Cryptocurrencies find themselves in an ambiguous and often perplexing legal zone. The main reason for this is the novelty of the technology. To be honest, the blockchain technology behind these digital assets is still relatively new, making it challenging for banks and regulatory bodies to fully grasp the implications.

Their decentralized and anti-regulatory essence only adds to the complexity. Take the example of Satoshi Nakamoto's foundational Bitcoin whitepaper—one of the core intentions was to create a financial system free from third-party oversight and control.

This very autonomy sets cryptocurrencies apart from traditional financial assets. The decentralized blockchain structure allows cryptocurrencies to self-regulate and apply their own rules.

In an ideal scenario, that would be the way things work. However, the practical landscape of finance is far more intricate. For instance, the U.S. Internal Revenue Service has already confirmed that cryptocurrency transactions are taxable events.

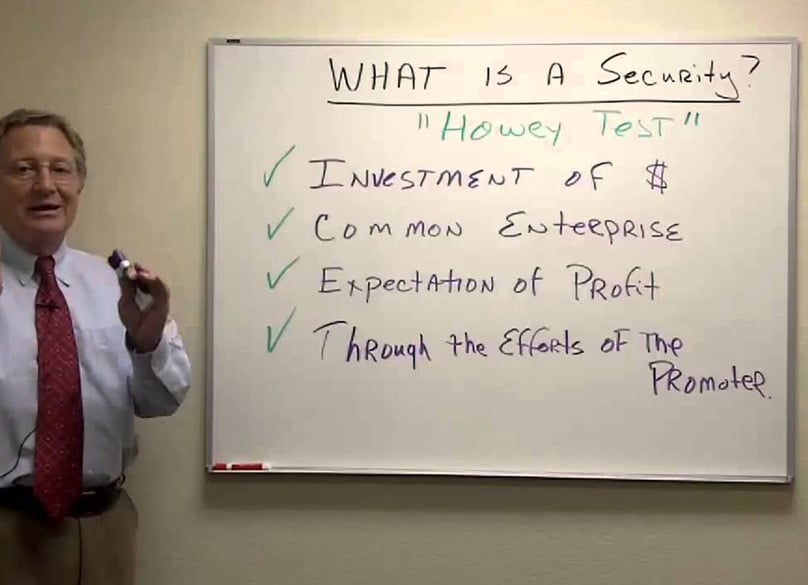

Moreover, the The U.S. Securities and Exchange Commission (SEC) has also made it clear that cryptocurrencies can meet the criteria outlined by the Howey Test, categorizing them as securities and thus subjecting them to corresponding regulations. Let's explore the Howey Test, see how it applies to digital currencies, and consider its influence on the cryptocurrency market moving ahead.

The Howey Test traces its origins to a 1946 Supreme Court case. In this landmark decision, the W.J. Howey Company offered citrus grove parcels to external investors. The arrangement was that the buyers would lease the groves back to Howey, which would then manage the harvesting and sale of citrus fruits.

The Howey Test

The Supreme Court identified the citrus grove transactions as investment contracts, hence categorizing them as securities. This was based on four key criteria, later known as the Howey Test.

For a financial instrument to fall under the definition of a security, according to the SEC, it must satisfy these four conditions:

The expectation of profits drawn from the efforts of a third party.

- It must be an investment of money

- With an expectation of profit

- In a common enterprise

- The Howey Test, Illustration by RealEstateCE

A more common security example would be stocks, which also pass the Howey Test. For instance, buying a share in U.S. Steel involves monetary investment with the hope of future appreciation. This investment occurs collectively with others, relying on the company's leadership to drive profits.

Investors' lack of control over profit-making decisions is crucial. The essence of securities regulation lies in protecting investors from potentially exploitative schemes, which aims to ensure transparency and accountability in financial dealings.

While this is the theoretical framework, in reality, large companies often employ teams of expensive lawyers and accountants to navigate complex regulatory demands.

Cryptocurrency initial coin offerings (ICOs) challenge these traditional systems. Unlike big corporations, coin developers are typically smaller startups, sometimes even lone innovators, lacking the resources to vet their ICOs against stringent security regulations.

In fact, until 2017, the classification of cryptocurrencies as securities was uncertain.

The DAO, a German initiative, conducted a token sale in 2016. These tokens were then

The DAO

Though the SEC chose not to penalize The DAO, its decision attacked by hackers , forcing a fork in the Ethereum blockchain .

made it explicit that from that moment on, all cryptocurrencies were considered securities. a statement in July 2017 \"These rules apply uniformly to anyone offering or selling securities in the U.S., whether it be a traditional corporation or a decentralized autonomous organization. It doesn't matter if these securities are purchased with dollars or digital currencies, or if they're distributed via physical certificates or through a blockchain,\" stated the SEC. \"Moreover, any entity operating an exchange, such as coordinating securities orders between multiple buyers and sellers via predefined methods, must comply with registration requirements as a national securities exchange or qualify for an exemption.\"

The legal revelation was the illegality of unregistered crypto ICOs, effectively banning U.S. citizens from participating in them. This lumped small-time cryptocurrency developers next to titanic corporations and banks in the legal arena.

This shift sparked immediate backlash from within the cryptocurrency community, who feared that enforcing SEC jurisdiction over ICOs might stifle innovation in this rapidly advancing industry.

Critics point out, for starters, that it's not self-evident that all tokens are indeed securities. The SEC's report targeted The DAO specifically, but did not necessarily incriminate all cryptocurrencies. Some may not meet the Howey Test's criteria, but developers must prove this.

Furthermore, considering them as securities substantially raises the entry barriers for coin developers. ICOs often serve as essential liquidity boosters for jumpstarting projects. If these offerings are obstructed by costly regulatory measures, projects risk premature cessation.

As with much of the crypto realm, the future remains murky. The SEC hasn't released more detailed guidance on cryptocurrency developments, which could be intentional; some industry experts appreciate the SEC's moderate approach, allowing the crypto community to self-regulate to some extent.

Moving Forward

Additionally, by not broadly categorizing all cryptocurrencies alike, the SEC has tasked developers with proving whether their projects qualify as securities or not.

That task demands significant resources and, undeniably, introduces a new dynamic to ICOs' once-unrestricted nature—at least on U.S. soil. operating a security .

This could potentially benefit the broader market. Coinmarketcap.com lists over 1,600 coins, some with dubious applications or honest intent.

The term ”scam” is thrown around in the crypto space more often than warranted, due to ventures that seem to emerge, inflate in value, and vanish mysteriously.

shadowy groups often operate away from regulated oversight. Shady developers and pump-and-dump , may bring stricter oversight forth.

A measure of legitimacy, and perhaps institutional money There is a cost, however, to this more hands-off development atmosphere.

Editor-in-Chief of Blockonomi and founder of Kooc Media, an online media firm based in the UK. Advocate for Open-Source Software, Blockchain Technology, and an inclusive digital landscape.

References

- https://bitcoin.org/bitcoin.pdf

- https://www.irs.gov/newsroom/irs-virtual-currency-guidance

- https://caselaw.findlaw.com/us-supreme-court/328/293.html

- https://consumer.findlaw.com/securities-law/what-is-the-howey-test.html

- https://www.sec.gov/litigation/investreport/34-81207.pdf

- https://www.cnbc.com/2018/03/07/the-sec-made-it-clearer-that-securities-laws-apply-to-cryptocurrencies.html

- https://blog.xtrabytes.global/general-crypto/understanding-the-howey-test/

- https://www.coindesk.com/every-token-snowflake-secs-ico-guidance-isnt-enough/

- https://www.sec.gov/news/public-statement/corpfin-enforcement-statement-report-investigation-dao

- https://www.coindesk.com/simplest-way-understand-dao-security/

- https://coinmarketcap.com/all/views/all/