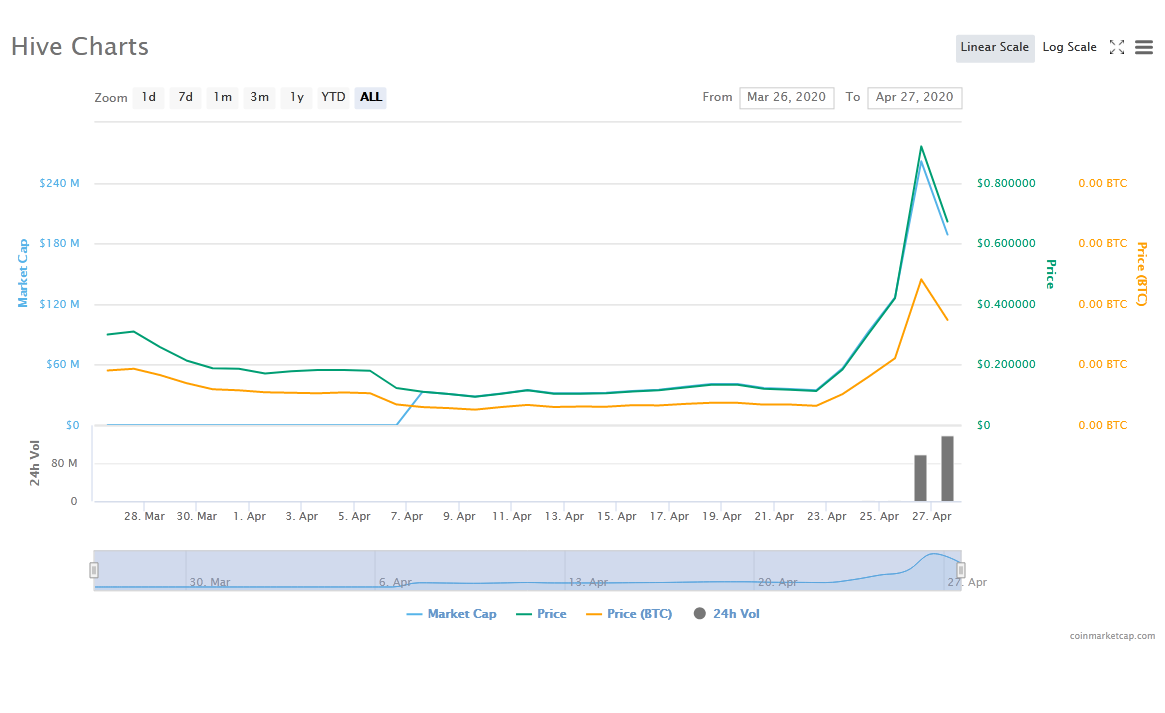

Hive ( HIVE ), the crypto that forked from Steem (STEEM) Amidst concerns about Tron CEO Justin Sun's involvement, leading to accusations of a hostile takeover, Hive is garnering significant backing from major exchanges. Now, Hive ranks within the top 40 cryptocurrencies by market cap, with its price soaring over 460% in just a few days.

Elsewhere in the cryptocurrency landscape, Ethereum's value has increased by more than 50% since the beginning of the year, fueled by substantial institutional interest in this second-largest digital currency. Meanwhile, Bitcoin is experiencing BTC ) appears to have shaken off the “ Black Thursday a dip and currently faces a region of triple resistance that could shape its price path, especially with the halving event on the horizon.

Binance Embraces the Hive Hype as Price Announcements Boost

In a statement In an update released on Monday (April 27, 2020), Binance, a titan in crypto trading, unveiled its decision to list Hive on its platform. According to their blog, Binance will introduce support for three trading pairs: HIVE/BTC, HIVE/BNB, and HIVE/USDT.

#Binance Will List @hiveblocks $HIVE https://t.co/YGD3stV5wN pic.twitter.com/WFTu9KqXq6

— Binance (@binance) April 27, 2020

Furthermore, Binance has scheduled the beginning of Hive deposits and withdrawals for Wednesday (April 29, 2020). This announcement marks another major crypto exchange listing for Hive in recent weeks.

Significant exchanges such as Bittrex, Probit, and Huobi Global are part of the exchanges endorsing Hive. On Monday, Huobi also allowed Hive withdrawals, even though the listing was announced back in March.

The wave of exchange listings has coincided with a bullish momentum for Hive, pushing the 37th-ranked cryptocurrency up by more than 460% in mere days. This price jump has propelled Hive's market value to $191.4 million, nearly two and a half times that of Steem.

Hive's rise from Steem justifies its supporters, particularly after the events leading to the hard fork. In March, some within the Steem community accused Justin Sun, Tron's CEO, of attempting a hostile takeover.

Reports back then suggested Sun used STEEM holdings on exchanges like Huobi and Binance to influence voting on the platform, aiming to block a planned soft fork to limit his influence over Steem. Later in March 2020, a faction within the Steem community, opposed to Sun's control, successfully initiated a hard fork, giving birth to Hive.

Ethereum Sees 50% Growth in 2020 Amid Rising Interest from Institutions

In another corner of the crypto market, Ethereum is experiencing a 50% rise this year amid a flood of interest from large investors. Analysis shows that Grayscale Investment’s Ethereum investors in crypto asset management have bought nearly half of the 1.56 million ETH produced in 2020.

This substantial purchasing activity led to Grayscale's Ethereum investments surpassing $110 million in Q1 2020 alone. Indeed, Grayscale is on track to set a new record for investment inflows this year.

According to Grayscale’s Q1 2020 report Overall, inflows have reached $503.7 million. In 2019, Grayscale recorded $607 million in crypto investments, primarily from institutional investors such as hedge funds.

For Bitcoin (BTC), despite being the top-crypto by market cap, its price has rebounded from the sharp dip in mid-March 2020. At the time of writing, BTC has reclaimed the $7,700 threshold and faces resistance between $8,000 and $8,400.

The Black Thursday crash impacted Bitcoin's 2020 performance, keeping its growth at nearly 8%. The upcoming halving halving in May is expected to positively affect Bitcoin's price as the supply reduction might lead to demand outpacing available amounts.