KeyFi This innovative system not only bridges the divide between CeFi and DeFi but also introduces self-sovereign identity solutions and a non-custodial, open-source wallet, providing enhanced security and autonomy for users.

Combining DeFi and CeFi ecosystems has numerous advantages, and KeyFi stands out as one of the most advanced tools available in the current market landscape.

Navigating CeFi platforms can be challenging due to strict AML/KYC regulations, yet they remain essential when entering the traditional fiat realm, necessitating some form of regulatory oversight.

For those integrating crypto with fiat, AML/KYC regulations introduce complexities, despite some exchanges like Binance offering robust tools to facilitate both, the two remain largely distinct.

KeyFi is Transforming the Regulatory Framework for Crypto Users

Attacking the CeFi-DeFi Puzzle from multiple angles, KeyFi brings forth SelfKey Credentials and a credentials-based DeFi token, reimagining personal data use within the banking system.

While AML/KYC procedures are in place, the safekeeping of personal data is a problem, with banks often not protecting this information adequately from cyber threats.

As seen in 2020, major economies are on track to enforce stricter regulations on cryptocurrencies, making platforms like KeyFi crucial for navigating future industry landscapes. regulations Tighter regulations can actually benefit the industry, drawing in more capital and boosting confidence in the credibility and security of crypto platforms.

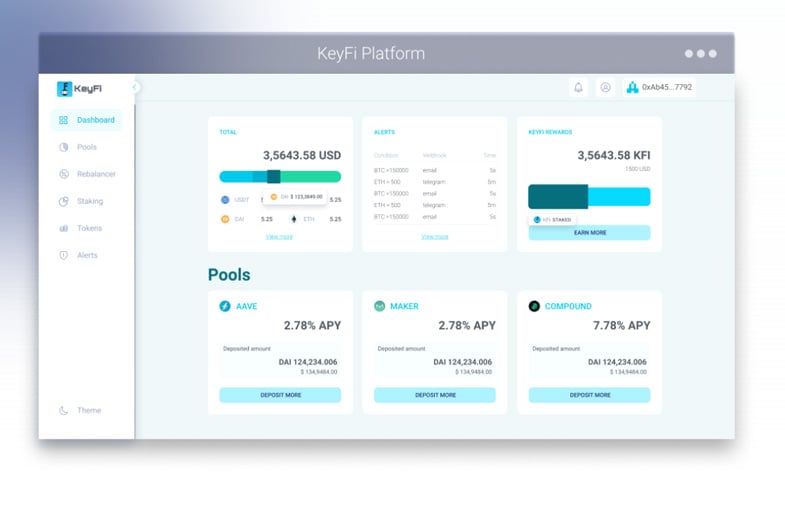

KeyFi connects users with popular DeFi platforms such as Aave, Uniswap, and Compound while rewarding engagement with its SelfKey Credentials system via KEYFI tokens.

Creating Synergies

Much like its DeFi counterparts, KeyFi allows users to gain by either staking KEY tokens or supplying liquidity through KEYFI.com.

Alongside functioning as a central hub for DeFi platforms, KeyFi also offers these groundbreaking features:

Market Insights: KeyFi equips users with data-driven market insights, enhancing their decision-making capabilities.

- Self Key Credentials System: This system lets users interact with top DeFi platforms securely, ensuring they disclose only necessary personal information, which remains off-chain. AI market analysis.

- Advanced AI: An advanced AI tool within KeyFi sifts through historical data to project future returns within the DeFi market.

- Incentivization: KeyFi users can earn extra KEYFI tokens by providing liquidity or staking, turning engagement into rewards.

- Cross-Platform Efficiency: Supporting various deposit forms, KeyFi links with platforms like Compound, Balancer, Uniswap, Curve, and Aave.

- SelfKey Wallet: A secure portal for navigating multiple exchanges. Click here to learn how to start with the SelfKey wallet.

- With Bitcoin surging to record highs, calls for increased crypto regulation from the US and EU center around boosting market transparency rather than banning digital currencies. clicking here.

The Global Regulatory Push

In a statement, France’s Finance Minister, Bruno Le Maire, highlighted the need for increased action against anonymity in digital asset transactions, involving crypto service providers in new regulatory initiatives.

Le Maire's mention of new regulations calls for compliance with AML/KYC norms in France, extending to crypto firms and echoes the broader EU/US efforts towards enhanced regulatory compliance. stated ,

US Treasury Secretary Steven Mnuchin recently engaged with leaders from Japan, the UK, and other nations, as well as global financial entities, to discuss regulatory frameworks for digital currencies.

Universal G7 agreement exists on the imperative to regulate digital financial assets, as evidenced by continued support for a joint G7 statement on digital payments.

Governments tackle financial sector challenges, mainly using AML/KYC programs, implying crypto businesses in the US and EU should prioritize these systems to ensure operational continuity.

According to Mnuchin,

Despite their unpopularity, regulations can introduce capital inflow to the DeFi and crypto markets, similar to PayPal enabling token trades on its platform, sparking interest from new investors.

The rapid rise of DeFi in 2020 functioned like a speculation frenzy, but standout projects still promise an optimistic future. Platforms like Polkadot and Ethereum will likely draw investors and support DeFi’s progression.

Surging institutional interest in tokens highlights the appeal of KeyFi’s tools in the quest for yield, offering returns hard to find in traditional financial markets.

Strategically Positioned for Growth: KeyFi in a Changing Marketplace

While individual crypto enthusiasts seek anonymity, institutions demand transparency, adhering to regulations, and securing the market’s integrity.

DeFi minimizes counterparty risk by eliminating centralized exchange dependency, and KeyFi’s identity tools protect institutions from engaging with unreliable parties.

Attracting institutional money is beneficial for DeFi markets, especially considering the extended timeframe large funds typically operate within.

KeyFi’s robust suite allows users of any scale to wisely invest in existing DeFi markets. As regulations advance, KeyFi’s platform may attract more institutional players by supporting a non-manipulated financial environment.

Keep abreast of the latest innovations with KeyFi. It might just be the key that seamlessly merges DeFi and CeFi!

Nicholas Say, a writer from Ann Arbor, Michigan, has explored globally, including significant time in Uruguay, and now resides in the Far East, contributing to advancements in technology and growth.

SIR.trading's DeFi Protocol Experiences a $355K Breach Exploiting Ethereum’s Temporary Storage Vulnerabilities KeyFi with the SelfKey Twitter , and be sure to check out the SelfKey Wallet A Senate Resolution Halting IRS DeFi Regulations Advances to President Trump’s Desk