Embedded within Bitcoin's genesis block is a renowned excerpt picked from The Times , a notable British news source, which stated:

\"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks\"

In the wake of the global financial upheaval in 2008, the message's timing and its context were spot on. In response to the housing market crash triggered by the subprime mortgage debacle, the U.S. government intervened with a substantial $700 billion infusion into the financial system, precipitating a worldwide economic downturn. just bailed out Although numerous factors led to the crisis, such as reckless risk behavior and banking missteps, a common thread across numerous such past economic recessions is the underlying structure of today's financial system, widely identified as Fractional-Reserve Banking.

serves as a stark contrast to, presenting a groundbreaking and divergent alternative.

A system that Bitcoin The Origins of Fractional-Reserve Banking

Mechanisms of the Fractional-Reserve Banking System: Unveiling the Process of Money Creation

FRB is the prevailing financial model across most global nations. Despite its historical longevity, our focus is on its modern incarnation—a system watched over by government monetary authorities and centralized banks exerting control over currency flow and stability.

emerged as an origin point and is regarded as a forerunner to contemporary central banking systems. Of notable influence was the Bank of Amsterdam, a pivotal force in introducing paper currency through bank receipts for tangible deposits like gold and silver. In those times, tangible assets like gold held primary value but posed practical challenges for trade, especially across vast distances.

Established in 1609, the Bank of Amsterdam These receipts, or banknotes, evolved to represent commonly accepted exchanges as they symbolized bank deposits. Soon, banks and goldsmiths discerned the feasibility of issuing more receipts than the reserves held, driven by the observation that deposit holders typically reclaimed their deposits sporadically rather than simultaneously. In a shift from mere protection of assets, these entities transformed into commercial establishments offering and earning interest, leading to the rise of FRB.

A pertinent and enduring concern today is the potential scenario where a bank cannot fulfill its deposit promises. Should reserves fall short, the bank faces insolvency and potential bankruptcy, resulting in creditor losses and market disruptions.

This may sound familiar because when multiple major banks falter simultaneously, triggering a scenario of

Read: The Problems with Fiat Currency

, the repercussions are significant financial turmoil, government rescue operations, and heightened central bank interventions along with societal conflicts. The infamous Great Depression illustrated this chaos, in which international GDP saw a sharp 15% dip. bank run Following the advent of paper currency and the establishment of the Bank of Amsterdam, the world’s first central bank—the Swedish Riksbank—came into being in 1668. Other nations soon followed with central banks tasked with enforcing reserve mandates, currency issuance, and consolidating value reserves from other commercial banks. This centralization aimed to mitigate financial crises stemming from bank runs with the central bank acting as the lender of last resort.

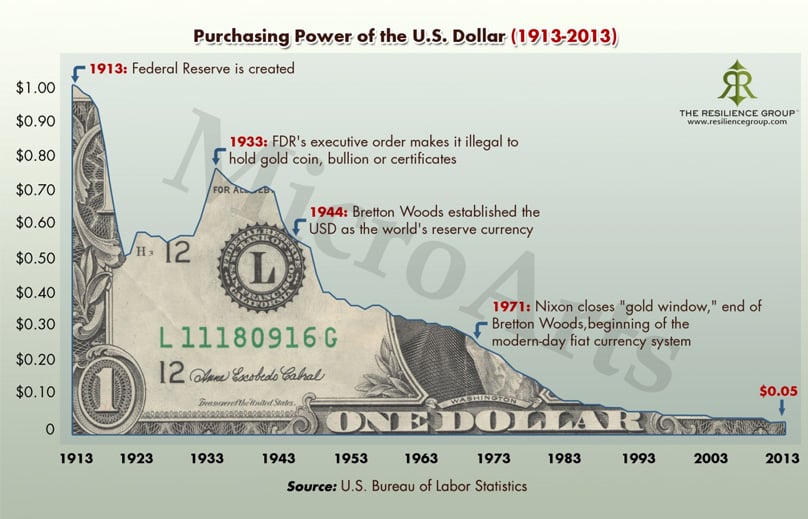

Acknowledging that bank runs are an intrinsic risk within the FRB structure has prompted further centralization of authority in the global monetary framework. A contemporary illustration is the US Federal Reserve, whose enhanced capabilities post events like the Great Depression and the 2008 financial crisis underscore this trend.

The U.S. Federal Reserve

The Federal Reserve came into being on December 23, 1913, through the

. Its core mandate, as devised by Congress, includes: Federal Reserve Act The term \"interest rates\" becomes pivotal as it brings clarity to how monetary creation occurs and why debt serves as a fundamental pillar in the FRB model. It’s crucial to comprehend that the Federal Reserve blends elements of both private and government operations, overseeing private banks yet devoid of its currency printing—managed instead by the US Treasury.

- Maximize Employment

- Stabilize Prices

- Moderate Long-Term Interest Rates

While widely acknowledged for ensuring economic stability, the Federal Reserve's necessity wasn't always a consensus.

characterized the first two central banking attempts in the US, initiated in 1791 and 1816, respectively. Due to rampant over-printing, the First Bank’s paper money, branded as “Continentals,” depreciated swiftly, prompting Congress in 1787 to outlaw paper money issuance through a constitutional draft. The First Bank of The United States and The Second Bank of The United States The First Bank’s charter renewal was denied by Congress in 1811, while the Second Bank, initiated in 1816, met a similar rejection in 1836 under President

Jackson famously critiqued central banks, stating: Andrew Jackson .

\"The bold effort the present (central) bank had made to control the government … are but premonitions of the fate that await the American people should they be deluded into a perpetuation of this institution or the establishment of another like it.\"

In specific reference to the Second Bank of the United States:

\"Independently of its misdeeds, the mere power, — the bare existence of such a power, — is a thing irreconcilable with the nature and spirit of our institutions.\"

Jackson, uniquely, removed the entire national debt but, despite his efforts, the Federal Reserve, a third central bank, was ultimately formed in 1913. From 1837 to 1862, the US experienced the

an era devoid of a central banking entity, relying solely on state-chartered banks. Free Banking Era From a cryptocurrency perspective, gaining insight into how digital assets provide an alternative to the conventional Fractional-Reserve Banking model requires an understanding of the intricate monetary flow within FRB. Analyzing the processes of money creation, its distribution into the financial veins, and the effect of such processes will be illuminated through examples in the US financial setting.

A recurring element in the narrative of Fractional-Reserve Banking (FRB) and its present framework is the concept of debt. Therefore, grasping the historical development of FRB is vital for understanding its current operations. Moreover, it offers insights into why innovations like Bitcoin are distinctly transformative.

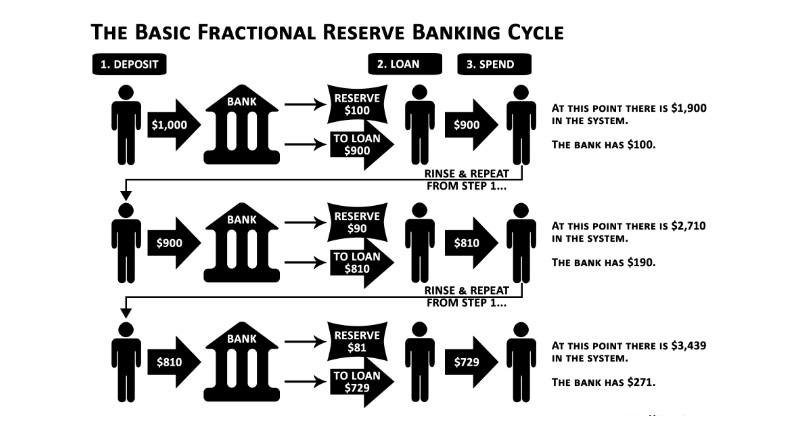

Fractional-Reserve Banking permits banks to support only a fraction of deposits with available cash, aimed at releasing capital to fuel economic lending. This fractional aspect of FRB indicates that only a segment of deposits is maintained in liquid form.

Follow the Money

Legally, banks must hold a certain reserve (Reserve of FRB) of depositors’ funds, accessible for withdrawal. Most banks are obligated to maintain a 10% reserve threshold. In practice, this translates to retaining $10 from a $100 deposit as a reserve. The Federal Reserve oversees reserve mandates, modulating economic liquidity by adjusting this reserve threshold.

Many may find it surprising that when you deposit cash into a bank account, ownership transfers to the bank . The bank extends the depositor an asset termed a deposit account, which appears on the bank's balance sheet as a liability. The bank is bound to honor this liability upon request, contingent on having the requisite funds (consider the bank run phenomena).

The scenario gets intriguing with the emergence of

. Predominantly, the capital flow occurs as follows. Multiplier Effect Alice visits a prominent commercial bank (JP Morgan, Wells Fargo, etc.) and deposits $1 billion into her account.

- This allows the bank to extend $900 million in loans.

- The bank is legally required to reserve 10% of her deposit, so they reserve $100 million as cash on hand, available for withdrawals.

- Bob then approaches the same bank to secure a $900 million loan.

- The bank consents, furnishing Bob with $900 million, adhering to its legal capacity to issue credit amplified by several folds of its reserved funds (typically 9-10 times greater).

- ***Consequently, available reserves to satisfy deposit liabilities are less than the amount banks must fulfill immediately, should demand arise.

- Thus, the $900 million Bob acquired is effectively an addition to Alice’s original $1 billion deposit.

- Bob relocates his $900 million to yet another bank, initiating deposit.

- Cumulatively, Alice’s $1 billion snowballs into a $1.9 billion money circulation.

- Each cycle of deposits and loan issuances perpetuates an event termed the Multiplier Effect.

- The wider ecosystem of FRB is significantly more intricate and multifaceted than this exemplification, though it encapsulates the central principles; delving deeper allows us to examine broader questions, most notably, how an additional $900 million materializes.

Exploring the Concept of the Fractional-Reserve Banking System - A Guide for Beginners

Wondering how the Fractional-Reserve Banking System operates and why Bitcoin might be a superior choice? Let’s explore.

A Beginner’s Exploration into the Fractional-Reserve Banking System

The process of credit issuance and deposits can repeat over and over again, originating from Alice’s initial $1 billion deposit. This is the multiplier effect, and a simple estimate for the potential impact of FRB on the money supply (from a deposit instance) is roughly achieved by multiplying the deposit by 10. So, in the case of Alice, her $1 billion deposit can potentially create $10 billion of new USD into the financial system. Again, this is not always the case, and there is much more nuance to it, but still, that is the general concept.

Inflation & Debt

Understanding the Dynamics of the Fractional-Reserve Banking System

An intriguing piece of Bitcoin's origin lies in a specific message embedded in its genesis block. Black Swan , a respected publication from the UK, presented this statement:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

In the wake of the 2008 global economic crisis, the timing and implication of this message were nothing short of remarkable. Following the housing market's collapse due to the subprime mortgage fiasco, the U.S. government injected a hefty $700 billion into the financial sector to prevent further disaster.

The current U.S. debt The collapse resulted from numerous factors, such as high-risk procedures and unethical strategies by banks. However, a larger narrative emerges when examining recent recessionary events: the pervasive structure of today’s financial world, known as Fractional-Reserve Banking.

Taking a Step Back

offers a stark contrast, presenting a groundbreaking shift from traditional methods.

Delving into the Evolution of Fractional-Reserve Banking

An Insight into How Money is Created via the Fractional-Reserve Banking System

Debt often takes the spotlight as we trace the roots and modern form of Fractional-Reserve Banking (FRB). Understanding its history sheds light on the revolutionary nature of Bitcoin.

Conclusion

FRB dominates most nations’ banking landscapes today. Despite its longstanding presence, we focus on its modern version where federal central banks and government financial authorities manage currency supply.

emerged as a notable precursor to today’s central banks. Significantly, the Bank of Amsterdam introduced paper currency as bank receipts for valuables like gold and silver, which gradually transformed trade despite logistical challenges.

This paper currency eventually became a common exchange medium. Soon enough, goldsmiths and banks started issuing more notes than they held in reserve, realising that few would redeem them simultaneously. Thus began the transition from guardians of valuables to profit-driven institutions, laying the foundation for FRB.

A pressing question arises: what if banks can't retrieve the necessary reserves for depositors? Insolvency leads to bankruptcy, devastating creditors and destabilizing financial markets.

1Comment

The establishment of the Federal Reserve on December 23, 1913, through the