In the continuation of our cryptocurrency insights, we break down how these digital currencies function, why the decentralized nature and blockchain technology captivate users, and familiarize readers with terms that are frequent in cryptocurrency discussions.

Consensus: Ensuring Security and Non-Repudiation

Cryptocurrencies rely on a distributed network. Unlike banks, where power is centralized, here, it’s spread across many participants.

The network comprises numerous individuals, known as 'nodes,' each with access keys, preventing any single user from monopolizing trust. Thousands can operate within one network, gaining rewards for rule-following or facing penalties for violations, fostering an ecosystem where adherence is preferable to misconduct.

This decentralization equips cryptocurrency users with security layers absent from traditional banks.

Hacking concerns are mitigated as transactions are fragmented, dispersed, and sealed within the blockchain through intricate equations. Breaches are swiftly detected and thwarted by resilient defenses.

Consensus algorithms perform dual roles: ensuring the blockchain remains genuine and preventing powerful disruptors from corrupting the system.

We'll explore various consensus methodologies employed by cryptocurrencies today.

Proof of Work (PoW)

Completing a cryptocurrency ledger segment, called a 'block,' requires nodes to solve challenging equations, consuming extensive power. Successful solutions earn them 'block rewards' and transaction fees, a process termed 'mining,' with participants known as 'miners.'

Mining Mining utilizes computer resources, often GPUs or specialized ASICs, and in some cases, CPUs can suffice.

If a miner's solution deviates, it's dismissed, as mining energy expenditure discourages deceit. Instead, miners provide proof of work and receive compensation.

Dominating the network necessitates grasping 51% control, an investment typically unrewarding, given the complexity in altering transactions.

Miners form collectives, 'mining pools,' stabilizing earnings, while the challenge level of obtaining rewards is labeled as 'block difficulty.'

Exploring Proof of Stake (PoS) and Proof of Importance (PoI) in-depth

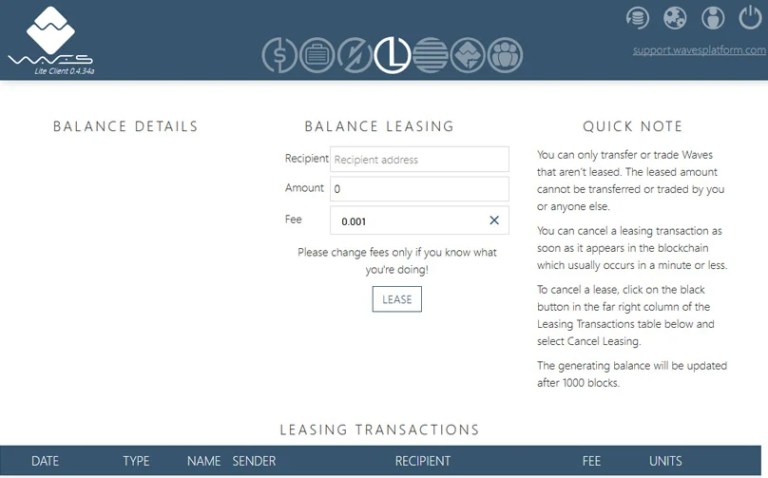

Another rewarding avenue in cryptocurrency is proof of stake (PoS), bypassing mining, where a designated node processes transactions sans solving equations, verified by other nodes.

Participants engage in 'staking,' securing currency within virtual safes. Misconduct leads to forfeited stakes, deterring deception. Nodes with the largest stakes are preferred for block creation.

In proof of importance, mining isn't required, but staking is key. Selection for block creation hinges on an 'importance score' based on network engagement and large transactions.

Understanding Delegated Byzantine Fault Tolerance (dBFT)

This method, not involving mining, elects nodes through shareholder voting, requiring currency staking, though the amount isn't crucial, equalizing weight.

Minimum staked amounts are defined, inflating node control costs. Elected nodes generally offer minimal transaction fees, attracting network users.

Delegated Proof of Stake (dPoS)

Delegated proof of stake involves two node types: witnesses validating transactions for fees and delegates governing transaction aspects.

The Tangle Network

This system mandates users to validate prior transactions, forming a network and enabling free transactions, adhering to universal rules.

Smart Contracts and Dapps

Beyond currency, blockchain technology is expanding into smart contracts and dapps, with startups exploiting its broad applicability.

Once signed, smart contracts indelibly link to the blockchain, autonomously executed per agreements, removing reliance on human delivery failures.

Dapps, working with smart contracts, automate service coordination, eliminating third-party necessity for transaction validation and agreement enforcement.

Digital Assets

Digital assets are narrowing the divide between digital and tangible realms, promising impactful life improvements.

While smart contracts and dapps are digital-centric, digital assets bring tangible items to blockchain, attaching legally binding certificates, revolutionizing voting, property transactions, and personal data management.