In the realm of cryptocurrencies, game theory is incredibly significant yet often remains underappreciated, despite its crucial role in ensuring the security and longevity of these platforms.

An upswing in the development and analysis of game theory has occurred alongside heightened interest and focus on advancing various cryptocurrency platforms.

This has given rise to a fascinating new domain known as cryptoeconomics, where both historical and modern game theory models are essential for understanding how participants interact within cryptocurrency systems.

To truly grasp the importance of game theory in the context of cryptocurrency platforms, it's essential to first understand what game theory is and how its principles can be applied across numerous different situations.

What Is Game Theory?

Game theory, in a nutshell, involves studying the rational decisions players make within a structured framework, be it a game, a scenario, or a system. It utilizes mathematical models and finds application in fields like economics, psychology, logic, computer science, distributed systems, and more. Consider game theory as a microcosm of human behavior; within set conditions, certain structures of incentives and rules can guide players towards predictable and honest actions.

There are three main components that typically define a game theory situation.

- Players

- Strategies

- Outcomes

Players represent the individuals making decisions in the system. Strategies are the actions they take while simultaneously considering the possible strategies of others involved. Outcomes are the results of players’ actions within the framework, and with the right incentives, these can lead to consistent directions or repetitive patterns of results.

The Prisoner’s Dilemma

To illustrate, one classic example of game theory you might be familiar with is known as the Prisoner’s Dilemma In this hypothetical situation, two suspects are being questioned separately about a crime they equally committed.

Let’s call them Alice and Bob…

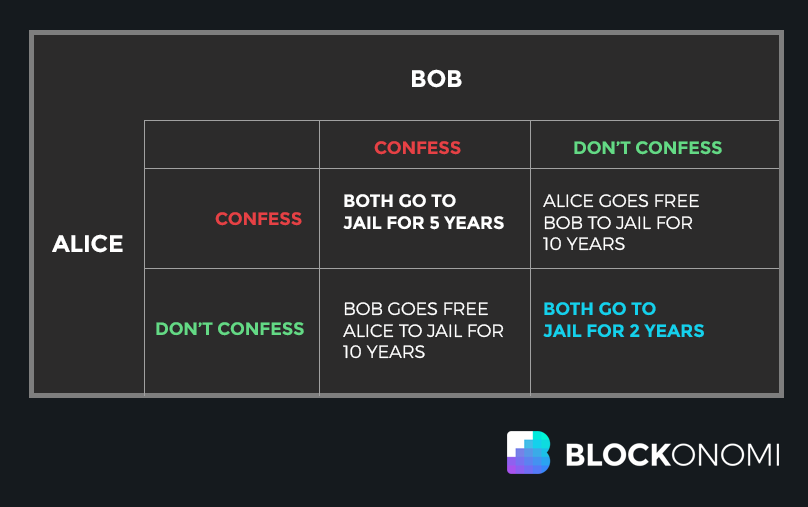

Each prisoner, Alice and Bob, is given a chance to confess in exchange for a lighter sentence. This scenario unfolds into four possible outcomes, as both Alice and Bob face the binary choice of either confessing or staying silent. The resulting four potential outcomes are shown in the table below.

The scenario ideally favors both prisoners remaining silent, which would minimize their collective jail time, marked in blue at the table's bottom right corner. However, this is considered an unstable solution because it assumes both would forsake a better offer—they could walk free if one confesses while the other stays silent.

Recurrent game theory model outcomes and behavioral psychology suggest that such mutual silence is improbable, as rational players tend to prioritize their self-interests, leading them to defect.

In game theory, the stable resolution occurs when each player chooses their best possible strategy given the other's choice, with no benefit from altering it. This is referred to as Nash Equilibrium .

This condition, a stable state, appears in the top left corner of the chart, demonstrating Alice and Bob making optimal decisions while considering each other's moves.

The Prisoner's Dilemma stands as a classic non-cooperative game theory model showcasing a non-zero sum game situation. In this context, non-zero sum games allow participants to have aggregate gains and losses that aren't fixed at zero. This dynamic can lead to either competitive or non-competitive scenarios, unlike zero-sum games, which are intrinsically competitive.

The Prisoner's Dilemma example is applicable in numerous real-world contexts, showcasing how players might cooperate. Within distributed systems, this notion is crucial for upholding trustless consensus models and holds significant implications for cryptocurrencies, as explored through cryptoeconomics.

The Interplay of Cryptoeconomics and Game Theory in the Landscape of Cryptocurrencies

Cryptoeconomics is the merging of cryptography, economics, and game-theoretic incentive structures within blockchain protocols designed to establish a secure, consistent, and lasting system.

While a relatively novel idea, delving into the essential functions of cryptocurrency platforms reveals its importance in deterring dishonest behavior and fostering reliability and integrity across blockchain networks.

Take Bitcoin for instance—a prime example to comprehend how game theory and cryptoeconomics operate within cryptocurrency platforms. For networks like Bitcoin to maintain security and meet blockchain consensus needs, they must be Byzantine Fault Tolerant .

Achieving Byzantine Fault Tolerance means decentralized nodes must agree on the current blockchain state without mutual trust.

This presents a significant challenge, primarily because cryptography ensures links between blockchain blocks but doesn't validate transactions or determine which competing chains are legitimate.

Bitcoin addresses this challenge via its Proof-of-Work consensus method. In this model, miners must solve computationally demanding puzzles to earn rewards for mining consecutive blocks.

This solution requires validation from other miners, where the process demands substantial energy—a tangible asset with financial implications. Consequently, the blockchain becomes secure and tougher to attack. As the network expands and decentralizes, thwarting internal or external attacks grows increasingly challenging.

Incentives rooted in game-theory mechanisms motivate participants—users and miners—to act in accordance with the system. Beyond that, subtle game-theory concepts quietly influence behavior behind the scenes.

For miners, the apparent economic incentive lies in the block reward for solving the next mining puzzle, currently pegged at 12.5 BTC. Since miners gain rewards in Bitcoin, their best interests align with Bitcoin's increasing value and the network's sustenance and security.

They expend resources (electricity) for the chance to secure a block, meaning dishonest actions that undermine network integrity entail a sunk cost. Acting dishonestly becomes more costly than adhering to honesty.

This setup nurtures a feedback loop where miners perpetually have incentives to uphold the valid blockchain—curbing malicious entities and ensuring a safe network.

Miners might act maliciously by adding invalid transactions to blocks or extending invalid blocks for more BTC. Game theory mechanics, however, acts as a countermeasure. Invalid blocks get dismissed by most miners in a cooperative game format, incentivizing them financially to align with the majority and abstain from creating invalid blocks due to escalating costs.

The outcome is a Bitcoin blockchain perpetually held in a self-enforcing Nash Equilibrium. The network achieves Byzantine Fault Tolerance by miners coordinating to preserve its most stable state.

For users, favoring the longest and most secure chain stems from Bounded Rationality. Essentially, users are accustomed to the main chain, avoiding unnecessary switching complexities. Though perhaps naïve, most users trust that the mechanisms keep miner power balanced.

Challenges in Applying Game Theory Mechanics within Distributed Systems

Despite the motivating structures and game-theory mechanics ensuring honest behavior in Bitcoin's network, notable concerns remain. Mining centralization due to mining pools raises alarms of potentially compromising the system’s reinforcing Nash Equilibrium through a 51% attack.

This scenario involves dishonest miners controlling enough of the network's hash power to create a blockchain fork, disrupting the decentralized coordination of miners. Consequently, some argue that incentive mechanisms aren't crucial or perhaps just a backup for cryptocurrency platforms due to the logical complexity they introduce.

Critics point out that assessing game theory models' success on these platforms goes beyond academic evaluation—practice is key. Game theory models in cryptocurrency platforms rely on assumptions about a threshold of honest or dishonest behavior.

Relying on implied human behavior assumptions for platform security is risky, particularly with unprecedented technology and models in place.

Bitcoin as a decentralized entity relies on uncoordinated choice, where party coordination is limited to their size interactions. Centralized mining pools defy this principle, posing significant security risks.

Conclusion

The evolution of game theory in the realm of cryptocurrencies is set to unfold dramatically. This intricate concept is becoming a cornerstone of the industry, significantly impacting elements such as security and the longstanding effectiveness of networks. As cutting-edge platforms emerge and attract a growing user base, the true potential or pitfalls of these systems will be revealed in real time.

We're at the dawn of a new era in crypto economics, a field that extends beyond just the frameworks of cryptocurrencies to reimagining the very mechanics of game theory itself. The repercussions of such developments promise to be far-reaching and transformative.

1Comment

Fascinating! I can now articulate the nuances of crypto to those unfamiliar with it much more effectively. Thanks!