The Gemini Exchange was founded in October 2015 by the Winklevoss twins (which explains their nickname). Cameron and Tyler Winklevoss gained when they famously took Mark Zuckerberg to court over Facebook, accusing him of copying their concept. They ended up with an astounding $65 million USD settlement, a portion of which, $11 million, they put into Bitcoin – solidifying their position as massive holders with their assets now being worth over a billion dollars .

Cameron and Tyler Winklevoss, depicted by Mashable .

However, their attention turned towards creating a highly respected cryptocurrency exchange – Gemini. Within just two short years, they carved out a significant slice of the market, pushing into Bitcoin trading's top 20.

Our review will delve into every corner of the Gemini Exchange, examining its attributes, user-friendliness, and fee structure.

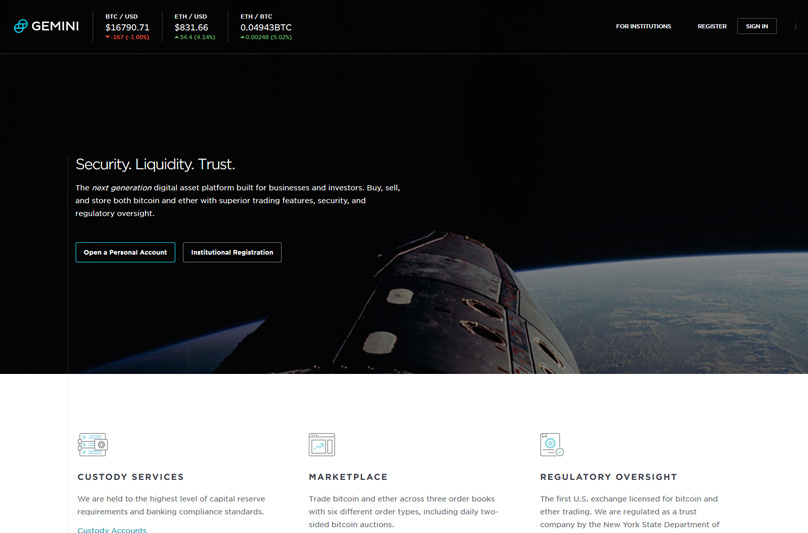

Gemini Exchange

Operating out of New York, Gemini proudly stands as a New York State limited liability Trust, fully compliant, and registered, following the strictest banking standards. Catering to both big institutions and solo investors, it's a go-to, thanks to its commitment to security and seamless functionality.

Gemini sets itself apart with a sterling reputation, bridging traditional finance and the bustling world of cryptocurrency while delivering service excellence that customers often rave about.

Key Features

- Usability – Gemini boasts a clean and intuitive platform, ensuring users have an effortless experience. Essential price, order, and balance data flow easily and swiftly, keeping the service snappy and users ahead of their trades.

- Protection – Adhering to all digital asset statutes and consumer safety laws, Gemini operates at a peak security level. FDIC insures US Dollar accounts, with monies housed in a New York-chartered bank. Offline protection is strict, with digital assets in cold storage and online assets safeguarded by Amazon Web Services’ arsenal of security protocols.

- Help & Guidance – Gemini offers a robust FAQ for common queries, along with a blog step-by-step walkthrough for purchasing and selling Bitcoin. More particular inquiries get addressed via email, promising prompt responses, typically within hours.

- Global Reach – Currently, Gemini extends its services across about 45 U.S. states and areas including Canada, Hong Kong, Puerto Rico, Singapore, South Korea, and the UK.

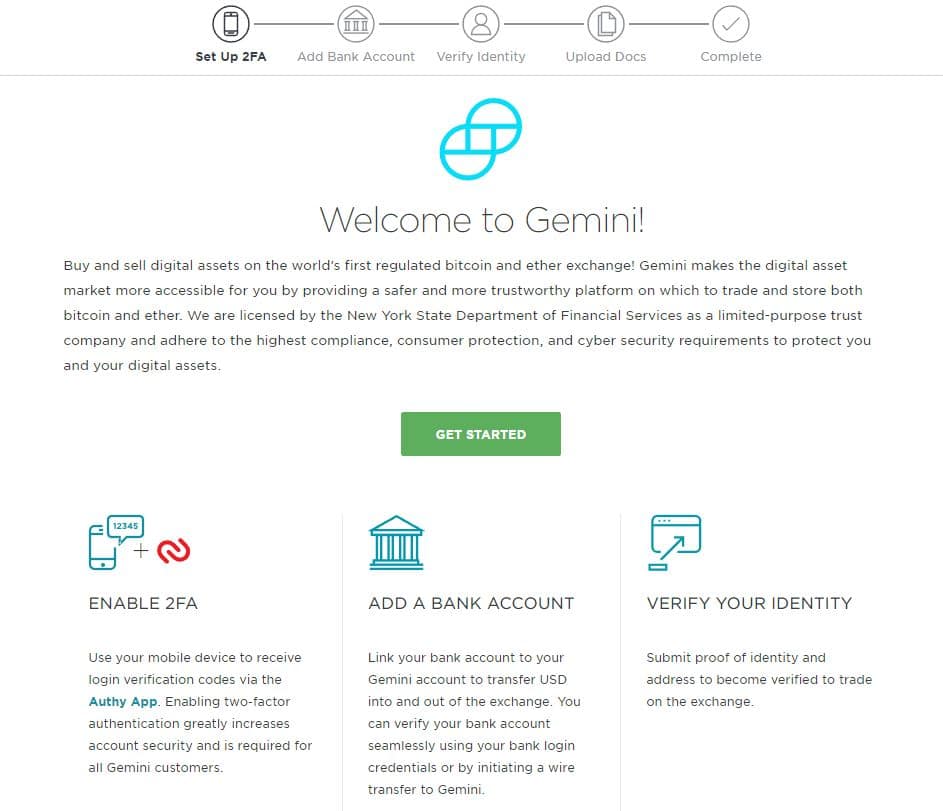

Gemini Signup & Login

1) Register

Visit the website and kick off the registration journey. Getting an account up and running is a breeze – simply fill in basic details like your name and email.

After checking your email, you should:

- Provide your place of residence and phone number, then augment security with Two-Factor Authentication (2FA), adding a safeguard to your account.

- Link your bank account for future transactions. Currently, Gemini only processes bank transfers and wires for depositing funds.

- Send in a government-issued ID. This verification step lets Gemini comply with the Bank Secrecy Act (BSA) and Anti Money Laundering (AML) laws, enabling you to deposit, withdraw, and trade USD. Processing time varies based on volume, from a few days to a week.

- Once completed, you're all set to start funding your account.

2) Make a Deposit

Access 'Transfer Funds' from the Menu, then go to 'Deposit into Exchange' through 'Bank Transfer'. Here you can input your desired deposit amount. Note: daily transfers are capped at $500.

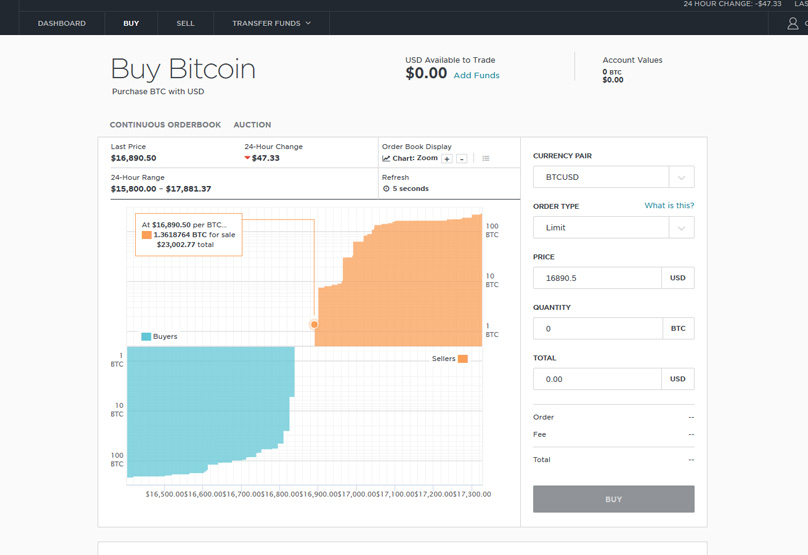

3) Buy Bitcoin and Ethereum

Bank transfers deposit funds instantly for trading. Navigate the Menu to select your preferred trading pair, like BTC/USD for Bitcoin or ETH/USD for Ethereum.

Input the amount and price, then hit go to fulfill your order. You can also explore the marketplace where others’ market orders are listed for trade.

Once your purchase finalizes, your account reflects the addition of Bitcoin or Ethereum. You can take to the market to sell, though withdraws await the completion of bank transfers.

Gemini Marketplace

Gemini also operates a marketplace continuously, round-the-clock, letting users engage in limitless orders with broad trading options, including:

- Market Orders that match instantly at the present best rates.

- Limit Orders fulfilled at or above a chosen price remain on the books until filled or canceled.

- Immediate or Cancel (IOC) Limit Orders meet quickly at specified rates, with unfulfilled portions canceled, leaving no lingering balances.

- Maker or Cancel (MOC) Limit Orders rest on the order book at set prices and cancel completely if partially matchable.

Gemini stands as a fully reserving exchange, requiring all trades to be fully financed. Margin trading remains unoffered, and any pending interest aligns with user account balances only. Additionally, open orders decrease available balances until resolved.

Gemini Fees

In terms of deposits, Gemini supports a low fee policy free deposits of Bitcoin, Ether, and Wells Fargo and wire transfers. Please note, individual bank wires to Gemini may incur separate charges. Platform withdrawals remain gratis, introducing 30 fee-free withdrawals per calendar month, after which applicable network mining fees apply: estimated around 100,000 satoshi (0.001 BTC) on Bitcoin Network; 0 GWei (0 ETH) on Ethereum Network.

With trading fees pegged at 0.25% for both makers and takers, favorable volumes reduce this charge. Maker fees drop to 0% for volumes exceeding 5,000 Bitcoin or 100,000 Ether, likewise, taker fees dip to 0.10% for those same trading amounts.

Gemini embraces a fluid maker and taker fee arrangement; offering traders potential rebates on liquidity-generating trades based on trade volumes and buy-sell ratios compiled over 30 days. This recalibrates daily, and additional fee specifics are available here .

Trading Limits

For most transfer methods, restrictions don't exist, however, Automated Clearing House (ACH) imposes a $500 daily cap, and $15,000 monthly cap for individuals; institutions see a $10,000 daily and $300,000 monthly maximum.

Concerning purchases, a minimum Bitcoin buy equates to 0.00001 BTC (1000 satoshis), while Ethereum demands a 0.001 ETH minimum buy.

Is Gemini Safe?

Recognized for its ironclad security, Gemini relies on cutting-edge tactics akin to traditional finance. Two-factor authentication shores up accounts, enforcing extra device-based authentication.

US Dollar accounts' FDIC insurance tap Ni-Charter banks within New York. Moreover, digital assets find cold storage homes, while Amazon Web Services shelters online assets with tech-centric safety features like multifactor techniques, tiered access, and secure hardware modules.

This steadfast security ethos wins admiration from institutional and affluent investors, plus casual traders alike, ensuring all can operate with trust, big or small.

Though a newcomer to crypto's hustle, Gemini is methodically charting rapid growth. Prioritizing a platform where safety, security, and quality service for its clientele reign supreme.

Originating as a US-centric Bitcoin exchange, Gemini carefully diversifies with Ethereum offerings, hinting at future broadening across trading pairs. Despite global presence, the platform currently supports only US Dollar fiat operations.

Revamping customer support would benefit Gemini, appealing to crypto novices needing more than email for assistance. Introducing phone and live chat services could enrich user interactions significantly.

Conclusion

Gemini is a well-regarded platform known for its trustworthy image that opens up the world of cryptocurrency trading to newcomers and experienced traders alike. Acting as a bridge for buying prominent cryptocurrencies like Bitcoin and Ethereum, it provides users with the facility to link directly with their bank accounts for transactions, just like Coinbase does. This feature greatly enhances its appeal by providing a seamless experience which many find pivotal, thus allowing Gemini to stand tall among its rivals.

When considering where to safely trade Bitcoin or Ethereum, Gemini emerges as a commendable option. It caters to those new to the crypto scene and seasoned traders alike, thanks to its straightforward bank transfer capabilities. While there's still potential for the platform to elevate its services further, its current offerings already cement it as a secure choice for anyone aspiring to engage in Bitcoin and Ethereum transactions with a sense of assurance and ease.

4Comments

As a UK resident holding dollars on the Gemini exchange, will the FDIC provide me with coverage?

When is the pre sales starting

It’s been over a month without any response. They just ignore email communications.

Gemini's customer support is severely lacking in responsiveness. Email is the sole channel, with no phone support available, leaving customers feeling neglected. After I deposited funds, my account was frozen, and their silence persists. Absolutely the worst!