Looking into getting involved in cryptocurrency mining Whether you’re venturing into mining just for fun or thinking about it as a small personal business, knowing the essentials of hash rates is crucial for making informed decisions. In this article, we'll walk you through the basic framework of hash rates and explore how factors like electricity costs could significantly impact your profits.

The Basics – What is a Hash Rate?

In layman's terms, a hash rate measures how quickly a mining device operates. Unlike the straightforward process suggested by the term “mining,” which sounds like digging through a tunnel, it's more like playing a high-speed guessing game. Each mining device is trying countless possibilities per second to crack the code of the current block.

While technically possible, the likelihood of cracking a bitcoin block and reaping the entire 12.5 bitcoin reward with an outdated laptop is astronomically low, akin to the odds of being struck by lightning on a sunny day. At the current levels of difficulty, mining a single block solo with only 50 hashes per second using a traditional CPU could take over 750,000 years.

When evaluating mining hardware, such as an ASIC miner or GPU, you can compare their hash rates, essentially the number of attempts per second to solve a block and earn a reward. Although pool mining alters the payout method, the fundamental principle remains: higher hash rates typically lead to greater rewards.

Hash rates can be represented in various formats, and we'll delve into these different types now.

Decoding Hash Rate Terminology

Hash rates incorporate terms familiar to anyone knowledgeable about computer data, using prefixes like mega, giga, and tera to describe the scale.

Starting at a basic level, a hash rate of 60 hashes per second means the device can make 60 computational attempts each second to figure out a block.

The hierarchy progresses to kilohashes (KH/s), megahashes (MH/s), gigahashes (GH/s), terahashes (TH/s), and petahashes (PH/s), and here's a useful graph illustrating how these calculations are derived.

kilohash = 1,000 hashes

megahash = 1,000 kilohashes

terahash = 1,000 megahashes

petahash = 1,000 terahashes

Not all Hashes are Equal

A comparison between a bitcoin miner and one designed for Ethereum, for example, reveals a substantial difference in hash rates due to the distinct algorithms used by various cryptocurrencies, each requiring different amounts of memory and computational power.

In a nutshell, the Bitcoin SHA256 algorithm is relatively straightforward by contemporary standards. Consequently, miners today require hashes in the terahash range or above to remain viable.

In contrast, Ethereum miners, often based on GPUs, typically perform in the megahash range.

Etherum Mining Rig

At first glance, it may appear that a bitcoin miner is more advanced or productive, churning out more SHA256 hashes. However, these hashes are easier to compute, raising bitcoin's network difficulty considerably.

To complicate matters, some cryptocurrencies adopt algorithms that are only feasible for basic CPU mining. Devices on these networks that generate a few hundred hashes per second can be considered top-tier and among the most competitive.

What is the takeaway from all of this? Simply put, hash rate alone doesn't determine a miner's efficiency. Understanding network difficulty and what average miners produce for that specific cryptocurrency is equally vital.

Calculating Profitability

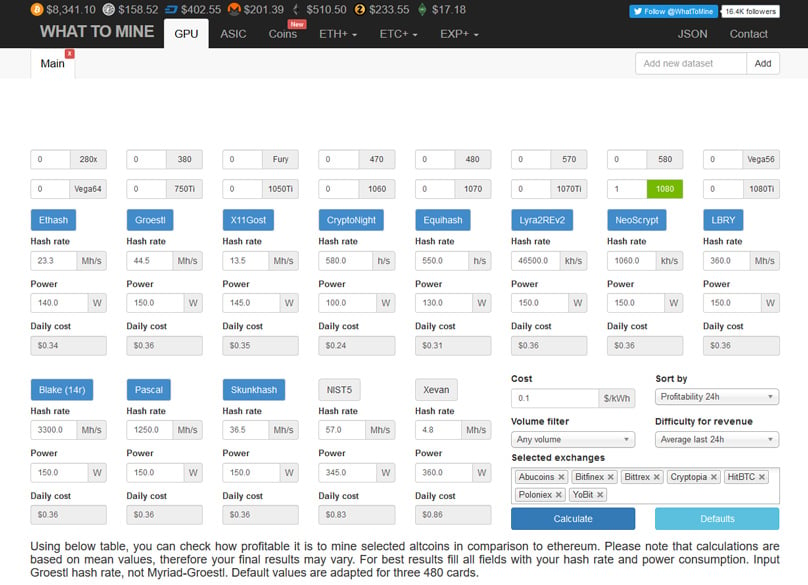

Since not all hash calculations are equal, it's essential to calculate a miner's potential profitability using its hash rate.

For accurate predictions, utilizing a mining profitability calculator can be immensely helpful. here .

Taking a closer look at Bitcoin: today’s top-tier ASICs are capable of producing around 12 terahashes per second. Given today's difficulty, this translates to an expected yield of approximately 0.318 BTC annually. If the same hashing power is directed towards Bitcoin Cash, a miner might anticipate earning 2.7635 BCH annually. While the value difference is minor currently, BTC maintains a higher valuation.

Examining Ethereum mining, a competent GPU might achieve about 50 megahashes per second. When assuming this hash rate, an Ethereum miner could earn around 1.45 ETH per year. Typically, an Ethereum mining rig holds seven GPUs, so with each operating at similar speeds, one could expect to mine just over 10 ETH annually.

Factoring in Electricity Costs

A critical aspect of determining mining profitability is the cost of electricity powering the mining equipment. This efficiency, or energy usage relative to the hash rate, is vital for assessing a miner's profitability.

Although GPUs were once the standard for bitcoin mining, attempting such today would incur excessive electricity costs outweighing gains from hash rates, rendering the endeavor unprofitable. This is why ASIC miners prevail, offering not only superior hash rates but also relatively lower energy expenses.

The hash rate alone doesn't define profitability; rather, efficiency matters. An apparatus with a 10% superior hash rate but 50% increased energy usage might not be as lucrative.

Wrapping Things Up

Hash rates are key metrics for any cryptocurrency mining gear, whether an ASIC or simple laptop CPU. Yet, these figures can be deceiving. Therefore, deeper understanding is needed to interpret what hash rates actually indicate.

For those looking to profit, the electricity usage versus hash rate efficiency is a critical factor, ensuring that expenses and earnings align adequately.

1Comment

GPU Hashrate List for Gaming & Mining

GPULister is an online platform where you can explore and catalog various graphics cards, detailing their attributes like Core clock, Memory Clock, Power consumption, Driver Version, and Operating System specific to different algorithms. Visit https://gpulister.com/