The iconic message embedded in the first Bitcoin block was sourced from The Times a notable British newspaper, proclaiming:

“The Times 03/Jan/2009 Chancellor on the brink of second bank bailout”

In the wake of the 2008 global financial turmoil, this message was perfectly timed. The U.S. government had injected just bailed out a hefty $700 billion into the financial system after the subprime mortgage debacle caused a housing market collapse, leading to a worldwide recession.

While multiple factors contributed to the crash, including reckless bank behavior, the overarching issue, which history has repeated, relates to the existing financial architecture known as Fractional-Reserve Banking.

A system that Bitcoin stands in stark contrast to, and provides a groundbreaking alternative with.

The Evolution of Fractional-Reserve Banking

A recurring concept in both the inception and the current form of Fractional-Reserve Banking (FRB) is debt. To grasp its modern framework, one must understand its origins, and how cryptocurrencies like Bitcoin offer something entirely different.

FRB is the dominant banking model worldwide. Despite its long history, this discussion focuses on its modern-day version, where governmental economic authorities and central banks oversee the financial ecosystem and regulate currency supply.

Established in 1609, the Bank of Amsterdam was established, becoming the cornerstone for today's central banking institutions. Notably, the Bank of Amsterdam significantly contributed to the development of paper money, in the form of bank receipts for gold, silver, and other valuables deposited at the bank. Gold and silver were major value sources, though cumbersome for trade, especially over distances.

The advent of banknotes as standard exchange mediums opened a new chapter. Goldsmiths and banks soon issued more banknotes than they held in reserves. With people not redeeming all their deposits at once, banks shifted from safe-keeping to profit-making entities through interest. Hence, FRB was born.

A pressing issue remains: what if a bank can't meet its obligations to depositors? In such cases, insolvency and bankruptcy occur, potentially wiping out creditors' funds and destabilizing financial markets.

Read: The Problems with Fiat Currency

This should sound familiar: simultaneous failures of major banks, a situation termed as bank run lead to severe financial crises, government rescues, enhanced central bank power, and societal impact. During the Great Depression, bank runs were key factors, causing a 15% global GDP downturn.

Following the inception of paper money and the Bank of Amsterdam, the Swedish Riksbank emerged in 1668, noted as the world's first central bank. This model was soon adopted globally, granting central banks authority to set reserve rates, issue currency, and centralize commercial banks' reserves, acting as a crisis aversion measure.

The U.S. Federal Reserve

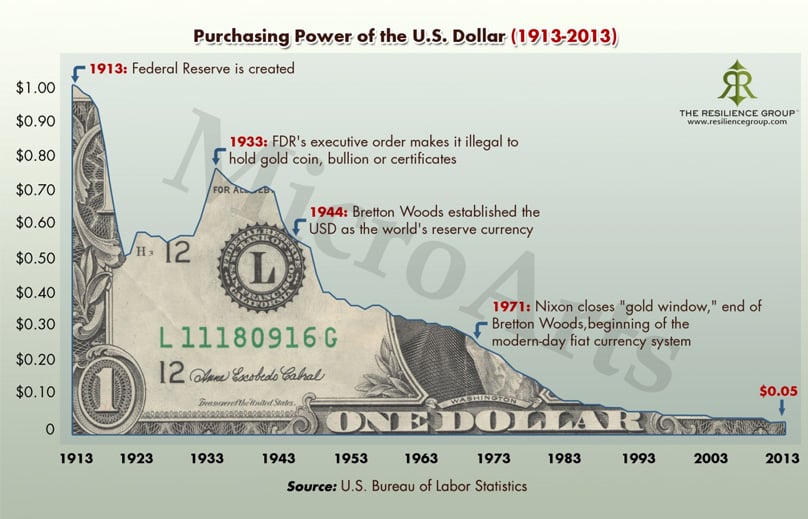

The inevitable reality of bank runs catalyzed further centralization in the FRB model. As a modern illustration, the US Federal Reserve, the central banking system of the U.S., has expanded its authority significantly following events like the Great Depression and the 2008 global economic crisis.

The Federal Reserve was founded on December 23, 1913, under the Federal Reserve Act Congressional mandate aimed to:

- Maximize Employment

- Stabilize Prices

- Moderate Long-Term Interest Rates

Understanding “interest rates” is crucial to grasping money creation and the role of debt in the FRB system. Notably, the Federal Reserve mixes private and public elements, supervising private banks and uniquely, not printing its currency—this remains the Treasury Department's task.

Despite its pivotal role in economic stability, the Federal Reserve’s acceptance wasn't always a given. The First Bank of The United States and The Second Bank of The United States were America's initial central banks, established in 1791 and 1816. Over-issuance of the First Bank's “Continentals” led to devaluation, prompting Congress's 1787 ban on paper money.

In 1811, Congress declined to renew the First Bank's charter, and the Second Bank, established in 1816, met the same fate in 1836 under President Andrew Jackson .

Jackson, who famously critiqued central banks, is quoted as saying:

“The audacious attempt by the current (central) bank to dominate the government signals the peril awaiting America if it perpetuates or recreates such an institution.”

Regarding the Second Bank of the United States:

“Apart from wrongdoing, the mere existence of such power contradicts our institutional spirit.”

Jackson, the lone president to fully pay off U.S. debt, saw the Federal Reserve formed later in 1913, following a period called the Free Banking Era from 1837 to 1862, lacking a formal central bank, functioning solely with state-chartered banks.

Unpacking the Mechanics of Fractional-Reserve Banking and Money Generation

Considering cryptocurrencies' alternative to the modern FRB system, it's vital to comprehend FRB's monetary flow, its creation, circulation, and impacts. We'll exemplify this with the US Financial System.

Follow the Money

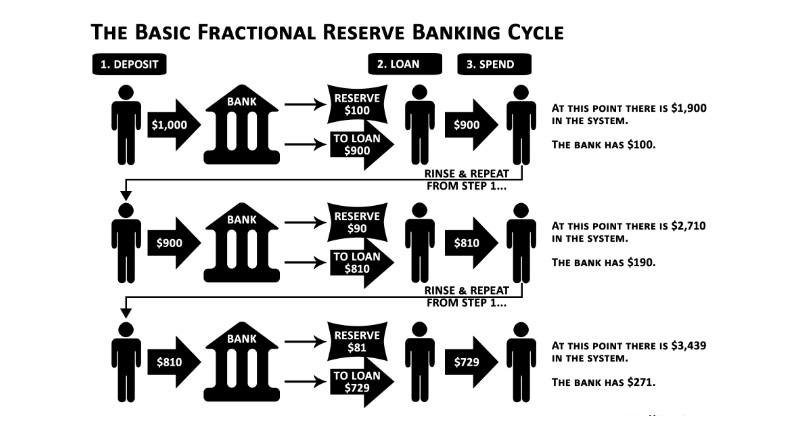

In Fractional-Reserve Banking, only a fraction of deposits are retained as cash, with the rest available for lending, aiding economic expansion.

Laws dictate banks must reserve a portion of depositors' cash for potential withdrawals, typically 10%. For every $100 deposited, $10 must remain as reserve, per Federal Reserve regulations. Raising reserve rates retracts money from circulation, while lowering injects money.

A surprising fact for many: depositing money converts it from personal property to bank property, transforming it into a bank liability called a deposit account, owed to you upon request, assuming fund availability (consider bank runs).

The intriguing aspect lies with the Multiplier Effect where the money's journey begins.

- Alice deposits $1 billion into her account at a key commercial bank like JP Morgan or Wells Fargo.

- The bank is legally required to reserve 10% of her deposit, so they reserve $100 million as cash on hand, available for withdrawals.

- The bank now has $900 million available for lending.

- Bob applies for a $900 million loan at the same bank.

- The bank approves Bob's request, issuing the $900 million. Banks can legally extend credit up to a multiple of their reserves, often 9–10 times.

- ***This leads to reserves unable to meet full deposit claims, as banks owe more than held.

- Thus, Bob’s $900 million loan adds to Alice’s initial $1 billion, generating $900 million more than the deposit.

- Bob deposits his $900 million at another bank.

- Alice’s $1 billion deposit results in a total of $1.9 billion.

- This credit cycle, upon each deposit and loan, is called the Multiplier Effect.

Although the FRB system is more intricate than this example, these basics highlight the core issues, especially the question: how does additional money like $900 million emerge?

An Insightful Introduction to the Fractional-Reserve Banking System for Complete Beginners

Explore the Mechanics of Fractional-Reserve Banking and Discover Why Bitcoin Offers a Compelling Alternative

The process of credit issuance and deposits can repeat over and over again, originating from Alice’s initial $1 billion deposit. This is the multiplier effect, and a simple estimate for the potential impact of FRB on the money supply (from a deposit instance) is roughly achieved by multiplying the deposit by 10. So, in the case of Alice, her $1 billion deposit can potentially create $10 billion of new USD into the financial system. Again, this is not always the case, and there is much more nuance to it, but still, that is the general concept.

Inflation & Debt

A Beginner’s Comprehensive Guide to Understanding the Fractional-Reserve Banking System

Introducing the World of Fractional-Reserve Banking Black Swan The Intriguing Reference in Bitcoin's Genesis Block Comes from

, a well-regarded British publication:

\"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks\"

The current U.S. debt The repercussions of the 2008 global financial meltdown were still unfolding, and the timing of this message was impeccable. The U.S. government had thrown a lifeline to the financial sector, amounting to $700 billion, after the subprime mortgage debacle burst the housing bubble, plunging the world into a recession.

Taking a Step Back

While various factors and excessive risk-taking by banks contributed to the collapse, the backdrop remains rooted in the framework of modern finance—Fractional-Reserve Banking.

stands in stark contrast to, and proposes a revolutionary alternative to.

The Evolution of Fractional-Reserve Banking

Under the Hood of the Fractional-Reserve Banking System: Money Creation and Operation

Conclusion

A recurring theme when reflecting on the emergence and evolution of Fractional-Reserve Banking (FRB) is debt. Understanding the origins of FRB is crucial to comprehend its modern form and the unprecedented nature of cryptocurrencies like Bitcoin.

FRB is the dominant banking structure globally. Although it has been around for a significant period, this discussion focuses on its modern form, wherein government authorities and central banks keep tabs on the financial system and regulate currency supply.

was founded and is regarded as the forerunner of modern central banks. The Bank of Amsterdam played a pioneering role in the introduction of paper money, functioning as receipts for gold, silver, and other precious items deposited in the bank. Gold and silver were the benchmarks of value, yet inconvenient for trade over long distances.

Banknotes became a conventional means of trade as they symbolized bank deposits. Soon, goldsmiths and banks noticed they could issue more notes than they had in reserves, knowing people seldom redeemed all at once but staggered over time. Eventually, this turned goldsmiths into institutions of lending and borrowing, paving the way for FRB.

1Comment

Over time, the realization that bank runs are inherent to FRB has led to increased centralization and authority of central banks worldwide. Take, for example, the US Federal Reserve, whose powers expanded significantly following events like the Great Depression and the 2008 financial crisis.