on trading volume and equity; higher volumes and equities yield reduced commissions.

Specific adjustable commission rates are available under Trading Accounts on the Commissions page, which also covers stock trading via PRO MT5 commissions.

ForexTime Web Trader

The platform supports numerous deposit and withdrawal methods to attract a diverse client base.

Deposit options include FasaPay, local transfers in Ghana, Nigeria, Algeria, Kenya, and Indonesia among others.

Additionally, local transfers for Pakistan and India, Indonesia online banking, Malaysia online banking, Local Exchange House, and Afghani local transfers.

Further options include local transfers in Laos, Nganluong’s e-wallet and banking channel, Baokim, GlobePay, and local transfers in Egypt, Iraq, and Bangladesh.

ForexTime Mobile Trading

Finally, Palestinian local transfers, online banking in Thailand and Vietnam, China Online Banking, and Tanzanian Local Transfers (BRK).

Clients can also deposit using Visa, Mastercard, or Maestro cards. VIPs have the added option of Neteller or Skrill/Moneybookers.

All clients can also use cryptocurrencies, Dusupay, Alfa-Click, Dixipay, WebMoney, Yandex.Money, QIWI, Perfectmoney, Bitcoin via Skrill, Konnexone, and bank wire transfers.

None of these deposit methods incur fees, and processing usually takes from instant to 24 hours, except for bank wires taking three to five business days.

Withdrawal methods are mostly the same, with minor differences, like being able to withdraw via China Union Pay but not Alfa-Click or Cash U. Most withdrawals process in 24 hours, except China Online Banking needing 48 hours.

Additional exceptions include Konnexone up to a business day, while crypto and Bitcoin transactions, including those via Skrill, take between 24 to 48 hours. Some withdrawal methods do have fees — either low flat fees or a small percentage of the transaction, but many still remain commission-free.

Always review the associated fees and time frames for your selected withdrawal or deposit method on ForexTime.

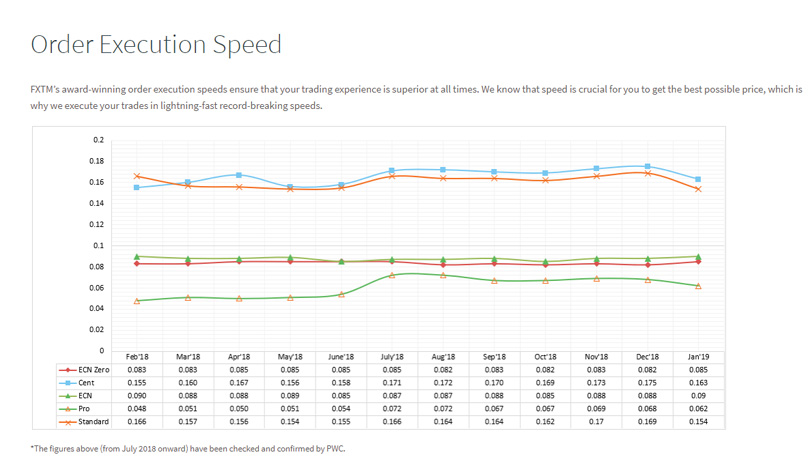

ForexTime Performance Statistics

Minimum and maximum deposit amounts for ForexTime depend on the account type you select.

For Standard, Shares, ECN, and ECN Zero Accounts, the minimum deposit is $/€/₤100 or ₦20,000, with no maximum limit.

Cent Accounts have a minimum deposit of $/€/₤10 or ₦1,000, also with no cap on the deposit size.

FXTM Pro accounts come with a minimum deposit requirement of $/€/₤25,000, once again with no maximum.

Standard Accounts consist of a Standard Account, CENT Account (with micro lots), and Shares Account.

ECN Accounts encompass the ECN MT4 Account, the ECN MT5 Account, and the ECN ZERO Account.

Additional ECN accounts include ECN Manager, FXTM Pro, FXTM Pro MT5, and ECN Zero MT5.

Standard Accounts incorporate MetaTrader 4, featuring tight floating spreads, leverage up to 1:1,000, instant trade execution, hedging options, a SWAP-free alternative, and no hidden fees. These accounts allow USD, EUR, GBP, or NGN.

Cent Accounts offer instant execution, tight floating spreads, a SWAP-free option, and employ MT4, available in EUR cents, GB pence, USD cents, or NGN kobo, with Cent Lots and a minimal deposit of just 5 EUR/USD/GBP.

ForexTime Market News

ForexTime has a streaming news Feeder Shares Accounts also leverage MT4 with a SWAP-free option and instantaneous execution. These permit hedging, involve zero commissions, fixed leverage at 1:10, and access to over 180 US shares, available in USD, EUR, GBP, or NGN.

ECN Zero Accounts are compatible with MT4 or MT5 and can include FXTM Invest. They feature tight floating spreads, no commissions, market execution without requotes, and floating leverage up to 1:1,000.

ForexTime Market Analysis

These Accounts provide a SWAP-free option and accept GBP, USD, EUR, and NGN. Both scalping and hedging are supported.

A Thorough 2023 Assessment of FXTM (ForexTime): Safe Haven or Pitfall? Discover Every Advantage & Disadvantage.

Considering Forex Time as your brokerage gateway? Dive into our comprehensive analysis to determine its safety and discover all the upsides and drawbacks.

Unpacking FXTM (ForexTime) for 2023: Ensuring Your Safety or Risk? Every Pro & Con Laid Bare.

Explore FXTM as a robust financial platform with a multitude of tools and enticing spreads. Uncover the nuances in our detailed review.

Founded by Andrey Dashin in 2011, this platform caters to a wide array of trading expertise.

ForexTime Trading Signals

ForexTime (FXTM) builds on the MetaTrader 4 and 5 platforms, offering a rich selection of trading opportunities, encompassing Forex, CFDs on indices and commodities, spot metals, and shares.

With FXTM, benefit from competitive spreads and dual regulatory oversight by the FCA in the UK and CySec in Cyprus.

Among the newer brokerage firms, ForexTime is quickly gaining acclaim and collecting accolades. Delve into our candid scrutiny of this broker's credentials.

Risk Notice: Trading CFDs involves high risks due to leverage. A striking 81% of retail investor accounts experience losses when interacting with CFDs through this broker. It's crucial to weigh your understanding and readiness to accept such financial hazards.

Other Trading Tools

Dive into CFDs across Forex, Indices, Commodities, Spot Metals, and Shares.

The diverse FXTM brand offers varying leverage influenced by regulatory guidelines, client knowledge, experience, and residence. This allows for adaptable leverage options.

ForexTime Limited, represented online at www.forextime.com/eu, operates under the CIF license 185/12 issued by the Cyprus Securities and Exchange Commission.

Additionally, the Financial Sector Conduct Authority (FSCA) of South Africa validates it under FSP No. 46614.

In the UK, its registration with the Financial Conduct Authority is held under number 600475.

Exinity Limited, a part of ForexTime found on www.forextime.com, holds an Investment Dealer License C113012295 with the Financial Services Commission of Mauritius.

Forextime UK Limited, accessible via www.forextime.com/uk, is sanctioned and supervised by the Financial Conduct Authority under firm reference number 777911.

Traders on this platform can enjoy an appealing variety of trading tools.

Expanding portfolios is attainable here by engaging in CFDs, spot metals, stock CFDs, and CFDs on commodity futures.

Educational Resources

ForexTime has a Options also include CFDs on indices and ETFs for those looking to broaden their investment strategies. Engage in trading with up to 59 unique currency pairs, 5 spot metals, 14 spot CFDs, and 3 commodity CFDs.

Traders favor ForexTime for their ability to trade both stocks directly and via CFDs, offering trading versatility.

For portfolio diversification and risk introduction, trading stocks with FXTM—free from CFD time constraints—proves beneficial.

To trade stocks efficiently with FXTM, acquire an FXTM Pro MT5 Account featuring spreads from zero pips, ultra-fast execution, and customizable lot sizes.

Experience speedy trade execution and the availability of micro and mini lots.

Enjoy low minimum deposits with FXTM, utilizing No Dealing Desk (NDD) technology for smooth transactions and options for Expert Advisors and Logarithmic Trading.

Achieve high leverage levels, up to 1:1,000, with spreads as tight as 0.1 pips, contingent on market conditions and account selection.

ForexTime Loyalty Program

The floating leverage approach of FXTM, reaching up to 1:1,000, enables traders to amplify potential gains by handling larger trade volumes, albeit with increased risks.

Note that leverage provided adheres to your trading knowledge and expertise. Regulatory changes may affect leverage/margin norms based on your geographical location.

ForexTime's narrow spreads grant traders affordable initial trading costs.

Swift execution from FXTM minimizes delay risks, securing optimal pricing during trades.

NDD technology empowers ForexTime, liaising with numerous liquidity sources for the best bid and ask prices, supported by robust interbank liquidity, to guarantee prompt executions.

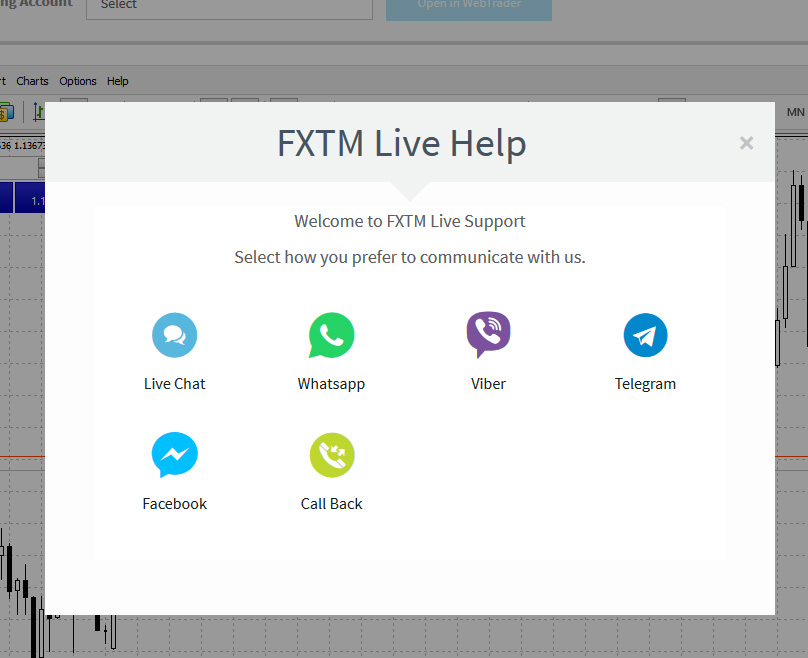

ForexTime Customer Service

To examine the detailed contract conditions for all instruments, navigate to ForexTime's website under Trading Instruments, then head to Contract Specifications.

Here, you will find data on forex, spot metals, US share CFDs, spot commodities, stock trades, and spot indices, detailing spreads, pip values, swaps, and trading sessions.

Check every specific margin and leverage requirement pertinent to ForexTime's trading options.

Discover this critical info under the Trading Accounts main category on the broker’s site.

Is ForexTime Safe?

Margin and leverage specifications are outlined for Standard, ECN, and ECN Zero account types across categories including FX majors, minors, exotics, spot metals, and various cryptocurrency pairs.

Each trading type details notional values in USD, EUR, GBP, or NGN, along with provided leverage and percentage-based floating margins.

Similarly, the FXTM Pro MT4 and MT5 Trading Accounts list their characteristics at the same location.

FXTM’s commission structure varies by account type, with no fees for Standard, Cent, Shares, ECN Zero, or FXTM Pro Accounts, but $2 per lot for ECN Accounts.

Certain account types come with variable commissions, such as the ECN MT4, where the fee is determined by trading volume and equity, reducing as trading activities increase.

Find specific floating commission details on the broker's site under Trading Accounts, Commissions section, including stock trading commissions via PRO MT5.

A multitude of deposit and withdrawal methods support FXTM's client appeal.

FXTM offers a plethora of methods, including FasaPay, various local bank transfers across different countries like Ghana, Nigeria, Algeria, Kenya, Indonesia, Pakistan, and India.

Competitors

Further options include online banking for Indonesia and Malaysia, Local Exchange House, transfers in Afghanistan, Laos, Nganluong, Baokim, GlobePay, Egypt, Iraq, Bangladesh, Palestine, veering into more territories.

ForexTime Awards

Over the years, ForexTime has earned Additional choices extend to online solutions like Thailand and Vietnam banking, China Online Banking, and Tanzanian Local Transfers (BRK).

- Clients may also choose currency cards like Visa, Mastercard, or Maestro, and VIP clients have the added Neteller and Skrill/Moneybookers options.

- Even extending to cryptocurrencies, options include Dusupay, Alfa-Click, Dixipay, WebMoney, Yandex.Money, QIWI, Perfectmoney, and choices like Bitcoin via Skrill.

- All these deposit avenues impose zero fees, featuring processing times from nearly instant to one business day, except for bank wires, taking three to five business days.

- Withdrawal methods nearly mirror deposit options, with slight differences like the inclusion of China Union Pay and exclusion of Alfa-Click or Cash U.

Conclusion

ForexTime Typically, withdrawal processing requires 24 hours, except for China Online Banking at 48 hours. Commissions vary by method, either modest flat rates or small transaction-based percentages, with many still commission-free.

Always scrutinize the costs and timings tied to your preferred ForexTime withdrawal or deposit strategy.

Account-specific attributes like minimum and maximum deposits vary accordingly on ForexTime.

Standard, Shares, ECN, and ECN Zero accounts all require a modest $/€/\£100 or ₦20,000 entrance deposit, with no upper ceiling.

For Cent Accounts, the entry is $/€/\£10 or ₦1,000, unrestricted by a maximum cap.

FXTM Pro accounts stand apart with a significant $/€/\£25,000 minimum deposit, yet remain ceiling-free. apart from eToro Standard Accounts accommodate Standard, CENT featuring micro-lot capabilities, and Shares Account.

ECN suites present the ECN MT4, ECN MT5, and ECN ZERO accounts.

In addition, you have the ECN Manager, FXTM Pro, FXTM Pro MT5, and the innovative ECN Zero MT5 Account.

Standard Accounts harness the power of MetaTrader 4 with narrow floating spreads and leverage up to 1:1,000, ensuring immediate trade execution, hedging facilities, a SWAP-free provision, and no unforeseen fees. Choose your account in USD, EUR, GBP, or NGN.

1Comment

This account type offers spreads starting as low as 0.1, the possibility of a SWAP-free account, and similar currency options. It's perfect for strategies like scalping and hedging, with commission fees beginning at just $4. Plus, it integrates seamlessly with FXTM Invest.