Koinly is an online crypto tax platform This smart platform gives you a bird's-eye view of your entire crypto history, from trades to staking, ensuring your tax reports are always compliant with regulations.

Automatically syncing transactions, tracking crypto performance, and compiling your gains and losses, Koinly makes tax reporting a breeze.

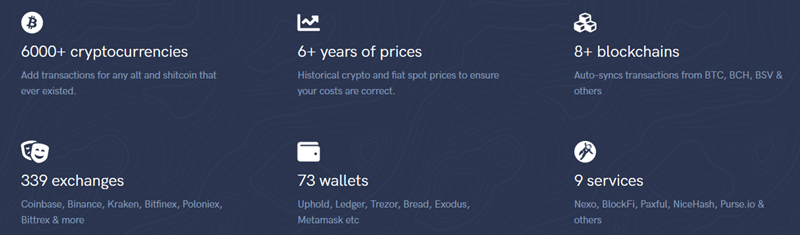

Accessible in over 20 countries, Koinly collaborates with 6,000+ blockchains, 350 exchanges, and 75 wallets, providing an all-encompassing solution. Options range from free access to premium subscriptions costing between $49 and $279 per year.

Quick Wrap-Up: Koinly is your go-to digital platform for crypto taxes, offering seamless integration across a massive range of exchanges and wallets to help track, calculate, and report taxes efficiently across 20+ nations.

Quick Facts

| Quick Facts | |

|---|---|

| Founded | 2018 |

| Headquarters | UK, US, Sweden, Germany |

| Integrations | 6,000+ blockchains, 350 exchanges, 75 wallets |

| Reporting Options | FIFO, LIFO, HIFO, LOFO, ACB, etc. |

| Tax Reports | Form 8949, Schedule D, localized reports |

| Countries Supported | 20+ countries globally |

| Pricing | Free service for up to 10,000 transactions, with paid options from $49 to $279 per annum. |

Overview

Founded in 2018 by Robin Singh, Koinly has offices in the UK, US, Sweden, and Germany, maintaining a strong presence in Palo Alto, California, and complying with local legislations.

Explore the company further through its LinkedIn profile .

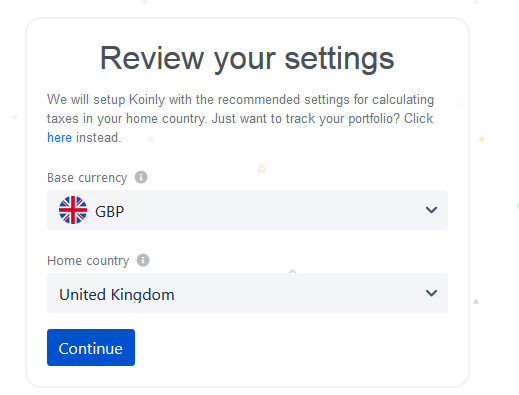

Operable in more than 20 nations such as the US, UK, Canada, Australia, and New Zealand, Koinly supports data imports via API, CSV, or x/y/zpub keys with downloadable PDF reports.

Options include FIFO, LIFO, Form 8949, and Schedule D, alongside international tax evaluations, all supported by the complete online crypto audit service allowing access to regional tax experts.

Koinly Key Features

Some of the platform’s key features include:

- Wide-Ranging Country Support – Koinly is functional in 20+ countries across Europe, Asia, Oceania, and the Americas, delivering tailored tax forms like Form 8949, Schedule D, K4, Rf1159, and Sheet 9A.

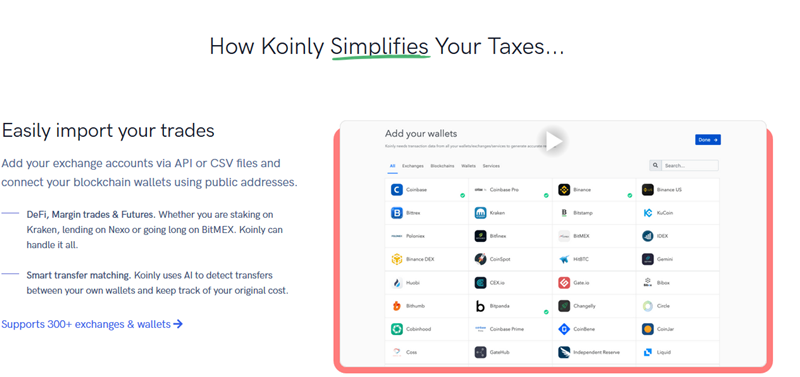

- Comprehensive Service Integration – Compatible with 6,000+ blockchains, Koinly supports imports for Bitcoin, Ethereum, Litecoin, NEO, and 350 exchanges, including Binance, Coinbase, and Kraken, and easily tracks mining, staking, and DeFi.

- User-Friendly Data Input – Connect various services through API or manually via CSV and xPub/yPub/zPub keys, supported for many platforms like Nexo, BlockFi, Bitmex, Deribit, and CoinTracking.

- Complimentary Account Option – Free access to track up to 10,000 transactions and preview capital gains taxes without charge, endlessly monitor trading activities.

- Rich Resource Availability – Access a trove of information including a Crypto Tax Calculator, localized Tax Guides, a Tax Advisor List, and a constantly updating Blog.

- Customer Support – The team provide a Support section , and an FAQ page catering to the most frequent questions. Contact them through email and live chat and run a Facebook page and Twitter account .

Countries Supported for Tax Calculations by Koinly

Koinly facilitates tax outcomes in many nations, covering:

- The Americas – USA, Canada

- Europe – UK, Germany, Sweden, Denmark, Finland, Norway, Netherlands, France, Spain, Italy, Austria, Lichtenstein, Ireland, Czech Republic, Estonia, Malta

- Asia – Japan, South Korea, Singapore

- Oceania – Australia, New Zealand

Other countries with varied accounting practices are also compatible, including:

- First In First Out (FIFO)

- Last In First Out (LIFO)

- Highest Cost

- Lowest Cost

- Average Cost Basis

- Shared Pool

For assurance on compatibility, it's advisable to discuss your specifics with the Koinly team.

Tax Reports

Furthermore, Koinly offers specific tax forms for various regions:

- Form 8949 and Schedule D

- Capital gains summary for UK

- K4

- Rf1159

- Swiss Valuation Report

- Sheet 9A

These bespoke forms are additional to standard ones like:

- Complete Tax Documents – Encompasses capital gains summaries, year-end balances, asset details, and income, downloadable as PDFs.

- Transaction Summaries – Includes all transactions and is exportable as a CSV.

- Capital Gains Documentation – A CSV listing all asset disposals.

- Income Details – CSV format capturing income from airdrops, forks, interest, and staking rewards.

- Gift, Donation & Lost Asset Reports – CSV format noting transactions flagged as Gifts, Donations, or Lost.

- Cost Reports – CSV highlighting expense-related transactions, exclusive of trading fees calculated in capital gains.

- Year-End Holdings Summaries – CSV detailing end-of-year asset status.

- Turbotax Integration Files – CSV format for seamless Turbotax import.

How to Get Started on Koinly

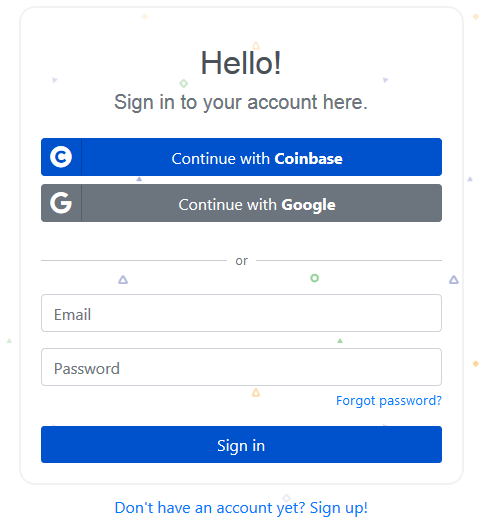

Joining is straightforward with main website displays a”Sign up” button at the top right of the page.

- Register using a Coinbase or Google account or simply via email and password.

- Localize for tax tracking or focus solely on portfolio monitoring.

- Access the dashboard to add and manage exchanges and wallets.

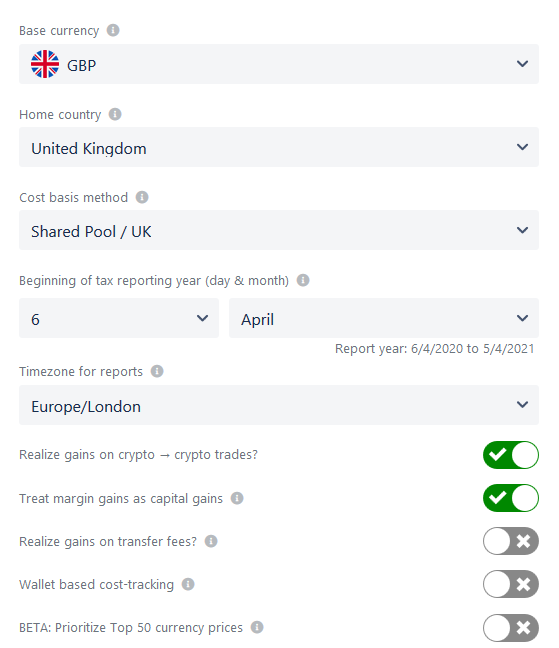

- Tailor your profile to suit jurisdictional regulations from the 'Settings' section.

Koinly's Support for Exchanges, Wallets, and Services

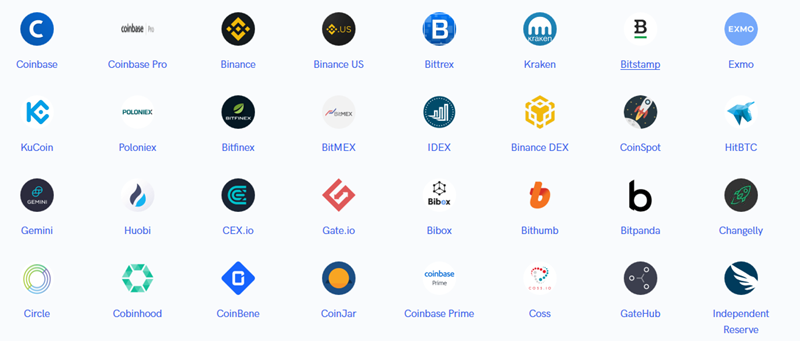

With support for numerous crypto services, Koinly manages over 6,000 blockchains, 350 exchanges, and 75 wallets.

This means almost all top crypto services are compatible, and Koinly also links with crypto lenders like Nexo , Integrations 6,000+ blockchains, 350 exchanges, 75 wallets

Remember, portfolio tracking is straightforward through accounts like Blockfolio, Delta, and CoinTracking.

Auto import from Bitcoin, Ethereum, Litecoin, NEO, and EOS is supported along with CSV/manual entry for 6000+ cryptocurrencies.

Tax Reports

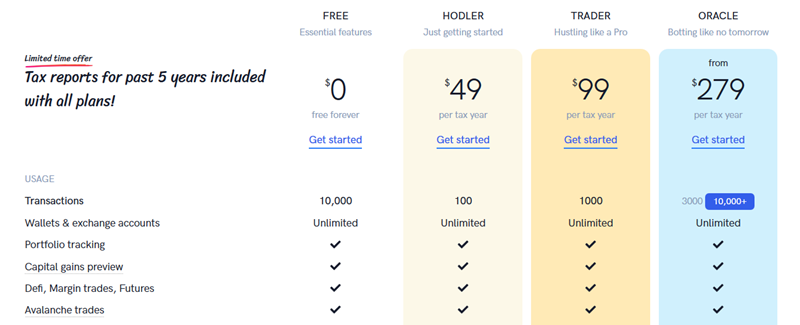

Various plans are available catering to different trading intensities.

- Koinly's Complimentary Plan offers considerable usage for tracking trades and accounts, with capital gains preview, plus FIFO and LIFO tax documentation, boasting wide data imports and support through chat or email.

- The Hodler Subscription at $49 yearly enables more in-depth reports, supporting international audits and Form 8949/Schedule D. It allows TurboTax, TaxACT export but is capped at 100 transactions.

- The Trader Plan available at $99 annually expands features, handling up to 1000 transactions with priority support.

- The Oracle Package starts at $179 annually for 3000 and $279 for 10,000 transactions, granting full platform capabilities, custom reports, enhanced support, and priority aid for bulk and custom processes.

Every model includes access to tax reviews across five years of crypto dealings.

For precise costs and options, consult the comprehensive pricing list by the team. Countries Supported .

20+ countries globally

Promoting trust, Koinly safeguards user data by employing numerous security strategies.

Critically, Koinly never requests access to your private keys or direct funds, though API links exist, disable withdrawal/trading during API setups for safety.

Every key is encrypted with aes-256-gcm, communications are via HTTPS and 256-bit encryption, ensuring data security.

Utilization of AWS and Heroku for hosting strengthens data safety, with hi-tech secure storage and service isolation.

Proactive security ensures operations without customer interference or disruptions, maintaining 99.9% uptime with preannounced downtimes.

Koinly simplifies account creation by allowing users to sign up via their Google or Coinbase accounts, thereby minimizing the burden of remembering passwords. For those opting for email, Koinly secures passwords with bcrypt encryption. Moreover, they diligently monitor for system vulnerabilities and restrict data access to personnel on a need-to-know basis.

To put it succinctly, Koinly has embraced a robust range of security measures typically found in the industry, and their team is transparent about how they maintain these standards. Overview It’s important to be vigilant with your personal information and practice safe habits, as this will significantly contribute to your protection from potential data breaches.

LinkedIn profile

The primary audience for this platform is individuals who are already participating in various aspects of the cryptocurrency world, whether that be trading, mining, investing, staking, or lending. Hence, if you're a complete beginner in crypto, Koinly might not be your starting point.

Nevertheless, the platform offers something for crypto hobbyists at all experience levels, enabling newcomers to track their transactions from day one. It's noteworthy that Koinly allows users to backtrack and examine their trading history over the past five years, making it convenient for seasoned traders to generate reports at their leisure.

Koinly provides extensive coverage by connecting with top exchanges, leading wallets, and prominent blockchains. Users can effortlessly create different reports, such as capital gains, income, and end-of-year tax filings, which are essential for managing crypto finances.

Their resource section educates users with crypto tax guides that keep you abreast of changes in your region. The local tax reports are especially practical, coupled with features like automatic balance checks and alerts for negative balances, assisting those who might not be tax-savvy.

For more active crypto enthusiasts, exploring the Oracle plan could be beneficial. This package offers tailored reports, access to live chat support, and the ability to track a large volume of transactions, making it ideal for frequent traders, while the free plan remains accessible for casual users.

Koinly Key Features

Some of the Koinly stands as a feasible choice for residents in supported areas who need a reliable method to track their crypto dealings for tax submissions. The platform’s intuitive interface lets you swiftly link exchange accounts and wallet addresses, thus simplifying activity monitoring.

Integrating seamlessly with numerous crypto service providers, Koinly manages its fundamental functions with proficiency, helping users maintain a clear record of all transactions without stress.

The service is reasonably priced, albeit without a crypto payment option. The company, still in its infancy since 2018, continues to grow.

However, the no-cost account option permits anyone to test the waters, helping you determine the accuracy with which the platform helps you oversee all trading activities.

Overall, Koinly is designed for the growing crypto audience, enticing anyone eager to ensure their financial dealings stay compliant, allowing seamless transitions between crypto and fiat currencies.

include:

Customer Support – The team provide a

Koinly serves as an online hub for cryptocurrency tax calculations and reporting. It connects to crypto exchanges, wallets, blockchains, and lending platforms to autonomously log transactions and calculates capital gains, income, and losses, ensuring the production of tax reports that meet regulatory standards.

Support section

Koinly supports a wide array of cryptocurrencies, with over 6000 included, such as Bitcoin, Ethereum, Litecoin, and NEO. It also features automatic integration for 14 major blockchains and can handle CSV data import for thousands of other cryptocurrencies.

Where does Koinly assist with crypto tax reporting?

Koinly is accessible to individuals and companies in over 20 countries worldwide, spanning the Americas, Europe, Asia, and Oceania, including markets like the USA, UK, Canada, Australia, Germany, and Sweden. The platform also generates region-specific tax forms, like the IRS Form 8949 and equivalents in other regions.

What exchanges and wallets pair with Koinly?

Koinly is well-integrated, connecting with over 350 leading exchanges such as Coinbase, Kraken, Gemini, and Binance, alongside 75 wallet options including MetaMask and Trust Wallet. It can also track transactions on major crypto lending platforms.

How does Koinly calculate taxes?

Koinly offers multiple methods for calculating cost basis, including FIFO, LIFO, HIFO, and LOFO, along with advanced options like average cost basis and share pooling, which can be adjusted in your account settings.

Which crypto tax documents can Koinly create?

Aside from comprehensive transaction reports, Koinly generates ready-to-file tax forms like IRS Schedule D 8949, UK Capital Gains, and many others. Reports are available for download in both PDF and CSV formats.

, and an

Koinly provides a no-cost plan for up to 10,000 transactions. Their paid plans range from $49 to $279 annually, with higher tiers offering perks like priority support, tailored reports, and unlimited transfers.

FAQ page

Yes, Koinly employs high-level AES-256 data encryption akin to bank security, utilizes protected AWS cloud servers, and maintains stringent internal access controls. It doesn’t require private keys and offers read-only API access for enhanced security.