You've decided it's the right moment to delve into the world of cryptocurrency investments.

You've picked an intriguing time to dive in. Major players like Bitcoin (BTC) and Ethereum (ETH) skyrocketed in 2017, and with institutional-backed Bitcoin futures rolling out, 2018 promises even more impressive growth.

Unsure about your starting point? Don’t worry. We’re here to cover all the essentials every newcomer should grasp when investing in crypto.

Investing in Cryptocurrencies

The first crucial thing you must know: brace yourself for market fluctuations. Remember the time Bitcoin shot past $17,000, merely days after breaking the $10k mark. Bitcoin’s recent price Bitcoin has experienced a tumultuous yet powerful year – Visual from Coinbase.

Ethereum, sitting at the second spot by market cap, is a testament to immense growth, appreciating a staggering 6,000 percent just in 2017: Mt. Gox Ethereum’s surge is compelling this year – Image courtesy of Coinbase.

Even from that snapshot, the volatility's nature is apparent. Notice how ETH’s value dropped sharply from June to August. the price of ETH For traditional investors, this kind of volatility feels like a whirlwind. But this arises from the burgeoning nature of the crypto landscape.

Not bad at all, right?

Many skeptics brand cryptocurrencies as scams. However, Bitcoin, the original digital currency, is a groundbreaking innovation on par with history-making entities like the printing press and the Magna Carta. Prospective investors should keep this historical significance in mind.

The Magna Carta's significance lay in its defiance against tyrannical authority, while the printing press empowered the masses with accessible knowledge. Similarly, these innovations set the stage for a new epoch of freedom, with Bitcoin and its crypto wave promising to alleviate growing societal pressures.

As proof of its commencement, the first Bitcoin block was accompanied by this headline: 'The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks.' Born amid the 2008 Financial Crisis, Bitcoin’s timing was no coincidence.

Backstory: What’s Fueling This Cryptocurrency Phenomenon?

In 2008, centralized institutions caused widespread economic turmoil – Image from Quora.

Bitcoin emerged to tackle the trust breaches by central bodies, which precipitated the Great Recession.

Unknown visionaries behind Bitcoin crafted a blockchain ledger facilitating direct value and idea exchanges without requiring trust or permission, immune to censorship and intermediary interference.

Isn't that the pinnacle of personal freedom? As digital theorist Andreas Antonopoulos suggests, money bridges human relations like language, expressing value among individuals.

Bitcoin represents a monumental milestone akin to the Magna Carta, empowering individuals against overreach. It’s sparking an era of freedom, initiating blockchains uplifting social autonomy.

The Bitcoin network is a decentralized P2P system – Visual via Blockstream.

Picture future decentralized structures operated through blockchain smart contracts instead of error-prone bureaucracies.

Blockchains offer top-to-bottom societal diversification, presenting unparalleled opportunities for fairness and compassion.

That is the bold promise held by Bitcoin. This is why the boom around Bitcoin and cryptocurrencies is substantial.

Additionally, there are numerous cryptocurrencies to consider. Some are promising, while others are deceptive. Generalizations can be misleading.

However, it's clear that cryptocurrencies are an undeniably transformative technology that can reshape societies fundamentally.

By now, many pundits have repeatedly declared Bitcoin dead. But your curiosity in reading this indicates an interest in exploring what cryptocurrency investments entail. not a traditional speculative bubble.

Should I Invest? And How Much?

Reflect on insights from Mike Novogratz, former hedge fund manager, who recommended allocating one to three percent of your net worth to cryptocurrencies, providing secure exposure without exposing you to significant risk.

These are sensible and careful guidelines, especially if you're not a seasoned investor.

Remember, it's critical to follow this principle: Don’t invest more in cryptocurrencies than you're prepared to lose.

In other words, only commit funds to crypto that wouldn't be devastating to see depreciate entirely. Not that a full crash is probable, but sudden downturns have occurred. Events like China’s crypto exchange prohibition and lurking scams highlight the field’s early stage.

Not every crypto project matches the integrity of leading names like Bitcoin and Ethereum, which assert their top market cap ranks through substantial contributions.

Simply put, certain crypto projects are mere facades.

Some investors have, indeed, lost everything in the scams within the community. To avoid such outcomes, diligence is key. Ensure thorough research into coins with established, reliable histories.

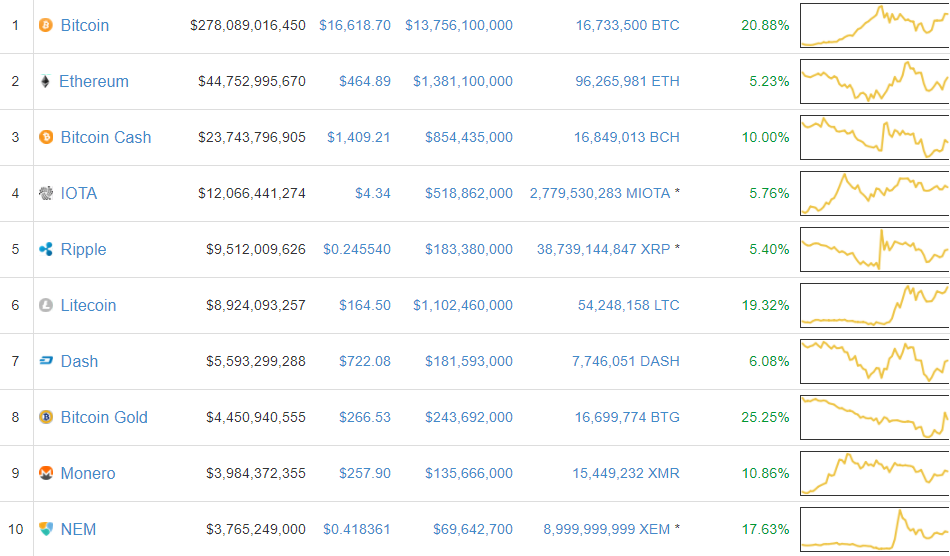

Every crypto has strengths and weaknesses, but generally, market trends reflect credibility. Most of the current top 10 cryptocurrencies by market capitalization have strong fundamentals.

Noteworthy, current leading projects in the top 10 include:

Scammers Want Your $$

The current top 10 cryptocurrencies – Image from CoinMarketCap

Interesting developments are ongoing in the top 100 by market cap, but risks heighten past the top two. scams We have compiled guides for purchasing major cryptocurrencies like Ethereum and Bitcoin. Following their acquisition, you can venture into other currencies through different exchanges.

Steps to Purchase Bitcoin via Credit or Debit Card what you choose for your portfolio Steps to Purchase Ethereum via Credit or Debit Card

Noteworthy Cryptos Worth Your Investment

Best Platforms for Alternative Digital Currencies:

Leading Cryptocurrency Exchanges for Beginners

You'll encounter two basic cryptocurrency investing approaches: holding and day trading. Both aim for a common goal: buy low, sell high.

How to Buy Cryptocurrencies

Holding is advisable for beginners without professional investing expertise. It's about accumulating a specific coin, anticipating appreciation over the long term. This approach is straightforward and accessible.

Purchase Ethereum and Bitcoin:

- The ideal scenario is buying coins during market downturns. In simple terms, capitalize on lower prices for maximum gains.

- How to Buy Bitcoin With PayPal

- Practically applying this is challenging, though. Yet, holding becomes less critical if you're bullish on long-term prospects. For example, should you anticipate Ethereum hitting $3,000 eventually, whether you purchase at $300 or $400 becomes inconsequential.

Alternatively, day trading involves regular buying and selling to grow your trading investments actively.

- Delve Into Crypto Investing: A Newcomer's Journey

- Coinbase Review

- Binance Review

- Coinmama Review

- Paxful review

- CEX Review

- Localbitcoins Review

- Bittrex Review

Cryptocurrency Investing Strategy

Peruse our Newbie Resource on Investing in Cryptocurrencies for Insightful Tips and Strategies for Acquiring Bitcoin & More.

Strategy 1: “Hold”

Cryptocurrency Investing: The Essentials for Novices

You've finally decided: you're ready to jump into the world of cryptocurrency investments.

Now is a great moment to explore this interest. Leading cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) experienced extraordinary expansion in 2017, and with the upcoming institutional Bitcoin futures, 2018 appears primed for even more significant advancements.

Unsure of where to kick off your journey? No worries. We'll cover all the critical aspects that every newcomer should be aware of when venturing into the crypto space.

Strategy 2: “Daytrade”

Tracing the Roots: What Fuels This Crypto Frenzy?

Cryptocurrencies Worth Your Attention

Safeguarding Your Crypto Assets for Long-Term Gains

Protect Your Investments for Long-Term Prosperity

When Bitcoin first launched, one BTC was worth far less than .01 USD. Now, at press time one bitcoin is worth $16,800. That’s the most fundamental example of the long-term gains that the crypto space has seen so far.

Stay Informed and In Tune with the Marketplace

To start, brace yourself for the frequent and intense fluctuations in value within this market. Envision

shooting past $17,000 USD, when just days before, it had barely exceeded the $10k mark:

The best way to do that? Get yourself a cryptocurrency hardware wallet.

Bitcoin has had a standout year – Image via Coinbase.

Such sharp volatility has driven portfolios upward, greatly benefiting investors. Nonetheless, the reverse has also occurred, as illustrated when the

exchange platform for digital assets collapsed back in 2014, leading to a plummet in bitcoin prices.

Investing 101: Track Your Trades

Then there's Ethereum, the runner-up in terms of market cap. It's unbelievable, but

A great site for this purpose is cointracking.info .

saw a remarkable 6,000 percent increase in 2017 alone:

ETH's gains have reached spectacular heights this year – Image via Coinbase. CoinMarketCap , Coincap.io , and CryptoCompare .

Find Trustworthy Resources

Despite the impressive chart, the extreme price swings are evident. Notice how ETH's value nearly halved between June and August.

This rollercoaster-like fluctuation is baffling to traditional investors. Nevertheless, it's important to recognize that such wild price movements stem mainly from the nascency of the crypto ecosystem. Boxmining and Ivan on Tech .

At the end of the day, there's no certainty about the future trajectories of crypto prices. However, the potential of groundbreaking technology that top cryptos, primarily Bitcoin, bring offers solid grounds for enthusiasm and hope.

Many uninformed critics have labeled cryptocurrencies fraudulent. Yet, Bitcoin, the initial cryptocurrency, will be historically documented alongside the printing press and the Magna Carta as one of humanity's most resilient achievements. This is key knowledge for potential investors.

The Magna Carta, a profound emblem of every human's longing for justice, curbed a tyrannical monarch. Similarly, the printing press empowered the powerless by lending a voice to those without. It catalyzed the birth of more genuine human freedom in the ages that followed.

Stay Updated on the Latest Crypto Movements

And thus, began an Age of Liberty. An age not devoid of challenges – challenges that Bitcoin and the cryptocurrency revolution it sparked may help alleviate permanently.

Signifying its inception, the inaugural Bitcoin block was etched with the headline of that day: 'The Times 03/Jan/2009 Chancellor on the brink of the second bailout for banks.' Bitcoin's emergence during the initial days of the 2008 Financial Crisis is no coincidence; it’s poetic in a sense.

In 2008, centralized institutions precipitated a global economic collapse – Image via Quora

Remember To Not Get Too Caught Up

Bitcoin arose as a remedy to the Great Recession's underlying issue: the betrayal of public trust by centralized establishments.

Thus, the anonymous creator(s) of Bitcoin crafted the solution: a blockchain ledger where value, even concepts, can be traded directly between individuals without the need for trust, permission, or censorship – devoid of third-party interference.

Isn't that the ultimate form of personal freedom? Because money, as scholar Andreas Antonopolous articulates, 'is a language. Money is the language humans devised to convey value to each other.'

Now, nobody – from Kim Jong Un to President Trump or anyone spanning the extremes – can stop you from communicating value to anyone globally. This represents a sovereignty unknown to humans before, and its implications are monumental.

Bitcoin resembles the modern-day Magna Carta. It's a leveler between common folks and those wielding power. It ensures people have a mechanism to balance power, marking the next groundbreaking milestone in humanity's quest for freedom. And like dominoes, Bitcoin will, and already has, paved the way for new blockchains that will further refine freedom.

1How to Buy Bitcoin With PayPal

At Blockonomi, we can't offer financial counsel; you're the architect of your financial destiny, and it's your responsibility to conduct research to decide if crypto investments suit your circumstances.