Coinbase is among the most popular cryptocurrency exchanges Coinbase, established in June 2012, has since become a major player with over 10 million users and $50 billion in trades. Based in San Francisco, California, its operations are heavily regulated under U.S. law, which mandates additional security protocols not seen in other exchanges. Despite these measures, it's prudent to research Coinbase's safety before engaging with the platform.

This piece focuses on Coinbase's security measures. For broader insights about the exchange, keep reading. see our full review and comparison we carried out of Coinbase vs GDAX .

How Does Coinbase Ensure the Safety of Your Assets?

As part of its numerous security strategies, Coinbase stores a whopping 98% of customer funds offline. This minimizes exposure to hacking or theft. These funds aren't just offline—they're spread out globally in vaults and secure facilities.

For protecting sensitive data, Coinbase implements multiple strategies. Instead of online servers, this data is stored offline, sheltered from cyber attack risks. To heighten security, the information is redundantly segmented and protected with AES-256 encryption before being backed up onto physical formats and FIPS-140 USB drives. These measures mirror the fund storage strategy: widespread geographic distribution in vaults.

Coinbase doesn't just recommend two-step verification for accounts; it mandates it. This means users must verify their identity with a mobile code on top of their password and username for specific operations. This layered approach makes unauthorized access significantly harder.

Completing their security protocols, Coinbase adheres to top-notch industry practices, all web traffic is channeled through HTTPS via encrypted SSL. In addition, wallets and private keys benefit from AES-256 encryption.

Examining the Organizational Security Measures at Coinbase

Coinbase's security extends beyond funds and platform. Internal procedures safeguard the organization, including thorough criminal checks for potential hires. Employees must encrypt hard drives, use strong passwords, and enforce screen locks. Furthermore, distinct passwords and two-factor authentication are requisite for every service and device.

An Insight into Coinbase's Application Security Features

Preventing CSRF attacks is another strong point; Coinbase applies SQL filters to confirm request authenticity for POST, DELETE, and PUT actions. It also caps login attempts and whitelists attributes to avert mass-assignment exploitation.

What Extra Authentication Processes Boost Coinbase's Security?

For authentication processes, Coinbase hashes passwords using bcrypt with a 12-cost factor, assesses password strength upon account creation or reset, and maintains application credentials separate from code and databases.

Coinbase Custody

Confident in its security, Coinbase has launched a custody service for institutions, charging a $100,000 setup fee with a $10 million minimum holding, targeting major financial entities like banks or hedge funds requiring such robust service.

Coinbase Bug Bounty Program

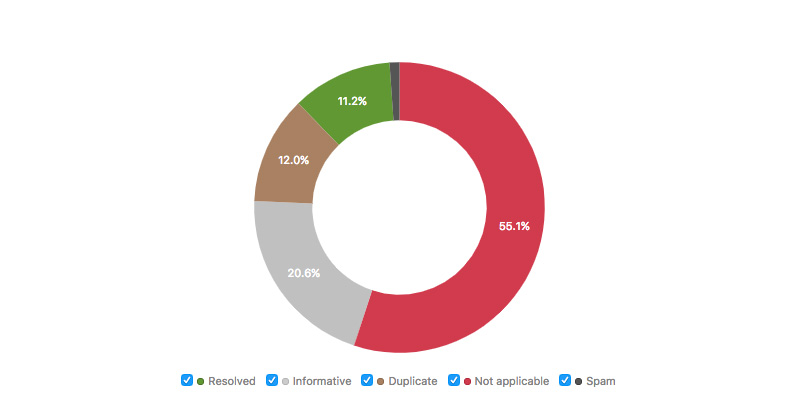

The Coinbase Bug Bounty Program Offering a unique reward program, Coinbase pays developers for identifying potential software vulnerabilities. This encourages constant testing, maximizing internal resource efficiency while updating security systematically.

Just recently Coinbase rewarded a Dutch company Recently, they awarded $10,000 for uncovering a bug that could've led to unauthorized Ethereum currency generation on the platform.

What Insurance Does Coinbase Offer?

Coinbase provides insurance for all digitally stored currency. Should a breach occur, insurance steps in to recoup customers' losses. It's crucial to note that less than 2% of customer assets are online. The policy covers security breaches and internal theft, excluding individual account compromises.

Given that digital currencies don't count as legal tender, they're absent of protections from the Securities Investor Protection Corporation or Federal Deposit Insurance Corporation. However, U.S. residents enjoy coverage for cash balances. FDIC insurance for their Coinbase USD Wallet of up to $250,000.

In handling fiat currencies, Coinbase uses custodial accounts or U.S. Treasuries within the States, and segregated accounts outside, ensuring customer funds remain secure and untouched even if Coinbase faces business challenges.

Understanding How Regulatory Compliance Enhances Coinbase's Security

Adhering to global regulations and laws, Coinbase is licensed in most U.S. states as a money transmitter and has official registration. FinCEN as a Money Services Business.

Ways to Enhance Your Own Security While Using Coinbase

Securing yourself on Coinbase includes never sharing your password, login credentials, or two-factor codes. Support teams will not request this information. Contact Coinbase support directly through verified channels; don't trust search engine results alone, as imitation scams are rampant.

Setting a unique, complex password that differs from other sites is vital for safety. Update your password every few months. Fully utilize Coinbase's two-factor options, even for transactions. Remember, TOTP apps like Google Authenticator are safer than SMS two-factor, reducing risks from phone porting attacks.

If worried about account security or breaches, check your security settings for IP activity, which lists verified devices and login activity.

For the utmost security of your digital coins, we suggest utilizing a hardware wallet such as a Ledger or Trezor. Ledger or a Trezor .

Conclusion

While it's evident that Coinbase is among the safest exchanges, remember it's not intended for crypto storage. It's best to conduct transactions then transfer holdings to more secure personal wallets. safe hardware wallet .

In conducting crypto transactions, rest assured that Coinbase stands at the forefront of exchange security, having never succumbed to a breach, revolutionizing industry standards.