The world of crypto futures is on the rise, with more trading platforms popping up that offer a plethora of tools, including advanced trading bots, to enhance the trading experience.

These platforms primarily make their money through different types of fees, whether from transactions or interest, with the nature of the contract dictating the specifics. However, navigating futures trading, especially with leverage, comes with its own set of risks.

This makes it critical for traders Selecting a trustworthy platform is crucial, and with numerous options available, safeguarding your investments must be a top priority. Phemex , or any of the other major exchanges.

Let’s dive deep and truly understand what crypto futures are all about and how to skillfully engage with them for potential gains.

What are Crypto Futures Contracts?

Futures contracts constitute legal agreements for the purchase or sale of an asset at a pre-established price on a certain future date. Imagine two enthusiasts invested in Bitcoin; one promises to offload it at a set price, and the other vows to purchase it upon settlement. These contracts are a hub for speculators striving to cash in on predicted price shifts.

Futures contracts also serve to hedge against unfortunate price fluctuations. For instance, if you currently hold 1 BTC yet fear a potential price drop, a futures contract can enable you to sell at today's rates regardless of future changes, providing a safety net against depreciation.

Among the different types of futures, perpetual contracts stand out due to their simplicity and popularity. Many investors have found significant success trading these, so we'll focus primarily on these instruments.

What is the operational framework for Crypto Perpetual Futures Contracts?

Similar to traditional futures contracts, these are agreements for future transactions between buyers and sellers. The twist is that there’s no set date for settlement, giving traders the flexibility to terminate or execute their positions anytime they wish.

The technical details might get overwhelming, so let's simplify the concept by illustrating how perpetual contracts function on a crypto exchange.

The key idea is that these contracts let traders benefit from price movements in crypto markets without owning the actual digital currency.

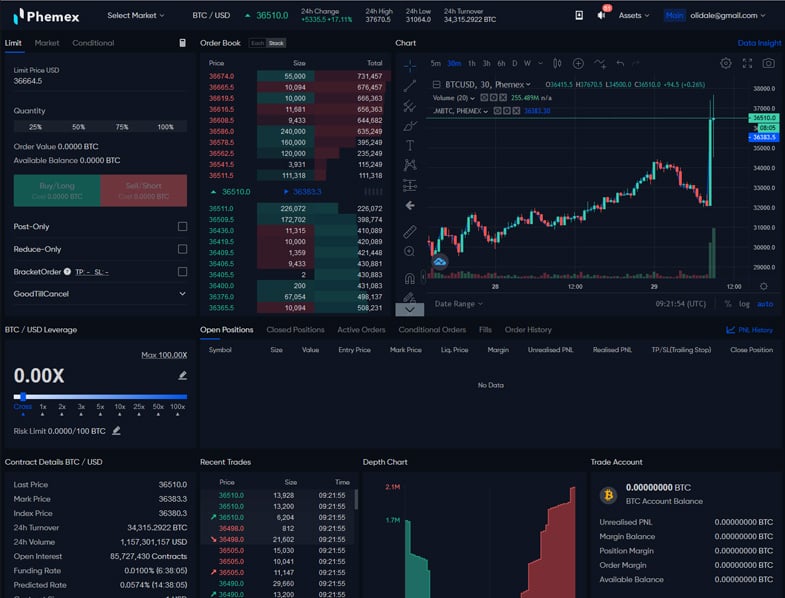

Take Phemex’s ETH/USD perpetual contracts For instance, the exchange gives you the liberty to predict whether the price will soar or plummet.

- Opting to 'long' (buy) means you think the price of ETH in USD terms will climb, while 'shorting' (selling) indicates a belief that it will decrease.

- Imagine you're 'long' in a position equivalent to 1 ETH. Therefore, with every dollar increase in ETH's value, your profit echoes this rise, pending fees.

- The absence of expiration dates means perpetual contracts can be maintained indefinitely, allowing traders to close them when they are happy with their gains.

- Once you're content with your earnings, you can close your position, and the exchange will promptly award your gains in a stablecoin like USDT.

This approach enables traders to profit from ETH price oscillations without directly engaging in ETH transactions. Instead, it relies on correctly predicting price trends.

The exchange uses mechanisms like funding fees to ensure the ETH/USD contracts are always pegged to real ETH’s market price. It also pairs you with a counterparty, ensuring that once your position is closed, profits are distributed, and losses are factored in without delay.

Phemex hosts an array of perpetual crypto futures contracts available for 24/7 trading in many regions.

Build Up a Trading Plan

The foundation of crypto futures contracts is largely straightforward. With a solid understanding of their mechanics, it's prudent to develop a sound trading strategy.

A robust trading plan has two main components:

- Strategy

- Risk management

Strategy

Trading strategies have filled countless books, with technical analysis now essential to traders, helping them determine the right entry and exit points using diverse market indicators.

These concepts and tools are key in algorithmic trading, with indicators like volume, moving averages, and Bollinger Bands playing essential roles.

We’re not offering precise trading tips here, but mastering these tools is critical. Dive into Phemex’s vast pool of educational resources to bolster your market knowledge. Crypto Academy Testing your strategies in a risk-free environment via a demo account is a wise move before venturing into real trades.

Phemex offers these simulation accounts where you can practice until you're ready to hit the real market. At the heart of trading success is risk management, particularly when incorporating leverage.

Risk Management

Leverage enables you to control much larger positions than your initial capital would normally allow.

Using the previous example, assuming you're ready to trade with 1 ETH, Phemex facilitates up to 20x leverage, ballooning your position to 20 ETH. This amplifies potential profits.

However, with increased profit potential also comes heightened risk of loss. Price movements against you could result in exponential losses, potentially wiping out your position.

In leveraged trading, deploying Stop Loss orders is critical to capping losses by automatically closing positions at predefined points. Recognize the dangers before engaging in this high-stakes world!

With a multitude of exchanges and platforms available, thoroughly assess each one to avoid sending your crypto into the void.

Choose a Trusted Exchange

Beyond checking reputations, ensure the platform serves your location, safely accepts deposits, and matches your trading needs.

Here are some crypto futures exchanges worth exploring:

Arm yourself with in-depth research, a rock-solid trading strategy, and astute risk management to navigate the crypto futures landscape profitably.

Nicholas Say, originally from Ann Arbor, Michigan, has widely traveled, residing in Uruguay for years and now calling the Far East home. His writings are prolific online, concentrating on tangible innovation and technological evolution.