As the realm of cryptocurrency surges forward, a variety of exchange platforms have entered the scene, each bringing its own unique set of fees, coin pairings, regional peculiarities, and user experiences.

Huobi Huobi, rooted in Singapore, is distinctly customer-centric and offers standout cryptocurrency evaluations. Established in 2013, it has its sights firmly set on the Asian market, with branches in Japan, Korea, and Hong Kong along with its Singapore headquarters. There's a single Huobi office in the U.S., yet from May 2018, Huobi advises American visitors that they cannot register due to legal restrictions. However, Huobi plans to roll out services for U.S. residents soon, out of San Francisco.

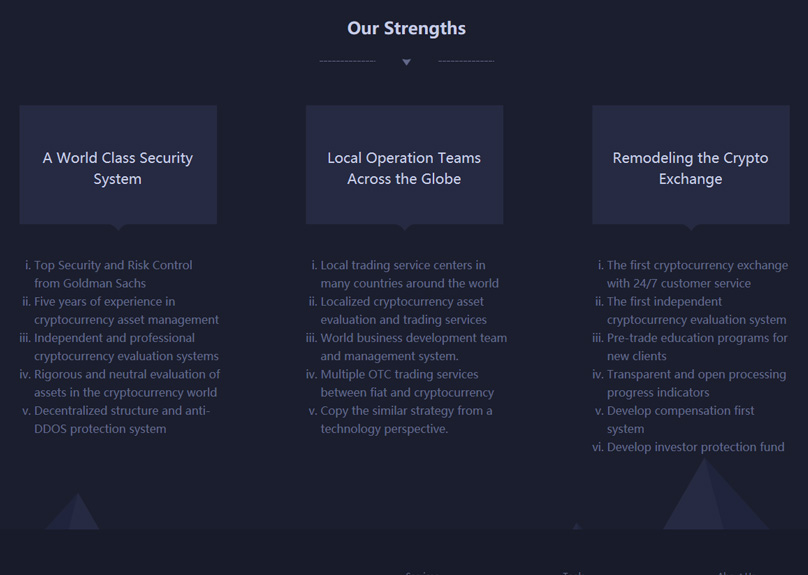

This dive into Huobi will dissect the essentials and unique attributes of trading on the platform, including coin pairings, security protocols, and trading tools. We’ll also explore Huobi's accolade-worthy 24/7 customer service and their noteworthy investor protection fund.

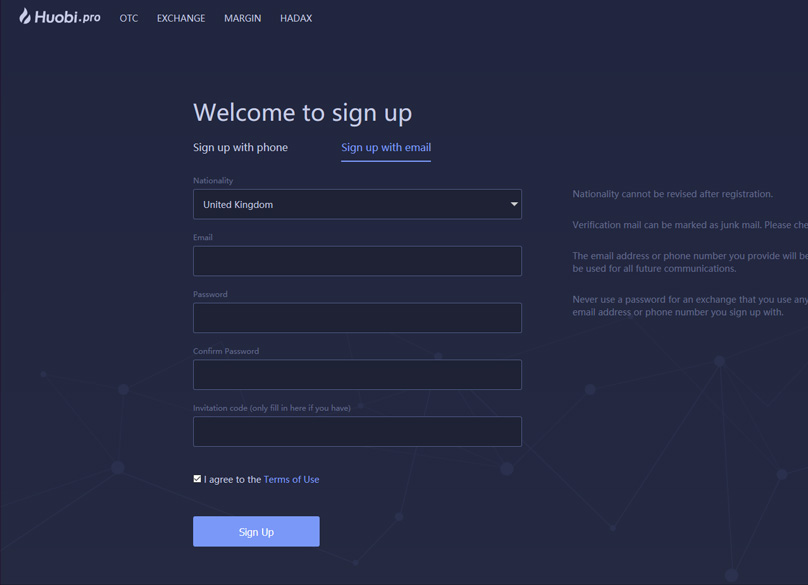

Huobi Account Signup

Setting up an account on Huobi is quite straightforward. The relevant link awaits you in the top-right part of the homepage. Initially, it requires you to provide your nationality, reminding you that this selection is irreversible. Huobi operates in over 130 countries. Notably, the United States isn't an option. As of May 2018, popular picks include China, Hong Kong, Taiwan, Japan, Korea, Germany, the UK, and Canada. to create an account Choose a username which can be your mobile number or an email. Huobi cautions that email verifications might peek into your spam folder, so give it a check once the account is set up.

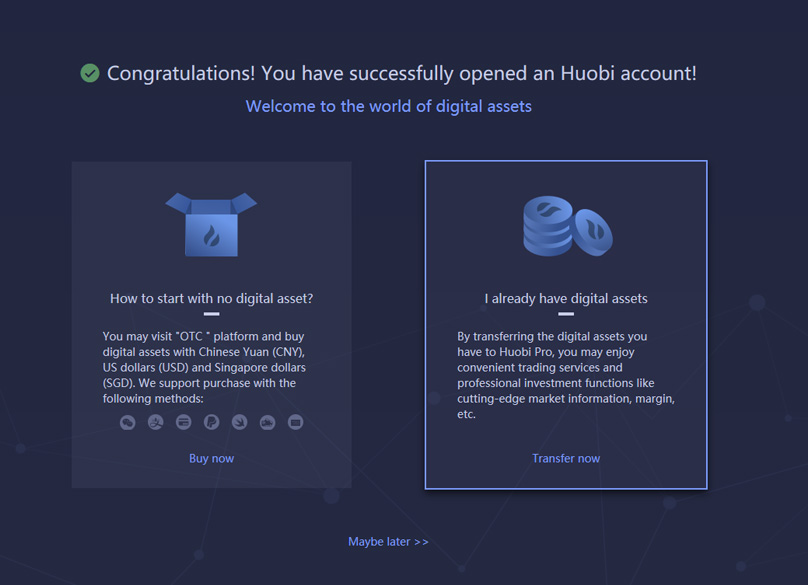

Post account creation and confirming your email, logging in presents a welcome screen inviting you to procure cryptocurrency using Chinese Yuan, US dollars, and Singapore dollars. Alternatively, you can transfer your existing assets onto the platform.

Post setup, the basic exchange awaits. Huobi provides trading pairs in USDT, BTC, and ETH. Over 40 USDT, around 100 BTC, and a comparable range of ETH pairings are available. They're sorted by their age on Huobi or if they branched off from another coin, and can be viewed in trading pair terms or USD. OTC service The detailed trading setup organizes available pairs in a sidebar on the left, while on the right, an interactive candlestick chart from Trading View offers a wide array of Technical Analysis tools.

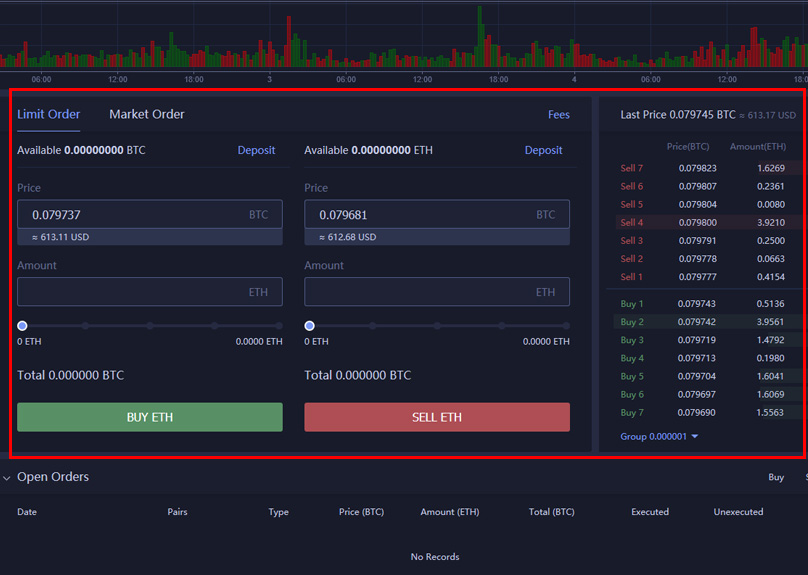

How to Trade on Huobi

Situated beneath the chart are the order forms for buying and selling using limit or market orders. Adjacent are recent pricing data and order lists for the selected coin.

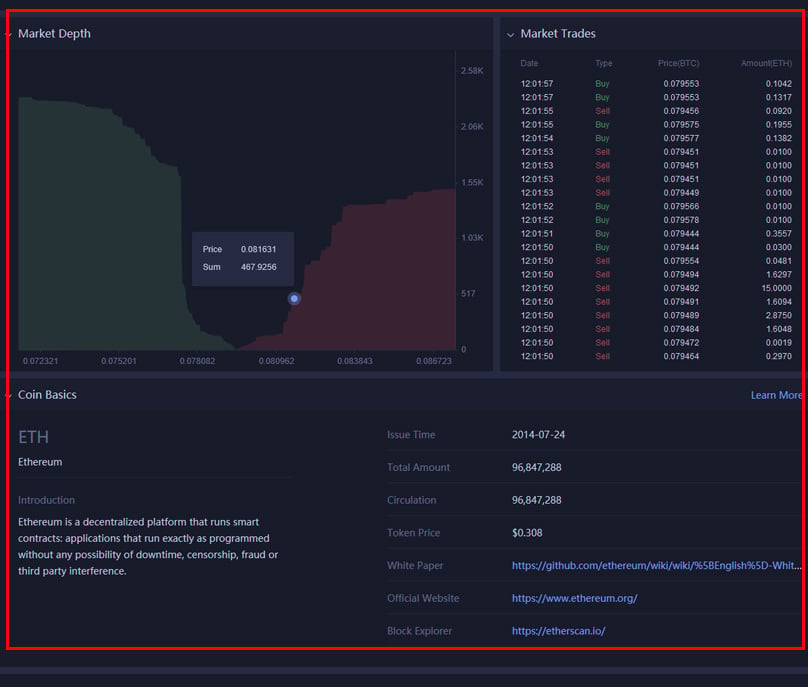

The main trading screen Below these features is a market depth chart, ongoing trade stats, and handy coin-specific details. Compared to others, Huobi's tools are rather comprehensive,

Users can swiftly garner insights on coin supplies, circulating volumes, official documentation, and more, significantly easing the research efforts for investors. More information can be accessed via Huobi's asset introduction page, linked from the 'Help' option on the screen's bottom. Bollinger Bands , Moving Averages and so on.

Following the wallet funding with the chosen cryptocurrency, Huobi lets you dive into market dealings through their interface, with limit or market orders supported.

Its trading interfaces are quite intuitive, showing prices in potential pairings and USD, with amounts adjustable via manual entry or a slider. This slider is a visual aid for determining the ratio of your holdings intended for trade, fully right implies all-in, half suggests a half-stake, etc. like Binance .

Besides basic trading, Huobi also offers two other trading tools.

Making Your Trades

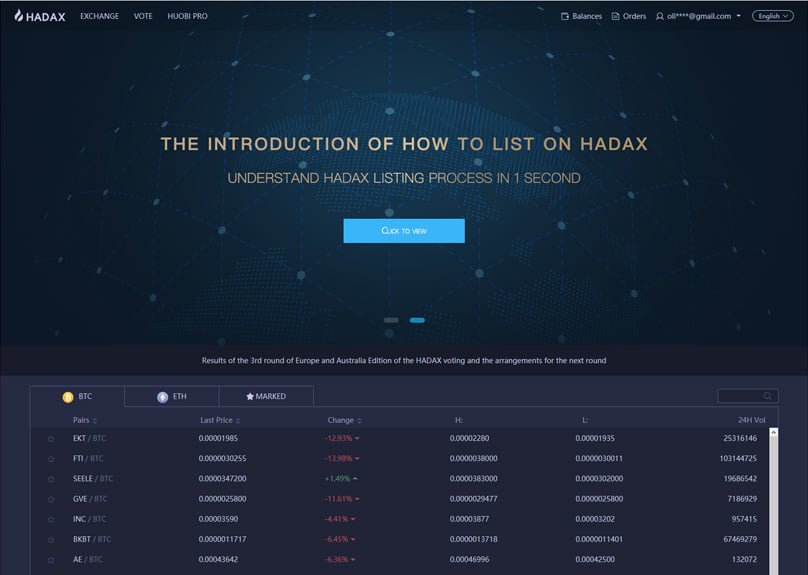

The HADAX - Huobi Autonomous Digital Asset Exchange - provides seasoned traders access to an even more adventurous version of the usual crypto market. It's user-governed, with voting for token listings that are then validated by HADAX. Entrants must meet specific investment criteria due to heightened risks.

Coins making it onto HADAX can transition to Huobi's main listings after meeting certain standards. Removal from Huobi doesn't mean HADAX exclusion.

Other Trading Options

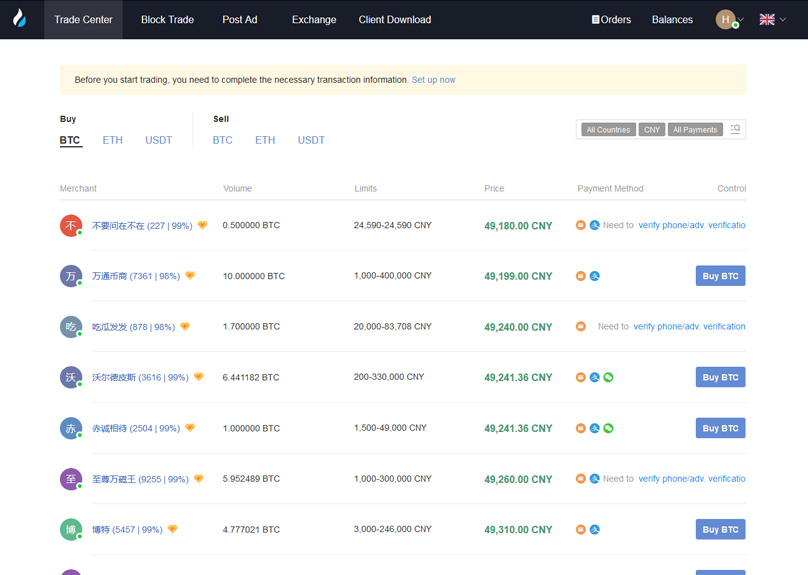

In the OTC - over-the-counter - section, potential bulk buyers and sellers can exchange coins outside the main market's unpredictability. It's for certified merchants looking to mitigate slippage, matching transactions without market orders.

HADAX

OTC trades make sense when transaction sizes could influence market movements significantly, or when speed is imperative.

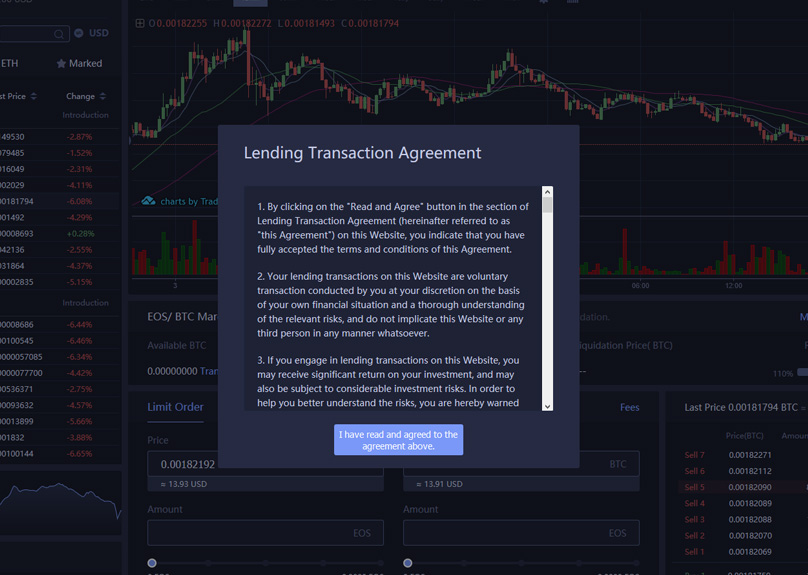

There's also margin trading on Huobi, differing from basic trading. Borrowed funds from brokers are used here, with your cryptocurrency as loan collateral. Choices between long and short positions can amplify profits or losses, recommended for skillful traders only owing to its complexity.

OTC

Before indulging in Margin Trading on Huobi, an extra Lending Transaction deal needs to be ratified.

Huobi caters to a wide range of trading needs, from large buys to taking chances on experimental coins.

Margin Trading

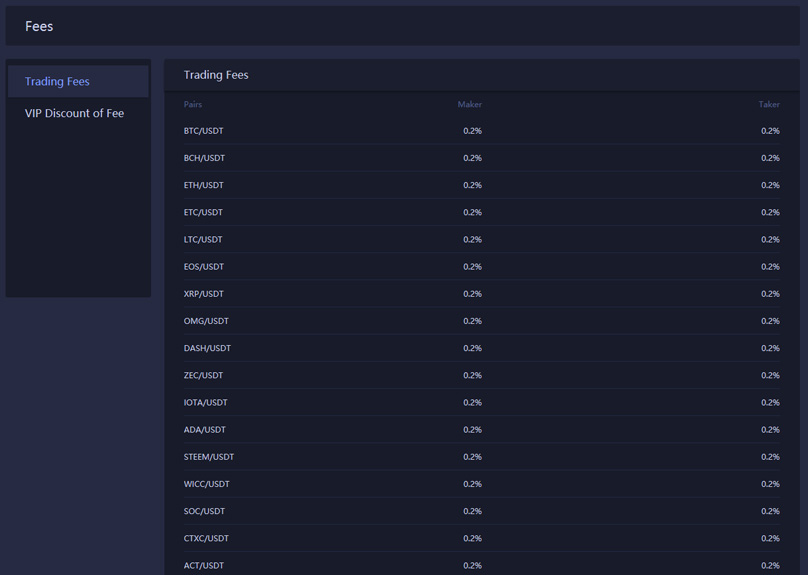

Despite the versatility in trading, Huobi adopts a fairly straightforward fee policy. Both makers and takers are usually charged a 0.2% fee on most trades.

Makers get a fee for adding liquidity via a limit order below the buying price or above the selling price. Takers incur fees by subtracting liquidity through orders matching the existing ones. It’s always deducted from the total executed value of the final coin.

Huobi also has a VIP discount fee program purchasable with its native HT token, with savings ranging from 10 to 50 percent.

Huobi Fees

Huobi houses its own cryptocurrency, HT, accessible via their exchange and awarded in loyalty and new user programs. Of the total 500 million HT, Huobi buys back some to uphold an emergency user protection fund. By May, HT’s trading rate was $2.679.

Regarding security, Huobi seeks to elevate cryptocurrency safety standards. With backing from financial juggernaut Goldman Sachs for security and risk control, alongside employing HT for an investor safety fund, Huobi aims to filter out potentially harmful coins. It further benefits from a decentralized, anti-DDOS robust infrastructure.

ID verification and two-factor checks are available for trading and withdrawals. Over 98% of investors' funds are kept in cold storage to thwart hacks. By May 2018, Huobi faced hacking trials but retained customer funds.

Spotlight on Huobi Token: The In-House Cryptocurrency of Huobi

Like Binance’s BNB and Kucoin’s KCS Huobi's dedicated investor security fund warrants a deep look, signifying the platform's long-term market commitment.

Is Huobi Safe?

By allocating 20% of seasonal transaction fees to repurchase HT, Huobi sets them aside for loss reimbursement. Furthermore, the platform claims a 20,000 BTC reserve in an independent account, ready to compensate investors should disaster strike. Although this protection doesn’t extend to individual user hacks or phishing, the exchange is well insulated, with its BTC reserves estimated to surpass its hot wallet capacity, ensuring prompt fund replacement after massive-loss incidents.

The Ultimate Beginner's Handbook: Discovering Huobi in 2019 – Is It a Secure Choice?

Considering trading on the Huobi Cryptocurrency Exchange? Wonder if it's secure? Dive into our in-depth Beginner's Guide Review to glean essential insights.

Exploring Huobi: A Comprehensive Guide for Beginners

Huobi Customer Support

As the crypto scene accelerates, a variety of exchanges have taken the spotlight, each offering its own set of fees, pairings, localized features, and user experiences.

Rooted in Singapore, Huobi stands out with its customer service excellence and independent crypto evaluations. Having begun its journey in 2013, it remains a key player in Asia, with hubs in Japan, Korea, and Hong Kong, plus its Singapore HQ. Though a U.S. office exists, by May 2018, U.S. users were advised against registration due to strict regulations. A U.S.-based service is anticipated soon, courtesy of its San Francisco branch.

Conclusion

This exploration will delve into the workings of Huobi trading, spotlighting unique aspects such as its coin pairings, protective measures, and trading tools. We'll also examine Huobi's customer service approach, reportedly the first 24/7 service in crypto trading, alongside its dedicated investor protection fund.

Huobi Token Explained: The Platform's Own Digital Currency read more about here .

Signing up on Huobi is fairly straightforward. You can find the link in the top-right corner of their homepage.

The signup process starts with choosing your nationality, a decision that can't be revised later. Huobi claims a reach in over 130 countries, though notably, the U.S. is absent from the list. As of May 2018, most users come from China, Hong Kong, Taiwan, Japan, Korea, Germany, the UK, and Canada.